- 50 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Carbon pricing is a key element of the broader climate policy architecture that can help countries reduce their greenhouse gas (GHG) emissions cost-effectively, while mobilizing fiscal resources to foster green recovery and growth. This publication introduces carbon pricing instruments and provides insights on how they can be designed to stimulate and not constrain economic activity in the context of recovery from the coronavirus disease (COVID-19) pandemic. It aims to help countries design and implement an efficient climate change response. The publication underscores the important role of carbon pricing in achieving nationally determined contributions and developing road maps for longer-term net-zero GHG emission targets.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Carbon Pricing for Green Recovery and Growth by in PDF and/or ePUB format, as well as other popular books in Biological Sciences & Global Warming & Climate Change. We have over one million books available in our catalogue for you to explore.

Information

1 Introduction

Economies around the world are facing an unprecedented shock due to the coronavirus disease (COVID-19) pandemic. Countries are experiencing an increasing need to mobilize resources in response to the immediate crisis and to support economic recovery. This need has come at a time of shrinking fiscal space1 and heightened debt vulnerabilities. At the same time, the threat of climate change persists. Countries will be tempted to follow the 2010-style recipe of carbon-intensive austerity,2 but doing so may result in economies being locked onto a high-carbon emissions pathway that contributes to a future with high risks of severe negative climate impacts on economic and social development.

Although global emissions have rebounded strongly,3 countries can still carefully plan their economic recovery to avoid returning to pre-pandemic emission trajectories. The objective should be to create transformational change and work toward ambitious mitigation goals. To do this, there is a need for green recovery plans that restrict greenhouse gas (GHG) emissions. These plans must re-focus attention to address the climate crisis and build resilience, while working toward inclusive economic recovery and sustained growth. Accordingly, there has been a strong call for and a growing momentum to “build back better” and for the COVID-19 recovery to be “green,”4 taking advantage of the large global stimulus to tackle the ongoing climate crisis and invest in a more sustainable and resilient future.

This publication describes the role carbon-pricing initiatives can play in fostering green recovery and growth, as well as transitioning to a low-carbon economy and in achieving a net-zero target in the longer term. With such initiatives, countries can mobilize resources in a timely way and provide much-needed countercyclical support for green recovery. Clear and predictable carbon price signals in domestic and international markets, which can be achieved through carbon taxes, emissions-trading systems (ETS–cap and trade), and international offset mechanisms can facilitate not just a green recovery but also the cost-effective achievement of climate targets under the Paris Agreement as indicated in the nationally determined contributions (NDCs) of developing member countries (DMCs) of the Asian Development Bank (ADB). Carbon pricing can be effective in raising domestic revenues (through carbon taxes or ETS) as well as mobilizing international carbon finance to incentivize investments in low-carbon advanced technologies (through international offset mechanisms), which can be used to support not just a green economic recovery in the near term, but also sustained green growth and low-carbon transition in the future.5

This publication focuses on how carbon taxes and ETS can support a green recovery and growth, and highlights opportunities to mobilize finance by scaling-up international cooperation through Article 6 of the Paris Agreement. However, the landscape of carbon-pricing initiatives is much broader and includes other instruments such as internal carbon pricing, which are not the focus of this paper.

The primary target audience of this paper are policy makers in ADB DMCs who are responsible for mobilizing resources to support the post-COVID green economic recovery, as well as other policy makers involved in the development of GHG emission reduction strategies for green growth. Given the desirability of incorporating climate change and broader green development goals into economic recovery packages, this paper intends to demonstrate the important role that carbon pricing, in particular, could play in green recovery and growth and outline approaches to ameliorating price shocks, while retaining the longer-term environmental and economic benefits of such policy instruments.

2 Why Is It Advantageous for COVID-19 Recovery to be Green?

As countries transition from “rescue” to “recovery” phase, the greening of recovery has emerged as an imperative for ensuring that national recovery strategies are consistent with the Paris Agreement goals. The arguments justifying green recovery are compelling. A green recovery will not only create better jobs, catalyze capital, and boost the economy, but by supporting low-carbon development, will also protect the environment, improve the quality of life, and strengthen climate and disaster resilience.

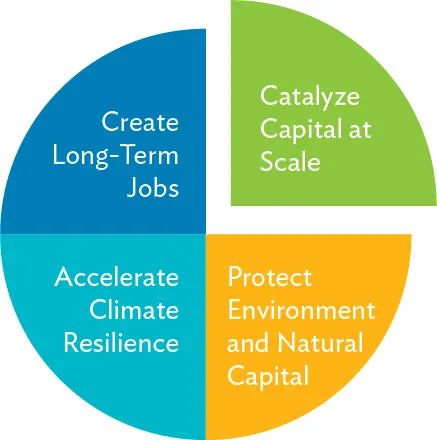

Green—and in particular climate-responsible—recovery has certain benefits over a traditional fiscal stimulus package: in many cases, the long-run economic multipliers of climate-positive policies have been found to be high, yielding a higher return on investment for government spending.6 ADB emphasizes a fourfold rationale for green recovery, including both economic and environmental elements and responding to the need to (i) build an economy that generates more and better jobs (ii) catalyze capital at scale, (iii) accelerate climate resilience, and (iv) protect the environment and natural capital.7 A green recovery can also provide important co-benefits such as reduced negative impacts of local pollution on health, infrastructure, and agriculture. Integrating the United Nations (UN) Sustainable Development Goals into climate action not only provides development co-benefits, but also ensures effective and efficient use of scarce financial resources and mobilization of sustainable finance.

There is a growing momentum for adopting green recovery strategies and toward promoting carbon neutrality, given their benefits over traditional fiscal stimulus packages. The European Union (EU) has adopted the EU Green Deal to support economic recovery from the pandemic. In Asia, Japan and the Republic of Korea have committed to reduce GHG emissions to net zero by 2050 in pursuing a green recovery. The People’s Republic of China (PRC) has also adopted a policy to become carbon-neutral by 2060. Climate-vulnerable countries such as the Maldives have also set highly ambitious targets for achieving carbon neutrality by 2030, if provided with sufficient support. Fiji, Malawi, Nauru, and Nepal aim to meet the 2050 goal or carbon neutrality or net-zero carbon.8 In the private sector, companies are also increasingly shifting toward carbon neutrality of their entire supply chains. These are important steps forward given that Asia—a major contributor to global economic growth—has also become the largest source of GHG emissions.

Implementing green recovery strategies across developing Asia is challenging, primarily due to unprecedented fiscal pressures. According to the International Monetary Fund (IMF) January 2021 update, the pandemic has caused the global economy to contract by an estimated 3.5% in 2020. ADB forecasts that developing Asia will achieve economic growth of 7.2% in 2021 and moderating to 5.4% in 2022, although growth will remain below what was envisioned prior to the pandemic.9 The combination of increasing expenditures associated with managing COVID-19-related developments and a collapsing revenue base due to a sharp contraction in economic activity and stimulus measures has put severe pressure on the fiscal space. This pressure increases the risk that governments will prematurely withdraw critically needed fiscal support for managing the COVID-19 pandemic and supporting economic recovery. Mobilizing resources in a way that creates fiscal space can play a critical role in addressing this fiscal challenge and securing a better future. Diffusing mature low-carbon technologies while increasing access to innovative and advanced low-carbon technologies is also key to achieving green economic recovery and the targets expressed in NDCs.

Countries will need to boost both domestic and international sources of finance to tackle the challenges of pursuing a green recovery. The current crisis presents an unprecedented opportunity to put in place policies that create much-needed fiscal space, while putting the economy on a sustainable growth path for the long term. How can countries proceed to realize this opportunity? A significant first step will involve putting a price on carbon.

3 What is Carbon Pricing?

Climate change, caused by increased concentrations of GHGs in the atmosphere resulting from human activities, creates widespread and protracted damage—to the environment, to economies, and to society. Because the cost of such damage is typically not incorporated into the price of goods and services that result in GHG emissions, there is no economic incentive to reduce emissions. The basic premise behind carbon pricing is that well-designed carbon-pricing policies can be used effectively to “internalize” the external cost of damage caused by climate change, in part or in full, thereby providing such an incentive.

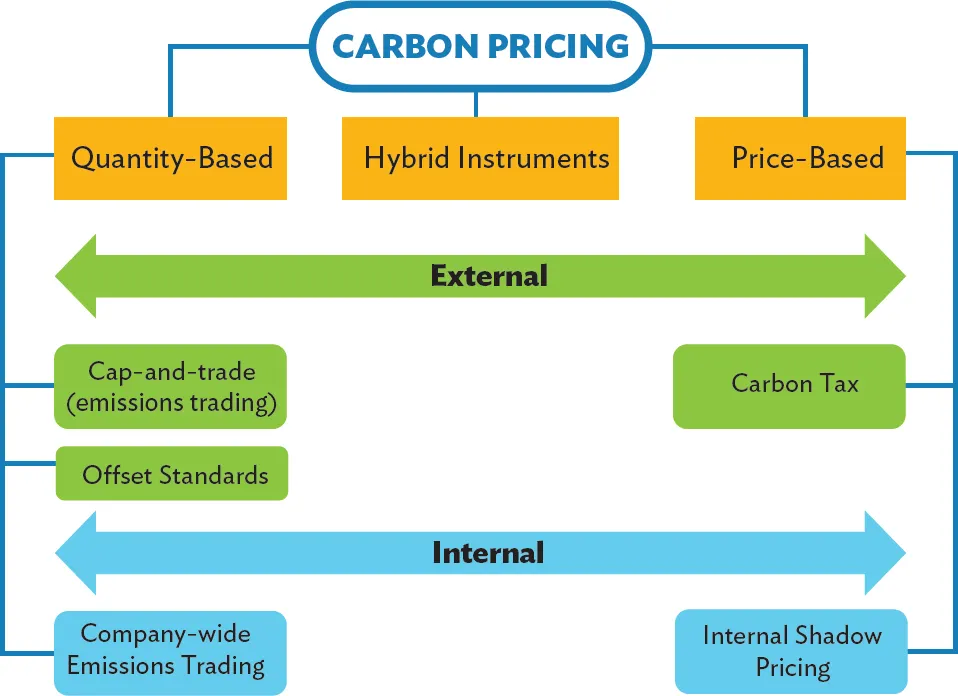

Figure 2 illustrates the landscape of what is typically considered as direct carbon-pricing instruments. The term “internal carbon pricing” is typically used to represent pricing within a company, i.e., not being a response to the government imposing carbon pricing, which is referred to as “external” in Figure 2.10 GHG emissions can also be priced somewhat less directly using carbon offsetting or crediting. Fossil fuel taxes and, in some cases results-based finance, can also price carbon indirectly. From the perspective of a policy maker for the broader economy, however, there are two primary carbon-pricing policy instruments: carbon taxes and emissions trading systems (ETS–cap and trade), which are also the focus of this paper. Carbon pricing is also just one part of the overall climate policy architecture as highlighted in Box 1.

Box 1: Carbon Pricing in the Overall Climate Policy Architecture

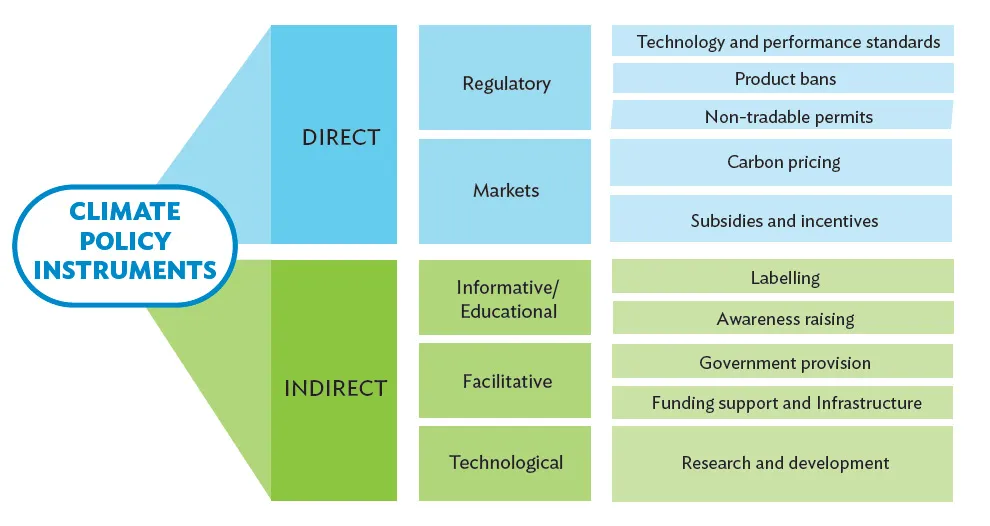

Although carbon pricing is widely seen as the most cost-effective solution to have an economy-wide impact on emissions, it is still not a silver bullet. Carbon pricing is part of the overall climate policy architecture and given policy instruments have different effects, features, and applicability, it is important to ensure that different policies work together and toward common objectives by avoiding detrimental policy overlaps and avoiding policy failure. The figure below shows where carbon pricing falls in the overall climate policy architecture.

To ensure that carbon pricing plays a key role in the climate policy package, policy makers could reflect on what the system is designed for and expected to do. For example, the key role of an emissions trading system could be to drive emissions reductions, but it could also provide a backstop for other policies. The primary goal of carbon pricing is to reduce greenhouse gas (GHG) emissions cost-effectively, but it can also provide other benefits. For instance, the outcomes of the carbon-pricing instrument could be other than initially expected, such as becoming an instrument for raising revenue to invest in low-carbon technology in sectors other than those covered by the system.a Another key aspect is to ensure that the carbon-pricing instrument does not create redundancy in the policy package. Policy makers should assess whether the additional GHG abatement or other benefits from each policy are sufficient to justify the additional difficulty of including it in an already complex package. The costs and benefits will be different in the presence of other policies; so policies, including carbon pricing, need to be assessed as a package and not separately.b While it is difficult to achieve perfect results from the start, by allowing for policy review and continuously making improvements, a policy mix will improve over time.

a International Energy Agency (IEA). 2020. Implementing Effective Emissions Trading Systems. Paris. https://www.iea.org/reports/implementing-effective-emissions-trading-systems

b C. Hood. 2013. Managing interactions between carbon pricing and existing energy policies. Guidance for Policymakers. Insight Series 2013. Paris: IEA.

Source: Asiand Development Bank.

With a carbon tax, a jurisdiction (e.g., a regional, national, or provincial governing entity) imposes a fee per unit of emission, usually a metric ton of carbon dioxide equivalent (tCO2e).11 The fee is typically uniform across the economy or regulated sector, and it typically increases over time to continue reducing total emissions. In an ETS, a jurisdiction imposes a “cap” (or limit, usually per year) on total emissions across an economy or selected sectors. The government then issues emissions permits (or “allowances”) to the entities regulated within the ETS (e.g., firms or installations), equivalent in aggregate to the cap. These allowances are allocated across the regulated segment of the economy—either through a provision of receiving allowances according to their historical emissions in a base year or base period, commonly referred to as “grandfathering,”12 or by auctioning—and may...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Table, Figures, and Boxes

- Foreword

- Preface

- Acknowledgments

- Executive Summary

- Abbreviations

- 1. Introduction

- 2. Why Is It Advantageous for COVID-19 Recovery to be Green?

- 3. What is Carbon Pricing?

- 4. The Benefits of Carbon Pricing

- 5. How Can Carbon Pricing Generate Revenue?

- 6. Growing Momentum of Carbon Pricing in Asia and the Pacific

- 7. Designing Carbon Pricing to Support a Green Recovery

- 8. Carbon Pricing, Green Growth, and the Path toward Net Zero

- 9. Conclusion

- References

- Footnotes

- Back Cover