- 344 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Professional Tips and Workarounds for QuickBooks Online

About this book

Save hours of guesswork and Internet browsing by enhancing your QuickBooks Online skills and leveraging Ash Beetson's extensive QuickBooks knowledgeKey Features• Broaden your knowledge of QuickBooks Online and accounting concepts• Understand how QuickBooks can be adapted to suit different business types using professional techniques• Learn best practices for preparing annual accounts before closing the books for the yearBook DescriptionAccountants and bookkeepers can sometimes face challenges while coming up with solutions to help their clients. QuickBooks Online, a popular cloud accounting software, comes with a wide range of tools that can take time to learn. This book will show you how to properly combine the tools available in QuickBooks to get the most out of this software.Complete with step-by-step explanations of essential concepts and practical examples, the book will begin by helping you understand how to create opening balances for a new company. You'll then discover essential bookkeeping and accountancy tips and tricks, and find guidance to help make QuickBooks as easy to use as possible. As you advance, you'll explore different scenarios in which QuickBooks Online can be used for various business types. This will help you understand that not every business is the same, but using the wide range of functionalities QuickBooks Online offers, you can customize solutions to really make it work for you.By the end of this QuickBooks book, you'll have gained deep insights into how you can use QuickBooks Online to work for different business types, and you'll have a complete checklist of the different things you should be doing when you start reviewing accounts ahead of tax season.What you will learn• Discover how to correctly set up QuickBooks Online with opening balances• Adapt QuickBooks Online to meet specific industry needs, from manufacturing and retail using inventory to helping lawyers and property agents handle client funds• Get the most out of features such as Projects and Multicurrency• Review reports within QuickBooks Online, understand why errors occur, and learn how to resolve them• Get to grips with key accounting principles and concepts tailored for bookkeeping and accounting beginners• Find out how the audit trail works and explore all of the information it holdsWho this book is forBusiness owners, company directors, accountants, bookkeepers, certified public accountants (CPAs), and anyone studying accounting and bookkeeping will find this book useful. The book contains general bookkeeping and accountancy tips and is designed to help you get the most out of the tools available in QuickBooks Online. Prior QuickBooks knowledge is necessary.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Section 1 – General Tips and Shortcuts

- Chapter 1, Creating and Reviewing Opening Balances in QuickBooks Online

- Chapter 2, Useful Tips and Tricks Every QuickBooks User Should Know

Chapter 1: Creating and Reviewing Opening Balances in QuickBooks Online

- Should opening balances be in place before using QuickBooks?

- Opening balances – Customers

- Opening balances – Suppliers

- Opening balances – Bank

- Opening balances – VAT/GST/Sales Tax

- Other opening balances

Should opening balances be in place before using QuickBooks?

What dates are used for opening balances?

- Any time for a new business (no historical transactions to worry about)

- Start of new financial year/tax year

- Start of new VAT/GST/Sales tax period

Opening balances – Customers

- Customer name

- Invoice date

- Invoice number

- Net charge

- VAT/GST/sales Tax

- Invoice total

Table of contents

- Professional Tips and Workarounds for QuickBooks Online

- Contributors

- Preface

- Section 1 – General Tips and Shortcuts

- Chapter 1: Creating and Reviewing Opening Balances in QuickBooks Online

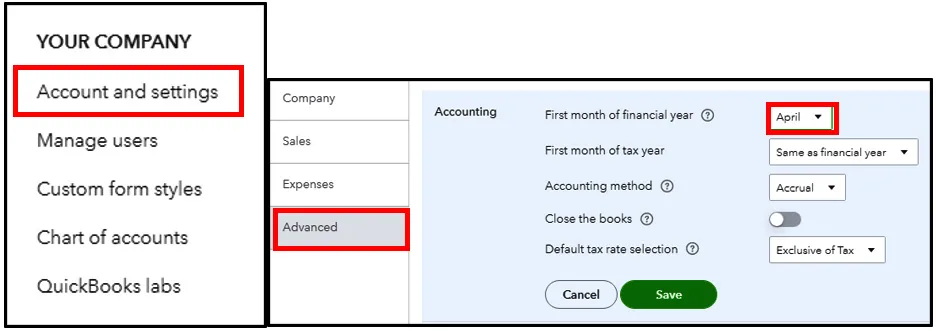

- Chapter 2: Useful Tips and Tricks Every QuickBooks User Should Know

- Section 2 – Adapting QuickBooks Online to Suit Different Business Types

- Chapter 3: QuickBooks Online for Manufacturing Businesses

- Chapter 4: Recording Income for Retail Businesses

- Chapter 5: Handling Client Money

- Chapter 6: The Secret to Success with Projects in QuickBooks Online

- Chapter 7: Handling Foreign Currencies in QuickBooks Online

- Section 3 – Reviewing and Reporting Data in QuickBooks Online

- Chapter 8: Best Practices When Reviewing Financial Records

- Chapter 9: Enhancing the Consistency of Your Financial Statements

- Chapter 10: Reconciling the Balance Sheet

- Chapter 11: Closing the Year-End, the Audit Log, and More

- Other Books You May Enjoy