![]()

Chapter ONE

Introduction to Microeconomics

The introduction explained that the task of the manager in the legal environment is to identify and qualify risk. This chapter focuses simply on a model for qualifying all kinds of risks. That model is based on economic theory.

Economics is choice in the presence of scarcity. A resource is scarce when there is less of it than can provide for all possible needs. Managers often deal with this problem because scarcity necessarily requires a decision of how to use resources. That decision is complicated because managers have desires to both help themselves and to help others, which would seem to create a paradox as to how scarce resources should be utilized. Adam Smith questioned that paradox by arguing that by following their own self-interests, economic agents frequently serve society as well.

Cooperation

Most managers realize that when they are able to cooperate with peers, subordinates and supervisors, the organization is most productive. This is true for the economy on the whole as well.

Cooperation is greatly responsible for the development of more affordable and desirable products and services; in a society where each individual can rely on others to provide the majority of products and services, one can focus on perfecting their own wares. By doing so, they are able to sell more, as the desirability and affordability of their merchandise is greater than that of competitors’, in the process benefitting both themselves in the form of higher prosperity and society as a whole with cheaper, better, or more abundant goods.

The Production Possibilities Frontier

The manager in the example below has two employees that need direction. Cara is working on one plot of land and Bob is working on another plot of land. The manager can direct Cara and Bob to produce apples, peaches or some combination of these. Cara and Bob have a limited ability to produce because their respective plots of land have limited size.

The manager can use the Production Possibilities Frontier (PPF) to analyze this situation. The PPF is a simple model describing the trade-offs that an entity (a person, a company, a nation) has to make when making production decisions. In its simplest form, the PPF is a two-dimensional figure with two axes each representing a product (like apples and peaches). Increasing the quantity of one resource necessarily limits the ability to produce the other resource (because land is limited). The slope of the production possibility frontier is called the marginal rate of transformation (MRT). In case of a linear PPF, the slope (“m”) is constant. The “rise over run” equation can be used to determine the slope of a linear curve.

Worked Example

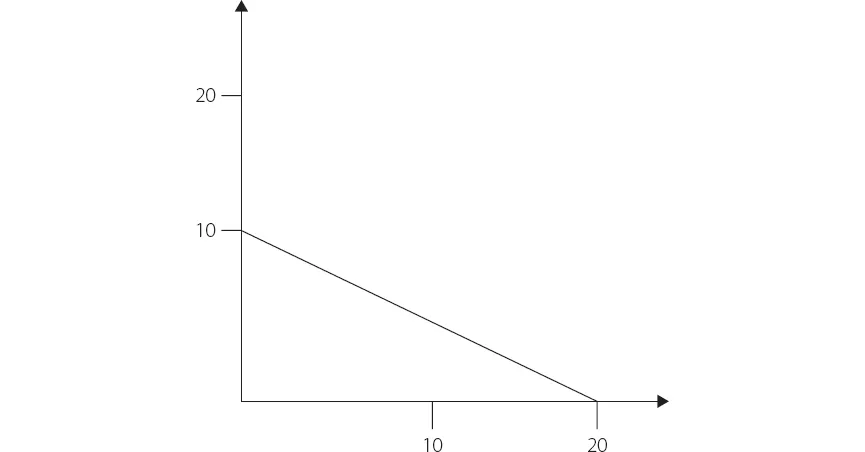

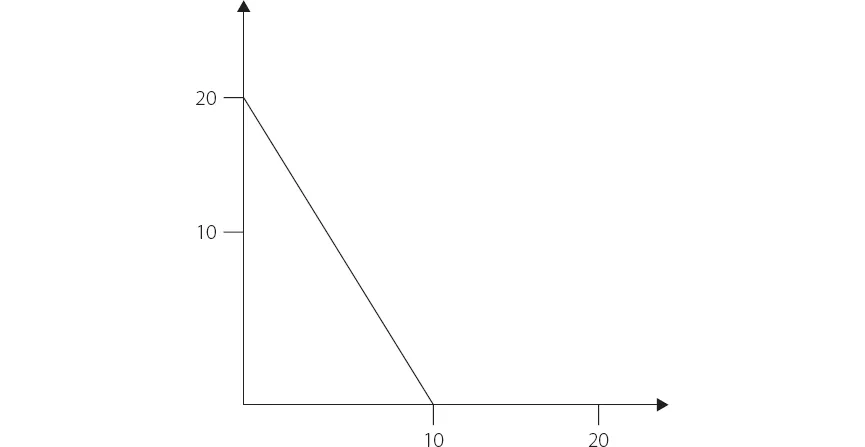

Consider a first producer, Cara, whose PPF is defined by Equation 1 and shown in Figure 1 and a second producer, Bob, whose PPF is defined by Equation 2 and shown in Figure 2. Both producers can make apples (A) and peaches (P):

| (Eqn. 1) |

| (Eqn. 2) |

Figure 1 The PPF for Cara.

Figure 2 The PPF for Bob.

What is the slope (or the marginal rate of transformation) of Cara’s PPF?

The equation for slope is:

This means that for every two additional apples Cara produces, she will produce one fewer peach. Cara can only produce at or below her production possibility frontier. She could not produce ten apples and ten peaches because that point is not on her product possibility frontier. See if you can take this example and use it to answer some questions about Bob.

Case Problems

How many apples can Bob produce?

How many peaches can Bob produce?

For each reduction in peach production, how many extra apples can Bob produce?

What is the slope of Bob’s PPF?

Can Bob produce 10 peaches and 10 apples?

Specialization

The key is specialization. Alice is better at producing apples—for every apple she produces, she only has to give up half a peach—and Bob is better at producing peaches—for every peach he produces, he only has to give up half an apple. If Alice produces only apples and Bob produces only peaches, Alice will have 20 apples, and Bob will have 20 peaches. Exchanging 10 apples to 10 peaches nets each of them 10 apples and 10 peaches—something that was impossible for them on their own.

In some situations, managers have no choice about how to allocate resources. For instance, if Bob were to go on paternity leave, the manager would have to let him go and then return a few weeks later under a statute passed by Congress in the United States. In general, where there is a law that limits (or requires) the use of resources, that statute is part of the regulatory environment of business.

The law provides constraints to economic activities. It defines illegal activities, mandatory activities, and how certain activities are regulated at the state and federal levels. Of equal importance to the law is the confidence that mediation is available; economic partners have less need to trust each other than they would in the absence of mediation.

Isolated Decision Making

The general decision model in economics is called cost-benefit analysis. At its simplest, it works by comparing the benefit and cost of every action and by taking the action where net benefit (profit) is at its greatest or by taking all of the actions where this gap is positive. The first approach is used where only one action can be taken. The second approach is applicable when the manager can take multiple actions. The manager can compare the cost and benefit of each repair and choose the one with the largest net profit between cost and benefits.

Costs

In economics, the cost of something is considered in view of the next best option and is called opportunity cost. As opposed to accountants or finance professionals, economists consider every outcome or loss a cost incurs due to choosing an action.

Both the costs and the benefits need to be evaluated to determine their magnitude. While monetary costs and monetary benefits come with a built-in measurement system, other kinds of costs and benefits have to be measured individually. In economics, the subjective value of a given good or service is the reservation price.1

A sunk cost is contrasted with an opportunity cost. A sunk cost is a resource that has either been allocated or lost regardless of a decision. In choosing one option, more than one thing might be forfeited. For instance, if three decisions are ranked first, second, and third, only one can be chosen. The opportunity cost of choosing first is losing second. Third would not have been chosen regardless of choosing first or second and is therefore the sunk cost. Forgoing other opportunities can only compare with the “second best” option as an opportunity cost, since all other options must be given up for the second best possibility anyway.

Benefits

Similar to costs, benefits are also viewed rather broadly in economics. Aside from the monetary benefits, every other conceivable benefit like happiness, friendship, health, or the potentially positive feeling of learning something new must be considered. Holistically, this is utility.2

Utility can quantify the inherent non-linearity of the perceived value gained from increasing the amount of any given good a consumer consumes. The first unit of consumption creates a large utility improvement. The additional utility of a second unit of consumption is less. This tendency of lowering additional gain from increased consumption is called diminishing marginal utility.3

It is important to note that nearly all goods, including money itself, have diminishing marginal utility. In case of production (as it is generally assumed to be done by some kind of corporate entity), there is more attention paid to monetary gains than to utility.

Marginalism

Whether money or utility is used, marginalism attempts to explain the change in value of products by reference to their secondary unit. In marketing, firms use the marginal approach to determine sensitivity of q...