![]()

CHAPTER 1

WHY THIS FINANCIAL STUFF MATTERS

Are you ready?

This book is about money stuff—financial matters and financial decisions that will have a profound effect on your life. You can learn about this stuff and reap the considerable benefits . . . or skip this semester and suffer the consequences. You might not get these subjects in school, and they don’t usually make for locker-room or water-cooler conversation. But they affect critical decisions almost all of us face. Still, there are topics here many people hesitate to discuss—maybe because they don’t know the right questions to ask, or because they don’t realize they are already making choices with potentially big consequences.

If this applies to you, you are not alone. What we talk about here is based on our personal experiences as well as the real-life experiences of many others, people probably just like you. We can’t promise to rid you of worries about issues like debt, income, and financial obligations. We can help you avoid pitfalls and see opportunities. Start today. Why today? Because it’s expensive to wait, as you’ll see.

Consider a few facts about our collective financial life:

77% of Americans are stressed over finances.1

69% of Americans live paycheck-to-paycheck.2

54% of American households spend more than they earn each year.3

Student debt increased to an estimated 1.5 TRILLION dollars in 2020.4

The sticker price of a college education has increased 370% over the last thirty two years.5

Total credit card debt is approaching one TRILLION dollars.6

Much of our education system is designed to prepare us for careers in specific fields, and most institutions do an exemplary job of that. But few, if any, teach us “how to live” in relation to money. Take the plight of a physical therapist whom we interviewed for this book. After seven years of school to gain hard-earned undergraduate and doctorate degrees, her starting salary limited her ability to live on her own and repay her student loans. Anyone with a modest salary facing seven years’ worth of college debt would be similarly challenged. This problem should have been addressed seven years ago! The flaw in this case, or in the curriculum, was in the lack of preparation for life after school. But don’t panic. Your education might not have prepared you for life’s financial challenges, but it doesn’t prohibit you from making good, disciplined decisions. We can grumble that school hasn’t prepared us for financial life, or we can do something about it. Remember, hope, while important, is not a plan. A course of action is.

Begin by briefing yourself on the basics. Take control of your financial life today. Ignore the financial basics and risk paying the future consequences (you’ll only be able to blame yourself).

Consider this a book about how to avoid big problems. It starts with a short course on managing spending and earnings. Postponing discussion of a job, it digs first into debt, since most graduates, with or without an income now, left school with debt of one kind or another. In any case, this book isn’t a job guide. Although, after discussing debt we’ll address financial decisions about your job and your income, then go on to investing, housing, and finally, preparing for the long term, retirement.

The “missing semester” that follows is not a tough one, but it’s arguably the most important semester of all. We hope it helps to prepare you for what’s ahead.

![]()

CHAPTER 2

THE REST OF YOUR LIFE STARTS NOW

Are you prepared for “ life” after college?

Authors’ note: If you chose to bypass college in favor of trade school, military service, or any number of other

possibilities—please read on. The information that follows still applies.

Over 1.9 million students graduated with bachelor’s degrees from U.S. colleges in 2020, and for many of these now young professionals, the world just got narrower.7 This might seem counter-intuitive; and to an extent, it is. Most of your school life you heard that the world would be at your fingertips after college, and that you would be able to do what you want. This sounds nice, but the reality is that responsibility takes precedence—responsibility to provide for yourself and to fulfill past promises. College is over, and the next semester of your life begins now. Welcome to the real world! At the outset, let us offer a simple formula worth remembering and repeating to yourself, often.

Do not let your spending dictate your saving.

You’ll hear this again from us.

If you are like most graduates, and many non-graduates and not-yet-graduates, the elephant in the room at this point in your life is debt, probably in the form of student loans (and likely credit cards). If you are an “average” 2019 graduate, your student loans total over $29,2008 and your unpaid credit card balance totals $2,351.9 It is your responsibility to repay these debts; and the consequences of not paying are severe. That is one reason the world just got more narrow.

While spending more for your education does not necessarily translate to a better education, more opportunities, or even a higher salary, that’s irrelevant now. The cost of your education has become what businesses refer to as a sunk cost. It is money that has already been spent. You don’t need to be reminded that a college education is not free. Nor, for that matter, is it cheap.

When you choose to pursue a formal education, colleges agree to provide it in exchange for tuition that is often manageable only by borrowing money in the form of student loans. We will address this subject (and your credit cards) in greater detail later in this book. But for starters, in order to eliminate debt, you need income. And if, in addition to eliminating debt, you have the audacity to want food, shelter, clothing, and transportation, then you had better prepare accordingly.

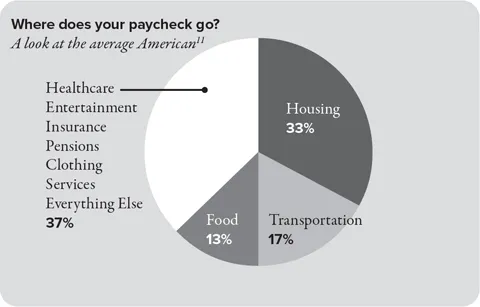

The average starting salary for 2019 college graduates was $51,000.10 Clearly this amount—bumped up by a few in high-start fields—is a considerable sum. Whether your salary is smaller, or larger, the question is “what do I do with it?” For an answer, it’s helpful to examine how the average American spends his or her income.

The following pie chart shows our spending habits as a nation.

Looking at these numbers, you can see that the necessities of food, transportation, and shelter, represent a substantial percentage of our spending. These three consume 63% of the average American’s after tax annual income! You can expect the same. But, neither taxes nor student loan payments are included in the pie chart. Remember, the average 2019 college graduate is responsible for the repayment of over $29,200 in school loans. Using a student loan interest rate of 6%, repayment of that average comes to $324 each month for the next ten years, or $3,890 a year!

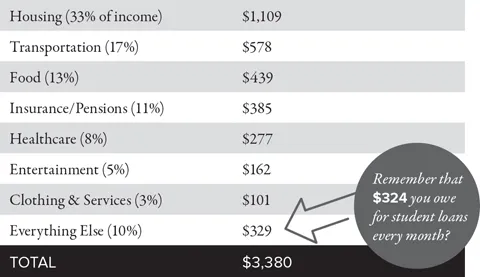

MONTHLY EXPENSES, AFTER TAXES

(based on averages)

For an estimate of your spending power in actual dollars when you include student loan responsibilities, look at the list of monthly expenses above. It applies the percentages from the pie chart you saw on the previous page to that average starting salary of $51,000 mentioned at the beginning of the chapter. That salary equates to a monthly take-home pay of $3,380 (after income taxes, Social Security, Medicare, etc.).12 So if your monthly income is $3,380, the list shows how much of that total will go to each expense, if you match the average. If your income is smaller, you’ll have to reduce each expense on your list proportionally.

The value of this exercise is three-fold. It gives a glimpse of the big picture— that is, the financial challenges we all face. More specifically, it points out potential problem areas that might be unique to you as an individual. Finally, it shows how little room there is for error.

Assuming you already have a job, there are a couple of ways to increase your actual end-of-the-month income. You can pursue the obvious and try to earn more money. Less evident, but very effective and perhaps quicker, is to spend less. In combination, the two are powerful.

MANAGE YOUR EXPENSES

For example, if you are paying more than “average” for a house or apartment (more than 33% of your income), you are likely having to make sacrifices elsewhere. Housing costs can be reduced substantially by living with friends or family and sharing the cost. The same exercise also helps you to identify other areas for potential savings. In the lis...