- 62 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

This cloud audit toolkit is designed to support the work of financial regulators in developing member countries of the Asian Development Bank. It aims to assist and accelerate the uptake of cloud computing technologies and digital tools to improve the efficiency and efficacy of financial regulators' work processes. Drawing on existing practices observed by leading regulators from across the globe, the toolkit provides a comprehensive framework for improving supervisory work processes. It also includes a checklist to help regulators conduct an initial review of their existing oversight mechanisms.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1 Introduction

Financial regulators are increasingly recognizing the power of new technologies such as cloud computing to create new opportunities for improving and accelerating innovation in banking systems.

In the Philippines, for example, Bangko Sentral ng Pilipinas (BSP), the central bank, supported a partnership between the Asian Development Bank (ADB) and Cantilan Bank Inc to pilot a study on cloud-based core banking technology. It placed the project in a “regulatory sandbox” while it processed and updated related regulations. And in January 2019, Cantilan Bank became the first BSP-regulated bank in the Philippines to fully rely on a cloud-based “software as a service” system as their core banking system.

The shift to cloud computing technologies has increased Cantilan Bank’s flexibility and given it a more accurate banking system. It has raised operational efficiency and enabled the bank to respond faster than other financial institutions to customer needs, particularly as the coronavirus disease has caused economic lockdowns across the country.

As a result of the pilot, financial institutions’ trust in cloud technology has increased and the regulator has strengthened innovation-enabling regulations and adopted an effective supervisory approach that fosters innovations such as cloud computing services for core and non-core banking systems and activities. Indeed, the BSP has since approved over 40 other financial institutions to migrate their core banking to the cloud.

Challenges in Regulating for Cloud Computing

Yet, some regulators may still have questions about how to transition from a pre-cloud to a cloud-first regulatory framework. Questions around data governance frameworks to be put in place, managing security standards, conducting audits and inspections, assessing risk management approaches, business continuity and incident responses, and so on, often arise when regulating financial institutions look to move to the cloud.

This paper addresses the questions regulators may have, particularly common issues surrounding mechanisms for oversight, monitoring, and control of cloud technology in the financial sector.

Introducing the Cloud Audit Toolkit for Financial Regulators

The Cloud Audit Toolkit for Financial Regulators is a two-part paper which aims to assist and accelerate opportunities to cloud computing technologies and digital tools to improve the efficiency and efficacy of financial regulators’ work processes. It addresses the question: “What do regulators need to know when regulating and/or supervising the adoption of cloud computing services in the financial services sector?”

Using existing practices observed by leading regulators globally, such as the BSP, and the Monetary Authority of Singapore’s (MAS) Guidelines on Technology Risk Practices,1 this regulatory toolkit comprises two components:

(i)Regulatory toolkit paper (this paper) which develops a framework for financial regulators to oversee technology and outsourcing risks in using and deploying technology tools such as cloud computing.

(ii)Regulator’s checklist (in Appendix): To assist the regulator in its initial review of current oversight mechanisms.

Cloud Audit Toolkit for Financial Regulators Workshop. Workshop participants from the Bangko Sentral ng Pilipinas Technology Risk and Innovation Supervision Department led by Director Melchor T. Plabasan.

Pilot of the Cloud Audit Toolkit for Financial Regulators Training Program

This toolkit was piloted as a half-day capacity-building training program organized with the BSP on 24 May 2021 for about 50 staff. Due to coronavirus disease travel restrictions, in lieu of an in-person workshop, this was held as a virtual training session.

2 Service Provider Oversight

Use of cloud computing in financial services has been growing and financial regulators have been regularly updating regulations and guidelines to allow better oversight and risk management of the technologies their regulated entities are using.

Cloud Computing Regulated as Risk-Based, Outsourcing Arrangement

Regulation of cloud computing has evolved differently in each financial market, but financial regulators have generally considered cloud computing a risk-based outsourcing arrangement, ensuring that regulated entities are identifying the relevant risks and managing them effectively. This technology-neutral approach is preferred over making new regulations specific to cloud computing technologies, which may become outdated as technology and its applications develop. Examples of this arrangement include the following:

• Australian Prudential Regulation Authority regulates the cloud under the Prudential Standard CPS 231 Outsourcing (Jul 2017)2 and the Prudential Practice Guide PPG 231 Outsourcing (Oct 2006).3

• MAS addresses cloud computing within its updated 2018 Guidelines on Outsourcing,4 supported by additional Technology Risk Management Guidelines.5

• The Hong Kong Monetary Authority regulates cloud computing technology under SA-2 Outsourcing (Dec 2001)6 —major supervisory concerns, and IC-1 Risk Management Framework (Oct 2017).7

• BSP regulates cloud computing technology guided by BSP Circular No. 808 on Information Technology Risk Management,8 and BSP Circular No. 899 on Outsourcing.9

This regulatory toolkit therefore recommends checklist items under cloud computing regulated as risk-based, outsourcing arrangement in the Appendix (1.1.1 to 1.1.3).

Technology Oversight, Monitoring, and Control

The management and control of outsourcing arrangements of a financial institution or regulated entity are based on the nature and extent of risks in the outsourcing arrangements. The regulated entity itself is best placed to determine the specific monitoring and control measures to be instituted for oversight of outsourcing agreements. Financial regulators should allow regulated entities the flexibility to customize their outsourcing arrangement through a risk-based approach, possibly augmented with suggestions for baseline standards or guidelines which advise how regulated entities can exercise their oversight responsibilities.

How is Oversight Different in the Cloud?

Though the basic rationale behind oversight in the cloud is the same as in other forms of outsourcing, the cloud presents unique challenges and advantages. Importantly, regulators should bear in mind that some cases may need regulated entities to maintain more mechanisms for oversight, monitoring, and control when using the cloud. The increasing sophistication of cloud technology has revealed that traditional oversight mechanisms which do not incorporate information technology (IT) expertise may insufficiently address these risks.10 It has also demanded that regulated entities and the financial regulator have strong technical knowledge to understand and address the risks arising from technology usage.

One benefit of cloud technology is that the standards for oversight are well-established and being kept up–to–date, and moving financial services into the cloud can in fact facilitate and improve oversight functions. For example, major cloud providers are certified in international standards such as the ISO/IEC 27000 series and conduct regular third-party audits, which automatically raises a regulated entity’s oversight and standard of outsourcing arrangements.

Regtech and Suptech

Among the new technologies and cloud computing useful in financial services are data analytics and artificial intelligence to assist regulators with supervisory and regulatory monitoring mechanisms, i.e., “regtech” and “suptech.” Efforts could range from ensuring the entire process of regulatory review and supervision is available in digital formats (moving from analog reporting to digital), to developing sophisticated methods for real-time monitoring of regulated entities. For example:

• Alessa is a Canadian regtech solution which offers real-time due diligence, transaction monitoring, sanctions screening, and other regulatory reporting capabilities to comply with anti-money laundering and counter terrorist funding regulations.11

• 360factors is a United States (US) regtech solution which designs bespoke cloud-based regulatory and risk reporting mechanisms for the financial sector.12

• 6Clicks is a British regtech solution which offers their clients a dashboard-style automated assessment and compliance management platform.13

• 8of9 is a US regtech solution which captures financial regulations and legislation in real-time and provides timely alerts to clients.14

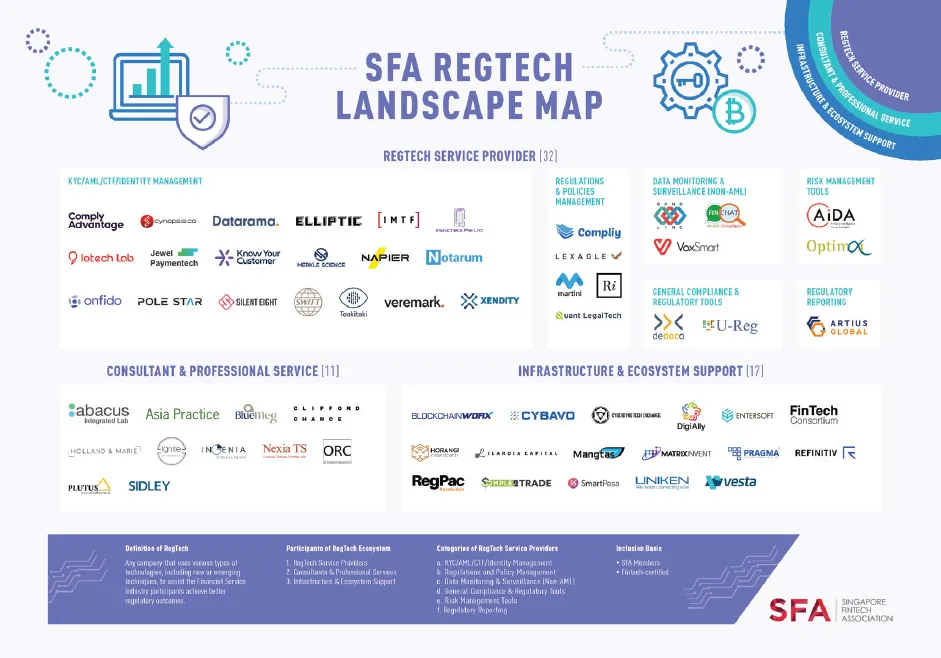

The Singapore Fintech Association has published a list of the various types of regtech which have been developed, and the companies which have solutions (Figure 1.)

A final note on regtech and suptech—in some instances, it has been useful for the public sector to work with the private sector to develop these solutions together, to ensure that regulatory reporting is fully compliant and interoperable with a country’s financial regulatory submissions. Austrian Reporting Services, for example, Europe’s largest regulatory reporting utility and reporting hub,15 was established through partnership between the Austrian National Bank (the central bank) and the country’s banks. The regtech speeds up regulatory reporting, including standard template reporting, and ad hoc requests from regulators.

Recordkeeping

As a starting point for ensuring effective oversight and monitoring, financial institutions should keep adequate records on outsourcing arrangements, particularly those critical or material. Definitions of what constitutes material or critical may differ slightly from regulator to regulator, but the concept generally encompasses agreements that if not performed or that otherwise suffer a service failure or data breach, would have a material or severe impact on the regulated entity’s core operations (see page...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Table and Figures

- About This Toolkit

- Acknowledgments

- Abbreviations

- 1 Introduction

- 2 Service Provider Oversight

- 3 Physical and Logical Audit and Inspection Rights

- 4 Security and Cybersecurity Requirements

- 5 Data Protection and Privacy

- 6 Data Governance, Retention, and Exit Strategy

- 7 Business Continuity and Disaster Recovery Planning

- 8 Incident Response Requirements and Processes

- 9 Standards, Certifications, and Global Best Practices

- Appendix: Cloud Audit Toolkit for Financial Regulators—Checklist

- References

- Footnotes

- Back Cover

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Cloud Audit Toolkit for Financial Regulators by in PDF and/or ePUB format, as well as other popular books in Computer Science & Cloud Computing. We have over one million books available in our catalogue for you to explore.