- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The offshore currency market is a foundation of offshore bond market, helping well-established corporations in global financing. Following the global financial tsunami in 2008 and European debt crisis in 2009-2011, this book aims to document the latest issues, challenges, trends and thoughts relating to offshore currency markets in Asia.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Investing in Asian Offshore Currency Markets by M. Wong, W. Chan, M. Wong,W. Chan in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

Part I

Issues in Offshore Currency and Bond Markets

1

Determinants of the Distribution of Eurodollar Deposits in Offshore Financial Centres

David W. Y. Leung and Jim Wong

Introduction

Hong Kong has rapidly developed as the premier offshore RMB business centre in recent years. In particular, a turning point occurred in 2010 when a series of path-breaking measures were introduced. These measures include the expansion of the RMB trade settlement pilot scheme in June 2010 and the amended Clearing Agreement in July 2010.1 As an indicator of the rapid development, the RMB deposits in the Hong Kong banking system reached RMB 588.5 billion by the end of 2011, an 86.9 per cent increase over the end of the preceding year. This pool of RMB liquidity provides the basis for a wide range of RMB products and services in the offshore RMB market in Hong Kong, which is also known as the Chinese yuan (CNH) market.

Supportive policy measures are definitely pivotal to Hong Kong’s RMB business, notably during the early stage of market development. First, these measures give Hong Kong a first-mover advantage over other potential competitors.2 Second, these measures help reduce legal and regulatory uncertainties.3

However, the sustained growth and development of an OFC in the longer term cannot solely depend on government support. The success of any OFC hinges ultimately on its capability to provide essential economic functions: it allows a separation of currency from country risks, and offers a more convenient location of service to some investors and fund-raisers for considerations of legal and regulatory structures, language and time zone.4 The predominant position of Hong Kong as an offshore RMB centre therefore cannot be taken for granted, and for policymakers as well as market participants understanding the determinants of Hong Kong’s capability to provide such essential economic functions is important.

Since Hong Kong’s RMB banking business is still in its early stage of development, available data are not sufficient for conducting any in-depth quantitative analysis for the determinants of a successful offshore RMB centre. In this essay, we therefore draw insights from the development of the Eurodollar market. Admittedly, there are crucial differences between the two cases, notably in terms of regulatory regimes and the role of the US dollar as a major vehicle currency for international trade and financial transactions. Nonetheless, the continuing internationalization of RMB and liberalization of the Mainland’s capital-account transactions suggest that these differences are likely to narrow in the coming years. The experiences of the Eurodollar market can therefore shed light on the issue and provide food for thought for further studies.

Against the above backdrop, we hypothesize two types of determinants for decisions of placing foreign currency deposits in an OFC. The first type is location-specific characteristics of the OFC itself. In particular, the time-zone factor of the OFC relative to the onshore market may be a significant determinant. Other relevant characteristics of the OFC include its legal and regulatory quality, turnover of foreign-exchange markets and portfolio inflows. The second type is the economic integration between the OFC and the host country where the currency is issued.

Overview of offshore foreign currency deposits

This section gives an overview of offshore US dollar deposits, including their pattern and distribution by the various offshore centres. However, as the data of US dollar deposits of individual countries are classified as “restricted” by the data source (i.e. the Bank for International Settlements), we use the figures of all foreign-currency deposits placed by foreign entities in individual countries as a reference. These data reflect to a large extent the pattern of offshore US dollar deposits, since the latter has been the dominant deposits in all offshore foreign-currency deposits, accounting for more than half (55.7 per cent) of the total at the end of 2010. It should, nevertheless, be pointed out that in the subsequent section of quantitative analysis, data of offshore US dollar deposits of individual countries are used in conducting the empirical estimation.

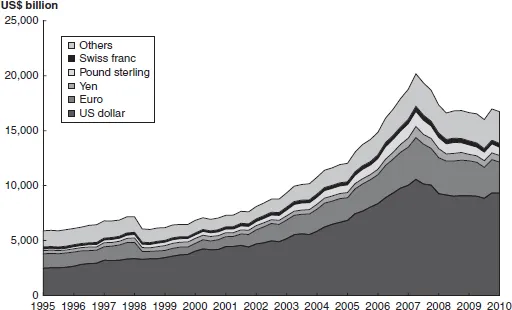

According to the Bank for International Settlements (BIS) locational banking statistics, offshore foreign-currency deposits totalled US$16.7 trillion at the end of 2010, registering sustained growth at a compound annual rate of 9.3 per cent during 2000–2010 (Figure 1.1). However, the outbreak of the global financial crisis had an impact on the growth momentum of these deposits, peaking at US$20.2 trillion in March 2008 but moderating subsequently.

Figure 1.1 Global offshore deposits denominated in foreign currencies

Note: Prior to the launch of the euro in 1999, euro-denominated deposits refer to the total amount of deposits denominated in former currencies of eurozone members.

Source: BIS.

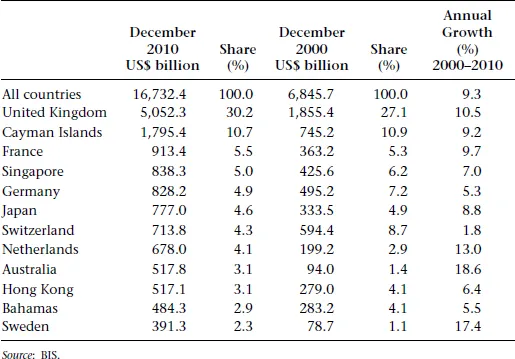

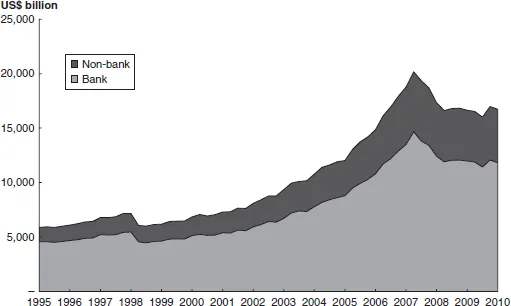

These offshore foreign-currency deposits have clustered in major financial centres. The UK alone accounted for 30.2 per cent of the foreign-currency deposits at the end of 2010 (Table 1.1). Other major destinations are developed markets in Western Europe and the Asian-Pacific region, with the notable exceptions of Cayman Islands and Bahamas that are widely regarded as tax-haven OFCs. Taken together, the top ten destinations accounted for 75.5 per cent of these offshore deposits. It is noteworthy that the market shares are changing over time, with Australia, Netherlands, the UK and Sweden gaining shares. In terms of sector composition, the bulk of these deposits (70.6 per cent) was held by foreign banks, and the foreign non-bank sector accounted for the remaining 29.4 per cent (Figure 1.2).

Econometric model

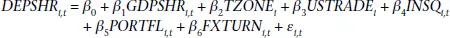

A cross-country panel data model is estimated5 to identify and quantify the determinants of the distribution of Eurodollar deposits. The dependent variable DEPSHR is the market share of bank deposits denominated in the US dollars of a non-US country received from foreign entities. The baseline econometric model is as follows, with the parentheses after the definitions of the explanatory variables representing the expected signs of the coefficients:

Table 1.1 Major destinations of offshore deposits denominated in foreign currencies

Figure 1.2 Sector distribution of global offshore deposits denominated in foreign currencies

Where

DEPSHR | The market share of offshore bank deposits denominated in US dollars | |

GDPSHR | Gross domestic product share of a country to world total (+) | |

TZONE | The number of time zones away from New York6 (?) | |

USTRADE | Share of US total external trade (+) | |

INSQ | World Bank score of legal and regulatory quality7 (+) | |

PORTFL | Share of total world portfolio investments inflows (+) | |

FXTURN | Share of total foreign-exchange market turnover (+) | |

ε | Error term8 |

Among the explanatory variables, GDPSHR is included to control for the size of the economy, since a larger economy tends to receive more deposits. This is also consistent with the gravity model, which is the standard working model in the international economics literature. The variable USTRADE is included to capture the economic linkage between an OFC and the US. The remaining explanatory variables, namely TZONE, INSQ, PORTFL and FXTURN, are location-specific, which are included to measure various aspects of the deposit recipient country that may attract Eurodollar deposits, such as institutional quality, the number of time zones away from New York, and the depth of its foreign-exchange market and portfolio inflows.

The sign of TZONE is to be empirically determined since both signs are plausible from a theoretical point of view. On the one hand, home bias means US residents tend to place US dollar deposits closer to the US. In addition, markets of similar time zones usually have overlapping trading hours, which can facilitate cross-market financial transactions. On the other hand, country risk diversification9 suggests that considerable amounts of US dollar deposits could be held in regions far away from the US. It is worth noting that in many financial centres Eurodollar deposits are largely held by non-US residents. For the remaining explanatory variables, their signs are expected to be positive.

Data

Quarterly data of offshore deposits denominated in US dollars10 placed in 29 BIS-reporting economies11 (except the US itself) for the period 1995–2010 are selected for the empirical analysis. In order to be comprehensive, the sample covers both advanced and emerging-market economies from Europe, North America, South America and the Asian Pacific region. The selection of the time period is subject to data availability. Regarding the explanatory variables, the data sources consist of cross-country datasets of the BIS, International Monetary Fund (IMF) and World Bank.

Empirical findings

Table 1.2 presents the major empirical findings, which are subdivided into three cases: (1) Eurodollar deposits from all sectors; (2) Eurodollar deposits from the banking sector; and (3) Eurodollar deposits from the non-bank sector. In summary, after controlling for the size of the economy, it is found that the following determinants are significant in attracting Eurodollar deposits to an OFC from foreign entities:

•number of time zones away from New York;

•quality of legal system and regulatory framework;

•foreign-exchange market turnover;

•inflows of portfolio investments;

•trade linkage with the US.

The sign of the coefficient of time-zone factor is found to be negative, suggesting that the further away from New York, the less likely an OFC will attract Eurodollar deposits. In other words, our empirical study found that the benefits brought by being in similar time zones (e.g. overlapping trading hours) outweigh those of far-away time zones (e.g. risk diversification). In order to t...

Table of contents

- Cover

- Title

- Part I Issues in Offshore Currency and Bond Markets

- Part II Challenges and Strategies of Developing Offshore Renminbi Markets

- Index