eBook - ePub

Finance in Africa

for green, smart and inclusive private sector development

- 146 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Africa's recovery from the COVID-19 crisis will depend on private firms sustaining and creating jobs. But even previously thriving enterprises have been badly hit by the crisis. This report outlines the consequences of the health crisis in Africa, the potential cost of the recovery and the willingness of banks to support green investments as they look to the future.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Finance in Africa by European Investment Bank in PDF and/or ePUB format, as well as other popular books in Business & Corporate Finance. We have over one million books available in our catalogue for you to explore.

Information

1

Banking in Africa: supporting a sustainable and inclusive recovery[1,2]

Introduction and context

Africa’s economies – emerging from crisis to uncertain prospects

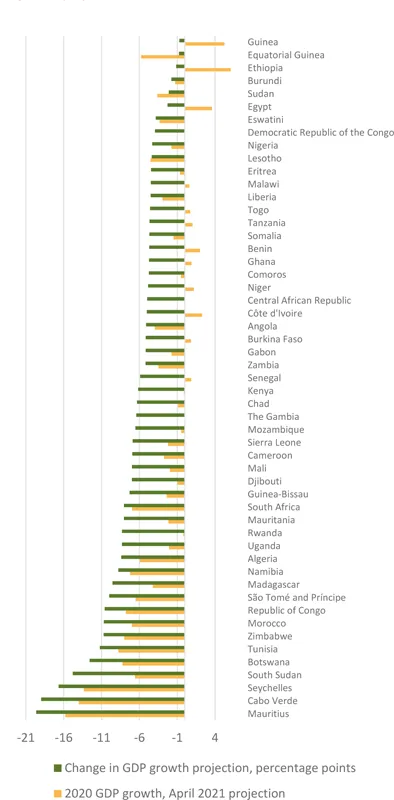

The COVID-19 crisis has had a significant human and economic impact on Africa, despite the reported virus caseload being relatively low for the continent. As of July 2021, Africa has reported fewer COVID-19 cases and deaths, relative to the population, than any other world region except the Western Pacific[3]. Nonetheless, some countries (particularly Tunisia and South Africa) have been severely hit, with seven African countries reporting death rates above the world average[4]. Moreover, as test rates in most African countries are extremely low, the extent of the health crisis may be understated. Almost all African countries have implemented measures to contain the pandemic, which has significantly reduced economic activity. The crisis has also affected international financial and commodity markets and Africa’s trading partners, with knock-on effects for African economies. Tourism, which is important for numerous African economies (particularly but not only small island states), came to an almost complete standstill during 2020, while the prices of oil, gas and other commodities plummeted early in the year. Overall, gross domestic product (GDP) contracted by 2.3% on average across Africa during 2020 (IMF, 2021a), with the vast majority of countries experiencing a contraction (Figure 1). Countries highly dependent on tourism or commodity exports experienced the most severe slowdowns, along with states already grappling with severe macroeconomic challenges before the crisis (such as growth slowdowns or nascent debt crises). Furthermore, like many emerging or developing markets, African economies had fragilities at micro and macro levels that have exacerbated the impact of the crisis, despite their growth contraction being smaller in percentage terms than that of advanced economies.

Figure 1: The contraction – GDP growth in Africa, 2020 and change to growth projections, %

Source: IMF World Economic Outlook database, October 2019 and April 2021 versions[5].

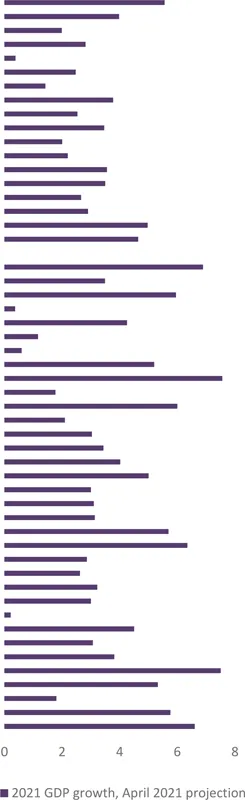

Figure 2: The recovery – projected GDP growth in Africa, 2021, %

Although the average growth contraction in Africa has been smaller than in developed regions, African firms and households are highly exposed to financial risks, with already vulnerable groups most severely affected. The small and informal enterprises and self-employed workers that form the backbone of African economies often have limited resources to withstand economic downturns. Many may find it difficult to restart activities even when conditions improve. Most low-income households lack savings to cushion the impact of lost earnings. Furthermore, few workers can rely on social safety nets or insurance, as these generally do not cover informal sector workers and, in many African countries, provide only limited benefits even to formal sector workers. Within countries, the poor and vulnerable are particularly exposed, with migrant workers, refugees and other marginalised groups likely to be worst hit. GDP per capita is not expected to recover to 2019 levels until 2024 (with risks tilted to the downside), and the crisis has reversed an expected decrease in the number of people living in poverty (IMF, 2021a). This could result in an additional 30 million people in sub-Saharan Africa living in extreme poverty by 2021, plus an additional nine million in the Middle East and North Africa (MENA) region, relative to pre-crisis projections (World Bank, 2021a)[6]. The economic challenges facing households and the imposition of lockdown measures have exacerbated existing tensions and reduced trust in government institutions, triggering social unrest and destabilisation in several cases. Pangea-Risk, for example, reports that many African governments are facing criticism from citizens for a perceived lack of preparedness, corruption scandals, and for imposing new lockdowns too late, thus weakening confidence in the state (Pangea-Risk, 2021). Of the 39 countries on the World Bank’s harmonised list of fragile and conflict-affected situations, 20 are in Africa[7].

The fiscal response to the crisis has been muted in African states compared to advanced economies, but the increased debt burden in Africa has limited capacity to support the recovery. African countries’ fiscal stimulus packages up to mid-2020 represented about 1-2% of GDP, supplemented by monetary stimulus estimated at 2% of GDP[8]. This is close to the average for low-income developing countries worldwide reported by the IMF (around 2% of 2020 GDP over a one-year period from the start of the crisis). By contrast, emerging markets implemented a package equivalent to around 4% of GDP over the same period, while the package implemented by advanced economies was equivalent to around 16% of GDP (IMF, 2021b). This reflects the weaker capacity of African states, compared even to emerging markets, to use fiscal stimulus to support their economies during crises. Even without a large fiscal stimulus package, the average fiscal deficit across Africa rose from 5% of GDP in 2019 to over 8% in 2020 as African states sought to address the health and economic effects of the crisis while experiencing often dramatic contractions in revenues[9]. A lack of fiscal space meant that the deficit led to increased borrowing, which African states have less capacity to absorb than advanced economies. Before the pandemic, average public debt was expected to gradually decline across Africa, but average net government debt rose by 2 percentage points during 2020, reaching 61% of GDP. The rise was even steeper for sub-Saharan Africa, exceeding 6 percentage points on average. Because of this increased debt burden, countries are facing higher debt servicing costs and some have lost international market access altogether, leaving them dependent on relatively limited domestic resources and concessional funding[10]. Sixteen African countries have been downgraded by at least one ratings agency since the start of the pandemic, including one country that defaulted (Zambia)[11]. Further defaults have been forestalled, partly thanks to debt relief initiatives by the international community, but these are limited and not all countries will take up debt relief to preserve market access[12]. Even countries that retain market access are likely to face higher costs of funding. Overall, African governments are left with limited capacity to either stimulate the economy during the recovery or support much-needed investments for a resilient, sustainable and inclusive future.

The recovery is expected to be gradual, and uncertainty about economic prospects remains very high. The IMF expects average growth across Africa to recover to 4.5% in 2021 and 4.0% in 2022, with all economies apart from Comoros expanding in 2021 (IMF, 2021a). However, significant variation in growth rates is forecast (between 0.2% in the Republic of the Congo and 7.6% in Kenya during 2021; see Figure 2). More recent estimates have downgraded the growth prospects even further. For example, the World Bank’s June 2021 economic update adjusted the growth projection for sub-Saharan Africa down by 0.2 percentage points[13]. The relatively moderate projected growth rates for the medium term are below pre-crisis projections, both on average and for most countries[14]. This reflects sluggish growth prospects in most of the continent’s large economies[15]. Although the recovery in commodity prices has boosted the medium-term prospects of countries dependent on oil, gas and mining exports, vaccine rollouts have been very slow compared to developed countries[16], which raises the risk of further ...

Table of contents

- Cover

- Title

- About

- Contents

- Executive summary

- 1. Banking in Africa: supporting a sustainable and inclusive recovery

- 2. Microfinance and COVID-19

- 3. Private equity and venture capital

- 4. Digital financial services

- 5. Greening Africa’s financial sector during crisis recovery

- 6. Partnering with African financial sectors to support businesses during the COVID-19 crisis

- Addendum: data updates and recent developments

- Copyright