- 512 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Effective Investor

About this book

Why is the South African stock market important? First, it is classified as an emerging market. However, while the country shows emerging characteristics, its stock market is highly developed. It is one of the oldest stock exchanges in the world and is the eighteenth largest in the world in terms of market capitalisation and trade. It is by far the largest of Africa's 29 exchanges and accounts for over a third of the stocks listed on the continent. It is an integral part of the world-class financial infrastructure of the country, and South Africa was ranked first of 139 countries for its regulation of securities exchanges by the World Economic Forum in 2010. Global emerging markets are evolving into developed markets, while frontier markets are becoming the new emerging markets. Understanding the South African market provides insight into the paths that these markets will follow in future. Similarly, the techniques highlighted in the book for dealing with volatility are applicable to similar markets elsewhere. Second, South Africa is the newest member of the BRICS grouping. This gives it the role of Africa's representative and it is of particular interest to China as a bridgehead to access this resource-rich continent. Third, it is a gateway into Africa, both directly in terms of its highly developed financial, legal and banking infrastructure and indirectly, through the exposure of many of its top corporates to African countries. Finally, it is an attractive market in its own right. It has been the third-best performing stock market in the world since 1900, and has weathered the great financial crisis with flying colours. While the investment lessons from the South African market outlined in this book are universal, understanding some of its peculiarities is also important. For example, some insight into the behaviour of the currency, the rand, is clearly critical in terms of any investment in this market, as well as in providing some understanding of other volatile emerging market currencies, and also because it is often treated as the most liquid proxy for these currencies, particularly during upheavals. In addition, traditional macroeconomic approaches to investment in this market often don't work because of the weak correspondence between the compositions of the economy and the market and the dominance of resources, a fact which is usually missed by analysts in developed countries. Unlike the promises in many populist investment books, this book won't make you immensely wealthy quickly. It may not even make you immensely wealthy slowly. What it will do is explain the most important features of how the stock market works; guide you into forming realistic expectations; help you to avoid the most common pitfalls and evaluate investment information critically and show you how to reduce risk and enhance returns. It should save you money and time and I hope it provides new and practical insights, regardless of your investment experience.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

PART ONE

THE FUNDAMENTALS

1

WHAT DRIVES RETURNS

TOTAL RETURNS

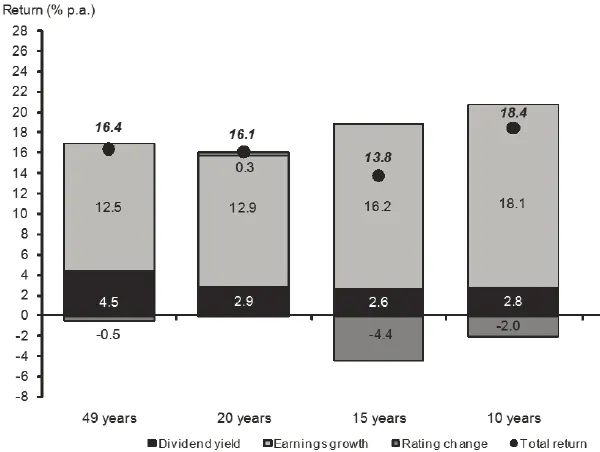

COMPONENTS OF RETURN

Table of contents

- Cover

- Title

- Copyright

- Dedication

- Table of Contents

- The Eleven Great Investment Pictures

- Acknowledgements

- Foreword

- Introduction

- Part 1: The Fundamentals

- Part 2: The Implementation

- Part 3: The Psychology

- Part 4: Styles And Techniques

- Part 5: Looking After Yourself

- Appendix: Long-term asset class returns

- Bibliography: The best investment books

- Investment resources

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app