- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The term 'housing crisis' has recently been associated with rising foreclosure rates and tottering financial institutions, particularly in the US and Europe. However, in many emerging countries, the housing crisis is about urban poverty, unplanned settlements, overcrowded slums and homelessness.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Housing Finance Systems by S. Phang in PDF and/or ePUB format, as well as other popular books in Economics & Business General. We have over one million books available in our catalogue for you to explore.

Information

1

Background and Overview

Cities have historically served as centers of religion, politics, commerce, education and economic growth. They are the locations where agglomerations of activities facilitate the unleashing of energies of creativity, innovation and entrepreneurship. Cities offer the hope of education and learning, employment, social relationships and stimulating leisure activities.1 Dense social and business networks and close interactions lead to unforeseen opportunities that transform individual lives and the future of start-ups.

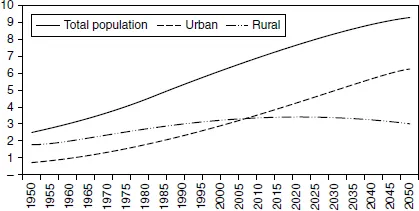

In 2010, the world entered a new urban age. For the first time in the history of mankind, more than 50 per cent of the world’s then population of 6.9 billion people lived in urban areas (see Figure 1.1).2 The United Nations has projected that more than two-thirds of the 9.3 billion people in the world in 2050 will live in cities. The expected increase of 2.7 billion urban dwellers over the next four decades, averaging over 69 million per year, poses unprecedented challenges as well as opportunities for governments, urban planners and businesses in the provision of infrastructure and real estate and in meeting the demand for goods and services of the growing urban class.

Urban population growth is forecast to be highest in the emerging economies of Asia and Africa. In the three decades from 1975 to 2005, China has overtaken India as the more urbanized giant, with this trend expected to continue into the future. In 1975, only 17.4 per cent of China’s population lived in cities. In 2010, the figure had risen to 49.2 per cent, and it is projected to increase to 61.0 per cent by 2020. In India, the corresponding figures are 21.3, 30.9 and 34.8 per cent in 1975, 2010 and 2020, respectively. In absolute numbers, the urban population of China is forecast to increase from 660 million in 2010 to 846 million in 2020, while India’s urban population is expected to increase from 379 million to 483 million over the same decade.

Figure 1.1 Projected growth in world’s urban population (in billions)

Source: Chart data from United Nations, Department of Economic and Social Affairs, Population Division (2012). World Urbanization Prospects: The 2011 Revision. CD-ROM Edition.

Mass urbanization will require investments in transportation, power, water and industrial and residential infrastructure on an unprecedented scale. This trend presents countless opportunities for investments by both governments and corporations, as well as opportunities to shape the growth, development and quality of life in cities.

However, this rapid urbanization also presents tremendous challenges for the provision of infrastructure, adequate housing, public health, social services and safety. The responsibility for mobilizing the trillions of dollars of finance required for urban infrastructure investment lies predominantly with the public sector.3 The adequate financing of cities is a crucial aspect of their sustainable growth and development. While an extremely important component of what makes for a good quality of life in cities, housing is nevertheless very much a private good; hence the norms and expectations for the government’s involvement in its provision and financing vary greatly.

With the equivalent of 69 million people moving from rural villages to cities every year, the majority today face the problems of housing affordability, the daily grind of living in slums and squatter settlements, and/or the harsh reality of homelessness. Meeting the housing aspirations of the middle class and providing shelter for the urban poor present enormous social, political and economic development challenges as well as opportunities. On the housing finance front, which is the focus of this book, the housing welfare of urban dwellers provides the imperative for getting housing finance policies and systems right.

Challenges for housing policymakers

Accessibility to adequate and affordable housing is extremely important for the happiness, productivity and well-being of all segments of society. The links among the rental sector, the asset sector, the housing production sector and the financial sector, as well as distinct segments of the housing market, are complex and important to understand. A list of broad questions (with answers that differ from city to city) will include the following: Does a housing shortage exist? What is the magnitude of the squatter slum problem? Is housing affordable? Does homeownership matter? How responsive is housing supply to changes in demand?

The fact that governments intervene (in some cases massively) in housing production, transaction and service delivery processes in multifaceted ways, ways that differ from country to country, raises policy questions on the appropriate role of government in the housing market, again with answers that vary greatly across the world. What is the range of policy options in the choice of housing finance systems? How does housing finance impact housing debt, cycles and housing asset bubbles? What are the linkages between housing debt and financial stability? What are the features of a good and sustainable housing finance system?

Current problems with housing finance

The global financial crisis of 2008 that had its roots in the US housing crisis has radically changed the answers both to the above questions and to the world’s understanding of the linkages between housing finance and the financial system. In the aftermath of the crisis, numerous unanswered questions remain. How well we learn from the lessons of past failures will determine the sustainable development of our cities and the housing welfare of future urban dwellers.

For the USA and Europe, the term “housing crisis” has, in recent times, been associated with rising foreclosure rates, bankrupt or tottering financial institutions and financial market instability. In many developing countries, on the other hand, the housing crisis is about high levels of urban poverty, unplanned settlements, overcrowded slums and homelessness. These faces of the housing crisis require solutions for the housing finance mechanisms and systems that lie at the root of each.

It was not too long ago that housing finance was a domestic (if not altogether local) lending activity, with the limited literature on housing finance tending to be country-specific. However, the extent of globalization of housing finance through financial markets hit home in a major way in 2008 and in the Eurozone crisis that followed. The repercussions as a consequence of getting housing finance policies wrong have global ramifications that are now widely recognized. While the attention of the best economic minds in the developed world has been engaged with redesigning the architecture of the global financial system, the governments of many developing countries continue to struggle with decisions on the selection and design of appropriate policy instruments to facilitate a long-term flow of much needed capital into the housing sector. Policy choices need to be carefully considered and decisions carefully made and effected with the historical knowledge of successes, failures and risks.

Overview of the book

Given the pivotal importance of housing finance, as explained above, the present book attempts to tackle the various (and related) issues in a systematic and integrated manner, bearing in mind that the relevant differences in various countries simultaneously necessitate a comparative perspective as well. Part I of the book discusses why a well-designed and well-functioning housing finance system matters for societal welfare. Part II provides a review of the housing finance policy instruments that have been commonly used in various countries on both the supply and demand sides. The special challenges posed by the cyclical nature of housing markets and the proclivity for housing booms to develop into bubbles are discussed in Part III. Part IV considers the various sources of risk for housing finance systems based on case studies from the experiences of various countries. Part V, drawing on the lessons learned from the previous parts, concludes with suggestions on smart practices for housing finance systems.

Part I: Why Housing Finance Policy Matters

A number of international human rights instruments and organizations, most notably the United Nations Human Settlements Programme,4 as well as most societies, regard the right to adequate housing as a basic human right. The availability of long-term finance for the housing sector is critical to ensuring improvements to the quantity and quality of the housing stock over time and in meeting the goal of access to adequate housing for all. Chapter 2 begins with the topic of affordable housing – how affordability is often defined and measured – and presents estimates for housing affordability for different countries and cities. Chapter 3 examines the sources of market failures in the housing sector, failures frequently used to justify government intervention in this sector.

Part II: Review of Policy Instruments

The housing market is subjected to more policy initiatives than any other consumer good. The main objective of Part II is to illustrate the categories of available policy instruments for housing finance and how they operate on the supply and demand sides of the housing sector. Chapter 4 deals with the range of taxes and subsidies used. Regulation of the housing market and of housing finance is discussed in Chapter 5 and 6, respectively, and housing finance institutions established by governments in Chapter 7. The government may also enter into collaborative agreements with the private sector with the objective of attracting private financing and expertise under Public–Private Partnerships (Chapter 8).

Part III: Housing Cycles and Bubbles

That real estate markets are prone to cyclical behavior is a phenomenon that has been recognized for centuries. Chapter 9 provides an overview of the features of the housing market which explains its proclivity to booms and busts. Market volatility and cycles naturally attract speculators, especially if the market concerned is supported by ready access to borrowing. Overinvestment is thus accentuated and housing asset price bubbles emerge. The hotly debated issue of whether (and how) governments should intervene to prevent the development of bubbles is considered in Chapter 10.

Part IV: Government Failures

While governments may have the best of intentions in putting in place housing finance policies to ensure access to housing and/or address the problems of market failures, there are, unfortunately, numerous examples of policy and regulatory failure in the housing finance sector. The fallout from such failures ranges from the manageable (from a fiscal standpoint) to global ramifications with losses in trillions of dollars – as seen in the global financial crisis of 2008, which had its roots in failures within the US housing finance market. Part IV of the book presents examples, from both developed and emerging countries, of government failure in the area of housing. Chapter 11 focuses on the risks associated with housing policies, and Chapter 12 discusses regulatory failure and regulatory capture.

Part V: Complexity and Risks

A well-functioning housing finance system can play an important role in helping to fulfill multiple objectives – promoting social and political stability, enhancing housing market performance, contributing to financial sector stability and development. However, the complex system within which it is embedded is also vulnerable to the risks from multiple sources of market, political and regulatory failures. Part V of the book, comprising Chapter 13, draws from the lessons learned to provide a list of smart practices for building more resilient housing finance systems.

Part I

Why Housing Finance Systems Matter

The first part of this book, comprising Chapter 2 and 3, is dedicated to explaining why housing finance policy matters for the quality of life in cities and for the sustainable development of the cities themselves. The housing sector encompasses numerous stakeholders who view the sector through differing lenses. Urban planners and architects focus on spatial parameters, design and aesthetics. Environmental groups concentrate on environmentally friendly practices in housing and urban development. Developers, bankers, speculators, investors and other businesses interests, on the other hand, are on a constant lookout for profitable opportunities. Local governments and politicians, regulators and providers of social services have their distinct agendas. Each of these viewpoints is vital to our collective understanding as to why housing finance systems matter.

These two chapters will concentrate on conveying how economists view the issues of housing affordability, tenure choice and market failures. Housing standards, affordability and homeownership rates vary widely across countries as well as regionally within a country. Chapter 2 reviews the definition of hou...

Table of contents

- Cover

- Title

- 1 Background and Overview

- Part I Why Housing Finance Systems Matter

- Part II Review of Housing Policy Instruments

- Part III Housing Bubbles, Crashes and Policy

- Part IV Government Failures

- Part V Complexity and Risks

- Notes

- Index