- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

G.L.S. Shackle

About this book

This is an intellectual biography of G.L.S. Shackle, economic theorist, philosopher, and historian of economic theory. It explores how Shackle challenged the aims, methods and assumptions of mainstream economics. He stressed macroeconomic instability, and developed a radically subjectivist theory for behavioural economics and business planning.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1

Introduction

Donald Rumsfeld (2002) was widely pilloried by the international media for his famous statement of a problem confronting military strategists in Afghanistan:

As we know, there are known knowns. There are things we know we know. We also know there are known unknowns. That is to say we know there are some things we do not know. But there are also unknown unknowns, the ones we don’t know we don’t know.

However, these are words to weigh. Robert McNamara had come to the same wise realization about the war in Vietnam. Warfare is not a defined problem with a set of technical solutions. We should instead expect the unexpected.

This problem of knowledge and its robust philosophical foundations had been central to George Lennox Sharman Shackle’s writing for half a century. Shackle (1903–92) stressed the unknown unknowns, what he called ‘unknowledge’. There is too much that we cannot know when we make crucial decisions. We live in an uncertain world that is not amenable to prediction or control. We cannot know in advance what our fate will come to turn upon. Indeed, we create the future; it is not sitting there merely beyond our epistemic grasp. Shackle is more associated with championing this view of reality than any other economist: we can and we will inescapably be surprised. This is not the result of a mere ignorance of the state of things, or ‘imperfect information’ about the known unknowns. We can prepare for merely unlikely events; we can insure our house in case it burns down. But some events leave us flabbergasted; their possibility never entered our imagination. The current financial crisis reminds us that we can trust neither market forces nor interventions by government to prevent the spasms of disorder to which economic and social life are intermittently prone.

Shackle’s economics drew the praise of famous management theorist Peter Drucker in his The Age of Discontinuity:

In Great Britain today [1968] the rising star in economics is none of the Keynesians in the public eye ... It is G.L.S. Shackle, who professes economics at Liverpool rather than in the prestige universities such as Oxford, Cambridge, or London, whence government advisers are usually drawn. ([1968] 1992, p. 167)

Discontinuity is at the heart of Shackle’s view of the economy: the world and our perception of it can suddenly change. It is as though we peer through a kaleidoscope, Shackle’s signature analogy. When disturbed, the tumbling crystals re-configure, and we marvel or stare aghast at the new pattern. We all have our own kaleidoscopes; each of us has a subjective view of the world and a personal response to it. Shackle coined the term ‘kaleidic’ to describe a world that may for a time be at rest only suddenly to lurch in a new direction, to a destination that may not even have been contemplated still less assigned a probability. Ordinary people have no telescope that looks beyond the horizon of the present, and neither do the experts. We have to make do with our kaleidoscopes. A society of Shackle’s design would rely more on the imagination and judgement of decision-makers and less on technical expertise.

Economic reasoning centres on getting the most of what you want from what you have, in the light of what is considered possible. It is about making effective decisions. Shackle’s fundamental ideas are simple on their surface, and they are subversive of much of mainstream economics.

Only some aspects of life are amenable to the calculation of mathematical expectation (working out the odds of each possible pay-off and deciding which way to bet). Insurance companies, bookmakers and professional gamblers may validly use these methods for a range of day-to-day purposes, but most of us do not live in a casino or on a racetrack. The odds of each configuration of events are not given; they are not potentially ascertainable by repeated experiment. Neither is there a complete list of relevant possibilities. Whatever they may teach in business school, a probability-weighted average return cannot be calculated. Some choices are made in unique circumstances and require full commitment. You may have only one chance. A general attacks or does not attack; one does not half-attack or attack half-heartedly. The choice is crucial and irreversible.

Napoleon could not repeat the battle of Waterloo a hundred times in the hope that, in a certain proportion of cases, the Prussians would arrive too late. His decision to fight on the field of Waterloo was what I call a crucial experiment, using the word crucial in the sense of a parting of the ways. Had he won, repetition would for a long time have been unnecessary; when he lost, repetition was impossible. (Shackle, 1955a, p. 25)

As picking the best option from a complete set of possibilities is infeasible, Shackle posits an alternative account of decision-making. Choices between two actions depend on an assessment of their uncertain respective consequences. Many things could happen, and the task is to filter them. Some possibilities are soon dismissed as not worth taking seriously. Some are more arresting. We focus on the most salient advantage and disadvantage of each option that we plausibly imagine. We cannot quantify and weigh risks and returns because we do not know (we cannot know) what they are. Some possibilities, the unknown unknowns, never even enter our heads, but we know that there are unknown unknowns. Decision-making is thus soaked in the emotions of uncertain hope and fear. A psychological balance is tipped between eager anticipation and dread. One option pushes itself above the other in the mind, and the action is taken. If torn by indecision, one waits and stays uncommitted or ‘liquid’. The prudent may try to limit the stakes that they commit and put aside some reserves in the hope they shall not need them. A unified suite of options may provide defensively for a host of unspecifiable contingencies. Shackle says we are gamblers who embrace chance at crucial moments while keeping a reserve if our fears suggest the need. Standard teaching instead commends holding a diversified portfolio that safely spreads calculable risks and maximizes long-run expected returns.

Mainstream economists have many reasons to reject Shackle’s radicalism. One stems from Milton Friedman (1953). It simply does not matter whether assumptions of perfect knowledge are realistic or not. We need not know all the probabilities either, because all that matters is whether the orthodox model permits successful prediction, and mainstream economists announced that it did. In the 1950s Leonard (Jimmie) Savage, John von Neumann, Oskar Morgenstern and others emerged with both vigour and rigour. Future Nobel Laureates assembled to build a science of managing quantifiable risks. Shackle insisted that theirs was a path to nowhere, but the stylish introspection of an old-fashioned Englishman was never going to prevail over the best and the brightest technicians in the US. An ambitious and self-confident ‘neoclassical’ research programme had formed, one promising to provide surgically interventionist policy. Shackle’s writings were a critique, a warning against hubris. There is nothing to fear in telling the truth to power; the danger is to tell the truth to vanity. His ascending career sputtered towards stall speed before he restored his reputation in later decades. We will plot the arc of his fortunes in later chapters. Admirers of Shackle’s works remain hopeful that his insights will find renewed favour beyond specialists in the history of economic ideas.

Taleb (2010, p. 185) places Shackle in distinguished company when he complains:

Tragically, before the proliferation of empirically blind idiot savants, interesting work had been done by true thinkers, J.M. Keynes, Friedrich Hayek and Benoît Mandelbrot, all of whom were displaced because they moved economics away from the precision of second-rate physics. Very sad. One great underestimated thinker is G.L.S. Shackle, now almost completely obscure, who introduced the concept of ‘unknowledge’ ... It is unusual to see Shackle’s work mentioned at all, and I had to buy his books from secondhand dealers in London.

Shackle is recently prominent in the elegant and scholarly work of Richard Bronk (2009) The Romantic Economist, a book that rebels against mechanistic modernism and its pursuit of efficiency through instrumental rationality. Bronk is not an academic economist though. Neither is Taleb or Drucker. Shackle finds respect in some parts of what is known as ‘Post Keynesian’ economics as well as in strands of free-market Austrian economics, but all his champions are scattered outside of mainstream economics. We consider how his ideas relate to those of Keynes on the one hand and, to a lesser extent, Hayek on the other. He chose to keep some noticeable distance from Keynes and (rather more) from Hayek, if only because his own distinctive light would not otherwise be seen.

Over the last two decades, parts of economics may have evolved to become more receptive to Shackle’s ideas. Specialization is acute and training is narrow, and islands in the great delta are gaining greater independence. We consider whether his ideas can indeed dovetail with modern writing on the psychology of choice. Realism has become acceptable: experimental economics is at very least tolerated. Shackle’s theory of choice may be directly testable or may have testable implications.

This book is an unusual kind of intellectual biography. It aims to amplify the voice of someone who is at risk of being lost in a roar of academic chatter. Shackle recognized this possibility and devised a suite of strategies designed to secure his legacy. He re-published his writings that were originally in less accessible sources. He provided elaborate indexes for his books. He worked on making his writing beautiful and moving, and thus quotable. He often gave his books to those who wrote encouraging letters to him. He established archives with letters, articles and books at the library of the University of Cambridge to help researchers study his writings and disseminate his ideas. He left annotated books in libraries at Liverpool and at St Edmund’s College in Cambridge.

In Shackle there is a strong sense of kindness, humility, aesthetic sensibility and a reserve stemming from a solitary and reflective disposition. This is not the formula for success in the modern academe. Where there was rough and tumble, there was no George Shackle. His friends revealed more about their thoughts, feelings and hopes than he provided in return, at least so far as the written records are concerned (for example, see the letters collected in Frowen, ed., 2004a). Shackle’s life reminds us of the powers of contingency and choice. We aim where suitable to interweave his ideas, temperament, ideals, published works and life events.

Those reasonably characterized as a ‘great economist’ commonly engage in policy debates and collaborate in co-authored publications and joint research projects. There is a dense archival record and a breadth of engagement. There are diaries, countless memoranda and anecdotes in the biographies of friends. Standard intellectual biographies are ‘thick’ and copiously documented. Although Shackle provided significant archival material to map the development of his academic ideas, he was much more closed concerning other aspects of his life. Perhaps more is involved than his simply being English.

Shackle was a solitary theorist, yet he felt that his ideas would dovetail with the needs and experiences of those responsible for major business decisions. He sought to combine aesthetics and serviceability. He has charmed the connoisseurs of ideas, but remains somewhat unrecognized more widely. One notable venue where his ideas have been taken seriously is within Royal Dutch Shell, in relation to scenario planning. We have invited a former Chief Economist at Shell, Professor Michael Jefferson, to explore the relationship between Shackle’s work and scenario analysis. His contribution appears here as Chapter 10 and it also serves as a case study of what it was like to correspond with Shackle.

It is fair to ask what work there is for economists if what Shackle says is true. We consider this in Chapter 9. The academic journals would likely be thinner and fewer, we admit, though this may be no bad thing. Reading lists would contain more of the milestone classics. There would not be so many models to explore and axioms to posit. But if economics returns to being the study of how the real-world economy works and how people operate within it, then its practical value in business may be restored. Economists would still find jobs.

Pervasive uncertainty is not an excuse for error or a reason to do nothing. Shackle’s remedy is not to seek more information or to understand better our psychological biases and limitations, useful though these may sometimes be. No remedy is required as there is no failure to address. An uncertain world is an opportunity, not a barrier. What emerges from uncertainty is the power to create, a power we should celebrate and use well.

Almost everybody who is familiar with Shackle’s writings is impressed by them, at least in some part. Jim Ford (1993, p. 683) declared: ‘He was also an intellectual giant; with his death [in 1992] we have lost one of the few Olympian figures in the history of both British and world economics.’ Shackle was driven by pious ambition. He was an evangelist of the imagination, and he hoped to convert the profession. And all of this alone at his writing desk equipped only with a pencil, armchair and, we imagine, a pot of tea.

2

Life and Vision

2.1 Introduction

Shackle asked a question to which his life’s work is an answer:

Is the economy to be seen as a machine, an organism, a battlefield or a drill ground, or is its history like an oral saga maintained and embellished by a hundred generations of individual poets? (1966a, p. 6)

The timelines and key areas of George Shackle’s contributions are clear. In the late 1930s he first made his mark as a theorist of the business cycle. Throughout his academic life, he was respected for his explanations of the meaning and significance of Keynes’s macroeconomics. Shackle was a key participant in post-war microeconomic debates over the theory of choice under uncertainty. Although his campaign to set the agenda for the further development of choice theory faltered during the 1950s, his insights deserve recognition, as later chapters show. In the second part of his career, the 1960s and the decades following his retirement in 1969, he earned new respect as an historian of economic thought and philosopher of economics. However, his work is unified by the expression of his underlying vision of economic life.

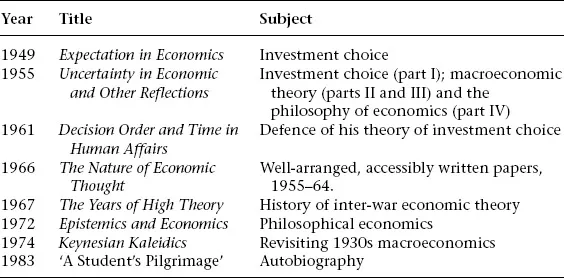

Shackle’s scholarly works are conveniently listed in Stephen (ed.) (1985, pp. 107–12), Frowen (1990, pp. 197–209) and Shackle (1990b, pp. 243–54), and the contents of the archival material housed in the library of the University of Cambridge are listed by Cann (2000).1 In an autobiographical piece Shackle (1992, p. 510) listed the works shown in Table 2.1 as his ‘major writings’.

Table 2.1 Shackle’s ‘major writings’

A sense of the man and his importance may be gauged from the following collage of assessments:

George Shackle is one of the most original thinkers in the history of economics. (Jim Ford, in Frowen 1990, p. 20)

Shackle stands in the history of economic thought as the one who first drew attention to the importance of that organic instrument, the human imagination. (Mark Perlman, 2005, p. 178)

Professor Shackle is the most courteous, the most erudite, and the most radical critic of orthodox economics. (Brian Loasby, 1985, p. 21)

It was left to Shackle, almost single-handed, to explore the subject of expectations. At first he received little recognition. For many years he was a lonely thinker. (Ludwig Lachmann, 1990, p. 5)

I believe, I have amply demonstrated my high regard for the importance of your ideas. (Isaac Levi, aerogram to Shackle, 19 February 1981, 9/8/184)

George Shackle ... has been one of the few economists who has not shunned the difficult task of trying to develop an analytical structure based on realistic axioms. Accordingly, modern ‘economic scientists’ have treated Shackle’s writings as if they were messages from Cassandra. (Paul Davidson, 1990, p. 79)

It has obviously been a source of disappointment to George Shackle that his own theory [of choice] has had virtually no impact on the profession. It is only now that his work is being acknowledged ... (Jim Ford, 1985, p. 10)

Shackle first argued in 1961 for the possibility of a relationship between Keynes’s early work [on probability] and his later work [on macroeconomics]. (Bradley Bateman, 1996, p. 3)

Following the path-breaking historical work of G. L. S. Shackle in the 1960s ... now economists of virtually every stripe acknowledge the place of confidence in [Keynes’s] The General Theory. (Bradley Bateman, 1996, p. 101)

His masterly precision [in his analysis of interest rates and investment] is unparalleled in economic literature and cannot be surpassed. (Stephen Frowen, 1990, p. 165)

... the quintessential English Christian gentleman – courteous, modest, unassuming, considerate, speaking no ill of anyone and not wishing to hear any, either. He has always been an exceptionally hard worker and retirement – he is now 86 – has made no difference ... (Geoff Harcourt, 1990,...

Table of contents

- Cover

- Title

- 1 Introduction

- 2 Life and Vision

- 3 Shackle’s Economics

- 4 Possibility versus Probability: The Rhetoric of Choice

- 5 Potential Surprise and Choice

- 6 Critical Perspectives on Shackle’s Theory

- 7 Making Sense of Diversification

- 8 Shackle and Behavioural Economics

- 9 Lessons for Economists, Entrepreneurs and Business Schools

- 10 The Passage of Time: Shackle, Shell and Scenarios

- 11 Coda

- Notes

- References

- Index of Names

- Index of Subjects

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access G.L.S. Shackle by P. Earl,Kenneth A. Loparo,Bruce Littleboy in PDF and/or ePUB format, as well as other popular books in Economics & Financial Services. We have over one million books available in our catalogue for you to explore.