- 58 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The Private Sector Operations—Report on Development E¬ffectiveness series reviews the development effectiveness of private sector operations of the Asian Development Bank (ADB) and their contributions to Strategy 2030 and the Sustainable Development Goals. This 11th edition highlights ADB's Private Sector Operations Department's wide-ranging responses to the coronavirus disease (COVID-19) pandemic, as well as its focus on priorities laid out under ADB's Operational Plan for Private Sector Operations, 2019-2024.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Private Sector Operations in 2020—Report on Development Effectiveness by in PDF and/or ePUB format, as well as other popular books in Commerce & Opérations. We have over one million books available in our catalogue for you to explore.

Information

OPERATIONAL PRIORITIES

Housing beneficiaries in Kolkata, India. In 2020, ADB committed debt assistance to Aavas Financiers to provide housing loans to low-income borrowers, including 110,000 women (photo by ADB).

Alignment and Contribution to Strategy 2030

PSOD’s new operational plan fully aligns its work with Strategy 2030’s seven operational priorities, which aim to achieve ADB’s vision of a prosperous, inclusive, resilient, and sustainable Asia and the Pacific. The plan strengthens efforts to address climate change and empower women, and targets more complex, innovative, and smaller-sized projects with investments in core areas such as clean energy, environmental infrastructure, agribusiness, quality health and education services, and finance.

Addressing Remaining Poverty and Reducing Inequalities

In developing Asia, pandemic-related disruptions to agricultural value chains threatened to plunge many smallholder farmers back into extreme hardship. PSOD responded with badly needed working capital to help keep agribusinesses afloat, allowing them to maintain purchases from their farmer suppliers.

The pandemic caused markets to close and smaller traders to cease buying farm products.

A coffee farmer in Indonesia. Working capital for agribusinesses like the Olam Group have been crucial for protecting the livelihoods of smallholder farmers across the region (photo by ADB).

A $93.8 million ADB loan to Singapore-based Olam International Limited will allow it to continue to boost purchases of coffee, cocoa, and other high-value crops from smallholder farmers in Indonesia, Papua New Guinea, and Viet Nam. The project is expected to benefit at least 100,000 smallholder farmers, nearly 30,000 of them women.

Northern Arc Capital Limited is a pioneer of financial inclusion in India, helping microfinance institutions and other inclusive nonbank financial companies raise debt capital and provide loans directly to underserved customer segments. As the pandemic squeezed access to finance, ADB committed debt finance of $40 million equivalent, giving the company access to long-term (5-year tenor) and stable funding that is not readily available in India. This assistance will allow Northern Arc to both resume lending directly to micro, small, and medium-sized enterprises (MSMEs) and to support nonbank financiers to help MSMEs and micro borrowers, including women, whose incomes and livelihoods have been severely impacted by the pandemic.

Accelerating Progress in Gender Equality

Improving gender equality is a core priority of PSOD’s operational plan, and in 2020, 36 of the 38 committed projects had gender considerations in their design (Figure 7). By comparison, only 31 of the 38 projects in 2019 had gender features in their design.

In Armenia, about 130,000 MSMEs employ two-thirds of all salaried workers with many of the businesses owned and/or run by women. Obtaining funding remains difficult with about half of these businesses having no access to commercial finance. In June 2020, ADB committed a $15 million nonsovereign loan to Armeconombank Open Joint-Stock Company, which will give it resources to expand its lending operations, targeting women and MSMEs in rural areas, where it has a strong footprint. At least 40% of the loan proceeds will go to businesses owned by women and 25% or more will go to enterprises outside the capital Yerevan, where the need is greatest.

India suffers from an acute shortage of homes, particularly affordable ones, and there are limited avenues of finance for home buying especially for low-income borrowers, including women. To support greater access to finance, ADB committed a debt security of $60 million equivalent to Aavas Financiers Limited. This will give the company the funds it needs to extend housing loans to low-income borrowers, including 110,000 women, especially in lagging states. Aavas intends to more than double the number of its outstanding housing loans to women by 2028, helping to boost the social status of women and improve their bargaining power within households.

Small business owner in Armenia. An ADB loan to Armeconombank Open Joint-Stock Company to finance struggling small businesses will channel at least 40% of the proceeds to enterprises run by women (photo by ADB).

Box 1 highlights the gender benefits of an emergency energy project in the PRC.

Box 1

Emergency Energy Project Aids Women in the People’s Republic of China

On 21 January 2020, the city of Wuhan in the People’s Republic of China, home to 11 million people, was effectively shut down as the authorities sought to halt the spread of coronavirus disease (COVID-19). Lunar New Year celebrations were canceled, schools and public facilities closed, and most people were confined to their homes. These actions caused significant challenges, especially for disadvantaged groups, including women who faced increased burdens from caring for children and the elderly, as well as curtailed access to services.

Concerns about the continuity of gas supplies for the city saw the Asian Development Bank (ADB) commit a loan of $20 million to Wuhan’s major gas supplier, China Gas Holdings Limited, to support its short-term working capital needs. This enabled the company’s local project units in the city to provide uninterrupted supplies of natural gas and liquefied petroleum gas to households, hospitals, and industrial and commercial users.

In addition to keeping gas supplies flowing, ADB’s support allowed China Gas to use its 24-hour online platform and presence as a last-mile service provider to deliver nutritious, market priced food items to households in a timely manner. Having a secure gas supply and food deliveries helped alleviate stresses at home that were felt most keenly by women and children.

With ADB support, the company also conducted a study into the gendered impacts of COVID-19 to ensure women and men receive equitable treatment during the recovery from the pandemic. The information gathered is expected to boost preparedness for similar shocks in future.

Supporting households during the pandemic. An ADB loan helped China Gas Holdings Limited maintain gas supplies and deliver nutritious food supplies to burdened residents and disadvantaged groups, including women, in the city of Wuhan (photo by China Gas Holdings Limited).

Source: ADB (Private Sector Operations Department).

Tackling Climate Change, Building Climate and Disaster Resilience, and Enhancing Environmental Sustainability

As ADB works to help the region respond to the worsening impacts of disasters triggered by natural and climate-related hazards, PSOD is playing an increasingly important role in supporting green bond and loan issuances and putting together innovative financing packages to get some large-scale renewable energy projects off the ground.

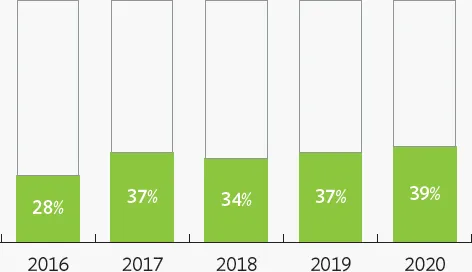

In 2020, there were 15 projects with committed finance for climate change mitigation and adaptation. This was triple the annual number since 2016 and comprised 39% of the year’s total commitments (Figure 8). The projects include 10 clean energy investments, lease financing for new-energy buses in the PRC, an equity investment in an infrastructure financing platform supporting sustainable infrastructure development, and ADB’s first independently verified private sector blue loan to expand recycling of waste plastic. Another project in the PRC city of Shenzhen is bringing adaptation benefits by using smart technology to develop urban water and wastewater facilities that absorb and reuse rainfall and floodwaters, and which will deliver more sustainable and secure water supplies for at least 2 million more people by 2026. These climate-related projects are expected to reduce emissions by 7.2 million tons of carbon dioxide (CO2) equivalent per year.

Avaada Energy Private Limited is a leading solar developer in India with a pipeline of projects that will contribute to the national government’s goal of doubling the country’s renewable energy capacity between 2018 and 2030. To help the company maintain momentum for its rollout plans, ADB committed convertible debt of $7.5 million equivalent and will administer cofinancing of $7.5 million from Leading Asia’s Private Infrastructure Fund. ADB’s support, along with assistance from other development institutions, will allow the company to continue its phase 2 projects that will increase solar generating capacity from 666 megawatts (MW) in June 2020 to 2,622 MW by 2023, avoiding 4.9 million tons of CO2 emissions annually from 2024.

In June 2020, ADB committed a loan of $13.3 million to Spectra Solar Park Limited to build the first private sector utility-scale solar plant in Bangladesh to be financed by a multilateral institution. The 12-year loan provides long-term finance that is not readily available in Bangladesh for renewable energy development. ADB’s participation in the project has helped draw in cofinancing support of $16.1 million from the Canadian Climate Fund for the Private Sector in Asia II and German development finance institution, DEG. Once complete, the 35 MW grid-connected plant will generate 52.2 gigawatt-hours (GWh) of clean electricity and avoid 33,200 tons of CO2 emissions annually, helping Bangladesh reduce imports of expensive fossil fuels.

Box 2 outlines how ADB raised finance for a private sector solar project in Uzbekistan.

Box 2

Major Private Sector Solar Project for Uzbekistan

Raising long-term finance for infrastructure projects in markets with limited or no access to such funds remains a significant challenge in many of the developing member countries of the Asian Development Bank (ADB), including Uzbekistan. To overcome this barrier, ADB and other development finance institutions put together a long-term financing package to fund the development, construction, operation, and maintenance of a 100-megawatt grid-connected solar power plant in Uzbekistan’s Navoi Region.

ADB signed loans of $17.5 million with Nur Navoi Solar Foreign Enterprise Limited Liability for the project, including cofinancing from the Canadian Climate Fund for the Private Sector in Asia II, which ADB administers. ADB’s loan has a tenor of up to 20 years. Additional finance of up to $38.8 million is bei...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Table, Figures, and Boxes

- Foreword

- Abbreviations

- Weights and Measures

- Executive Summary

- ADB’s Private Sector Operations AT A GLANCE

- Introduction

- Operational Overview

- Operational Priorities

- Strengthening Development Effectiveness

- Awards Received by ADB, Its Investees, and Transactions

- Measuring ADB’s Private Sector Operations Contributions to the Sustainable Development Goals

- Footnotes

- Back Cover