- 38 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Remittances are considered a lifeline of developing countries and are especially vital for migrants and their families. Digital data technology can help alleviate many of the "pain-points" in the remittances industry. For example, it can significantly enhance the convenience, speed, security, and affordability of sending and receiving remittances. This report discusses the importance of remittances in Asia and the Pacific, the key challenges faced by the industry, and the impacts of the coronavirus disease (COVID-19 pandemic. It also includes country case studies that demonstrate the benefits of digitization and makes recommendations on how the digitization of remittances across the region can be further advanced.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Harnessing Digitization for Remittances in Asia and the Pacific by in PDF and/or ePUB format, as well as other popular books in Personal Development & Personal Finance. We have over one million books available in our catalogue for you to explore.

Information

Digitization and Remittances

Digital remittances have been heralded as a key enabler for achieving global remittance targets. In particular:

• Digitization can bring a number of benefits, namely reducing transfer prices, and improving transparency, efficiency, convenience, and access:

» The Global System for Mobile Communications or GSM Association (commonly referred to as GSMA), the trade body for the mobile operators, has undertaken market surveys to determine the prices of sending money through mobile services compared to other methods. The data show that the price to send money from mobile wallet to another mobile wallet internationally was 3.53% in Q3 2020 compared to the global average for sending remittances which was 6.75% (Remittance Prices Worldwide) (GSMA 2020a).

» Digital remittances normally result in the crediting of money to an account. Account holders can then use remittances to pay for multiple products. Some of these products may have a cost attached (such as cashing out), but these costs are not included in remittance calculations because it is the account holder’s choice whether to incur these costs or not.

» Even where money is sent digitally to an account or a wallet and the consumer wishes to withdraw cash, the price is still lower than a traditional cash-to-cash remittance (GSMA and World Bank) because the send end of the transaction does not need an agent.15

• Digital financial services can boost the resilience of the financial sector, especially during crises. This is done by reducing prices, increasing convenience, reducing the time spent sending money, and increasing access. Senders and receivers do not need to leave home to make or receive money.

In total, international remittances via mobile money contribute to 14 of the 17 SDGs (Figure 4). Because of its reach and growing use among underserved people, mobile money is uniquely positioned to transform formal remittance markets and to advance financial inclusion. Mobile money providers are at the forefront of domestic payment services in many emerging markets, enabling the recipients of international remittances to pay for goods and services digitally, in turn creating a payments history that could enable them to access credit or insurance in the future. Mobile money has thus established itself as a critical tool for facilitating international remittances, while reducing remittance prices and maximizing the impact of remittances on development.

Three Case Studies: Philippines, Malaysia, Pakistan

Examples from the Philippines, Malaysia, and Pakistan provide insights into what can be done to improve the environment for remittances by using digital payments (Boxes 1, 2, and 3). In the Philippines, a key lesson is that by improving the domestic payments environment, international remittances can benefit. More broadly, better domestic payment systems can encourage more people to obtain accounts and become “financially included,” removing their need to receive money in cash. On a practical level, improved domestic payment systems can lead to faster straight-through processing of receiving transactions to accounts, which increases speed and lowers prices.

Box 1: Philippines

The Philippines has a coherent payments digitization strategy. The Bangko Sentral ng Pilipinas (BSP), the central bank, introduced the “Digital Payments Transformation Roadmap,” which outlines a series of initiatives to transition, and increase, digital payments to 50% of all payments by 2023 and aims to increase financial inclusion to 70%, also by 2023. The strategic outcomes include stronger customer preference for digital payments, and more innovative and responsive digital financial services.

Prior to introducing the road map, the number of Filipinos with any form of account, bank or otherwise, was low. Data from Findex suggests that only 34% of the adult population had an account in 2017.a The popularity of cash, varying socioeconomic levels due to geography, and the lack of financial inclusion were the reasons behind the low number.

B2B = business-to-business, B2G = business-to-government, B2P = business-to-person, G2B = government-to-business, G2G = government-to-government, G2P = government-to-person, ID = identification, KYC = know your customer, P2B = person-to-business, P2G = person-to-government, P2P = person-to-person.

Source: Bangko Sentral ng Pilipinas. Philippines Digital Payments Transformation Roadmap.

The road map’s three pillars for successful transition to digital payments are as follows:

• Digital payment streams: Create compelling and large-scale digital payments use cases. These include all use cases, such as government-to-person and person-to-person.

• Create digital finance infrastructure that is secure, reliable, efficient, and interconnected for smooth payment transactions. Interoperability is a key component of this. In the Philippines, this includes InstaPay (which is the current instant payment stream) and PESONet (a batched payment stream). An interoperable system will allow smooth transactions.

• Digital governance and standards aligned with global best practices and standards to ensure provision of digital products and services are covered by an adequate governance process (BSP). The last pillar also includes increasing customer confidence in digital services.

A supporting feature is the introduction of a digital national identification (ID) scheme. This will support the payment system and will facilitate real-time processing of financial transactions. In addition, the National QR Code Standard (QR Ph) was introduced in November 2019 to accelerate progress of digital payments. The QR code contains important information relating to an account, such as the account name and number, enabling use for retail payments and greater speed and efficiency. BSP wants to expand from peer-to-peer to person-to-merchant, so that small businesses that may not have an account can accept payments digitally.

a World Bank. 2017. Global Financial Inclusion (Global FINDEX) Database 2017. https://globalfindex.worldbank.org/ (accessed 13 January 2021).

Source: Authors.

Box 2: Valyou in Malaysia

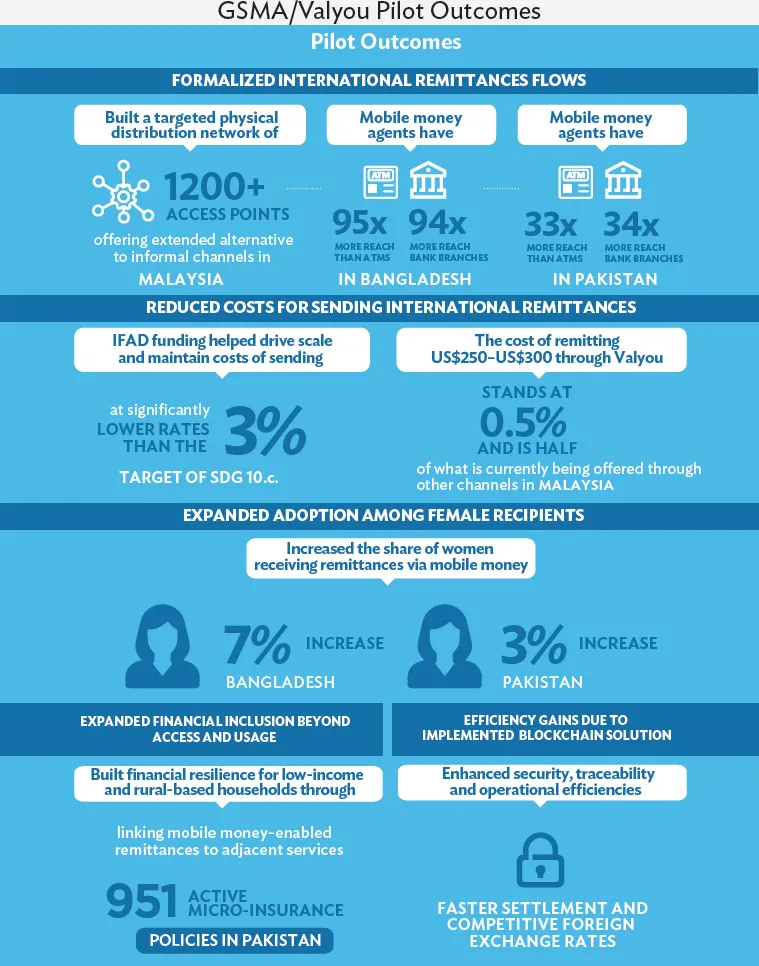

Between 2017 and 2020, the Global System for Mobile Communications Association (GSMA) conducted the study How Mobile Money is Scaling International Remittances and Fostering Financial Resilience: Learnings from Valyou in Malaysia. Traditionally, sending remittances from Malaysia to those two countries has been cash-based and often informal (using the hawala system). The Malaysian mobile money provider, Valyou, piloted an app-based international remittance service for migrant workers from Bangladesh and Pakistan. The pilot revealed that mobile money can help turn informal flows into formal, reduce remittance prices, and increasing financial inclusion and uptake by female recipients.

The figure details a high-level overview of the outcomes of the pilot.

ATM = automated teller machine, IFAD = International Fund for Agricultural Development, SDG = Sustainable Development Goal.

Source: Global System for Mobile Communications Association. 2021. How mobile money is scaling international remittances and fostering financial resilience: Learnings from Valyou Malaysia.

A key outcome if the Valyou pilot is formalization of remittances flows. By leveraging their existing relationships with the Bangladeshi local telco, Digi, and partnering with mom-and-pop shops, Valyou was able to set up a targeted distribution network, significantly aiding higher formal remittance transactions. Customers in Bangladesh are also able to receive remittances directly into a mobile money account, which has helped increase convenience, particularly for those in rural areas who would have to travel to their nearest money transfer operator.

Consumer behavior changed in Pakistan by incentivizing consumers to remit funds through the mobile money app. The price of remitting was significantly lower than the 3% global target. To achieve this, Valyou concentrated on reducing business costs in physical locations. The pilot focused on migrating custom...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Tables, Figures, and Boxes

- Foreword

- Acknowledgments

- Abbreviations

- Introduction

- The Importance of Remittances to Asia

- Challenges with Remittances

- Impact of Coronavirus Disease on Remittances to Asia

- Digitization and Remittances

- ADB Support for Remittances

- Recommendations

- Key Messages

- References

- Footnotes

- Back Cover