- 106 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The rapid growth of fintech services in Asia and the Pacific can help countries leapfrog the challenges of traditional financial services infrastructure and dramatically increase access to financial services. An inclusive fintech ecosystem is essential to support economic growth, greater equality, and lower poverty levels. This publication details how to better understand and provide an enabling policy and regulatory environment to promote responsible fintech innovation, while ensuring consumer protection and supporting inclusive economic development in the region.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Fintech Policy Tool Kit For Regulators and Policy Makers in Asia and the Pacific by in PDF and/or ePUB format, as well as other popular books in Computer Science & Computer Science General. We have over one million books available in our catalogue for you to explore.

Information

1

INTRODUCTION

Digital financial services focused on innovative financial technologies (fintech) can benefit individuals, businesses, and governments. An appropriate policy and enabling regulatory environment for developing responsible and inclusive digital financial services can help expand inclusive economic growth and address the Sustainable Development Goals (SDGs).

Indeed, the rapid growth of fintech services in Asia and the Pacific has helped countries leapfrog the challenges of building traditional bricks-and-mortar financial services infrastructure and to dramatically increase access and use of these services. Fintech is also increasing the speed, security, and transparency of financial services.

An inclusive fintech ecosystem is recognized as an important tool to support economic growth, greater equality, and lower poverty levels. To achieve this, countries in this region can share their many experiences in developing appropriate policy and enabling regulatory approaches. These can support sound development of inclusive financial services while mitigating the risks of new fintech providers and technologies.

In light of the coronavirus disease (COVID-19) pandemic and its aftermath, digital access to financial services has become even more critical. As businesses and the general population have adapted to a digital lifestyle amid social distancing and quarantine measures, they are further embracing the convenience of remote access to financial services.

Digital payment platforms have helped many overcome the challenges of the pandemic. As the outbreak took hold, people shifted their activities to online transactions. And use of these platforms has surged around the region since then.

Many now hope that the new technologies can fuel economic recovery.

With appropriate legal and regulatory frameworks, policy makers and regulators hold the keys to enabling expansion of inclusive fintech services. To support this objective, this tool kit aims to help regulators and policy makers understand the following about fintech:

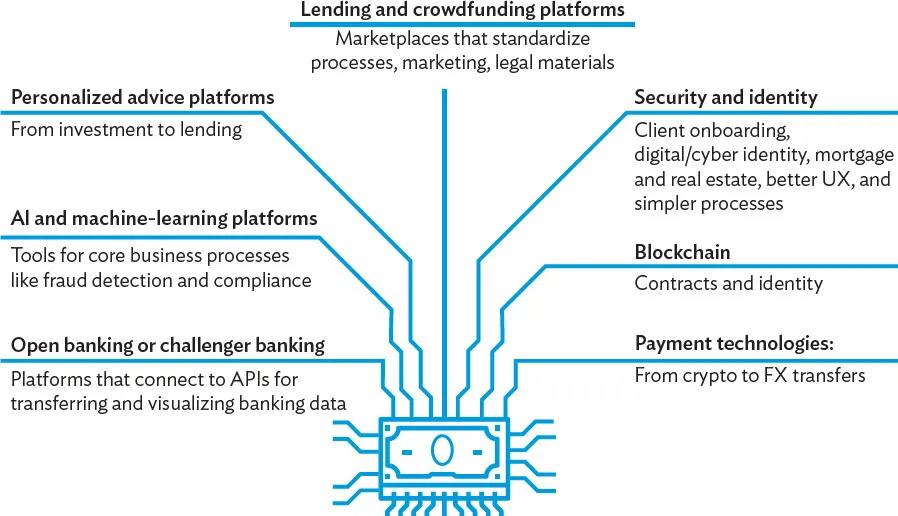

(i)The latest developments: especially advances in payment technologies, blockchain, security and identity, personalized advice platforms, machine learning, artificial intelligence, cloud technologies, and open application programming interfaces (APIs).

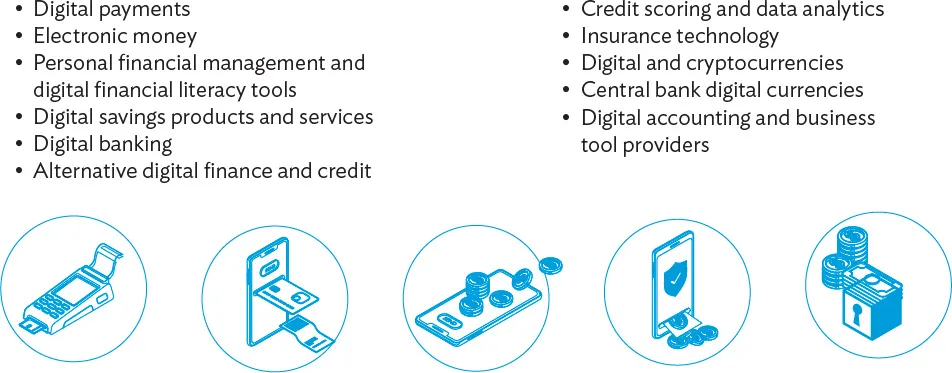

(ii)Support for financial inclusion, including access, use, and quality of services. This is especially so in digital payments, personal financial management, digital financial literacy tools, digital savings products and services, digital banking, alternative digital finance and credit, credit scoring and data analytics, insurance technologies, digital and crypto assets, and central bank digital currencies.

(iii)Support for the SDGs: this specifically includes those for ending hunger, achieving food security, and promoting sustainable agriculture, protecting health, gender equality and economic empowerment of women, economic growth and jobs, supporting industry, innovation, and infrastructure, reducing inequality, and building partnerships to implement the SDGs.

(iv)Development of an appropriate regulatory and policy environment that looks at policy enablers, enabling technologies, and specific fintech activities.

(v)Approaches to developing appropriate supervisory capacity, especially as it relates to regulatory technologies (regtech) and supervisory technologies (suptech).

Financial services have already begun to benefit from emerging and innovative digital technologies and will continue to do so. Tapping new fintech solutions, aided by strong policy and regulation, promises to create more inclusive growth and help economies recover from the COVID-19 pandemic.

2

FINTECH LANDSCAPE OVERVIEW

What Is Financial Technology?

Fintech firms use specialized software and algorithms on personal computers and, increasingly, smartphones. Companies, business owners, and consumers then use fintech to improve the management of financial operations and processes.

Initially, the term fintech was applied to back-end systems in traditional financial institutions. However, over the past decade, the focus has migrated toward front-end systems, consumer-oriented services and, increasingly, new financial players.

These services also impact a range of sectors and industries including:

• traditional banking services as well as personal financial management tools,

• investment services,

• insurance, and

• regulatory and supervisory technologies (or so-called regtech and suptech).

In addition, services encompass enabling agricultural value chains; access to health, education, and basic utilities; and even e-government and supporting “smart” cities. The list below and Figure 1 illustrate the rich array of services and trends.

Financial services using fintech:1

• payments (processing and networks);

• mobile wallets (e-money) and remittances;

• retail investing (robo-advisors);

• personal and wealth management;

• financial service automation;

• capital markets and institutional trading (including equity crowdfunding);

• core banking infrastructure (“cloud” providers);

• digital savings products and services;

• digital banking (neo banks, challenger banks, open banking, application programming interfaces [APIs]);

• security, fraud, and compliance-related providers (cybersecurity, anti-money laundering, and combating the financing of terrorism);

• alternative digital credit (marketplace, balance sheet, peer-to-peer [P2P], supply/trade finance);

• real estate and mortgage lending;

• credit scoring and data analytics;

• regulatory technologies and supervisory technologies (regtech/suptech);

• insurance technologies (insurtech);

• digital point-of-sale (POS) services;

• virtual and crypto assets;

• central bank digital currencies;

• blockchain and distributed ledger technologies; and

• digital accounting and business tools (including smart contracts).

Fintech Services and Financial Inclusion

Historically, financial service institutions, especially banks, typically offered a full range of products and services, including payments, credit, savings, and related banking services. With fintech, financial products and services have generally been “unbundled” and are often now offered individually.2 Innovation is often clustered into three categories:

• incremental (faster more efficient delivery of existing services);

• disruptive (Uber, Amazon); and

• transformative/breakthrough (internet).

Fintech’s ability to streamline individual offerings with new technologies has improved efficiency, lowered costs, and expanded access to financial services to more consumers than traditional brick-and-mortar financial service providers. This is expanding financial inclusion more than was previously possible. A 2016 study by McKinsey Global Institute—estimates that digital financial services could expand access to formal financial accounts to 1.6 billion people in the world’s developing economies. Such broader access could, in turn, help add 6% to gross domestic product in emerging economies by 2025 (Manyika et al. 2016).

As such, fintech should be viewed more as “transformational” or “evolutionary,” rather than “disruptive” of traditional financial service providers. In addition, rather than replacing or competing with the traditional banking sector, bank–fintech partnerships have emerged that can leverage new financial technologies within the banking sector.

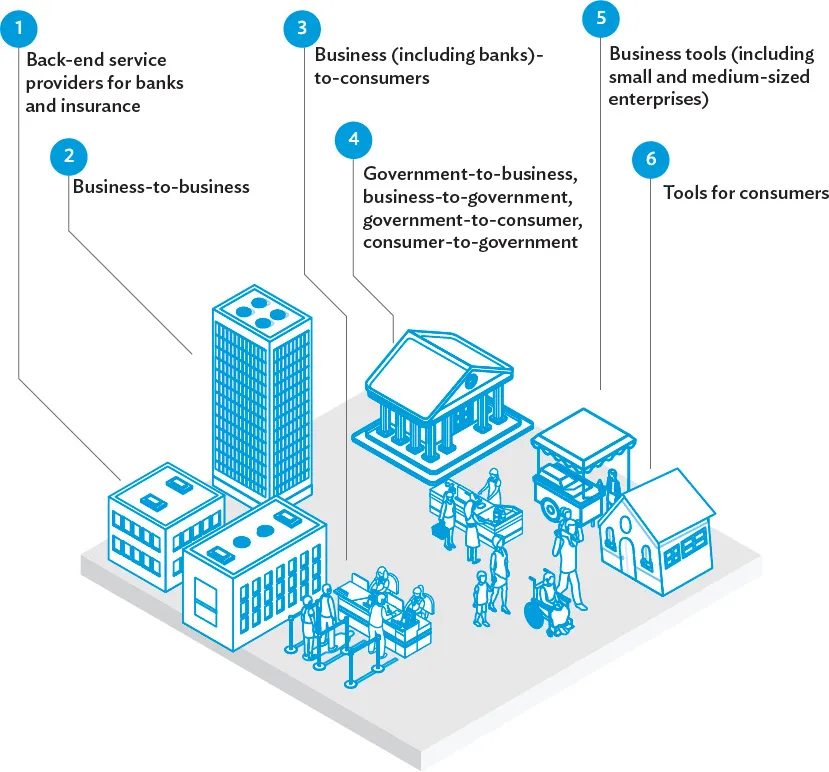

Fintech users fall into six broad categories:

(i)back-end service providers for banks and insurance;

(ii)business-to-business;

(iii)business (including banks)-to-consumers;

(iv)government-to-business, business-to-government, government-to-consumer, consumer-to-government;

(v)business tools (including small and medium-sized enterprises); and

(vi)tools for consumers.

Advances in mobile banking; greater information, data, and more accurate analytics; and broader access will expand opportunities in each of these six categories.

Discussion of fintech services focused on financial inclusion include issues listed in Figure 3. More detailed descriptions can be found in Annex 1.

New Technologies in Digital Finance

New technologies, such as machine learning/artificial intelligence (AI), predictive behavioral analytics, Internet of Things (IOT), and data-driven analysis and tools can improve access to financial products and services and personal financial management decision-making (Table 1).

“Learning” apps can reveal online behaviors that users themselves may be unaware of. With this information, these apps can provide customers with better financial tools to improve their automatic, unconscious spending and savings decisions, and provide SMEs better business management options.

Fintech also uses “chatbots” and AI to help customers with basic tasks and help businesses to reduce costs and improve inventory management and basic accounting services.

In addition, financial technologies are being used to combat fraud. Such fintech services leverage payment history information to flag unusual transactions. These tools not only improve regulatory compliance, fraud, and anti-money laundering, but can also help regulators.

Meanwhile, advances in regulatory technologies (regtech) and tools to help financial supervisors perform their jobs through new supervisory technologies (suptech) are improving regulatory oversight.

Advances in national retail payment systems that increasingly focus on interoperable and interconnected infrastructure support a move toward a more “cash-lite” society. Advances in e-money have allowed the creation of a range of new, simple transactional accounts that support stored-value and better payment and money transfer capabilities.

New back-end systems, especially “cloud” technologies, are also facilitating banking services. New digital banks and open banking via APIs are increasingly becoming tools to improve banking, and help leverage and interconnect traditional and new providers.

Numerous digital credit and finance models have been developed, both from existing banks, either directly or through partnerships, as well as new nonbank digital credit and finance platforms. Digital credit providers across Asia and the Pacific are increasingly utilizing ...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Tables, Figures, and Boxes

- Foreword

- Acknowledgments

- Abbreviations

- Key Content

- Fintech Policy Tool Kit Infographic

- 1. Introduction

- 2. Fintech Landscape Overview

- 3. Foundational Infrastructure and Policy Environment

- 4. Ensuring Responsible Fintech Services

- 5. Asean Comparative Fintech Laws, Policies, and Regulations

- 6. Conclusion and Recommendations

- Annex 1: List of Definitions

- Annex 2: Asean Comparative Fintech Laws, Policies, and Regulations

- References

- Footnotes

- Back Cover