eBook - ePub

Crisis, Risk and Stability in Financial Markets

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Crisis, Risk and Stability in Financial Markets

About this book

This book presents an in-depth appreciation of key topics related to the behaviour of financial institutions in the crisis and stresses areas of major research interest. It covers a selection of papers specialising ranging from the analysis of bank and stock market performance in the crisis, to other areas such as microinsurance and social lending.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Crisis, Risk and Stability in Financial Markets by Kenneth A. Loparo, Kenneth A. Loparo, Kenneth A. Loparo,Kenneth A. Loparo,Juan Fernández de Guevara Radoselovics,José Pastor Monsálvez, Juan Fernández de Guevara Radoselovics, José Pastor Monsálvez in PDF and/or ePUB format, as well as other popular books in Economics & Accounting. We have over one million books available in our catalogue for you to explore.

Information

1

Financial Stability and Economic Growth

Santiago Carbó-Valverde and Luis Pedauga Sánchez

1.1 Introduction

The relationship between the development of a country’s financial sector and its rate of economic growth has been studied in depth. However, few studies have tried to explain how the link between financial development and economic growth works during periods of financial instability. Bauducco, Buliř, and Čihák (2008), Hakkio and Keeton (2009) and Carlson, et al. (2009) have recently studied the effects of financial stress on economy performance. They have pointed out that there are three different channels through which financial instability can affect the relationship between finance development and economic growth.

The first channel is an increase in uncertainty about the fundamental value of assets and the behaviour of investors during periods of financial instability. Since these two sources of uncertainty are frequently followed by increases in the volatility of asset prices, this makes firms more careful about investment decisions until the uncertainty has disappeared. Additionally, households tend to cut back their spending in times of financial instability, since the uncertainty affects the expected value of their future wealth. As a consequence the reactions of these two agents produce a fall in economic output.

The second way in which financial instability can affect economic activity is by deteriorating borrowing conditions due to tightened credit standards (Lown et al., 2000). When financial institutions raise their minimum credit standards it becomes harder for borrowers to get funding, with a consequent negative effect on economic growth.

Another channel through which financial instability can lead to a slowing of economic growth is through an increase in cost for firms and households of financing spending. As Hakkio and Keeton (2009) have noted, instability increases interest rates on business and consumer debt in the capital markets, making it more expensive for firms to raise funds by issuing new equity. Such an increase in the cost of finance can cause firms and households to cut back on their spending and, as shown above, this has a negative effect on economic growth.

Overall, the relationship between the size of a country’s financial sector and its rate of economic growth has been studied in depth, but the empirical evidence on the finance-growth nexus in periods of financial instability is much more limited and is not conclusive. Most of the previous approaches assume that financial development has a linear correlation with growth; however, several theoretical studies suggest that the dynamics of economic growth and the role of financial institutions as a determinant of this growth follow a nonlinear pattern (Trew, 2008 and von Peter, 2009). In this sense, nonlinearities may well be the reason for the failure to empirically and generally validate specific aspects of the finance-growth nexus such as the relationship between the size of a financial sector and its growth.

The aim of this chapter is to overcome these problems by considering how nonlinear and intertemporal relationships between the main variables may help explain how the finance-growth nexus works during periods of financial instability. To achieve this goal, we consider a threshold model specification extended to a multivariate framework, known as Multivariate Threshold Autoregressive model (MVTAR), developed by Tsay (1998).

The main contribution of this chapter is to show the validity of a nonlinear approach to test how financial instability affects the relationship between financial development and economic growth. Section 2 summarizes some theoretical contributions and previous empirical evidence. Section 3 describes the data. Section 4 introduces the methodology and explains the multivariate threshold model with special emphasis on the modelling of nonlinear effects of financial instability. Section 5 refers to the estimation procedure and presents the main results. The chapter ends in Section 6 with a brief summary of conclusions and a discussion of policy implications.

1.2 Literature review

The theoretical treatment on how financial intermediation could promote economic growth has been carried out via studies from many specific perspectives while some studies have provided a more general framework which many other papers have relied upon (see, for example, Sims, 1972, Gupta, 1984, Greenwood and Jovanovic, 1990, Bencivenga et al., 1995 and Trew, 2008). Only some recent theoretical studies, such as Bauducco, Buliř, and Čihák (2008) and von Peter (2009), have paid attention to the relationship between financial instability and economic growth. Greenwood and Jovanovic (1990) develop a model that endogenously gives a role to financial intermediation on economic growth and explains the mechanisms through which financial intermediaries can invest more productively than can individuals, since they are better able to identify investment opportunities that promote economic growth. Similarly, Trew (2008) developed a conservative finance and growth model with microeconomic friction in entrepreneurship and a role for credit constraints. In this it is shown that while an efficiency–growth link will always exist, the efficiency–depth–growth relationship may not. This last result has important implications for the connection between the theory and the empirics of finance and growth, since, as we have pointed out above, this relationship is not always supported empirically, especially in countries that have suffered repeated episodes of financial instability.

One way to try to deal with the impact of financial instability on growth is to assume a nonlinear relationship between financial development and economic growth. In this sense, Acemoglu and Zilibotti (1997) offer a theoretical framework that links the degree of market incompleteness to capital accumulation and growth. Similarly, Deidda and Fattouh (2002) offer a theoretical model which establishes a nonlinear relationship between financial development and economic growth, supporting their hypotheses by applying a threshold regression model.

Analyzing the connection between financial instability and economic activity, Bauducco, Bulř, and Čihák (2008) developed a dynamic stochastic general equilibrium model including a financial system. Their model simulates the central bank response to changes in the probability of default in the banking system, and their effects on economic growth. Although their model is linear, they propose to include an arbitrary threshold used by the central bank to distinguish periods of financial instability, and in this way consider that the central bank response to changes in the probability of default is likely to be nonlinear. In a similar way, von Peter (2009) develops an overlapping-generations model that links banking with asset prices to provide a characterization of how financial instability can affect economic activity. The model shows how financial stability depends on bank behaviour in response to asset prices and bank losses. Their model specification results are relevant since they propose that the optimal conduct of monetary policy will change asymmetrically depending on a financial instability threshold, after which the credit contraction turns unstable and propels the system toward the collapse of the credit.

From a strictly conceptual perspective, the fact that nonlinear behaviour is more suitable when evaluating the hypothesis that financial development leads economic growth has also been shown in papers such as Beaudry and Koop (1993), Teräsvirta (1996), Gatti et al. (1998) and Öcal (2001); these have found that macroeconomic variables such as, for example, real output, investment and other financial variables, do not behave in a linear way. This is simply because the impact of business cycle and abrupt shocks may produce a nonlinear behaviour in most macroeconomic variables – that is, the economy behaves differently in recession than in expansion.

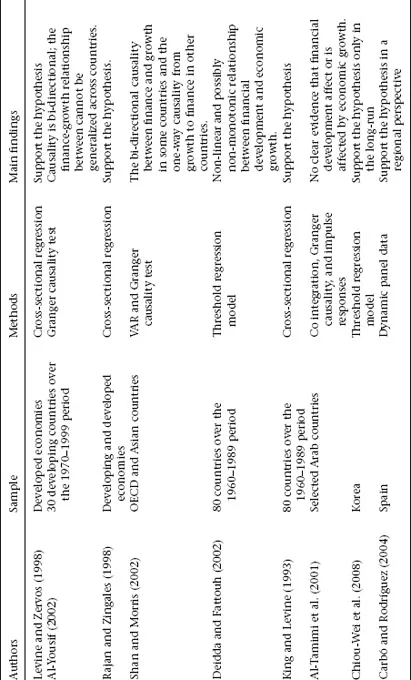

A survey of recent empirical literature studying the relationship between the financial development of a country and its rate of economic growth has been carried out using two common econometric approaches.1 Adopting a cross-sectional approach, King and Levine (1993), Levine (1997 and 1998), Levine and Zervos (1998) and Rajan and Zingales (1998), among others, have employed stock market liquidity and banking sector development as indicators that predict economic growth. However, as Ahmed and Ansari (1998) has pointed out, these studies have not been able to reveal the dynamic relationships in the finance-growth nexus. In this sense, using time-series modelling in studies such as Demetriades and Hussein (1996), Demetriades and Luintel (1996), Arestis and Demetriades (1997) and Shan (2005), it has been shown that a well developed financial system may stimulate economic growth in many different ways when nonlinear relationships are considered. Recently, Chiou-Wei et al. (2008) investigated the influences of financial development on economic growth for South Korea using a nonlinear smooth transition error-correction technique, and found that the effect of this relationship may not be positive and significant in the short term. Finally, using a dynamic causality technique and a panel data approach at a regional level for Spain, Carbó and Rodríguez (2004) found that economic growth predicts financial deepening.

1.3 Empirical model

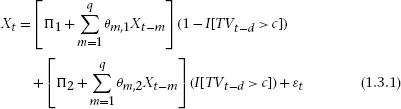

This study uses time-series data to estimate nonlinear dynamics between financial development and economic growth. To achieve this, the econometric approach estimates a vector autoregression model that allows a threshold effect (MVTAR). The main purpose of this specification is to test the hypothesis that the influences of financial development on economic growth and the way it behaves asymmetrically depend on the state of the economy, meaning that the link between financial development and growth may significantly change its economic impact and event in sign during periods of financial instability. As such, the MVTAR can be viewed as a VAR model that assumes different regimes, based on the threshold variable TVt−d, established as:

Table 1.1 Selected studies on the growth responsiveness finance hypothesis

where Xt = (∂fin, ∂gdp, ∂inv, ∂lab, ∂open) is the vector of macroeconomic variables (to be described in Section 4.1), θm is the vector of coefficients, and εt is the vector that contains linear combinations of random disturbances from each of the endogenous variables considered. Finally, I[.] is an ...

Table of contents

- Cover

- Title page

- Copyright

- Contents

- List of Illustrations

- Notes on Contributors

- Introduction

- 1 Financial Stability and Economic Growth

- 2 Financial Crisis and EU Banks’ Performance

- 3 Diversification, Diversity and Systemic Risk in European Banking

- 4 Basel III, Pillar 2: The Role of Banks’ Internal Control Systems

- 5 Shadow Banking and Systemic Risk: In Search of Regulatory Solutions

- 6 Social Lending in Europe: Structures, Regulation and Pricing Models

- 7 Banks’ Ratings, the Financial Crisis and Size of Entities

- 8 Stock Exchange Mergers in the Aftermath of the Crisis: New Insights

- 9 Sustainability and Financial Inclusion in Microinsurance

- Index