eBook - ePub

Asian Brand Strategy (Revised and Updated)

Building and Sustaining Strong Global Brands in Asia

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Asian Brand Strategy (Revised and Updated)

Building and Sustaining Strong Global Brands in Asia

About this book

This second edition of the bestselling Asian Brand Strategy takes a look at how Asian brands continue to gain share-of-voice and share-of-market. Featuring a user-friendly strategic model, new research, and case studies, this book provides a framework for understanding Asian branding strategies and Asian brands.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Asian Brand Strategy (Revised and Updated) by M. Roll in PDF and/or ePUB format, as well as other popular books in Business & Business Strategy. We have over one million books available in our catalogue for you to explore.

Information

chapter 1

Introduction

A journey of a thousand miles begins with a single step.

— Confucius

The face of business in Asia is changing faster than one can blink one’s eyes. Asian companies that used to be back-end workhorses, manufacturing consumer goods cheaply for Western companies, are slowly realizing the benefits of branding. In China, a smartphone manufacturer established in 2011 was able to overtake Apple to become the nation’s dominant mobile phone maker.1 By nearly replicating Apple’s processing power and design while improving distribution and manufacturing, some say the mobile industry’s future will no longer be decided in Silicon Valley, but in the Beijing headquarters of Xiaomi. Even Apple co-founder Steve Wozniak has admitted Xiaomi is “good enough to break the American market.”2 However, Chinese mobile brands like Xiaomi will face bumpy roads ahead when they expand globally due to patent disputes, user concerns over cyber spying, poor brand recognition, strong branded competition, and other challenges.3

In a market where competition implies slashing prices on unbranded products, Asian businesses are slowly realizing the power of brand identity in capturing consumers and returning larger profits on their investments. Asian boardrooms are realizing that instead of wearing themselves down on razor-thin margins to compete with the next supplier, they could increase returns through brand investment and differentiation.

Starting with a ladies’ footwear store in Singapore in 1996, brothers Charles and Keith Wong observed that while selling wholesale shoes provided a cost advantage, the lack of uniqueness meant limited growth. This made them realize the potential of creating a brand that consumers could identify with – leading to the creation of the Charles & Keith brand. Today, it is well-known among fashion-conscious shoppers for its distinctive designs and quick in-season turnaround that offers 20–30 new designs in stores every week. Charles & Keith has expanded its product range to include bags, belts, shades, tech accessories, and bracelets, evolving from a footwear brand to a lifestyle brand. The group has also created Pedro, a line of men’s footwear and accessories.

With the sale of a 20 percent stake in the company to L Capital Asia in 2011 – a private equity group sponsored by the LVMH Group and other investors – the world is taking notice of Charles & Keith. With more than 500 stores across Asia, Eastern Europe, and the Middle East, Charles & Keith is looking to conquer China, the US, and Western Europe to become a global aspirational fashion brand by utilizing the expertise of L Capital Asia and their sponsors.4

Sometimes, successful branding means doing the opposite of what is fashionable. Japanese clothing chain Uniqlo has become Asia’s biggest clothing retailer, thanks to its “Made for All” brand philosophy.5 Often mistaken as a fast fashion brand, Uniqlo’s strategy is to “totally ignore fashion” by not chasing trends.6 Instead, they focus on basic, affordable items that transcend age, gender, and ethnicity so that every individual can create his unique style. Uniqlo now has more than 800 stores worldwide and an ambitious CEO, Tadashi Yanai, who intends to make Uniqlo the world’s largest clothing retailer by 2020. The firm has learned much from its first failed attempt at expanding overseas. After opening too many stores too quickly in the UK in 2002, only eight remained open by 2006. Executives have admitted that they did not do a good enough job establishing a brand identity in new markets.7 With seven stores in the US, Uniqlo’s planned expansion of 1,000 locations in America will surely rely on their commitment to branding at the boardroom level.8

Most Asian firms, however, still view branding as advertising or logo design. If firms are to benefit from branding, they must recognize that it impacts the entire business – the structure, goals, attitude, and the very outlook of those in the boardroom. Managers will need to see branding not as an appendage to the ongoing business, but rather as an infusion that seeps through the very spirit of the organization, driving healthy return on investment (ROI). It will require a shift in focus and priority for every functional aspect of the organization.

Before branding can be implemented, it is important to understand its implications, its various shades and hues, its forms and practices, its purpose, and its advantages. It is indeed a paradigm shift that executives must undertake across Asian boardrooms. How this change in thinking can be analyzed, captured, and managed by Asian boardrooms and corporate management teams forms the core of this book.

Lack of Value Creation

Goldman Sachs has forecast that, by 2026, China will have overtaken the US economy in size to become the world’s largest economy. The Indian economy would be larger than Japan’s by 2028. China and India are indeed leading Asia’s growth path, with implications for industries and companies all over the world.9

The changes in the Asian competitive environment are driven by several factors: the rapid development of China and India, increasing deregulation and trade liberalization, and the emergence of new demographic and social trends throughout the region. These changes involve entire value chains in manufacturing and services, issues related to efficiencies in operations and productivity gains, innovation and design, and a reduced focus on broad diversification – which has been the prevalent structure of Asian businesses, particularly within family businesses.

The Eroding Low-Cost Advantage

A large part of Asia’s economic development can be attributed to low-cost advantages which enabled Asian companies to gain market share from other suppliers. In the past two decades, Asian countries have slowly but surely attracted many industries: light manufacturing in Guangdong, electrical equipment in Guangxi, and software development in Bangalore. But Western companies, by buying these Asian firms or aggressively outsourcing their operations, are already streamlining their cost structures. Low-cost alone no longer provides a significant advantage. The cut-throat competition in many industries, resulting in tremendous pressure on margins, has forced companies to look for additional measures for survival and growth. One example is mobile phones, where brand owners can reach gross margins up to double that of contract manufacturers.

Major companies based in Asia and expanding outside their home market believe innovation and brand building will be vital to flourishing overseas. Accenture asked senior executives what they believed the source of their competitive advantage would be in three years’ time. From 2012 to 2013, low-cost R&D slid in importance by 16 percent while low operating costs were down by 34 percent. Replacing them was an increase in importance for selling high-value, quality, branded, innovative products and services.10

However, Asia is still one of the world’s biggest providers of commodity products, a production hub housing 47 percent of the world’s manufacturing.11 Asian manufacturers mostly produce for other companies and the majority of these products are therefore non-branded. In other words, these are volume products without strong brand identities. Instead, the largest financial value is captured by the manufacturers’ customers – the next player in the value chain – primarily driven by strong brand strategies and successfully planned and executed marketing programs.

The difference in the proportion of value captured between the Asian manufacturing price and the Western retail price serves as a good example. A branded sports shoe is produced in Asia at an estimated US$5, sold to the sports shoe brand for US$10, and the consumer buys it in the retail store for US$100 – in other words, a twenty-fold increase throughout the “product-to-brand” value chain. This leaves the Asian manufacturer with only a fraction of the substantial value that consumers are willing to pay for, in addition to the fact that the consumer never comes to know the name of the Asian manufacturer who originally made the sports shoe.

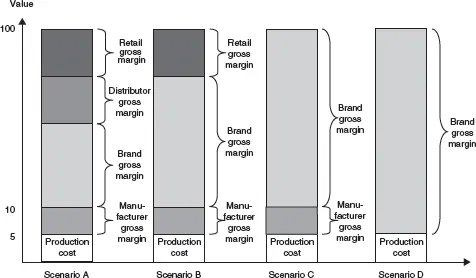

Figure 1.1 illustrates four scenarios of how a brand is integrated in the value chain. In certain cases, companies are vertically integrated and can own part of the channels, including retail outlets, the distributors, and/or the production facilities.

Since 2000, the number of distributors in the sports goods industry has declined more than 50 percent as many sports brands became distributors themselves. This is particularly the trend among larger brands. The sports shoe brand captures an estimated 40–95 percent of the entire financial value depending on its level of vertical integration.12

Successful global companies share certain common characteristics, including strong brand equity. Despite Asia’s size and economic growth, it has not seen the emergence of many strong, international brands.

FIGURE 1.1 Four scenarios for value creation through branding

Source: Martin Roll Company.

Few Global Brands Originating from Asia

In a 2014 Interbrand study measuring the financial value of worldwide brands, only 11 of the top 100 global brands originated in Asia.13 These brands are the familiar technology and automobile giants from Japan and South Korea, such as Samsung, Toyota, Honda, Canon, and Hyundai, and a single Chinese brand Huawei (ranked 94th) appeared on the global list for the first time. A simple question arises: What about the rest of Asia?

Given the size and volume of Asian businesses today, it is evident that Asia could build many more prominent brands and capture more financial value through better price premiums and customer loyalty. Asia certainly has some of the world’s largest companies. China is home to the world’s three biggest public sector companies and five of the top 10 public sector companies in the world. With 674 members on the Forbes Global 2000 list of largest public companies coming from Asia, it is the most strongly represented region. Yet these companies lack the brand recognition and value which accompany most of America and Europe’s largest companies.14

Branding can become an important driver of shareholder value for Asian companies in the future, as this book will illustrate.

Reasons for the Lack of Strong Asian Brands

There are many reasons why Asian companies have not developed many global brands until now. The appreciation of branding in Asian companies is primarily inhibited by the following five factors:

- Stage of economic development of societies

- Less focus on innovation

- Broad diversification of businesses

- Asian business structures

- Implications of intellectual property (IP) protection

Stage of Economic Development of Societies

Asian countries are at different stages of development. At one end of the spectrum are developed countries like Japan, South Korea, Singapore, Taiwan, and Hong Kong. At the other end are developing countries like Vietnam, Cambodia, and Indonesia. In between are countries like Malaysia, Thailand, China, and India, which are moving through rapid transitory phases. The development stages of these countries can influence business ...

Table of contents

- Cover

- Title

- Copyright

- Contents

- List of Figures and Tables

- Consulting and Speaking Enquiries

- Foreword

- Preface and Acknowledgments

- 1 Introduction

- 2 Branding – The Driver of a Successful Business Strategy

- 3 Transforming How We Understand Asian Cultures and Consumers

- 4 Asian Country Branding

- 5 Celebrity Branding in Asia

- 6 Asian Brand Strategy

- 7 Successful Asian Brand Cases

- 8 Aspiring Asian Brand Cases

- 9 Ten Steps to Building an Asian Brand

- 10 Asian Brands Toward 2020 – A New Confidence in the Boardroom

- 11 Conclusion

- Appendix A: Interbrand Brand Valuation

- Appendix B: Interbrand’s 2014 Best Global Brands

- Notes

- Index