- 224 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Islamic Finance: A Practical Introduction

About this book

Islamic finance and banking is governed by the tenets of Islam and is based upon the principles of the Shariah, a code of conduct for Muslims to adhere to when managing their lives, including their finances. This slim volume breaks down this code and teaches readers how it is practically applied in business, personal finances, and the global economy.

Tasnim Nazeer is a creative, experienced writer who has written for some of the UK's biggest publications and brands, including Al Jazeera, the BBC, The Huffington Post, and CNN.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

CHAPTER 1

Key Principles Governing Islamic Finance

Islamic finance is based upon adherence to the principles of the Shariah, which determines the codes of conduct for Muslims to adhere to in order to follow an Islamic way of life. Principles of Shariah law affect the economic, political and social conduct pertaining to Muslims and helps followers establish the right balance in managing all aspects of their life in a responsible and well informed manner. Some of the core underlying spiritual values of Islamic economics include the acknowledgement that Allah is the giver and owner of all wealth. Muslims believe that they have been entrusted with the wealth they have acquired and understand that they are fully responsible for the way they use their earnings and investments, which should be utilized according to that expectation of trust (amānah).

One of the significant differences between conventional finance and Islamic finance is the fact that Islamic finance is based upon a no-interest policy and interest is strictly prohibited in all financial deals, transactions or investments. Ribā (interest) is prohibited because it can result in societal injustice that would go against the tenets of Islam. In a ribā-based transaction, the owner of the wealth gets a return without making any effort, and the borrower carries all the risk, which means that the principle of risk sharing is neglected and therefore would not be accepted as a Shariah compliant method of managing finance.

The principles underlying Islamic behaviour are not only ethical but are also spiritually based. A Muslim’s economic activities and the way that an individual manages their wealth should contain a balance with the spiritual aspects of their life. The fundamental principles of Islamic finance are based upon the Shariah. If an individual manages their finances in adherence to the Shariah it is considered to be an act of worship, and this shows the importance and influence that Islam plays in all aspects of life, including managing finances.

In Islamic finance, any economic transaction should take place within justified and responsible economic expectations by essentializing maqāṣid al-Shariah (objectives of Islamic law). The principles of Islam outline the best ways to conduct economic activities and promote the concept of financial responsibility and sustainability when dealing with other people. Islam enables individuals to deal with their finances in a free-market environment and economy where the supply and demand are decided in the market itself. However, the function of the market is imposed by principles of Shariah articulated within the concept of hisbah (the market regulations and supervisions).

The main purpose for imposing the laws and ethics for fulfilling maqāṣid al-Shariah is in order to promote moral and social justice when dealing with finance. This means that the wealth earned by any individual is not profited only by a few investors or businesses whilst leaving others to suffer. According to Islamic law, risk should be carried equally between the two and this provides a highly ethical and socially responsible method of managing finance.

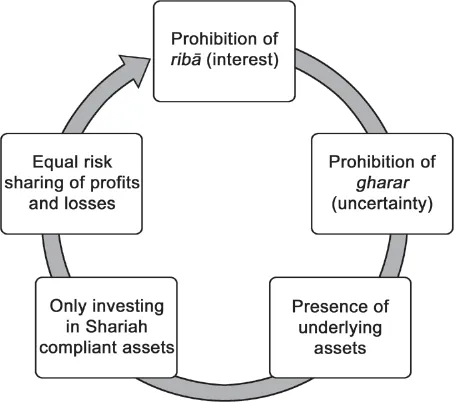

The fundamental principles of Islamic finance will be discussed individually in this chapter in detail. There are a few core principles that are compulsory to be applied in Islamic finance and banking and these are the sharing of profit, loss and risks, the prohibition of ribā, prohibition of uncertainty in transactions, the existence of an underlying asset and adherence to purely Shariah compliant investments and not those that deal with immoral industries such as pork, alcohol, pornography, gambling or any other prohibited investment.

The prohibition of interest is significant as an underlying principle, which provides a philosophy – or model – which helps to fulfil the other principles that govern Islamic finance in order to establish the wider objectives in the area of business. The fundamental principles of Islamic finance and banking also involve the acknowledgement of developmental and social economic goals as essentialized by Islamic developmentalism (‘imrān). The profit, loss and risk sharing element enables finance to be conducted justly and is believed to hold more economic benefits than conventional methods of profit sharing. Ribā is often seen as unfair gain or exploitation of money and one that is often used in a capitalist system.

Transactions that are reliant upon a matter of chance and leave room for speculation rather than a joint effort from both investors to produce a return, are considered invalid under the Shariah. The principles of Shariah do not extend to the prohibition of commercial speculation or risk taking, as transactions involving the use of options must be carefully checked for legitimacy as to whether the transaction is adherent to the Shariah. The presence of ambiguity in any transaction, also known as gharar, is not allowed when making any investment or financial deal. This complies with the principle that all transactions should be transparent and the various parties involved must present a full disclosure. Any type of transaction that fails to have full trust and transparency from both parties becomes invalid under Shariah law.

The principle of the prohibition of investing in impermissible industries such as pork, alcohol, pornography, gambling, conventional finance or any other industry which goes against the tenets of Islam is highly significant in Islamic finance. Islamic finance promotes an ethical system that aims to facilitate an honourable living based on financing that aims to benefit the society at large. Conventional financing does not take into account whether the investments are ethical or the impact of certain investments on society, such as investing in products that could potentially cause harm to the community. Islamic finance, however, provides a system whereby the impact of how money is spent is carefully considered from the onset. It offers an individual the opportunity to create and use their wealth responsibly, while following a system not created by human rulers but by divine guidance.

The principles of Islamic finance form the basis for all investments, transactions, products and services and provide a benchmark for Islamic financial institutions to turn to in conducting their business. All Islamic financial institutions have to abide by the laws outlined in the Islamic commercial law in conducting their businesses and product offerings. The main difference between conventional methods of financing and Islamic finance is based upon the fact that Islamic finance offers individuals a system and benchmark of ethical principles to refer to when conducting their finances. These principles are not merely a set of rules but are an important part of a Muslim’s adherence to their faith, and hold both spiritual significance as well as an economically ethical approach to handling finance. All Islamic banks and financial institutions that offer Islamic-based financial products have to refer to the principles of the Shariah and are authenticated by the authority of Shariah boards or scholars. Shariah supervisory boards are often used to determine whether a potential Islamic financial product is deemed as legitimately Shariah compliant or not. The basis for the fatwa (opinion) given to Islamic financial institutions as to whether a product is compliant or not, is based upon the adherence to the principles of Islamic finance as outlined in Figure 1.1.

Figure 1.1: A Review of the Key Principles of Islamic Finance

1.1 Ribā

Ribā is the Arabic term used in the Qur’an that means interest or usury, and it is strictly prohibited in adherence to Shariah compliant finance. The term ribā also refers to the increase or profit made by a lender who gains excess profits with no effort. This is because the role of ribā is to be a loan for the borrower, who will have to pay compensation or more profit to the lender than the actual amount that he or she initially borrowed. Islam considers interest to be unjust and immoral and the avoidance of interest is reiterated in the Holy Qur’an in many verses such as:

O you who believe! Fear Allah, and give up what remains of your demand for usury, if ye are indeed believers.

(al-Baqarah 2: 278)

(al-Baqarah 2: 278)

There are various verses in the Qur’an that outline the importance of dealing justly when managing finances and strictly forbids the use of interest in any transaction or dealing. The predetermined price of capital which a lender states in an interest-based transaction is clearly prohibited, as the principle amount borrowed has to be protected under the laws of the Shariah and any excess profits made will be deemed as exploitative and unjust. In accordance with Islamic commercial law, any form of ribā-based transaction is a major sin for a Muslim and gaining unjustly through trade, business or investments, which gain excess profit with no effort, is considered exploiting the borrower.

There are two main types of ribā which are discussed by Islamic jurists: an increase in capital without any services provided and speculation, which is prohibited by the Qur’an, and commodity exchanges in unequal quantities, which are also prohibited in accordance with the ethical principles outlined in adherence to the Holy Qur’an. As the Qur’an is an undisputed light of guidance for all Muslims, all scholars and Muslim authorities agree unanimously that ribā is explicitly forbidden and any transaction or investment involving usurious activities would not be considered to be adhering to the Qur’an or Sunnah. According to the principles of Islamic commercial law, ribā is a form of oppression and a means to unjustly take an increase of money from others with no effort. Ribā has been deemed as exploiting a borrower’s needs and circumstances with the lender unjustly progressing in profit. Islam, therefore, forbids a ribā-based system altogether and promotes the giving of charity as a highly ethical and beneficial alternative.

One of the main differences between Islamic finance and its conventional counterpart is that it provides a highly ethical approach to financing which deals with individuals justly and provides them with an alternative to being exploited through paying in excess. The global economic crisis left many people heavily in debt, including conventional banks, entrepreneurs and investors who had used the capitalist interest-based system and were unable to pay back the excess amount of interest that they had on their loans. Islamic finance protects the payment of an individual and enables them to benefit from not having to pay a surplus charge when borrowing money from an individual or institution.

There are many challenges that conventional financial institutions and banks have when dealing with ribā and there are many benefits to the ethical non-interest based financing that Islamic finance promotes and provides. Ribā is the income earned by the borrowed financial capital despite there being no effort from the lender, so the risk is carried completely by the borrower of the loan. The capital owner is considered as exploiting the borrower because any excess profit is gained through undeserved income achieved without producing or offering anything and without contributing any value to the revenue. The mechanism of a ribā-based system that conventional banks and financial institutions use has prevented the distribution of economic activities between the lender and borrower and subsequently worsens the distribution of income. The capital owner gains a certain and fixed percentage of earnings in any case, regardless of the gains of a considerable higher capital, which can leave the borrower heavily in debt and is considered to be an oppressive form of financing.

The main rationale for the prohibition of ribā, in accordance to the principles of Shariah, is that it is oppression involving exploitation of an excess capital gained by the lender with all risks being left on the borrower. The explicit exclusion of ribā ensures that Islamic finance is a justified and ethical way of managing finances and gaining its due share when dealing with transactions, projects or investments.

1.2 Profit and Risk Sharing

Profit and risk sharing of any investment or transaction holds great significance in Islamic finance. All profits and risks are to be shared equally among the parties involved so that one side does not carry the burden of a higher risk than the other. This provides an ethical and just method of managing the risks involved when participating in an investment, project or transaction. The importance of profit and risk sharing in Islamic finance and banking cannot be understated.

Profit-and-loss sharing (PLS) is a form of a partnership between two parties or more and is believed to hold more economic benefits than conventional, collateral-based lending, which favours only well established businesses. The principle of sharing profits and losses equally acknowledges the fact that profits cannot always be assured. In this case, an Islamic financial institution must ensure that they carry part of the risk of a given transaction. There should be no assumption of a guarantee of a fixed return when dealing with a profit-and-loss sharing transaction, which means that both depositors and Islamic financial institutions cannot invest under the impression that they will gain a guaranteed return. Seeking protection or a method of security is allowed in a PLS contract in order to safeguard against any breach of the contract by either party.

Raising funds through PLS according to the principles of Shariah has a number of benefits over conventional interest linked borrowing. Both entrepreneurs and society can reap the advantages of risk sharing as an alternative to conventional loans, which are considered to be far more risky to issuers than raising funds by way of risk sharing securities. Issuers of risk sharing securities are not required to provide investors with predetermined profits or capital guarantees. This is one of the major advantages of financing in accordance to the principles of the Shariah. The principle of PLS can also enhance the stability of financial institutions, as the sharing of risks can significantly reduce the risk facing any single party so one side does not become overburdened with debt. Utilizing PLS as part of Shariah compliant financing can also be more conducive to economic growth than financing by accumulating debt or being responsible for owing money to a financial institution. Since funds raised through risk sharing are not returned to investors, they continue to remain in the pool of income.

Another advantage of risk sharing, according to the principles of Islamic finance, is it helps to distribute wealth and profits more evenly, as more people can share the profits of a successful business or investment. A wider and transparent distribution of wealth can arouse many benefits for all parties involved. There are two main types of PLS contracts that are used in Islamic finance, such as mushārakah and muḍārabah contracts, which can be utilized for short, medium and long-term financing agreements for a Shari...

Table of contents

- Cover

- Title Page

- Copyright

- Contents

- Introduction

- 1. Key Principles Governing Islamic Finance

- 2. Islamic Banking

- 3. Financial Instruments

- 4. Islamic Financial Contracts

- 5. Islamic Wealth Management

- 6. Islamic Investments

- 7. Ṣukūk

- 8. Takāful

- 9. Future Developments in Islamic Finance

- Further Reading

- Glossary

- Bibliography

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Islamic Finance: A Practical Introduction by Tasnim Nazeer in PDF and/or ePUB format, as well as other popular books in Business & Islamic Banking & Finance. We have over one million books available in our catalogue for you to explore.