eBook - ePub

Wealth Without Stocks or Mutual Funds

The Ultimate Blueprint of Little-Known, Powerful Strategies for Building Diversified Wealth and Income

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Wealth Without Stocks or Mutual Funds

The Ultimate Blueprint of Little-Known, Powerful Strategies for Building Diversified Wealth and Income

About this book

Most traditional financial advisors will tell you a "balanced & diversified" portfolio consists of different sectors of stocks. Garbage! You will see that stocks & mutual funds are only one of dozens of ways to create wealth & income.Whether you have extensive assets or are just getting started and need to create more income this book will be your guide. Discover how to:

- Use the same secret programs banks and corporations have used for years to create wealth

- Launch your own business and brand on a shoestring and quickly dominate your niche

- Turn houses for big paychecks even if you have no money, no job, no credit and little time

- Make 5 figure paychecks on over-financed beautiful houses with no cash or credit

- Use a secret IRA to grow wealth safely, securely, and invest in almost anything you choose

- Tap into already set up turnkey real estate investment solutions all over the country

- Take advantage of the 21st century way to build passive income by networking

- Make double digit returns and have the government guarantee your results

"John is a knowledgeable, trustworthy, financial wizard" - Dr. Taj Haynes

But wait... there's SO MUCH MORE! Find out why:

- You should make yourself famous in your own niche to grow your income and sell out for a mint

- You would access private funds all over the country to fund your business and real estate

- You will turn your IRA into your own guaranteed lifetime income stream with no market risk

- You should master marketing to turn any business into a cash flow monster on your terms

- You should consider safely loaning out your money for high returns

- You are needlessly paying thousands more of income taxes every year and how to stop it

- You should change the way you bank and where you park money to rapidly pay down debts

Free bonus material available to be mailed and on-line!

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Wealth Without Stocks or Mutual Funds by John Jamieson in PDF and/or ePUB format, as well as other popular books in Business & Wealth Management. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

Beat the Bank by Becoming the Bank

When I train people how to be the bank they’re almost always fascinated by this concept, but they struggle to understand how it could benefit them. So before you read another word of this book, get out a pen, paper, and calculator and do this simple exercise:

Add up all the payments you’ve ever made in your life to a bank or finance company on every debt you’ve ever had. This includes cars, real estate, boats; any motorized anything, business loans, business equipment, student loans, etc. Now whatever that figure is (it will largely be a figure of age and income), double it. For instance, if you’ve shelled out $1 million in total payments, your number would be $2 million.

Why do we double that figure? Simple: By giving up control of all your money in the form of monthly payments for all those years, you turned over the growing power to the bank.

Depending on your age, even if you’d kept that money and earned a modest interest rate of 4 percent to 6 percent, your money would’ve easily doubled once—and, for many of you—doubled twice.

Now that we have your money lost score, let’s add up your money kept and invested score.

Simply add up all the money you’ve saved in your IRAs, 401ks, and other retirement accounts. Grab your most recent statements and add them up. This entire exercise can be done in 10 minutes, and I challenge you to do it before you read another word.

How much have you saved and invested for retirement?

Which of those two totals is bigger, the money you paid to the bank—or the money you set aside for yourself?

Now ask yourself who’s getting rich with that personal finance model.

The answer, of course, is obvious: the banks and Wall Street. This business model works like a charm for them. Wall Street is flat-out drunk with money and has been for decades.

When I do this exercise in front of a room, it always draws a laugh from the crowd because they realize that those monthly payments have deprived them of most of the wealth in their lives.

You borrow money your whole life and don’t care, as long as the interest rate is low. The problem is this keeps you in financial bondage to the banks. Whatever money you’re able to put away goes into a “qualified plan” and is then handed over to Wall Street.

The average participant in my workshops might tell me he’s shelled out $2 million in payments and lost growth over the years, and has only $70,000 saved for retirement. Which figure would you rather have for yourself? This is math that any fifth grader can do, and it makes sense to anyone with an open mind.

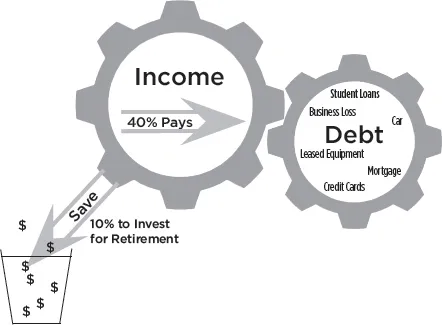

Now to be fair, very few people can afford to self-finance their first car or house, so the numbers get skewed because you probably didn’t have the option of self-financing those things. But your ultimate goal should be to self-finance your life. Think of it as one giant income wheel. Income comes into the wheel, but most of it gets spit right back out the other side.

Your goal is to keep as much of that money coming in on the wheel as possible. It’s important to understand that I’m not advocating just paying cash for items the way many financial gurus incessantly preach. I’m talking about using your capital just like a major bank.

If you took out a loan from the bank, do you think they’d mind if you didn’t pay it back? Or if they’d mind that you paid them no interest? (Don’t be fooled by those “0 percent loans” because there’s always a cost; sometimes it’s hidden in the actual price instead of in the finance charges.)

The answer to both of those questions is of course they would.

So if you’re acting as your own bank, why would it be acceptable to not pay yourself back, especially without interest? It’s never acceptable just to pay cash (especially for anything over $10,000) and not pay the bank back—even if you own the bank.

I’m going to show you how to make money on every car you ever own from this moment forward. When I teach this concept in my workshops, I always get someone who wants to show me how smart he is who says, “I don’t pay any interest on cars because I pay in cash.” These people want to prove that they don’t get robbed by banks, that they’re more sophisticated than most of us.

But the truth is that paying cash for a car does very little to stop the wealth drain of the car. The biggest expense you have when you own a car (not including operating expenses like gas, oil, and maintenance) isn’t the interest you pay on a loan, although that can substantial. The biggest expense is actually the depreciation.

Let’s look at a typical American car-buying experience:

Bob buys himself a new car (that’s his first mistake; he’d be far better off buying a used car that’s two to three years old, after the lion’s share of the depreciation has already occurred) or even a used car for $25,000. He takes out a loan for $25,000 for five years at 5.25 percent interest, giving him a monthly payment of $475.

So what will this transaction look like in five years?

At that point, Bob owns the car free and clear, but he’s shelled out a total of $28,500 (the original $25,000, plus $3,500 in interest). All he has to show for it is a $5,000 asset.

His loss on his “investment” is $23,500 over five years—and getting worse with every month.

So where did his biggest loss occur?

It wasn’t in the $3,500 interest paid, but in the car’s steady depreciation.

Interest lost to the bank: $3,500.

Money lost to depreciation: $20,000 (and climbing every month).

Anyone who thinks paying cash for a car is a good idea is living in a fool’s paradise. The cash left sitting inside the car disappears like magic. That money must be volumized and velocitized to recapture the massive depreciation and create interest in your favor instead of working against you.

Some gurus will tell you to pay cash for everything and drive around in a $2,000 jalopy. But what self-respecting adult wants to drive around in a “beater”? This is a great way to create a sense of scarcity in your life and actually repel wealth from your family. Driving a beater can have a huge negative effect on your personal wealth thermostat, causing you to subconsciously believe that you’re only worth what your “beater” car says your worth.

Instead, you can drive a nice car that’s in your budget and finance all or part of it yourself. That way you get the nice car and don’t lose your shirt in the process.

I would like to show you why you might be better off buying your car than funding your 401k. I know that sounds like financial heresy but I can prove it with fifth grade math. I’m going to ask you to do another exercise right now. I have a video that will show you in just a few short minutes what I am talking about and why any fifth grader could figure this out for themselves in about 10 minutes.

Visit us at www.MultipleWealthStreams.com to watch why buying a car might be better than funding your 401k. Search for the video entitled “car vs. 401k” and give it a watch and a share on your social network if you like what you hear. Many other training videos are available there so take the time and join our YouTube® community.

Plug up your 4 biggest wealth drains

The four wealth drains in most Americans’ lives are income taxes, interest and fees, market losses, and depreciation. In order to grow your wealth, regardless of what happens to any market, these drains must be stopped. I’ll elaborate on them throughout this book, especially on the biggest wealth drain of all: taxes.

The traditional financial model that we’ve all been brainwashed with says to put 10 percent of our income into our retirement accounts, such as a 401(k) or an IRA. But that money is almost always put into mutual funds and the stock market.

If you’re one of the few people who puts away 10 percent or more of your income for retirement, congratulations! You’re in better shape than most Americans. The bad news is that even you are getting bamboozled by the biggest magic show on earth.

The best magicians and illusionists are masters at having you focus on one area of the show, while at the same time using their other hand to actually achieve the “magic.”

This is a perfect analogy for our four wealth drains. The “magic” occurs when you focus on your investments and whether they’re going up or down. You ask yourself, “When should I get in the market? When should I get out? Should I buy stock or sell it?”

But while you’re focusing on the investment portion of your life, you can become oblivious to how you’re transferring your wealth almost every month to everyone but your family.

While you’re busy looking at your investments, here are the wealth drains you’re ignoring:

•Income taxes

•Interest and fees paid to banks and others

•Market losses from your investments, which steal the compounding curve

•Massive depreciation on assets (such as cars)

If we could stop or seriously slow down all of these wealth drains, wouldn’t we automatically create more wealth for our families? And wouldn’t that wealth accumulate regardless of what happens in any investment market? Could we set our watches by that wealth as opposed to just our investments?

Of course, the answer to all of these questions is a resounding YES!

Broke Business Model

Typical Retirement Savings Vehicles:

CDs, Stocks, Bonds, Mutual Funds, IRAs & 401(k)s, Money Market Accounts

CDs, Stocks, Bonds, Mutual Funds, IRAs & 401(k)s, Money Market Accounts

Would you rather save 40% or 4.3%?

(US National Average Savings Rate as of December 2014 was 4.3%)

Ben Franklin was right and wrong

As we know, Benjamin Franklin was one of the wisest men this country has ever known and helped lay the foundation for America, along with some other very talented men. His most famous saying is “A penny saved is a penny earned.”

When I’m talking to live crowds, I often ask this question:

“If a penny saved is a penny earned, then would $250,000 saved be $250,000 earned?” The crowd almost always says yes, and for the longest time I thought that was right.

But then I wised up.

To actually save $250,000 from your income for yourself, you probably have to make around $450,000. Why? Because you have to pay taxes on that new income.

So $250,000 saved is not $250,000 earned, but rather $250,000 saved is $450,000 earned!

This is one of the reasons I have dedicated an entire chapter to income taxes and how to legally and ethically reduce your income tax exposure every year. Since income taxes are one of the biggest expenses we have in life don’t you think it makes sense to know how the system works so you can arrange your affairs in such a way to pay the least amount of taxes allowed by law?

You might consider going to the chapter on taxes now or simply arrive there in the natural course of reading. Either way the information is not to be missed and once learned, please make sure you act upon the new strategies you’ll learn.

Interest and fees paid to banks

This massive number has already been made crystal clear in the exercise of adding up your payments and doubling that amount we discussed earlier. How would you like to recapture even 50 percent of your figure from the previous exercise and keep it for yourself and your family? To do so, we will take a close look at how banks really make money and how you can employ the same strategies. This is covered in an upcoming chapter in depth. Once this information is understood you will want to take steps to use these banking strategies for your own wealth creation efforts.

Market losses steal your compounding curve

Albert Einstein supposedly said that “compound interest is the eighth wonder of the world.” Compounding is a seemingly magic elixir that has the power to create wealth for anyone who grasps it. But for those who choose to ignore its power, it can be a real wealth-stealer.

Compound interest can be killed in two ways:

1)By withdrawing money from a financial account in which it was earning compound interest. When investors break the compounding curve like this, it can be a serious setback, so you should only withdraw these funds in an emergency.

2)When your investment loses value, it erases the compounding curve and puts it years behind the pace it would have been on if the money had not been lost. True compounding of money is interest on profits wit...

Table of contents

- Cover

- Title Page

- Copyright

- Dedication

- Contents

- Preface

- Introduction

- Chapter One: Beat the Bank by Becoming the Bank

- Chapter Two: Your “One” Account

- Chapter Three: Reduce Income Taxes by 50% or More

- Chapter Four: Fast Turning Houses for Big Paychecks

- Chapter Five: Fast Turn “No Equity” Homes

- Chapter Six: The Secret IRA Your Financial Advisor Doesn’t Even Know Exists

- Chapter Seven: Private Lending—No Banks Required

- Chapter Eight: Nationwide Turn-key Income Properties

- Chapter Nine: Million Dollar Marketing

- Chapter Ten: Million Dollar Internet Marketing

- Chapter Eleven: Million Dollar Media Strategies

- Chapter Twelve: Create Your Own Private Pension

- Chapter Thirteen: Mobile Home Park Investing

- Chapter Fourteen: Mortgage and Debt Payoff in Record Time

- Chapter Fifteen: Double Digit Returns Paying Other People’s Taxes

- Chapter Sixteen: Network Marketing in the 21st Century

- Chapter Seventeen: Wealth Without Stocks or Mutual Funds Game Plan

- About the Author John Jamieson

- Backcover