eBook - ePub

Lease Accounting with SAP: IFRS 16 and ASC 842

SAP RE-FX and SAP Lease Administration by Nakisa

- 435 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Lease Accounting with SAP: IFRS 16 and ASC 842

SAP RE-FX and SAP Lease Administration by Nakisa

About this book

Are you ready for IFRS 16 and ASC 842? Jump-start your leasing project with this guide to SAP Lease Administration by Nakisa and SAP Flexible Real Estate Management. Run compliance readiness checks and configure your leasing system using best practices for your industry. Then perform transition accounting and manage your leases the right way. Whether you're implementing SLAN or RE-FX, the clock is ticking! Highlights include:

SAP Lease Administration by Nakisa (SLAN)

SAP Flexible Real Estate Management (RE-FX)

Operating leases

Finance leases

IFRS 16

ASC 842

Configuration

Integration

Implementation best practices

Case studies

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Lease Accounting with SAP: IFRS 16 and ASC 842 by Hanno Hofmann,Pamela Lim,Joy Mabborang,Louis Teunissen,Tom Anderson,Imran Mia,Zeina Dabbagh,Puja Mehta in PDF and/or ePUB format, as well as other popular books in Informatik & Informatik Allgemein. We have over one million books available in our catalogue for you to explore.

Information

1 Lease Accounting Basics

Though a treatise on accounting is outside the scope of this book, this refresher on basic leasing concepts will help with your SAP Flexible Real Estate Management or SAP Lease Administration by Nakisa implementation.

Before we dive more deeply into implementing SAP’s software solutions to reconcile the new leasing requirements International Financial Reporting Standards 16 and Accounting Standards Codification 842, let’s review the fundamentals of leasing in Section 1.1. Then, in Section 1.2 and Section 1.3, respectively, we’ll differentiate between procedures for lessees and for lessors as we walk through the accounting processes for each role.

1.1 Building Blocks of a Lease

A lease is defined as a binding legal contract that outlines the terms and conditions of an agreement for the use of a specific asset for a period of time for a defined amount of regular payments. IFRS 16 and ASC 842 regulate all leases and subleases except for those relating to intangible assets, biological assets, exploration (or the use of non-regenerative resources such as oil and gas), inventory, and assets under construction.

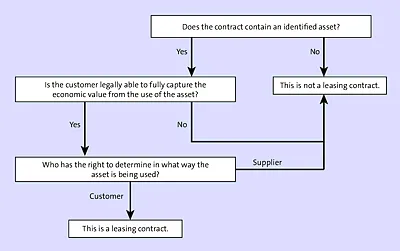

So how do you know if a contract is a lease contract? In this section, we’ll walk through the various decision points, continuously referring back to the basic lease contract identification workflow shown in Figure 1.1.

In some cases, leases are broken into multiple lease components. All components of a lease must be part of the contractual agreement and must meet the same criteria. Further, two additional criteria must be met to determine whether the right to use an underlying asset is a separate lease component (per IFRS 16, paragraph B32):

- The lessee can benefit from use of the underlying asset either on its own or together with other resources that are readily available to the lessee. For example, if you lease a computer and a separate monitor, you can either use these items on their own or lease another computer/monitor from the same supplier or a different supplier.

- The underlying asset is neither highly dependent on, nor highly interrelated with, the other underlying assets in the contract. For example, if you buy specific software for a computer that only works on that computer’s operating system, then the software is dependent on the computer.

Figure 1.1 Lease Contract Identification Process

The lease contract identification process looks for two lease components: the identified asset and the right of use of that asset. Let’s look at each.

1.1.1 Identified Asset

The first question in Figure 1.1 is whether the contract contains an identified asset—so let’s investigate that term in more detail.

The identified asset of a contract can either be explicitly defined in the contract, or it can be implicitly defined when the asset is made accessible for the lessee. Sometimes an asset can also contain another identified asset—for example, when a part of an asset that defines certain capabilities is physically distinct (e.g., the monitor of a computer). We can also identify non-physically distinct parts of an asset, which would be the case if the part substantially represents the entire capability of the whole asset; for example, if a telecommunications provider leases an antenna, that antenna substantially represents the whole asset.

Understanding that, from now on, leases need to be handled differently from service contracts is important. The key distinction is that a lease provides a customer with the right to control the use of an asset, whereas the supplier retains control in a service contract.

1.1.2 Right of Use of an Asset

If a contract contains an identified asset, we’ll proceed through the flowchart shown in Figure 1.1 to consider whether the contract includes the right of use for that asset.

To determine the right of use, your company needs to evaluate whether the lessee has permission to do two things:

- Achieve the full economic benefits of using the identified asset throughout its contractually agreed period. These benefits granted to the lessee would include the economic benefits from commercial transactions with a third party (such as subleasing the asset).

- Define the following: ...

Table of contents

- Dear Reader

- Notes on Usage

- Table of Contents

- Foreword

- Preface

- Introduction

- 1 Lease Accounting Basics

- 2 Evaluating Compliance Readiness

- 3 Managing Your Leasing Project

- 4 Implementing SAP Lease Administration by Nakisa

- 5 Configuring SAP Flexible Real Estate Management for Lease Valuations

- 6 Transition Accounting

- 7 Managing Leases with SAP Lease Administration by Nakisa

- 8 Managing Leases with SAP Flexible Real Estate Management

- 9 Disclosures, Reporting, and Analytics

- 10 Key Industry Considerations

- Conclusion

- A IFRS 16 and ASC 842 FAQs

- B The Authors

- Index

- Service Pages

- Legal Notes