- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The New Wealth Paradigm For Financial Freedom

About this book

SAFE, SIMPLE AND STRESS-FREE!

Most Americans do not understand their finances and are locked into a financial system designed to take away your freedom and keep you stressed, and in debt for our entire life. This book will give you a specific guide to help you find the peace, financial freedom, and security in your life.

You will learn how to:

• Be completely out of debt in 5 to 10 years.

• Make over 100% return, guaranteed, without risk or tax consequence.

• Learn the three choices that lead to happiness and peace.

• Safely and predictably invest on your own.

• Create your own Personal Bank

Make More, Eliminate Debt, Build True Wealth and Achieve an Incredible Stress-Free Life!

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The New Wealth Paradigm For Financial Freedom by Dr. Albert "Ace" Goerig in PDF and/or ePUB format, as well as other popular books in Business & Wealth Management. We have over one million books available in our catalogue for you to explore.

Information

Strategy 1

Double Your Money: Pay Off All Debts First

THE HIDDEN SECRET OF financial freedom is to pay off all debt first. This gives the highest rate of return guaranteed without taxes.

Banks, financial advisers, accountants, and Wall Street perpetuate the idea that debt is normal and that you would make more money by investing with them instead of paying off your house early. They also say that you will lose the tax benefit of writing off your mortgage interest. In most cases, this is not true but are the key reasons why people do not pay off their home and stay in debt. They perpetuate the lie that the extra principal payments toward your home does not earn you interest or make you money.

The truth is you can earn more than 200% interest by paying off the home early, as we see in the example below. They also state that the equity in your house is locked up and cannot be used. You can always use your home as collateral for any type of loan that you need. But, more importantly, you must see your paid-off home as a long-term bond that goes up with inflation and that your return on investment is the money that you did not have to use for your monthly payments to the bankers. Most importantly, how much do you really need to earn when you have no debt? This is all about your freedom and increased choice in your life.

Let us start with the big mortgage lie that the mortgage interest you pay makes you money by saving on your taxes. If you are in the 28% federal income tax bracket and you itemize your deductions, you will pay one dollar of mortgage interest and save 28 cents in taxes. This means you lose 72 cents for every 28 cents you save on taxes. For most families, the standard $24,000 deduction gives them a better tax result than itemizing to write off mortgage interest. So, the mortgage interest “write-off” benefit isn’t really a benefit at all.

The next lie is that you are only paying 4.5% interest on your loan. Consider a $310,000 mortgage at 4.5% for 30 years. In the table below, you can see that, of the first year’s loan payment (principal plus interest) of $18,849, only $5,001 goes to principal, and $13,848 goes to interest. This $13,848 that the bank keeps is lost to you forever. If you did not have a mortgage, what could you have used that money for? You think you have a 4.5% loan, but that year, it is actually 277% interest to the bank on your principal payment. At the same time, you are earning 0% interest from the bank on the money in your checking account. Does this seem fair?

Furthermore, in the 28% tax bracket, you had to earn around $17,724 and pay taxes on that to get $13,847 to give to the bank as interest payments. So that makes it a 354% interest-rate loan on your $5,001 principal payment. The biggest loss is the $255,461 of things you could have bought with the interest you paid the bank over the 30 years of the loan. These are the cars, vacations, college educations, home improvements, boats, and vacation homes gone forever.

You must understand that the interest is always the highest at the beginning of the loan. Over the first five years of the loan, you would have paid $96,243 in loan payments and only $27,410 would have gone to pay off the loan balance. For most loans, the first 10 years of this 30-year loan, the interest paid will always be above 100% of the principal paid. Always take advantage of this guaranteed high return!

If you invested an additional $5,231 (the second year’s principal amount) toward the principal in the first year, you will have saved an entire year from your mortgage term, which means saving $13,618 in interest. That is a guaranteed 260% return without risk. With this great return, why would anyone leave money in their savings account, earning a miserable taxable 0.1%, when they could pay an additional principal payment on their home and earn a 260% tax-free return instead? To maximize your return, use the money from your saving and money-market accounts to accelerate debt payments. Many people get out of the market and sell all their non-tax-deferred stocks to pay off debts. All extra payments must be directed only to the principal of the loan!

When we have debt, saving money is an encoded trap that keeps us poor. In the above example, if you have $100,000 in your savings, taxable, or tax-deferred investments, the best, safest, and highest guaranteed return on that money would be to pay off debt. Paying $100,000 toward the $310,000 home mortgage would drop your mortgage to $210,000 and save you $121,360 in interest payments while paying off 13 years of the mortgage.

Compare this $121,360 made by paying off debt to the $200 you would get with a taxable .2% bank 3-month CD for the same $100,000. You must see the $100,000 put into the house as a high-return, safe, long-term, inflation-adjusted bond that is always available to you through lines of credit or second mortgages. Once the home is paid off, the money used for mortgage payments becomes a constant source of available cash flow. It is like getting money from a bond or rental property.

Here is another way to look at it. Your $310,000 home with interest over 30 years at 4.5% will cost you $565,000. If you are in a 28% tax bracket, you will have to have earned around $800,000 to pay for that $310,000. This is why we pay these mortgages off in 5 to 7 years.

Always pay off the loan in the shortest time period that you can afford. This will allow you to direct most of your payment to the principal of the loan instead of losing a majority of your monthly payment to lost interest which the bank keeps. If you get a 30-year loan with a 3.5% interest rate, your first year real interest rate will be 181%. If you can pay of the loan in 10 years, the real interest paid to the bank will only be initially 40% on that 3.5% interest rate and becomes less each year afterwards. If paid off in 5 years the 3.5% interest loan rate is only 17% initially. Look at the chart below. Check out: https://www.drcalculator.com/mortgage/old/

THE MORTGAGE INTEREST RATE CHALLENGE

Call up your bank or mortgage company, and ask them the amount of your mortgage payment that goes to principal and how much goes to interest this month. Divide the principal into the interest rate and multiply it by 100% to determine the true interest you are paying that month. (Interest/principal × 100% = real interest rate). If you make one additional payment, this will be your rate of return on that investment.

It is all about net worth. Our net worth is the total of all our assets, including our investments, bank accounts, and real estate, minus our debts. Paying off debt increases your net worth (wealth) and provides an asset that you can use in emergencies as loan collateral. Paying off debt is the safest and most powerful investment strategy. Learn to be happy with less tax deductions, especially when you can’t even write off the mortgage interest due to the high standard deduction. Learn and avoid the tricks of the government and the banks to keep you in debt and servitude.

There is no good debt, only bad debt. All debt is bad, bad, bad! Debt keeps you imprisoned and prevents you from living a life of freedom, independence, and choice. Being overburdened with financial responsibilities increases your stress and can damage important and satisfying personal relationships and even lead to divorce, which could cost half of what you own. By changing your spending, saving, and investing habits, one step at a time, you can regain control of your life. You now know what interest payments really cost you and what to do to change your spending habits.

The advantages to paying off debt first are:

- Easiest and simplest to do and understand.

- No need for financial advisers and their expensive fees.

- It can give you a guaranteed 100% return on your money, without risk or taxes.

- Can be done automatically, right out of your bank account. You treat the payment as if it is a tax and becomes like a forced savings.

- Changes you from a spender into a saver.

- As you create equity in your home, you have access to cash through lines of credit or 2nd mortgages for opportunities or emergencies.

- Complete peace of mind and choices in your life because no one (banks) owns you.

- Once debt-free, it takes very little to live on. Now you have three times the amount of disposable income (previously, ⅔ of your disposable income was paid toward debt) to fund your own Personal Bank to have money to spend, invest, or just enjoy life with.

- Once your home is paid off, it acts like a long-term, inflation-adjusted bond. The 20% of your income that you were using to pay off your mortgage you now get to keep as a constant source of income that you never have to earn, and you will never have to worry about a house payment again.

DEBT IS THE DEVIL

When you become debt-free, there is no need to worry about your credit report because you pay cash for all your purchases. The ability to obtain credit is what got you into trouble in the first place. The idea that you need to build up your credit by borrowing is an illusion that keeps you in debt. But once you become debt-free, no one owns you, and this is true freedom.

Once debt-free, an individual would be able to maintain their lifestyle, fund their retirement, need to work only three days a week, and still take off eight to twelve weeks a year, which I call retiring-in-business. They could create a beautiful story and business environment for themselves and their teams, and love going to the office knowing that they have plenty of time off to play and rejuvenate. Under those circumstances, why would you ever want to retire?

When this strategy is implemented correctly, you will have created an automatic investment program using your own Personal Bank to buy income-producing real estate or low-cost index funds, and you will not worry about the ups and downs of the market. You will learn how to “retire-in-business,” which would allow you to work only two to three days a week, and take eight to twelve weeks of vacation a year. This comes from understanding the systems in business management and investing in yourself to learn these skills.

Strategy 2

Create a Financial Freedom Game Plan

FINANCIAL FREEDOM BEGINS with creating a step-by-step game plan to first evaluate and reduce your discretionary spending, find ways to make more money, and to focus this found income toward debt reduction. This will allow you to pay off all debt within 5 to 10 years. Stop all consumption debt. Most families in America are imprinted to use their credit cards and consume, whether they have the money to pay for something or not. If you do this, you typically pay high interest rates; this is not an effective way to manage your money.

Act Today. Declaring that you are seriously committed to getting out of debt is the first step to achieving personal wealth. Go through the steps below. All forms can be downloaded from DoctorAce.com. Sit down with your significant other: Both of you must be on board, knowing that this will strengthen your relationship, eliminate stress around money, and give you back your freedom. Then read this book together, and set time aside to do the following:

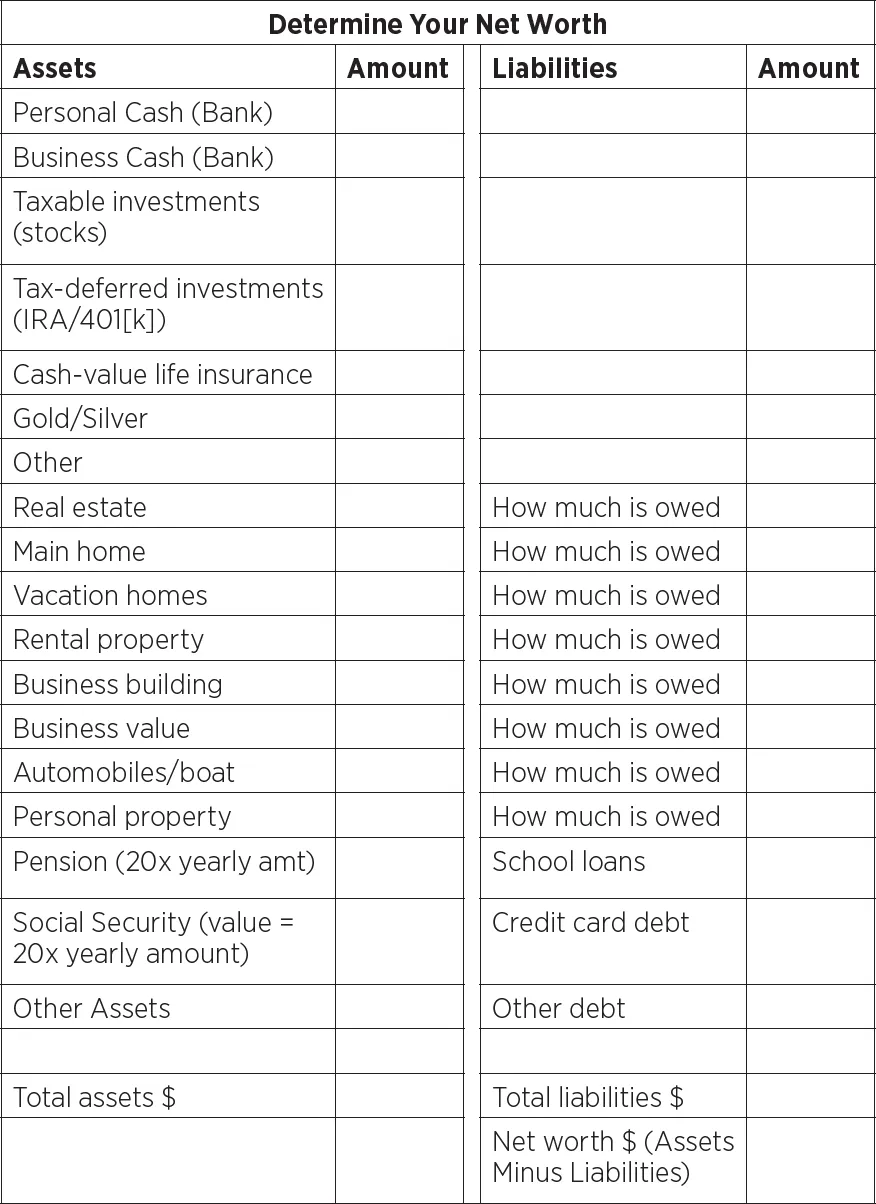

1. Add up your net worth, that is, everything you own, and then subtract everything you owe in the chart below.

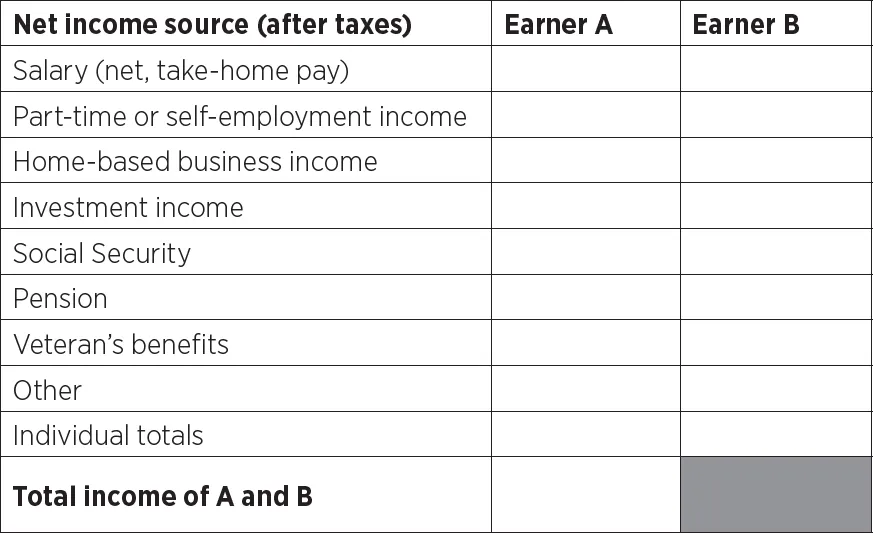

Write down your total household income.

2. Reduce your monthly expenses. List all your current monthly expenses in the “current” column below. In the “reduced” column, record the lowest amount you can reasonably spend on each item. Total up all “reduced” amounts at the bottom of column 3, and then subtract that amount from your total income. The resulting number is your maximum possible found debt-reduction money. Go through your credit-card receipts and checkbook, and add up all your monthly expenses. Use the list below. See where...

Table of contents

- Cover Page

- Title Page

- Copyright

- Disclaimer

- Contents

- Preface

- Introduction

- Financial Myths and Mistakes That Keep Us Poor

- Strategy 1: Double Your Money: Pay Off All Debts First

- Strategy 2: Create a Financial Freedom Game Plan

- Strategy 3: Learn How to Invest Safely and Simply

- Strategy 4: Create a Personal Bank

- Strategy 5: Enjoy Life, Liberty, and the Pursuit of Happiness

- About the Author

- Back Cover