- 44 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

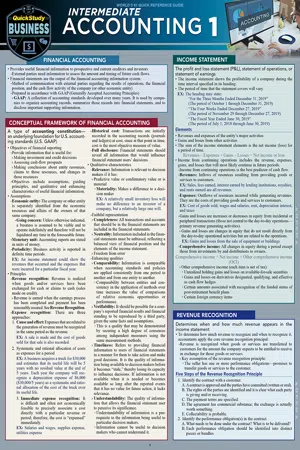

Essentials of the college level Intermediate Accounting 1 course expertly written in our time-tested condensed format that is proven to support students, their studies, grades and even their professional life after graduation. Our experienced author, professor and consultantMichael Griffin, MBA, CMA, CFM, ChFC has outdone himself providing the clearest organization of concepts streamlined to offer facts, equations, examples and explanations in this digital guide offering incredible value for quality course and professional support that you will not find anywhere else. Any business professional that deals with top-level management of multifaceted companies would also find this to be a great reference for facets they may not deal with on a daily basis, but that they are expected to understand regarding operations and strategy, again at an unbeatable value.

Digital guide includes:

- Financial Accounting

- Conceptual Framework of Financial Accounting

- Income Statement

- Revenue Recognition

- Discontinued Operations

- Comprehensive Income

- Earnings Per Share

- Statements

- Balance Sheet

- Cash & Cash Equivalents

- Receivables

- Inventory

- Self-Constructed Assets

- Research & Development

- Property, Plant & Equipment (PP&E)

- Depreciation, Depletion & Amortization

- Intangible Assets

- Time Value of Money

- Financial Disclosures

- Auditor's Report

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

- A dollar is worth more now than that same dollar will be worth in the future.

- Inflation reduces the purchasing power of the dollar.

- Because of the uncertainty surrounding the receipt of the dollar, an agreement to receive sooner, rather than later, will increase the value of that dollar.

- Time values involve the importance of opportunity costs. A dollar today is worth more than a dollar in one year because the dollar today can be productively invested and will grow more than a dollar in one year.

- Time value of money calculations are used in capital budgeting, real estate planning, investing, banking, insurance, retirement planning, and other areas of personal finance.

- Compounding: The process of determining the future value of a present sum.

- For multiple periods, compounding results in interest producing more interest (interest “giving birth” to more interest).

- Interest is the “rent” for the use of money.

- Interest is the amount received or paid in excess of the amount lent or borrowed.

- Discounting: The opposite of compounding, it is the process of determining the present value of a future sum.

- Present values can be calculated for future lump sums (a single amount received in the future) or a stream of equal cash flows (annuities) or unequal cash flows.

- The present value of a single amount is today’s equivalent of a particular amount in the future.

- Accountants use present value calculations more frequently than future value calculations.

- Valuation of long-term bonds, long-term leases, and pension obligations are all examples of the application of present value calculations.

- Single amount: Present value (PV) of a lump sum (FVn) given at the end of n periods at an interest rate of r%.

FVn |

(1 + r)n |

FVn | ||

(1 +

|

- Ordinary annuity: Present value of an ordinary annuity (PVA) of PMT per period for n periods at r% per period:

1 − (1 + r)-n | ||

r |

- The cash flows of an ordinary annuity occur at the end of each period. EX: If you were expecting to receive $500 at the end of each year for the next 10 years, that would be an ordinary annuity.

- The cash flows of an ordinary annuity occur at the end of each period.

- Annuity due: Present value of an annuity due (PVD) of n cash flows (PMT) at r% per period:

1 − (1 + r)-n | ||

r |

- The cash flows of an annuity due occur at the beginning of each period. EX: If you were expecting to receive $500 at the beginning of each year for the next 10 years, that would be an annuity due.

- The cash flows of an annuity due occur at the beginning of each period.

- Perpetuity: Present value of a perpetuity (PVP) of PMT per period at r% per period: PVP = PMTrEX: If you expect an investment to pay $1,000 each year forever, the value of that investment today, assuming an annual interest rate (r) of 5%, would be $20,000 ($1,000/.05 = $20,000).

- Series of cash flows: Present value of a series of cash flows (CFt) at times, t = 1, 2, …, n, at r% per period: PV =nΣt=1

=CFt(1 + r)t

+CF1(1 + r)1

+ ... +CF2(1 + r)2CFn(1 + r)nEX: If the cash flows of $1,000, $2,000, and $3,000 were to occur at the end of each year, and if it is assumed that the annual rate of return is 6%, the present value of that stream of unequal cash flows would be $5,242 ($1,000/1.06 + $2,000/1.124 + $3,000/1.191 = $5,242).

- The future value can be calculated based on a single amount or from a stream of cash flows extending into the future. EX: You can estimate what an investment made today will be worth at some future date by using the future value of a single amount. You can also calculate the future value of a stream of equal future cash flow, such as an ordinary annuity or an annuity due.

- Single amount: Future value at the end of n periods (FV) of a present amount (PV) in...

Table of contents

- Financial Accounting

- Conceptual Framework Of Financial Accounting

- Income Statement

- Revenue Recognition

- Discontinued Operations

- Comprehensive Income

- Earnings Per Share (EPS)

- Statements

- Balance Sheet

- Cash & Cash Equivalents

- Receivables

- Inventory

- Self-Constructed Assets

- Research & Development (R&D)

- Property, Plant & Equipment (PP&E)

- Depreciation, Depletion & Amortization

- Intangible Assets

- Time Value Of Money

- Financial Disclosures

- Auditor’s Report

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app