eBook - ePub

Investor Relations

Principles and International Best Practices in Financial Communications

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Investor Relations

Principles and International Best Practices in Financial Communications

About this book

This practical guide on the theory and practice of Investor Relations combines the art and science of marketing, financial analysis, and financial communications in a single source. It offers expert advice and helpful tips to be used in real business life by corporate executives, financial analysts, students, and anyone competing for capital.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Investor Relations by Anne Guimard in PDF and/or ePUB format, as well as other popular books in Business & Accounting. We have over one million books available in our catalogue for you to explore.

Information

1

Competing for Capital

Bringing in new shareholders, getting listed—or going public, as it is also called—or issuing new securities implies competing against hundreds or even thousands of companies all looking for partners to finance their development. These companies are often referred to as “the issuers.” They may be from the same sector or come from entirely different economic areas. They may be of comparable size, larger or smaller. And they may be active in their own country or run global operations.

If two issuers have comparable financial results, the quality of their Investor Relations can be a differentiating factor and a real competitive advantage, which will be reflected in their valuation.

This is true both for companies that are considering a stock-market listing and for those that want to work with private investors or venture capitalists. Likewise, if a government decides to privatize a state-owned company, it is important that the entity which is being put up for sale is presented to potential investors in the most attractive and honest way.

As early on as possible, before the planned transaction becomes reality, the management of the companies in question needs to be fully aware of the challenges it will face once the companies become issuers:

•Meeting significant demands and high expectations from new “clients”: financial analysts, institutional investors, individual shareholders journalists both domestic and international;

•Striking the balance between the short-term expectations of financial markets and their own long-term objectives;

•Maintaining and increasing investor appetite for their securities.

The goal is to tell an investment story that is convincing and consistent over the long term, while complying with the regulatory framework of the market (or markets where the securities are listed) and with international best practices. At the same time, the highest possible level of quality and consistency in terms of content and style needs to be applied. The rules that must be observed to achieve quality and consistency are as follows:

•Prepare for the transaction rigorously and with professionalism;

•Comply fully with a wide range of legal obligations;

•Aim for excellence in defining the methods and tools used to deliver financial information and communication to capital markets;

•Be clear, concise, and convincing;

•Inspire confidence;

•Devote the necessary time and resources to retaining the attention, and remaining on the radar screens, of journalists, analysts, and investors.

All of this requires a transparent and healthy relationship with both investors and the media. It means objectively separating information that is truly strategic and which needs to remain confidential, insofar as its disclosure could go against the company’s legitimate best interests, and that which is required for valuation purposes. Those who consider that living happily means living secretly should think twice before they decide to get listed, and wait until they come to believe that being thrust into the spotlight can in fact help them grow faster than competition. In addition, going public is an extremely strenuous exercise for these companies, one that can slow or even stop growth. In some cases, it may make sense, and be much wiser, to postpone the listing decision.

1.1 Why Go Public?

Companies may turn to capital markets at a given point in time in their history to fund their expansion, build their corporate reputation, or enable existing shareholders to sell their shares at the best possible price.

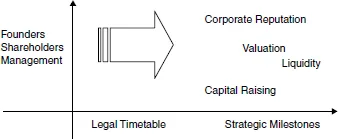

While this book is not intended as a complete guide to initial public offerings (IPO), it aims at focusing on the mission-critical role of Investor Relations throughout the process and well beyond (see Figure 1.1).

Providing it offers and maintains a consistently clear understanding of its activities and strategies (microeconomic factors) along with updates on the environment in which it is operating (macroeconomic picture) on a regular basis, the company will be able to achieve the following:

•Raise capital on the financial markets to help fund its development. Capital can be raised through debt (if the company issues bonds) or equity (if shares are issued). These two types of security can also be combined into hybrid instruments. The company’s Investor Relations program will relate to all of the securities issued since they are designed to reflect not only its overall image, but also to promote a specific category of securities. Equity can be a less expensive source of funding than bonds, but can be counterproductive if new issues dilute earnings per share. Different factors, such as financing costs and balance sheet structures, can prompt companies to issue other types of securities (bonds or hybrid instruments). The terms of the offering, notably the price, will have an impact on the success of the transaction, but investors are less likely to be interested if they are only a little, or not at all, familiar with the company, its track record, its management team, and its development strategy.

Figure 1.1 Players and Objectives in Issuing Securities

•Increase valuation. In general, public companies enjoy a higher valuation than private enterprises. Researchers and market specialists agree that valuation multiples tell whether an Investor Relations policy is successful. In other words, the market prices take into account transparency, clearly presented businesses and strategies, in addition to applying other more strictly financial stock selection and valuation criteria. In practical terms, this means that companies must provide the following:

❍More information about their different activities by giving detailed segmental descriptions of their profit streams, strategies, and managers or, in some cases, by organizing site visits. This will help investors evaluate the company’s competitive advantages (market share, pricing power between competitors, etc.) and distinguish between growth and mature businesses;

❍More open discussion about its financing and accounting practices (for instance, its policy with regard to risk provisions, management compensation).

•Take advantage of sector valuation discrepancies between geographies. For instance, listing your shares abroad, because your main competitor is listed there and is relatively better valued or better covered by the analysts’ community than your own stock.

•Provide liquidity. By going public, including via an international listing, a company creates a market for its share where buyers and sellers are able to trade the share. In general, shares in a public company are much more liquid than stock in a private enterprise. Liquidity is created for the investors, institutions, founders, owners, and venture capital professionals. It can also supply an investor or company owner with an exit, merger, and acquisition strategy, and portfolio diversity. As a consequence, enhanced liquidity will also allow for the diversification of the initial shareholder base.

•Raise visibility and increase corporate reputation. The objectives here are manifold. It is worth using the publicity around the listing to make a company’s brand known to a wider market, with clients and suppliers becoming shareholders, multiply business opportunities and even attract new business partners: These are likely to feel more confident in dealing with a company whose credibility is boosted by its complying with strict regulations and by the regular publication of audited financial statements. Getting listed is also about enhancing the company’s overall image by associating quality products with a proactive policy geared to retail investors. For instance, banks or consumer goods firms may decide to give their shareholders special status as customers (or vice versa!). This brings us well outside the framework of Investor Relations, particularly when it comes to promoting a company’s industrial or commercial strategy in a foreign country, even when it is not listed on the local market. It, however, only adds value to the necessity to design and implement a fully integrated communications strategy. It is also worth knowing that some investors actually have a tendency to hold long-term positions in companies that are household names. Public companies are more likely to appear in major newspapers and media than a private enterprise.

•Attract and retain employees. Visibility improves as financial information about listed companies is communicated via an increasingly wide range of media on a daily basis. Many medium-sized companies, the share prices of which are given regularly on TV or the radio in the local currency, gain much more publicity this way than they would through costly advertising campaigns with few measurable results. This allows them to attract and retain talented personnel they might otherwise not be able to reach and offer them attractive remuneration. These can take the form of stock-based compensation or be indexed to the evolution of the share price or result in a combination of both. In addition, through dedicated share ownership schemes, employees can become partial owners of the company where they work. Significant employee share holdings is often very well regarded by the investment community. It gives a strong sense of loyalty and commitment to productivity, and can prove a most efficient anti-takeover weapon.

It is clearly in listed companies’ interest to target the highest possible valuation in order to achieve the following:

•Ward off hostile bids and shareholder activism. Hostile moves are based on the target company’s share price, and potential predators tend to be scared off by higher market capitalizations. That said, let us be realistic: Institutional investors are accountable to their own shareholders and may have no choice but to sell their shares if the offer price is attractive.

•Protect themselves against excessive market reactions to adverse news flows. For instance, investors can overreact to economic data or major swings in exchange rates. Such sudden changes in the environment need not have a significant impact on a company’s share price when the market has the proper level of understanding. If shareholders know that the company purchases as much as it sells in a given currency, then they know that a sharp increase or decrease in that currency may not necessarily impact its earnings in the same proportion. It can take the Investor Relations Officer (IRO) a few hours or days to get this message across, or in significantly less time, if he or she

❍discusses the potential issue during regular descriptions of the company. Making sure that the IRO gets regular and objective feedback from the market and is well aware of the company’s perception by the investment community will be helpful in preparing for this eventuality;

❍responds immediately to the spate o...

Table of contents

- Cover

- Title

- 1 Competing for Capital

- 2 Seven Keys to Successful Investor Relations

- 3 Implementing Best Practices in Investor Relations

- 4 Measuring the Value of Investor Relations

- 5 Conclusion

- 6 Resources

- Index