![]()

1

Financial systems

In this section, a number of regularly used financial terms and phrases are introduced and explained, so that when they are used in other parts of the text readers should recognise them and understand their meaning. In order to make this learning process easier, new finance terminology will be highlighted in bold print, and defined both alongside the text and in a glossary at the end of the book.

This part of the book introduces the financial system that operates in New Zealand, which is similar to those systems operating in most free-market economies. The financial system deals with the environment in which financial assets are created, held and traded in the economy. Essentially, it facilitates payments, lending and risk transference. Financial assets are held in many forms, from cash to the electronic record for a share. An understanding of the system is important for all types of financial decision-making.

Chapter 1 introduces a number of the concepts covered in later chapters. Finance is defined, and the reasons why it should be studied are explained. Important financial decisions must be made by individuals and organisations, and these decisions are influenced by the financial environment in which we live and operate.

In Chapter 2 the financial assets created by government, financial intermediaries, corporations and individuals are described. Before financial assets can be bought or exchanged, a price has to be set or agreed upon. When a financial asset is being sold for the first time it is called ‘a primary issue’ and is sold in a primary market; the price could be set by the seller, or the market could determine the price with the new financial assets sold to the highest bidder. Secondary markets exist for the trading of existing financial assets. In these marketplaces, the price set will be the lowest price a seller is prepared to accept and the highest price a buyer is prepared to pay. As new information becomes available in the marketplace, it will be incorporated into financial asset prices.

Chapter 3 looks first at why, when compared with most industries, the financial system is highly regulated. Recurring bank failures with large losses to depositors led to government intervention, as governments are concerned with the stability of the financial system and the role of the central bank – in the case of New Zealand, the Reserve Bank – in promoting it. It then looks at financial intermediaries that facilitate cash flow in the financial system, why they take the form they do, and why this form is constantly changing. Markets have developed over centuries in response to the changing financial needs of participants as well as the changing regulatory controls, and will continue to evolve.

![]()

CHAPTER 1

An overview of finance

■Learning objectives

By the end of this chapter, you should:

■understand the interdisciplinary nature of finance

■be familiar with the concept of finance and the levels of financial decision-making

■recognise the role that financial markets play in the allocation of scarce resources

■understand the foundations of the market system and the regulatory environment that affect both individuals and organisations.

Introduction

This chapter sets the foundation for the remainder of the book by giving an overview of the topics that are to be covered. At the same time, some of the basic concepts referred to throughout the text will be introduced. A definition of finance is given, as well as the applications, strategies and goals that should be established to ensure that individuals and corporations achieve their objectives within the existing business or regulatory environment.

It should become apparent by the end of the chapter that the financial planning activities relating to money management, performed by individuals and households, are very similar to those undertaken by small, medium and large companies. In addition, very few financial decisions can be made without an understanding of the role played by financial markets in the allocation of scarce resources.

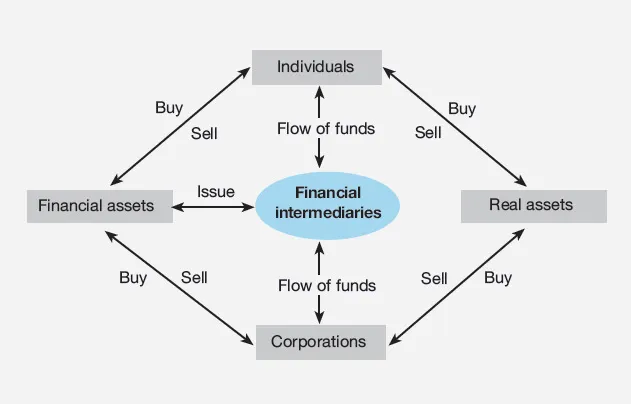

In fact, the role financial markets play in distributing funds between borrowers and lenders and between individuals and companies is central to the material covered in this book. If financial markets and financial intermediaries did not exist, then individuals would not be able to save or borrow money readily, and companies would find it difficult to raise funds in order to expand their operations. Both individuals and companies use financial intermediaries to obtain funds in order to acquire real and financial assets, as shown in Figure 1.1. Corporations use financial intermediaries to issue financial assets on their behalf for purchase by other companies and individuals.

The tools used to determine the outcome of any financial planning activities are time value of money concepts, and these are covered in Chapters 4 and 5. These tools permit borrowers and lenders to calculate the value of any financial decision in today’s dollars so that the best alternative can be selected. Given the uncertainty of outcomes that are to occur in the future, an element of risk is associated with these decisions. Risk and the effect it may have on the outcomes (or returns) to be received from financial planning activities conclude this section of the text.

Definition of finance

The definition of finance has changed over time as its role has been developed and refined. In the early part of the twentieth century, finance was concerned with the receipt and administration of funds on behalf of individuals and companies. Emphasis was placed on the securities (or financial instruments) used to transfer wealth, the institutions that acted as intermediaries between lenders (investors) and borrowers, and the financial markets in which they operated. Over time, the definition was broadened to encompass the financing requirements of a firm and, as a result, the emphasis has changed from an external (or outside the firm) approach to one that considers the internal financing requirements of a firm.

Figure 1.1 The parties involved in the acquisition of real and financial assets

Therefore, it can be said that finance is concerned with the allocation of scarce resources over time. These resources may be financial (money, shares, bonds) or real (property, minerals, goods) and, hence, require different types of decisions to be made. Financial decisions involve obtaining funds and then allocating them for a particular purpose. It is important to determine the costs and benefits associated with financing and investment activities because:

•they are spread out over a period of time

•they are not known with certainty.

In other words, because the costs and benefits arise in future periods, there is an element of uncertainty as to whether or not these forecast costs and benefits will actually occur.

The financial system

When a decision is made to invest today, the current consumption of funds is foregone in order to receive a return, or profit, in the future; that is, the use of those funds is transferred from one period to another. Figure 1.1 shows that this activity may be concerned with acquiring either a real asset (such as land or a car) or a financial asset (such as shares or bonds) for your own personal use or for use within a company. Once a company has decided to invest in a major asset, the financial manager will make a financing decision as to the choice of funds to be used to finance the required asset. One of the major objectives of finance is to acquire funds at the lowest possible cost and then use these funds efficiently in order to obtain the desired benefits from the investment.

When implementing the decision to invest, or the decision concerning how to finance a large asset, people look to the financial system to meet their requirements. The financial system assists the financial decision-making process by bringing together investors and borrowers. The system operates via a set of markets, such as markets for shares, bonds, foreign exchange and other financial instruments. Financial intermediaries, such as banks, insurance companies and finance companies, act as ‘go-betweens’, and are used to assist the flow of funds between investors and borrowers. Investors are those who have surplus funds, whereas borrowers are those who require additional funds to meet their financial commitments.

Other parties to the financial system include financial service organisations and regulatory bodies. Financial service organisations provide financial advice to individuals and corporations on either a fee or a commission basis, while regulatory bodies exist to oversee and govern the activities of those who participate in the financial system. The roles of financial markets and the effect of regulation will be discussed later in the chapter.

Finance as a discipline for study

Why study finance? The study of finance involves money management, and being able to manage funds successfully in a personal or corporate context is essential for the financial well-being of any person or company. There are three main areas of finance:

• financial institutions and markets

• investments

• corporate finance.

Financial institutions and markets are essential for permitting the flow of funds between individuals, corporations and governments. Financial institutions take in funds from savers and lend them to businesses or people who need funds. Financial markets offer another way to bring together those with funds to invest and those who need funds. Securities are issued and sold in financial markets, and there is overlap between the areas of finance because financial institutions operate in financial markets. These markets are important for determining interest rates, pricing securities and trading. The management of funds moving between countries is important for financial managers because of the effect that changes in currency values can have on the cost of imported and exported goods.

A knowledge of investment concepts allows investors and corporate managers to understand how real and financial securities are priced, as well as the risks associated with them. A knowledge of the complexities of the operations of the markets for these assets and the rules and regulations that govern them ensure that informed financial decisions are made.

Corporate finance provides the basis for financial decision-making in companies, where the financial manager’s ability to make sound financial decisions is essential to maximising the value of the organisation. Successful decisions benefit both the company and its owners, and good cash (or fund) management is critical to a company’s survival. For example, astute credit policies ensure that funds owing to the company are collected on time, while appropriate financing decisions ensure that the company can borrow funds when needed to finance projects and expansion.

However, perhaps the most important reason to study finance is to attempt to understand how to cope with uncertainty. Financial management deals with the risks and uncertainties of activities that may arise in the future. Financial management is forward-looking, and therefore sets objectives in order to achieve a desired result that can be measured in financial terms. Business people require an appreciation of the risks associated with decisions made in an uncertain world so that better-informed financial decisions can be made. This requires an understanding of how the financial system works and how individuals and organisations operate within it.

The interdisciplinary nature of finance

Finance, by its very nature, draws from, or builds on, a number of other disciplines, including accounting, the decision sciences, economics and the behavioural sciences, as shown in Figure 1.2.

Finance draws from accounting by using the information gathered and presented by accountants in order to obtain an understanding of the past or present position of an organisation’s activities. This information provides financial managers with the data required so that decisions about future projects or fun...