eBook - ePub

Global Luxury Trends

Innovative Strategies for Emerging Markets

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The rise of emerging market luxury brands, digital and online innovations, and growth in consumption globally has opened the doors for seasoned luxury houses and new players to expand their horizons. This book charts the trends that are shaping the luxury industry, particularly the rise of the luxury industry in Asia and emerging markets.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Global Luxury Trends by J. Hoffmann,I. Coste-Manière in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

1

ON LUXURY STRATEGIZING

Jonas Hoffmann

1.1 INTRODUCTION

Stand alone or merge? Be accessible or exclusive? Internationalize, but where? How fast?

Strategy is all about choice!1

The first choice: what is your offering?

The second choice: who are your clients (and competitors)?

The third choice: how do you sustain a viable business?

In a landscape that is fiercer than ever,2 these choices are critical and demand consistent implementation capabilities.

We explore some emerging paths on strategizing, that is, the way top-managers frame, practice and act to build a sustainable advantage for their companies. Along the lines of Richard Normann,3 we approach strategizing through the lens of framing: framing the “map and the landscape”, configuring the company and reconfiguring the mental space. Consequently, we do not offer best practices or ready-to-use formulas, but we will provide some food for thought, hoping that it might give you some insight into the minds of luxury decision-makers, be they top-managers or entrepreneurs. Maybe right away, maybe later, but, at one moment, to connect with some previous knowledge in your mind and . . . you reframe!

Which emerging paths are we interested in? The first path is that of business model innovation (BMI) in the luxury industry; we then explore effectual luxury strategies before finally moving to behavioral strategizing.4 The first provides a map, the second is about landscaping, the third promises a bridge between both. For each of these, we provide a brief definition of the concept, identify companies strategizing along these lines, and draw insights.

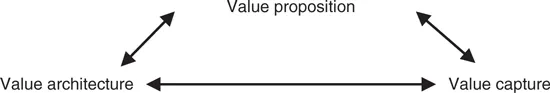

FIGURE 1.1 Components of a business model

1.2 PATH I – BUSINESS MODEL INNOVATION5

A business model is “the logic of the firm, the way it operates and how it creates value for its stakeholders”.6 Three basic components can be identified in a business model: value creation, value architecture and revenue model.7 Value creation integrates the definition of the value proposition, comprising “the targeted type of customer or the market segment addressed by the business activity, the product or service, and partners who create a link between the business and the customer”.8 It assumes that an offer has no value per se; the offer acquires value at the moment it is bought and used by a client in a certain context (Figure 1.1).9

Value architecture comprises the definition of the “value constellation required by the firm to create and distribute the offering, and determine the complementary assets needed to support the firm’s position in this chain”.10 The revenue model specifies “the revenue generation mechanism(s) for the firm, and estimates the cost structure and profit potential of producing the offering, given the value proposition and value chain structure chosen”.11

One interesting tool to articulate the presentation of a company’s business model is the business model canvas proposed by Osterwalder and Pigneur.12 It extends the three components of the business model into nine elements:

(1) Value proposition (What value does the company offer to customers?);

(2) Customer segments (Who are the customers?) Value architecture:

(3) Customer relationships (What sort of relationship does the company seek to establish with its customers?);

(4) Distribution channels (How does the company distribute its products?);

(5) Key activities (Which activities/processes are involved in the business?);

(6) Key resources (Which resources does the company depend on?);

(7) Key partners (Which external resources are involved in the company?)

Revenue model:

(8) Cost Structure (What is the cost structure like?);

(9) Revenue Streams (What types of revenue streams are involved?)

When talking about value proposition it is important to bear in mind that we define it in the sense given by Kapferer and Bastien, and Chevalier and Mazzalovo,13 that is, a luxury good must have a strong artistic content, be the result of craftsmanship and be unique; therefore, a luxury brand has an identity, not a positioning.

There is a dynamic interplay between business model components.14 Some luxury companies (such as Burberry, Celine and Loewe) decided to outsource the production of some pieces (for example, jeans) to low-wage countries, like China. This involves a series of redefinitions in the company-value architecture: redefinition of the key activities performed in-house or in the home country and establishing new partnerships, for example. This will certainly impact (positively) the company’s revenue model, but its consequences in the long term for the brand image are to be seen.

The decision to internationalize a company can be done in several ways (partnership, licensing or subsidiary), each one having consequences for the different elements of the business model. Brand licensing and extension decisions are at the heart of the value-creation process and will again impact the value architecture and the revenue model. Armani is probably stretching its umbrella too widely15 and Pierre Cardin, despite his artistic genius, has long lost its luxury status through indiscriminate licensing.

Since luxury industry companies can (and do) compete for the same share of wallet, some common patterns can be observed in luxury business models depending on the company activity sectors and strategic group membership.

Boundaries and strategic groups in the luxury industry

The European Cultural Creative Industries Alliance (ECCIA) includes the following sectors in the luxury industry: watches & jewelry, fashion, perfumes & cosmetics, accessories, leather goods, gastronomy, furniture & furnishing, design household equipment, cars, yachts, wines & spirits, hotels and leisure experience, retail and auction houses, and publishing.16 Chevalier and Mazzalovo17 add to these the sector of private banking. Others identify a continuum from Product to Experience or Lifestyle, where watches and accessories would fall in the first category, and hospitality in the second category.18

Which companies compete with each other? The consulting company Precepta conducted a study in 2010 to cluster luxury companies in different strategic groups.19 They identify five clusters:

1. “Breeders–consolidators”: these are the likes of LVMH, PPR Gucci and Richemont. They have large financial means and their development is based either on acquisition of emerging or under-exploited brands, or the management of a portfolio of brands. They target strong growth and performance.

2. Independent Luxury Maisons: this group includes companies like Chanel or Hermès that are controlled by family capital or individuals, and have a patrimonial mode of governance. Their brands are managed according to strict principles, and heritage is a core claim.

3. “3ML (Mass-Luxury Fashion Houses)”: the likes of Ralph Lauren, Armani or Hugo Boss are in this group that offers affordable luxury. Their strategy is based on market optimization by maximizing the umbrella brand image to enable brand extension and diversification.

4. Specialists: they include companies like Rolex or Mauboussin. These are brands with strong market legitimacy, although they are hardly as extensible as the previous group. Economic models are mainly based on strong margins and low volumes.

5. “FSMS (Specialized manufacturers multi-segments)”: these groups primarily include cosmetics groups like L’Oréal, Estée Lauder or Coty. They are present in several market segments from mass-market to luxury. Their model is mainly based on product innovation, marketing and managing a portfolio of brands, usually by licensing, to achieve economies of scale.

The strategic considerations of business-model components will weigh more or less heavily depending on the company’s strategic group.

For instance, cost rationalization will weigh more for luxury conglomerates and other publicly traded companies (that is, “Specialized manufacturers multi-segments” and “Mass-Luxury Fashion Houses”) but will be less important for specialists and maisons, where the strict respect of a certain brand philosophy will prevail. Richard Mille’s conservative business model,20 Chanel’s strategy and Osklen’s commitment to sustainable development are such examples. Luxury conglomerates are also under constant scrutiny from financial markets, and the temptation to stretch luxury brands is ever present in order to increase margins, treating them as “cash cows”. Specialists, on the other hand, have the flexibility to react quickly to market changes. They are, however, under strong pressure in the face of the consequent means required for international expansion, and it is not rare to find brands like Sonia Rykiel welcoming partners in their capital as a consequence.

Among the key activities of luxury conglomerates are acquisitions integration. They show an interesting positive track in that respect, given that in other industrial sectors, mergers and acquisitions often end up with mixed results.21 For instance, luxury conglomerates will use classic strategic tools of portfolio management as evidenced by LVMH’s recent acquisition of Bulgari to strengthen its jewelry division.

Regarding the revenue model, a certain balance needs to be found between profitable and non-profitable brands within a portfolio of brands. As Blanckaert22 observed, numerous are the luxury brands that make no profit at all.

Further on, BMI is a “reconfiguration of activities in the existing business model of a firm that is new to the product/service market in which the firm competes”.23 Apple is the ultimate example of BMI with the revolution it brought, for example, to the music, telecommunications and publishing industries. The iPod for instance, was a device with a revolutionary value proposition (e.g., seamless music experience) that, in association with the iTunes platform, completely changed the revenue mo...

Table of contents

- Cover

- Title Page

- Copyright

- Contents

- List of Figures and Tables

- Notes on Contributors

- Introduction

- 1. On Luxury Strategizing

- 2. Paths for the Emergence of Global Chinese Luxury Brands

- 3. Luxo Brasil and Osklen’s New Luxury

- 4. Über Luxury: For Billionaires Only

- 5. Occupation Fashion Blogging: Relation between Blogs and Luxury Fashion Brands

- 6. Engaging with the Luxury Consumer in China

- 7. Luxury and Arts in China: The Island6 Case

- 8. Luxury Shopping Places in China

- 9. Perspectives on Luxury Operations in China

- 10. Luxury Consumer Tribes in Asia: Insights from South Korea

- 11. Luxury in Russia and in Countries of Eastern Europe

- 12. Luxury in India: Seduction by Hypnotic Subtlety

- 13. Polo as a Vehicle for Communicating Luxury

- 14. Mimesis and the Nexus of Luxury Industry in India

- 15. Tesla Motors, The Reinvention of the Luxury Sports Car Industry

- 16. Why Buy Luxury? Insights from Consumer Research

- 17. Elie Saab: Strategic Presence in the Digital Luxury Space

- Index