- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

A Multi-Gear Strategy for Economic Recovery

About this book

Volume II proposes radical reform (1) of the accounting system – to bring corporate management under the control of market forces; and (2) of the tax system – to enable the economy to grow to its full potential and to establish an automatic mechanism for price stability without any arbitrary intervention.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access A Multi-Gear Strategy for Economic Recovery by A. Rayman in PDF and/or ePUB format, as well as other popular books in Economics & Econometrics. We have over one million books available in our catalogue for you to explore.

Information

Two Basic Laws of Economics

1

The Law of Competition and the Law of Circulation

In the writings of the predecessors of Adam Smith, it is possible to distinguish two basic laws of economics: the Law of Competition and the Law of Circulation. Both laws are well established in the “maxims” of the Physiocrats1 who receive a highly favourable mention from the “father of economics”:

They have for some years past made a pretty considerable sect, distinguished in the French republic of letters by the name of, The Œconomists”

[Smith (1776) vol.II, p.176]

Their Law of Competition is central to Smith’s Wealth of Nations written after his visit to France during the mid-1760s. If the economic maxims of the Physiocrats are imagined to have been inscribed on two tablets of stone, the one containing the Law of Circulation, having been left behind by Smith, seems to have disappeared from modern economics.

The consequences for economic policy are critical.

The Lost Commandment

The origin of what may be described as “Single-Gear Economic Fundamentalism” can be traced to the neo-classical consensus of the late 1970s. This signalled a truce between two rival sects – the Keynesians and the monetarists – after decades of controversy. Very broadly, the terms of the truce involved acceptance of classical theoretical foundations with a Keynesian empirical superstructure. The result was the resurrection of Orthodox Classical theory as the New Economic Fundamentalism. It re-established the classical belief in free competition, not only as necessary for the achievement of full economic potential, but also as sufficient.

In the previous volume, this is exposed as a fundamental theoretical error. It is described as the “single-gear fallacy”, because it mistakenly treats the economy as a single-gear machine requiring only the “ lubrication” of competition to operate at its full employment potential. Nevertheless, it has been elevated to the status of a religious principle of the New Single-Gear Fundamentalism.

The reason for the bankruptcy of modern economic policy is the failure of the New Fundamentalism to recognise the Law of Circulation.

The Importance of the Law of Circulation

The contrasting multi-gear view is that, although freedom of competition is necessary to enable an economy to achieve its full employment potential, it is not always sufficient. The economy is a multi-gear machine. In order to operate at its full employment potential it needs to be in top gear. In addition to the Law of Competition, the Law of Circulation, which requires freedom of circulation, must also be obeyed.

From a multi-gear perspective, the obsession of Single-Gear Fundamentalism with freedom of competition to the exclusion of freedom of circulation is the overwhelming reason for the bankruptcy of modern economic policy.

What’s Wrong with Single-Gear Economics?

Single-Gear Fundamentalism is essentially an up-to-date version of the Old Classical Orthodoxy. An ideal classical world of genuinely free competition in perfectly flexible markets is mistakenly believed to guarantee that there can be no such thing as unemployment. Any unemployment actually experienced is therefore wrongly assumed to be a “natural rate” determined by imperfections and frictional resistances in the market structure of the real world.

Policy mistakes inevitably follow from the false belief that the sole guarantee of a long-term fall in unemployment is structural reform to remove market imperfection. Other measures – like monetary expansion – are accepted as short-term expedients which can give no more than a temporary boost to employment so that the long-term result is a rise in the level of prices. The corollary is that measures to control inflation – like monetary restriction – are assumed to be “safe”. Any rise in unemployment is mistakenly believed to be a purely temporary side-effect so that the long-term result is a curb on the level of prices.

The single-gear view is half right. It is perfectly true that, in the absence of any change in the market structure, the “natural rate of unemployment” remains unaltered. That is because the “natural rate” represents a deviation from market-clearing equilibrium. What the single-gear view overlooks is the possibility of a fall in the underlying equilibrium itself – the equivalent of a gear change.

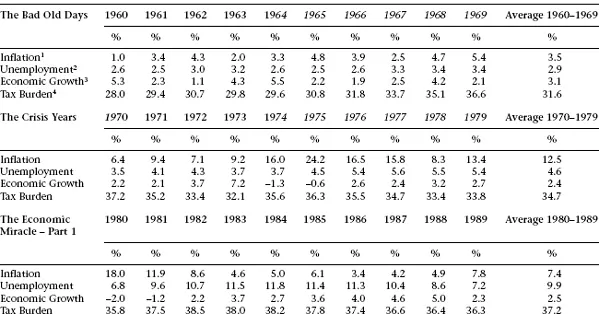

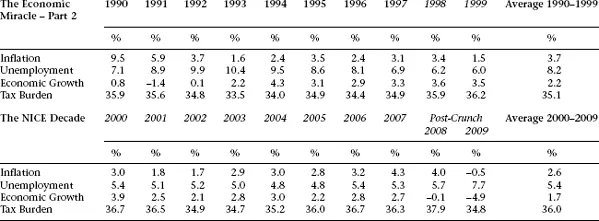

The survival of the old classical single-gear view is the reason why expert opinion still insists on structural reform as the only effective long-term remedy for unemployment and on monetary restriction as a safe method of controlling inflation. The historical record of the success achieved by these policies in the 1980s is presented in Table 1.1.

Table 1.1 reproduces the data in Table 2.1 of chapter 2 of the previous volume, which describes in more detail the economic results of the widely acclaimed “economic miracle” produced by single-gear economic policies during the 1980s.

Perhaps the most spectacular achievement was the microeconomic revolution in market flexibility accomplished by the government’s free-market policy of structural reform – a success acknowledged (and subsequently copied) even by the political opposition. That was not all. Other economic advantages included the microelectronic revolution in information technology; and the windfall of North Sea Oil.

The “economic miracle” of the 1980s, however, has a number of surprising features, which are apparent in Table 1.1:

1. the highest peacetime level of taxation in the whole of British history;

2. the highest level of unemployment since the Second World War; and

3. a rate of economic growth even lower than that criticised as “miserable” in the “bad old days” of the 1960s.

It is difficult to resist the conclusion that the “economic miracle” is a myth propagated by devotees of conventional single-gear theory in order to maintain the illusion of a halo of success over single-gear policy.

The Toxic Nature of Single-Gear Economics

The persistence of the mistaken view of the economy as a single-gear machine has serious policy implications for dealing with the current economic crisis. Toxic single-gear economic theory offers a choice of policy evils: “single-gear austerity” (with no mechanism for preventing damage to economic growth) and “single-gear growth” (with no mechanism for avoiding an explosion of future inflation). Nor are there any effective strategies either to prevent or to correct regional and international imbalances. Consequently, there is no coherent policy to deal with the unsustainable burden of debt carried by some of the weaker member states of the euro-zone.

Table 1.1 The United Kingdom economy from the “bad old days” to the NICE decade

1 Inflation: annual percentage change in the Retail Price Index. Office for National Statistics.

2 Unemployment: LFS: unemployment rate (% of workforce over age of 16). Office for National Statistics.

3 Economic Growth: annual percentage change in real Gross Domestic Product. Office for National Statistics.

4 Tax Burden: taxes and social contributions as a percentage of GDP. Office for National Statistics.

Note: Years printed in bold indicate periods of Conservative administration; years printed in italic indicate periods of Labour administration.

The Necessity for a Multi-Gear Alternative

The detoxification of single-gear theory is the subject of the previous volume, which exposes the fundamental theoretical flaws identified as the source of the poison. The microeconomic flaw – the “market-value fallacy” – is identified as the root cause of the credit crunch. It spread an epidemic of “balance-sheet myopia” which infected corporate reporting with fraudulent accounting standards. This encouraged a short-termist obsession with market values sufficiently widespread to ignite a property-price bubble fuelled by an unsustainable credit pyramid. The inevitable result was the credit crunch of 2007/8. It was, however, the macroeconomic flaw – the “single-gear fallacy” – that prevented a solution to the financial crisis and allowed the global economy to be tipped into recession.

The present volume contains the outline of an alternative multi-gear strategy based on observance of the two basic laws of economics: the Law of Competition and the Law of Circulation. Restoration of the Law of Circulation after centuries of neglect is an essential prerequisite. Freedom of circulation is no less necessary to economic prosperity than is freedom of competition.

1See Quesnay (1758).

Part II

The Lost Commandment: Freedom of Circulation

The Lost Commandment: Freedom of Circulation

Introduction

“Traffique” fully deserves its description as “The Praeheminent Studie of Princes” (see chapter 7 of the previous volume). Thriving economic traffic is vital for the maintenance and improvement of living standards. The main essentials are Freedom of Competition and Freedom of Circulation. It is in the pursuit of those two “freedoms” that the case is argued for market-determined rates of interest and market-related taxation.

The genuine Free-Market approach, however, is not to extol the virtues of “the market”. It is, on the contrary, to expose its vices. Only if the faults are corrected, can Adam Smith’s faith in freedom of competition as the instrument for advancing the Welfare of Nations be vindicated.

The biggest threat comes, not from its enemies, but from its friends. Two decades of capitalist triumphalism may have done more to bring “the market” into disrepute than seventy years of hostile communist propaganda.

Freedom to compete has been used as a licence to exploit monopoly. Fair trade arguments have been twisted to justify protecti...

Table of contents

- Cover

- Title

- Copyright

- Contents

- List of Tables

- List of Figures

- Preface

- Acknowledgements

- Part I Two Basic Laws of Economics

- Part II The Lost Commandment: Freedom of Circulation

- Part III A “Multi-Gear” Macroeconomic Policy

- Part IV The Reform of Economic Policy

- Part V The Current Economic Crisis

- Part VI The Most Successful Cover-up in Financial History?

- Appendix: Tax Avoidance and the Rule of Law

- References

- Index