eBook - ePub

Valley Boy

Adventures of the Renowned Venture Capitalist, Sillicon Valley Entrepreneur and One of the World's Most Successful Businessmen

- 312 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Valley Boy

Adventures of the Renowned Venture Capitalist, Sillicon Valley Entrepreneur and One of the World's Most Successful Businessmen

About this book

Known for his idiosyncratic ideas and Midas touch, Tom Perkins, described by Newsweek as a titan of American business, is one of the business world s most intriguing figures. In Valley Boy he presents The truth as I see it, unvarnished, and as beautiful or ugly as you may find it and offers a fascinating, behind-the-scenes look at one of the most exciting and dynamic periods of technological and corporate development, revealing his involvement in the creation of American industries no one could have dreamed of a century ago.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Valley Boy by Tom Perkins in PDF and/or ePUB format, as well as other popular books in Business & Management. We have over one million books available in our catalogue for you to explore.

Information

Chapter One

Sometimes in Cat and Mouse, the Mouse Wins!— Even If She Doesn’t Play the HP Way

Most board of directors meetings are pretty dull, and the bigger the company, the more true this becomes. The Hewlett-Packard Company is very big, one of the biggest in the world. So, when in early 2005 the board unanimously voted to invite me back, I didn’t anticipate much excitement. But I soon discovered that the old warhorse (me) was being summoned back for one final battle—and after the battle was won they found that the horse ate, as usual, too much hay and crapped, as usual, all over the landscape— But wait! I am getting ahead of the story.

My history with the company goes back decades, and later I’ll get to my experiences working directly for Dave Packard and Bill Hewlett. Even though I had already resigned from HP three times, twice as a kid employee and once as a director, I loved the place. I had no thought of resigning, in May 2006, from the board in cold fury!

The day was typical Palo Alto beautiful, and the boardroom had its usual bland and modest look. But there were deep tensions around the table. We directors had been through a struggle that had left ugly wounds. I had originally joined the board in 2001 when HP acquired Compaq, a Kleiner & Perkins company on whose board I sat. The merger was a tough-fought battle, brilliantly waged by Carly Fiorina, HP’s “celebrity” CEO.

Carly and I met for the first time just before the merger at that famous place for deal-making, the Village Pub in Woodside. Over dinner I agreed to join the new HP board if the merger went through, helping to represent the Compaq shareholders, myself included, who would be traveling along with a couple of other original Compaq directors into the future of the “new” HP.

Carly Fiorina, former CEO of the Hewlett-Packard Company

Carly is a star: an assured personality, attractive, and with a mind of the highest caliber. At that dinner I suggested that we establish a technology committee of the new board, like an audit committee but focused on the nearly five billion dollars per year that the combined companies would be spending on research and development. She loved the idea—an industry first—and made me the new committee’s chairman.

The merger, which cost HP nineteen billion dollars, was the biggest in high-tech history. Not only did Dave and Bill’s heirs hate it—voting against the combination, losing a very close proxy war (during the battle, Carly made a rare public relations faux pas, demeaning Walter Hewlett, then on the HP board, by calling him just “an academic and musician”)—but Wall Street hated it too, mostly. The family members didn’t like the idea of diluting their ownership by issuing all those new shares to acquire Compaq—they thought HP could do fine on its own—and Wall Street was fully aware that virtually all big mergers in high technology failed. They weren’t convinced that the synergies could be achieved. After 9/11, the stock really tanked.

But I had fought hard in favor, from the Compaq side, helping Carly as best I could. Around the world, where Compaq was weak, HP was strong and vice versa. The product lines didn’t overlap much in their markets, either; even the personal computers (PCs) fit together seamlessly. Where HP was strong in the consumer market, Compaq was strong in enterprise. Of course, in PCs Dell was beating the socks off both companies over the Internet with the Dell Direct engine.

Carly was dauntless. As chairman and CEO she made Michael Capellas, the former Compaq CEO, president and chief operating officer. Together they set about untangling product road maps as well as the two vast marketing organizations, and they began to squeeze huge savings (measured in billions of dollars) from the overlapping operations and increased economies of scale. The downturn in the world economy following the terrorist attacks, however, slowed the overall markets and delayed the results Wall Street was expecting. Both executives were under immense pressure from employees, the investment world, and the board.

Mike and Carly started out working together reasonably well and their decisions were being implemented. I was surprised and pleased at how quickly the two organizations’ cultures blended together, and after a short while it was hard to discern from which organization employees originally came. Plus, a number of the top jobs in the new company were held by executives from Compaq. It was almost as if giant, old, and ultra-conservative HP and the famous “HP Way” had experienced an injection of new “Texas hustle” DNA.

But the honeymoon at the top began to fade. In my opinion, Michael simply found it too hard to play the number-two role. Also in my opinion, Carly tried, very hard, to make the structure work. I spent literally hours on the phone and in person with Mike pleading to hold him in the job—hoping to convince him that he was a great “Mr. Inside” and that Carly was equally great in communication with the “outside world” of customers and investors—but I failed. He resigned after only about six months, having, however, laid much of the groundwork for the success that the merger has ultimately achieved.

The first inkling I had of the problem that I think ultimately led to Carly’s departure was a discussion I had with her about replacing Mike with another executive to share her burden. She chose, rather, to assume many of his responsibilities herself, and while she always encouraged directors to “mix it up” in reviews of strategy and general matters, she made it very clear, in my view, that our opinions were less than welcome on operational and organizational specifics. Also, Carly was evolving a highly complex matrix-type organizational structure, which I thought unwieldy. People weren’t clear on their responsibilities; if you could understand that organization chart, you’d find the recently solved Poincaré’s conjecture in mathematical topology child’s play.

Still, in the next three years, from 2001 through the end of 2003—when I did not stand for reelection to the board—much was accomplished. The technology committee became a major influence on policy. We established a program to license HP’s patent and intellectual property portfolio to begin to achieve the sort of income IBM earns, from an only marginally larger portfolio. This potential, which had been ignored for years, might grow to hundreds of millions of dollars added to the bottom line annually in the not-distant future.

Probably more importantly, we encouraged management to develop the very long process toward additional and alternate sources for microprocessors—HP is the world’s largest consumer of these devices—and thereby to siphon more profit into HP’s earnings, and away from the primary vendor. This program was sometimes referred to as “Operation Hickory Stake,” after my joking reference to that being the only thing through the heart of a blood-sucking vampire that might bring relief.

During 2004 I was not on the board. I didn’t argue with Carly about staying on after passing the retirement age. She probably was experiencing “director fatigue” with me—she makes that pretty clear in her autobiography. And so I was unaware of developments between Carly and her directors. In October of that year a friend (from the original pre-merger HP board) visited me at my place in England, and we discussed HP in a general way. He asked me if I would consider rejoining, and I answered, sure, if the invitation was unanimous.

In December the invitation came. I checked with several directors, including Carly, and was assured by all that the board would be delighted to have me back. I attended my first meeting as an observer in early January, and when I walked into the room Carly gave me a big smile and a hug, welcoming my return.

Only during this meeting did it become clear to me that the board and Carly were in a struggle over the direction of the company. Much has been written about the events that occurred over the next few weeks. A lot of what has been written is incorrect, and how individual directors voted still must remain confidential. In my opinion, the last thing the board wanted was for Carly to leave. I believe the directors wanted her to succeed, but also wanted her to take more specific direction on how to reorganize the business and what to do about the various problems the company faced.

Prior to this meeting, a delegation of three board members had met formally with her to review some specific requests; I was not in this group. I was told that she “stonewalled” them. I don’t have direct knowledge of whether she did or did not do so, but perhaps she reiterated her belief, as she had done with me three years earlier, that the board had no business poking into the specifics of management of the company. I am not sure that Carly, or for that matter any chief executive, entirely agrees what exactly should be the role of a board. Congress and the public probably think that it should be to insure that the company complies with the law. Of course that’s important, but I am of the school that believes the board is also like the rudder of a ship: without its guidance things can go badly wrong. In my view the board must be actively engaged.

Around this time, accounts of the rift at the top appeared in the press, first in the Wall Street Journal and then in BusinessWeek, Fortune, and soon in many other media sources. The press was having a field day. The information certainly came from multiple sources, and probably from some directors themselves. Carly was, justifiably, very angry about the articles, a few of which seemed aimed specifically to undermine her position.

Finally a special meeting of the board was called, which I attended. Carly was there, I am sure attending reluctantly. We went to lengths to keep this meeting out of the press, even making reservations at the hotel under assumed names. The meeting was turbulent, I think all would agree. I believed that I had been brought back to the board—the warhorse—to stiffen everyone’s resolve, and if Carly wouldn’t budge on at least some of the changes the board sought, to take decisive action to find a new CEO. I concurred with that idea, and during the discussion it was evident that a majority, not counting my vote, agreed that this was the right course. There was less agreement on the timing. Finally, the decision was made to ask for Carly’s resignation, and to appoint Bob Wayman, the CFO, as acting chief executive. Parts of this meeting made it into the press even before we returned home.

A director had resigned before this meeting for unrelated reasons, and another resigned shortly afterward, partly in disagreement with the decision. Among those who remained, deep disagreements lay just below the surface. It was necessary to elect a new chairman, to replace Carly, and to get on with finding a new CEO as quickly as possible. Director Pattie Dunn had, I thought, been particularly careful in being sure that the board followed all due process and procedure during these events, and I supported her election as chairman. She, Dr. Jay Keyworth, and I were appointed by the board to take on the responsibility of finding and recruiting a new CEO. We announced that the process might take up to six months. Among the three of us, we set a goal not to exceed six to eight weeks, hoping to minimize the period of uncertainty.

Pattie had been on the HP board for some years prior to the merger. She had an outstanding background in portfolio investment management with Barclays Bank with fiduciary responsibility for about a trillion dollars in investors’ assets. Dunn had little experience in manufacturing, technology, marketing, human resources, or any operating aspect of a giant high-tech business. But she was helpful in the Carly situation by keeping everyone focused upon the details of process; process and governance procedure became her chosen specialty. She seemed like a “neutral.” Some might say that with twenty-twenty hindsight, she was not the right choice for the board to have made chair. Jay Keyworth, on the other hand, had been on the board for about twenty years, having been brought on by Dave Packard. He has a PhD in nuclear physics, had run the physics section of the Los Alamos Laboratories (where the atomic bombs are made), was science advisor to President Reagan, and was very instrumental in the Strategic Defense Initiative (“Star Wars”), which is frequently credited with helping to bring about the demise of the Soviet Union. Jay was deeply involved in all aspects of HP and was, in my opinion, the most important director.

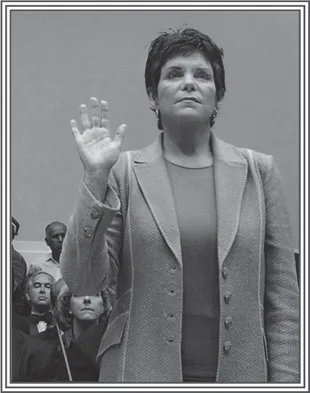

Patricia Dunn, former chairman, at the Congressional inquiry into the HP scandal

With the help of a top recruiter, Andrea Redmond of Russell Reynolds, we three assembled our list of dream candidates. We were gratified to discover that a shot at running one of the biggest companies in America, even with the problems that HP exhibited of slow growth and low margins, drew most of our prospects out of the woodwork (on a confidential basis) to talk with us. The three of us devoted nearly one hundred percent of our time to the task, and after a few weeks we thought we had the perfect choice in our crosshairs.

Along the way, a friend of mine in the New York financial world asked me if Mark Hurd was on our list. My contact recommended him highly, saying that Mark had done a terrific job in turning around the relatively small (revenues of eight billion) NCR (formerly the National Cash Register company) to the immense satisfaction of “the Street.”

We already had been flying around the country with our top candidates to introduce them to the other members of the HP board, wanting the directors’ one hundred percent involvement in the decision. We were confident the top person we were focusing on would be our choice. I need to point out that two very strong internal candidates were on our list as well, and they also got our full consideration. I was comfortable that we already had the right choice for the job at the top of our short list, so it was almost with reluctance that I scheduled Mark Hurd for an interview in my San Francisco office. Pattie and Jay joined me.

Simply put, in the course of about one and a half hours Mark blew all the others out of the water. He had done his homework, and based upon public information and available SEC filings, he had analyzed HP’s problems and prospects with an astonishing perception. Plus, he outlined a plan to fix things quickly and efficiently. When he left my office, the three of us just looked at one another and, virtually simultaneously, said, “He’s our man!”

We quickly got him to the other board members and negotiated the contract. Mark was very exposed, as his board at NCR had no idea that he was considering HP. He was loyal to his company and his board, and he wanted to clear it with them in advance of any leak or disclosure. We just made it, by a hair’s breadth—within hours of receiving the NCR board’s blessing, his acceptance of the HP position was leaked to the press. A potential catastrophe was narrowly avoided, for Mark would not have accepted our offer without his board’s okay. Leaks had, again, become a problem for us all.

Looking back now, I can only marvel at how quickly and effectively the HP board worked to find and hire Mark Hurd. He has accomplished much of what he set out to do. The merger has proven a strategic victory for Carly’s vision, as implemented by Mark’s management skills. Tens of billions of revenue have been added to the top line, and some new billions in earnings at the bottom of the P & L. The stock price has tripled from its post-merger low, becoming one of the fastest rising equities in the Dow-Jones index.

How then could this board, which to the outside world must have seemed invincible, eventually come to be, in my opinion, so dysfunctional and self-destructive? Well, probably much of it has been my fault. As I see it, some of the board’s thinking was preoccupied by the cat and mouse game being played between Pattie Dunn and Tom Perkins until the final terrible explosion. Probably, the two of us could not have been more mismatched for roles requiring close cooperation.

I thought that Pattie should be an “activist” chairman, be deeply involved in the strategy of the company and take a very busy role, as I had for three New York stock exchange companies: Tandem, Genentech, and Acuson. So I persuaded my fellow directors to vote to pay Dunn an additional hundred thousand dollars on top of her normal annual fees (an industry record) to be an involved chairman. I was able to do this because Pattie asked me to become chair of the nomination and governance committee of the board—a key job with more than a little influence but, sadly, not enough influence.

Backing Pattie was, I think, an error on my part. Dunn, normally as quiet as a mouse, had a will of iron. Her vision, I soon discovered, bore little or no relationship to my own. Can the cat and the mouse productively coexist? I thought that she focused too much on the legal and compliance aspects of the business. In my opinion, the tired cliché is alive and well in many boardrooms: if the deck chairs are all in order, then all is well aboard the Titanic. There are plenty of consultants, advisors, and lawyers to opine on the deck chairs; you only have to ask—and at HP we heard from lots of them. The advent of Sarbanes-Oxley, a complex of disclosures and guarantees required by Congress after Enron and other scandals, may have encouraged thinking of this kind.

There has been much gnashing of corporate teeth and copious complaints about the compliance aspects of Sarbanes-Oxley (usually abbreviated as “SOX”). And in my view the new regulations are a huge overreaction to the problem—the simple step of requiring the CEO to sign the financial statements under criminal penalties is the strongest and most effective part of SOX. But corporate America has only itself to blame when Congress moves in to fix abuses. Unfortunately, the compliance aspects of SOX can, if permitted, come to dominate everything that a board does. And at the end of the day compliance doesn’t add to earnings per share and a rising stock price. In my view it is bad news for the shareholders if a chairman’s proclivities for SOX, that is for form over substance, become ascendant. What’s most important is creating rising shareholder value.

The Dunn and Perkins meetings, both in private and at the board table, became increasingly rancorous, and maybe a little amusing to the other directors. I found that major disagreements always arose over the agenda. On what were we to spend our collective time? To Pattie, a discussion of the finer points of the company bylaws was quite productive, or so I believed she felt. To me, we never could have enough time to concentrate on direction: how to boost growth, improve profit, strengthen management, and how better to compete with IBM and Dell, ...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Dedication

- Contents

- Author’s Note

- Chapter One: Sometimes in Cat and Mouse, the Mouse Wins!—Even If She Doesn’t Play the HP Way

- Chapter Two: Sailing Is Not Always Pleasure Boating

- Chapter Three: Vindictiveness Is a Terrible Thing

- Chapter Four: A Ferrari Is Not Necessarily a Wise Substitute for the Company Chevrolet

- Chapter Five: Digging Up an Old Car

- Chapter Six: A New Partnership, and a New Approach, Change the Venture Landscape

- Chapter Seven: Coaching a Winning Team

- Chapter Eight: If You Are Interested in Bare-knuckle Infighting, Join a Civic Arts Group!

- Chapter Nine: In Ocean Racing, Preparation and Teamwork Make the Difference!

- Chapter Ten: Celebrity Wire 1 April

- Chapter Eleven: The Deal of a Lifetime Ends a Life

- Chapter Twelve: The Best Ever Argument for Book Burning

- Chapter Thirteen: The Man and the Myth

- Chapter Fourteen: What if Orville and Wilbur Had Really Gone for Broke?

- A Final Word

- Index