![]()

1 Digital Hesitation

By J.B. Wood and Thomas Lah

The predominant business model in an industry can change quickly. The rise of Netflix meant not only the death of Blockbuster, but it also constitutes a real threat to the future of movie theaters. The emergence of Uber didn’t just hurt the taxi business, it contributed to the temporary bankruptcy of Hertz. And Amazon didn’t just doom Barnes & Noble bookstores, it is threatening brick-and-mortar retail giants all over the world.

But we’ve always wondered…what was going through the minds of the executives at Hertz or Blockbuster at that time? Did they know their end was nigh? Did they realize their business model was being completely disrupted? Or did they just think they were losing a few orders?

Today almost every company is a tech company. And they are all riding a digital transformation (DT) wave that is disrupting the business and operating models of their industry. When DT marches through an industry, the results can be devastating to companies that are complacent. Digital capabilities upend the way customers buy and consume your products and services. Can you imagine being a bank without a mobile app today? A large retailer without an e-commerce site? And it’s not just business-to-consumer (B2C) companies. Will there be enterprise tech providers of tomorrow with which a customer can’t scope, price, and place a complex order online? Or industrial equipment providers that don’t use predictive analytics to completely eliminate customer outages?

One of the reasons that the term “digital transformation” has become so popular is because it is so vague. You can stuff just about any kind of digital project or investment under its purview, and it sounds progressive. But the reality is that meaningful DT usually shows up differently in each industry. The nature of the pivotal projects and the outcomes they deliver are based on how disruptive certain technology products and projects can be to the status quo of a particular marketplace. In consumer retail, DT has been synonymous with e-commerce and supply chain; not a different type of business, a different way of going to market. But, in other B2C industries, like transportation and hospitality, DT has brought entirely new forms of competition in the form of breakthrough ridesharing or home-sharing business models.

So, to be valuable, this book must be targeted. It is aimed at technology and industrial product companies that serve business customers, commonly referred to as business-to-business (B2B) companies. While there are certainly lessons here for companies in other industries, the B2B sectors will be our focus.

Wait! Yet Another Book About Digital Transformation?

Before we go further, let us address a fair question: There is already a lot of literature about DT. So why are the perspectives in this book any better or more important?

Our company name, TSIA, stands for the Technology & Services Industry Association. We are an industry research firm that is under nondisclosure with hundreds of the world’s leading public companies in hardware and software technology, as well as industrial, healthcare, and B2B/B2C professional service markets. Each of these member companies agrees to provide non-public data to TSIA about its business practices and operating results. We have industry experts and data scientists who then compile and analyze that data. We are trying to answer a specific question: What business practices are working better than others in the real world? Then, we look at the actual financial and operating results being generated, and how much better they are than other practices that might not be considered best practices. Once we know there is a best practice that is actually worth pursuing, we identify the specific corporate capabilities that any one of our member companies would need to execute it. Armed with that insight, we can work with a specific company, tell it where it is today on the journey, what’s missing, what’s already good, what can be adapted, and what tactics, timelines, and returns it can expect along the way.

In short, TSIA has a unique perch. We have seen just about everything that is good, bad, and missing from the DT of hundreds of the globe’s most important companies. That includes the new companies that are trying to disrupt the old ones, the old ones that are fighting off the new ones, and all the companies that see opportunity in software and the cloud. In short, we have unparalleled facts and insights that are derived from this amazing business community—probably more facts and more insight than any other source. And, most importantly, it’s real-world stuff. We don’t share a member company’s data with the public, which includes customers, analysts, or the media. If a TSIA member company is exaggerating its performance to TSIA, then it is just wasting its money. It’s how our model works; it’s a clean, safe place to tell the truth about the challenges of business evolutions big and small, and then learn how the best companies in the world accelerate them. We are also obligated to connect dots that form patterns. If we combine what we see at one company with what we see at others, we can spot trends or possibilities, both productive and counterproductive, very early. Think of it as on-demand management insight.

Finally, TSIA is looking at DT from an executive leadership perspective, not an information technology (IT) perspective. While deciding, developing, and managing architectures, data models, applications, development operations, security, and so forth—are all critical to effective DT—we are assuming companies can get that job done. What we want executives to do with this book is to think big, and then effectively set the conditions for success.

The Migration We Predicted

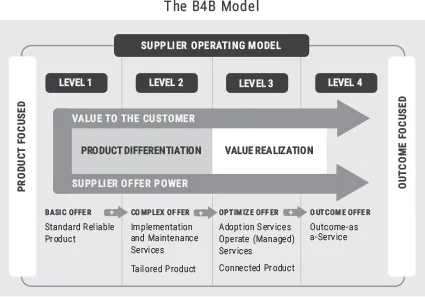

Before we move ahead, we must first go back a few years. In 2013, we published a best-selling tech book titled B4B: How Technology and Big Data Are Reinventing the Customer-Supplier Relationship.1 This book correctly predicted the (then) forthcoming evolution of B2B business models. Figure 1.1 shares a quick review.

FIGURE 1.1 The B4B Model

The B4B model allows companies to place part or all their portfolio into one of four levels. The level then clarifies the key value premise to the customer and how it should compete against rival offers at the same level. Offers that are designed to compete at higher levels require more advanced product capabilities and services. Most B2B companies and their channel partners traditionally operated as Level 1 or Level 2 suppliers. The hallmark of offers that compete at Level 1 and Level 2 is that they are products (hardware, software, systems) that are sold to and operated by the customer. While the supplier may offer services to get or keep the product operational, the customer assumes all the risk of turning its big capital-expenditure (CapEx) purchase into business outcome return on investment (ROI). In layman’s terms, the customer paid for it, and it works. Whether the customer uses it very much or extracts value from it is up to them.

Most technology and industrial companies today are well on their way to moving their portfolio away from Level 1 and Level 2. In most B2B industries, it’s just not good enough anymore. Most companies are moving completely or partially to being a Level 3 supplier that effectively rents its technology as a subscription and whose services actively manage and optimize the customer’s use of the technology to increase adoption and ROI success. Some are even experimenting with Level 4 sales discussions based on improving specific customer business outcomes. Level 3 and Level 4 suppliers are learning that there are a few characteristic pillars of these transformations:

• Their revenues shift from up-front transactions to recurring subscriptions (over a multiyear life cycle). That, according to the stock market, is a good thing.

• If the customer does not get the promised outcomes, they can stop subscribing. That is a bad thing.

• The supplier MUST be digitally connected to the customer via the product. That is a minimum requirement.

Digital Transformation: Wave One

These objectives—moving to recurring revenue and connected products, combined with classic IT activities, like moving workloads to the cloud and automating daily activities via new apps—constituted what we are calling Wave One of DT for most B2B tech and industrial companies. So, in the first wave of DT, technology providers started selling their technology as a service and got their technology more connected so that they had better visibility into what the customer was actually doing with the technology.

And the truth is, even after a decade, most companies are still navigating the Wave One journey. That was primarily a journey for legacy incumbents. They have spent many millions of dollars to migrate their business models, and they still have lots of work to do. They are amazed at how long it is taking. But the good news is this Wave One of DT is now well understood. As a result, we now have case studies to examine and healthy patterns to follow for Wave One transformation.

However, this book is called Digital Hesitation. In it we will spend time examining why most companies in Wave One of DT are under-performing. More importantly, we want to focus on what’s coming next—about considering what “all the way” will look like on the journey to digitally transform your B2B company. So, if you are still struggling through the first wave of DT, you need to accept that a second wave is coming, and it’s going to be more challenging than the first. This book will help born-in-the-cloud B2B companies to exploit their “clean slate” operating models. And, to be fair to everyone, it will also help large incumbents to defend their future.

Digital Transformation: Wave Two

As we watch these leading companies navigate the digital transformations of their industry, we can observe a few central themes. The first, as we mentioned, is that most are still actively on the Wave One journey. They are migrating their product portfolio to some form of subscription or consumption-based, recurring revenue model. They are also fully connected to (at least) their newer products. Some have done a better job than others about going back and connecting to older on-premises products in the field. In addition, they have implemented new cloud-based solutions for many of their main business applications and are moving some or all workloads to the cloud. Finally, they are beginning to pilot new service capabilities designed to accelerate customers through the land-adopt-expand-renew (APLAER) customer life cycle in order to improve adoption, stimulate expansion, and optimize renewals. (Note: APLAER is an update to TSIA’s well known LAER model. Please refer to Chapter 6 for an explanation of APLAER.)

All good so far? (By the way, if your company is not already well along in all these journeys, we politely suggest that you are behind the curve.)

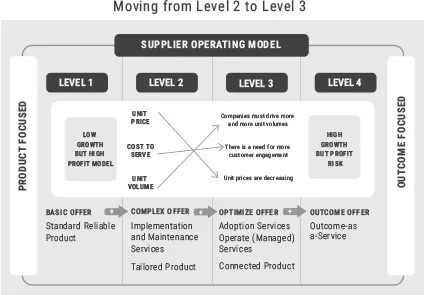

But, as this is happening in industry sector after industry sector, we are seeing the pattern shown in Figure 1.2 emerge—and it applies to companies both old and new.

FIGURE 1.2 Moving from Level 2 to Level 3

As markets, even traditionally hardware-centric segments, become software and subscription-dominant, companies are getting caught in a vicious cycle:

• Unit prices begin to drop over time because of software’s high margins and new entrants’ willingness to buy market share with lower prices.

• To maintain even flat revenues, incumbent companies must therefore sell and deliver more and more units every quarter.

• That increases the need for sales, marketing, and service/success resources.

• The total cost to serve customers threatens to trend upward.

• This growth-versus-profit trade-off throws a wrench into the transformation engine. Incumbent executives hesitate to fund those higher costs at scale. As a result, both unit sales and the customer experience suffer.

• Entrants eat at the market share of the incumbents through lower customer costs and a simpler, better customer experience.

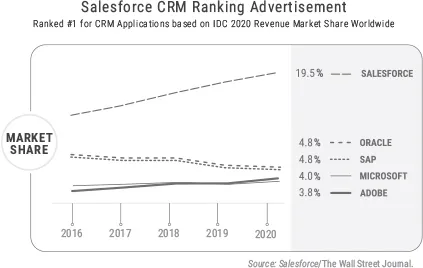

Have you ever seen the Salesforce advertisement shown in Figure 1.3 on the front page of The Wall Street Journal?

FIGURE 1.3 Salesforce CRM Ranking Advertisement

You could draw a similar picture for hundreds of specific B2B market segments as new entrants disrupt the old hierarchy. It’s hard to attribute this cycle to just one thing. Instead, we will settle for two:

• Born-in-the cloud companies struggle far less with the growth-versus-profit trade-off. For them and their investors, growth clearly trumps profits. If spending more money on serving customers means more growth, little, including losses, will hold them back.

• Large incumbents have legacy organizations and processes they are loath to transform or disrupt. But the new entrants aren’t held back by this weight.

So, what is Wave Two of DT? It’s about reimagining the customer’s path to value.

With very few exceptions, you s...