- 314 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

High and persistent levels of nonperforming loans (NPLs) have featured prominently in recent financial crises. This book traces NPL trends during and after crises, examines the economic impact of high NPLs, and compares the effectiveness of NPL resolution strategies across economies in Asia and Europe. The book distills important lessons from the experiences of economies using case studies and empirical investigation of ways to resolve NPLs. These findings can be invaluable in charting a course through the financial and economic fallout of the coronavirus disease (COVID-19) pandemic to recovery and sustained financial stability in Asia, Europe, and beyond.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Nonperforming Loans in Asia and Europe—Causes, Impacts, and Resolution Strategies by in PDF and/or ePUB format, as well as other popular books in Business & Financial Engineering. We have over one million books available in our catalogue for you to explore.

Information

PART 1

Summary of Nonperforming Loan Trends and Lessons from Three Decades of Crisis Resolution in Asia and Europe

1 Trends of Nonperforming Loans in Asia and Europe

1.1 Introduction

Nonperforming loans (NPLs) are an almost permanent feature of any banking sector. But in certain conditions, they become a serious problem for financial sectors and economies. Indeed, rapid credit growth followed by persistently high NPLs often accompany financial crisis. In East and Southeast Asia, NPLs rose sharply during and after the Asian financial crisis in the late 1990s, whereas the peak of the European NPL problem—particularly the euro area—was associated with the global financial crisis starting in 2008 and the subsequent euro area sovereign debt crisis, which began in 2010.

This chapter highlights the main features of NPL developments in Asia and Europe over the last 3 decades, examining both their commonalities and considerable heterogeneity between and within the regions.

NPLs are an unavoidable part of the banking business, although prudent bank lending standards can go a long way in making sure that only a small fraction of loans become nonperforming during their lifetime. Trying to avoid NPLs completely, however, appears almost impossible and would likely result in undesirably low levels of credit and economic activity, notably in most Asian and European economies, which are still characterized by relatively bank-centric financial systems.

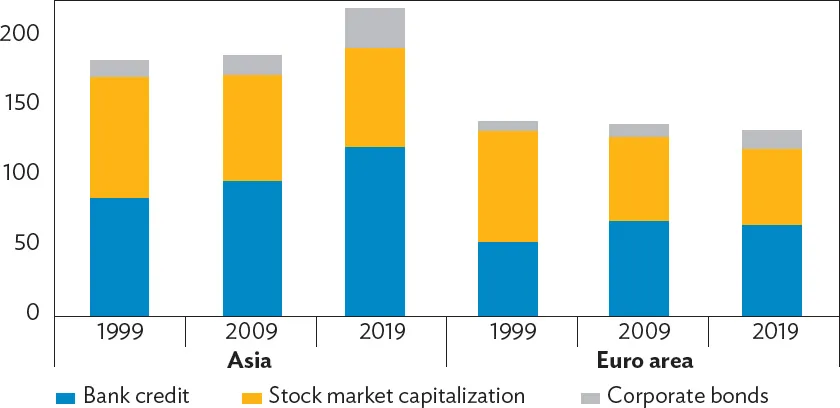

Banks are the main providers of corporate finance, both in Asia and in the euro area. In 2019, bank credit to firms relative to gross domestic product (GDP) stood at over 120% in Asia, exceeding the combined contributions of corporate bonds and stock markets to corporate financing (Figure 1.1). In the euro area, loans to nonfinancial firms fluctuated around 65% of GDP for most of the last decade, having increased from just over 50% in 1999. Despite having more than doubled in terms of GDP over the last 20 years, the corporate bond market remained a small part of corporate finance in both regions.

The dominance of bank finance in Asia and the euro area underpins the importance of efficient NPL resolution frameworks in these regions. Banks burdened with high NPLs may be unable to financially intermediate and thus support economic activity, while market-based finance may not yet be sufficiently well-developed to substitute for them. As other chapters show, empirical evidence from both Asia and the euro area suggests that high NPLs tend to reduce bank lending and economic activity. Preventing elevated NPLs, particularly over an extended period, is therefore an important public policy objective.

The chapter provides a high-level review of NPL developments across Asia and the euro area over the last few decades. More specifically, the two regional sections of this chapter look at correlations between NPLs and key economic indicators (such as GDP growth and interest rates), at the structure of the NPL stock in Asia and the euro area, and at key features of the regional secondary NPL markets. It thus provides a background for the subsequent analytical and policy-oriented chapters of the book.2

We find that regional economic crises played a key role in the buildup and subsequent decline of NPLs in the two regions. Asia experienced a major peak in NPLs in the aftermath of the Asian financial crisis, and it took nearly a decade for NPLs to return to pre-crisis levels. In the euro area, the surge in NPLs was related to the global financial crisis and the subsequent euro area sovereign debt crisis, which started in 2008 and 2010, respectively, and severely affected several euro area countries, mainly in Southern Europe. Underneath these high-level NPL trends, however, are often very heterogeneous context-specific NPL developments, shaped by a range of idiosyncratic economic and political factors.

1.2 Developments in Asia

The Asian financial crisis of 1997–1998 was a watershed moment for NPLs and financial sector development. In a little over a year after the outbreak of that crisis, the aggregate GDP of Indonesia, Malaysia, the Philippines, the Republic of Korea, and Thailand fell by 30%. Consequently, NPL ratios in Southeast Asia rose significantly, with Indonesia and Thailand experiencing NPL ratios higher than 40% in 1998 (Table 1.1). NPL ratios in the crisis-hit economies came down to considerably lower levels in a decade, due to strong post-crisis reforms, a combination of micro- and macroprudential policies, and sound macroeconomic conditions. In most other Asian economies, NPL ratios were also under control by the late 2000s.

Table 1.1: Evolution of Bank NPLs in Asia (% of gross loans)

NPL = nonperforming loan, PRC = People’s Republic of China.

Note: White cells denote nonperforming ratios less than 5%, yellow between 5% and 10%, and orange higher than 10%. Blank cells mean data are not available. Sources: Asian Development Bank calculations using data from Bank of Mongolia; CEIC Database; International Monetary Fund Financial Soundness Indicators. https://data.imf.org/; and World Bank World Development Indicators. http://databank.worldbank.org/data/reports.aspx?source=world-development-indicators (accessed June 2020).

However, in the aftermath of the global recession of 2008, distressed assets and the accompanying elevation in default risks and financial vulnerabilities increased in some countries, particularly in Central and South Asia, and in Mongolia. The NPL ratio reached 10.1% in Mongolia, due to a fall in prices of coal and natural resources after the global recession. A resurgence in these economies’ NPL ratios was a cause for concern, as high NPLs can destabilize banking systems and undermine economic growth.

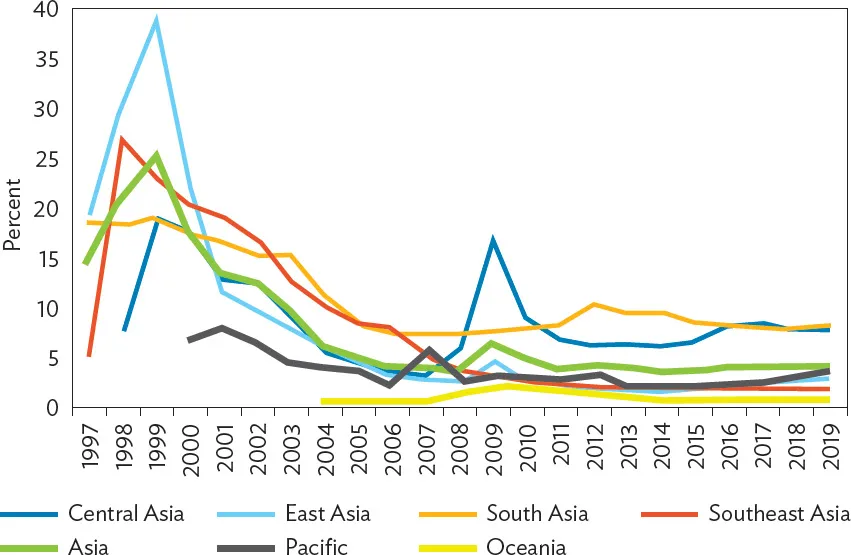

Examination of how NPL ratios evolved over the past 3 decades reveals two distinctive peaks during the Asian financial and global financial crises, especially for subregions affected directly by each crisis (Figure 1.2). The Asian financial crisis hit Southeast Asia hardest, while the euro area sovereign debt crisis a decade later hit Central Asia hardest.

On average, NPL ratios are lowest in East and Southeast Asia, at around 2%, together with Oceania and the Pacific. In Central and South Asia, NPL ratios remain relatively high, at 8%–10%, although they came down from the peak during the global financial crisis and the recession.

Notably, NPL ratios showed different patterns subregionally as they declined. In East Asia, the initial reduction was fast (falling from 39.5% to 11.9% in only 2 years) reflecting decisive post-Asian financial crisis reforms and political commitments. But in Southeast Asia, ratios went down more gradually (falling from 27.7% in 1998 to 12.8% in 2003 and taking another 5 years to come down to 3.6% in 2008), underscoring challenges of addressing high NPLs. Without direct crisis impact (and possibly no urgency and political will), NPL problems tend to persist even longer. In South Asia, the NPL ratio peaked at 19.4% in 1999 but was brought down to only 15.4% in 2003 and again to 7.5% in 2008. In Central Asia, the NPL ratio also came down slowly from its peak of 19.5% in 1999 to 9.0% in 2003 and again to 3.3% in 2007, before resurging to 17.4% in 2009 in the aftermath of the euro area sovereign debt crisis and a global recession. These experiences altogether also highlight the importance of timely resolution of NPL problems to avoid NPL overhangs.

In most economies that experience high NPLs, adverse macroeconomic conditions are important factors. The global financial crisis and the recession that followed exposed the vulnerabilities of the banking systems in many countries in Central Asia. Bank credit also grew rapidly in many of them in the years before the global financial crisis, spurred by favorable macroeconomic conditions. In 2008–2009, global oil prices fell sharply, however, undermining corporate profits and economic outlooks. NPLs rose sharply, compromising banking sector health and slowing the recovery with credit constraints.

These crisis episodes highlight the importance of macrofinancial linkages. Credit risks rise as macroeconomic conditions deteriorate and interest payments rise. Conversely, a deterioration in banks’ balance sheets may feed back into the economy as banks tighten credit conditions. While the macroeconomic impact is significant for NPL ratios, bank-specific factors cannot be overlooked.

The coronavirus disease (COVID-19) crisis magnifies concerns over NPL overhangs. Countries’ NPL ratios are expected to rise significantly with the unfolding of the pandemic and may well persist beyond the crisis period unless managed in a timely manner. These expectations call for policy measures to cushion the impact of COVID-19 on the banking sector and the economy in general.

Figure 1.3 illustrates the negative relationship between NPLs and economic growth, hinting at the possible harmful real economic effects associated with NPLs. From 2000 to 2017, changes in NPL ratios and GDP growth across different Asian subregions were negatively correlated. During the same period, Asian economies saw a positive relationship between the change in the NPL ratio and the change in interest rates.

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Tables, Figures, and Boxes

- Foreword

- Acknowledgments

- Editors

- Authors

- Key Messages and Overview

- Abbreviations

- Part 1: Summary of Nonperforming Loan Trends and Lessons from Three Decades of Crisis Resolution in Asia and Europe

- Part 2: Empirical Analyses of the Macrofinancial Implications of Nonperforming Loans in Asia and Europe

- Part 3: Country Case Studies on Nonperforming Loan Resolution in Asia and Europe

- Part 4: Policy Strategies for Nonperforming Loan Resolution and Market Development in Asia and Europe

- Back Cover