- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

No One Will Remain Unaffected.

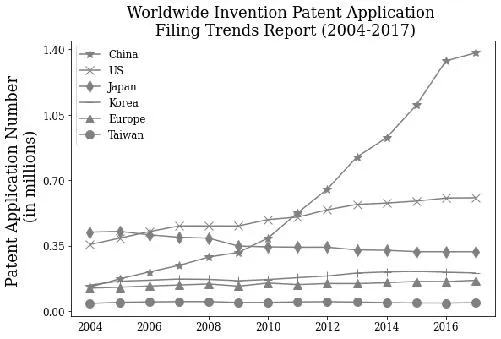

Upon the inception of the US-China trade war, China's IP regime experienced rapid-fire development. The STAR market and the first patent securitization deal are a few of many developments accelerated by this conflict showing that the market appetite for IP monetization has reached an extraordinary level in China.

Innovation's Crouching Tiger, like a telescope, is a tool that readers can use to clearly see the cutting-edge developments in China. Equipped with a three-lens methodology and case studies, Dr. Chung offers countless resources to help readers successfully make their own plan of action in this unprecedented time and is the first guide of its kind in English. Now, more than ever, is the best time to take action. To collaborate or to compete.

Features

.Unprecedented: The first book written for international readers who want to obtain their own insights on China's innovation regime and IP monetization.

.Structured content: Inspired by the three-lens analytical framework taught at MIT Sloan School, the book organizes content into three dimensions of IP: IP transfer, IP pledge and IP risk control, which can be effectively and precisely understood.

.Profound knowledge in simple language: The opening chapter uses simple concepts and stories to explain profound theories of socialism and historical tracks of China's innovation regime to enlighten readers with a strong foundation prior to going into deeper analysis. A special chapter crystalizes the essence of the book into actionable strategies, as a quick guidance to help readers formulate their own plans for co-competition.

.Timely surveys, case studies, news summaries with charts and tables: The book covers three independent surveys and five case studies, mining deep into the topics most intriguing to foreign observers. Topics including IP exchanges, AI and big data application in innovation, the new STAR board, and IP securitization deals.

Readers Who Benefit the Most

.Young business professionals planning their career paths under the new global economic norm

.Senior business managers shuffling their global technology supply chains around the US-China trade war

.Engineers, scientists, or researchers wanting to apprehend the changes of the global innovation ecosystem resulting from China's technological growth.

.Think tanks within governments, NGOs, or global institutes deploying their resources in response to China's developing innovation regime.

.Investors and their agents (bankers, lawyers, accountants) seeking insights on global investment opportunities created by chain reactions from China's move in innovation.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

- In 2017, 14,144 patent pledge transactions were recorded and continued to grow in the following years.1

- In 2019, the accumulated loan balance collateralized by patent pledges reached CN¥110 billion.2

- The number of enterprises filing patents increased from approximately 1,000 in 2013 to 2,000 in 2015. In 2017, the number increased to 2,300.3

- During the five years prior to 2014, the annual growth rate of the accumulated loan balance was about 100%. The growth rate slowed from 2015 through 2019 but remains robust.

- After some debate on the practice of the patent pledge and correction of the development direction from 2017 to 2019, the relevant regimes have undergone certain reforms and again demonstrate high growth potential. A more in-depth analysis of the implications for IP monetization is provided in Part II.

- Accumulated loan balance in 2019: CN¥41 billion.4

- Making a trademark pledge is a common practice in China.

- The average size of a loan using trademark rights as collateral: CN¥1 million.

- Largest loan on record: CN¥200 million (the underlying pledged trademark right in this loan is assessed at CN¥5 billion).

- In 2018, the accumulated loan amount backed up by copyright pledges totaled to CN¥84 billion in 380 transactions. This consisted of software copyright pledges for CN¥47 billion in under 350 transactions and pledges of non-software copyright work for CN¥37 billion in under 50 transactions.5

- The copyright pledge is common for television and movie production, cultural and creative industries. To name just a few:

- Pledge the IP directly to the lending bank.

- Pledge the IP to a guaranty company, who provides financing to the IP owner.

- Pledge the IP to a guarantor who guarantees the IP owners will repay the loan to the bank.

Case Study 1 FEATURE ARTICLE: How Social Media Is Fueling IP Monetization in China12 This August, The New York Times featured a profile of WeChat13, describing how it has changed people’s everyday life in China and created a new profit model envied by its foreign precursors, including Facebook and Line. The story balanced the positive news with a warning that this form of convenience comes at a cost to the privacy of individual users. The story did not go into a phenomenon that may be of interest to IP professionals, however, namely how social media in China has become a potential platform for monetizing intellectual property rights. The Legend of the Movie, Monkey King This phenomenon is best illustrated by the 2015 blockbuster Monkey King: The Hero is Back.14 This animated movie was based on a popular, classic Chinese novel, Monkey King. The movie production itself is aimed at exploiting the value of the script. Copyright protection is, of course, the main way in which the value of the intellectual property inherent in the script is protected. As such, financing the movie production itself can be viewed as a form of IP monetization. The movie producer raised funds to produce the film through the “Moments” feature on WeChat, which is similar to Facebook’s timeline. Individuals an... |

Table of contents

- About the Author

- Preface

- Foreword by Tianpeng Wang

- Foreword by James Hou

- Praise for Innovation’s Crouching Tiger

- Acknowledgments

- CONTENTS

- Charts

- Case Studies

- Chapter 1 IP Monetization in China: An Overview

- Chapter 2 Observations From Behind the Scenes

- 2.1. The Planned Economy and Regulatory Regimes

- Chapter 3 The First Lens: IP Creation and Transfer – IP In-kind Contribution

- Chapter 4 The First Lens: IP Creation and Transfer – Securitization

- 4.1. Overview of the Practice

- Chapter 5 The Second Lens: IP Pledge

- 5.1.2. Highlights of development

- 5.2. Obstacles and Challenges

- 5.2.1. Fading rosy pictures

- Chapter 6 The Third Lens: IP Risk Mitigation

- 6.1. Overview of the Practice

- Chapter 7 Nine Key Points for Success

- Chapter 8 Stand at the Gateway of IP and Never Be Defeated

- Notes

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app