- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Bank Performance, Risk and Securitisation

About this book

The latest scholarly developments in research on banking, financial markets, and the recent financial crisis. This selection of papers were presented at the Wolpertinger Conference held in Valletta, Malta, 2012 and provide insights into bank performance, banking risk, securitisation, bank stability, sovereign debt and derivatives.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1

The Impact of the New Structural Liquidity Rules on the Profitability of EU Banks

Laura Chiaramonte, Barbara Casu and Roberto Bottiglia

1.1 Introduction

One of the upshots of the 2007–2009 financial crisis is the evidence that liquidity risk had been underestimated and largely ignored by regulators. Indeed, the previous Capital Adequacy Accords, Basel I and II, did not explicitly require banks to provision for liquidity risk, as that risk had been considered incapable of threatening the stability of individual banks, let alone the entire banking system. For this reason, unlike credit and market risk, the Basel Accords had not set requirements for liquidity risk. Yet the recent financial crisis has shown how rapidly and acutely liquidity risk, in terms of both market liquidity risk and funding risk, can manifest itself in financial markets and how it can affect the stability of banks and indeed the whole financial system. Thus, the Basel Committee deemed it necessary to remedy the omission and, in the December 2010 final document (so-called Basel III),1 it has promoted the gradual introduction of two internationally harmonized global liquidity standards for banks: the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR), to be introduced by 1 January 2015 and by 1 January 2018 respectively.

The Liquidity Coverage Ratio (LCR), aims to promote short-term resilience by ensuring that a bank has enough high-quality liquid assets to survive an acute stress scenario that lasts for around a month. The Net Stable Funding Ratio (NSFR), on the other hand, aims to promote longer-term resilience by encouraging banks to fund their activities with more stable sources of funding.

The new Basel III regulation in general, and the gradual introduction of these two internationally harmonized global liquidity standards for banks in particular, while aiming to strengthen financial stability, will also radically modify the functioning of banks, their relationship with markets and their profitability. Traditionally, the relationship between liquidity and profitability is expected to be negative, as liquid assets tend to be low-yielding. It must be noted that a traditional liquidity ratio – for example, the ratio of liquid assets to total assets – is a rather different measure from the NSFR, which considers deposits (both stable and unstable) related to lending and bond-holding activities, and which should be at least 100 percent. Liquidity ratios, in contrast, are below 5 percent in developed countries, although they have been slightly increasing post-crisis.2 This difference not only makes comparison between NSFR and liquidity ratio difficult, but also makes the relationship between NSFR and profitability uncertain; to date, the impact of the new liquidity rules on bank profitability is not clear, and therefore necessitates further investigation. Hence, this study aims to shed some light on the relationship between bank profitability, defined using traditional measures (Return on average Assets, ROA, and Return on average Equity, ROE) and liquidity (measured by the new liquidity standards proposed by Basel III). Although the Basel Committee outlines two liquidity standards, this research focuses on the NSFR alone, since publicly available information does not allow an evaluation of the LCR.

Our empirical results highlight that contrary to expectations during the period 2003–2010 an increase in liquidity of the largest European banks included in our sample was accompanied by an increase, not a decrease, in bank performance. These findings are of particular interest to both academics and policymakers, as they will contribute to the current debate on banking sector reforms and to the debate on how to reconcile the need for financial stability without imposing too high a cost on banks’ profitability.

The remainder of this work is organized as follows: Section 1.2 of this study reviews the relevant literature. Section 1.3 describes the data sample and the variables used in our analysis. Section 1.4 illustrates the empirical methodology and the main results. Finally, Section 1.5 concludes.

1.2 Literature review

There is a considerable body of literature on the determinants of bank performance (Short, 1979; Bourke, 1989; Molyneux and Thornton, 1992; Goddard et al., 2004; Athanasoglou et al., 2006; Pasiouras and Kosmidou, 2007; Athanasoglou et al., 2008; Dietrich and Wanzenried, 2011, among others). These studies have classified the determinants of bank performance into internal factors, or bank-specific characteristics, such as proxies for bank size, credit risk, liquidity risk, capital ratio, operational efficiency etc., and external factors concerning macroeconomic and bank industry-specific aspects. The existing research focuses mainly on ratio analysis to explain the performance of banks.

A number of studies that have investigated the determinants of bank performance have also considered liquidity risk measures. These researches include proxies for liquidity as follows: the ratio of liquid assets to total assets (Bourke, 1989; Molyneux and Thornton, 1992; and Guru et al., 2002), the ratio of loans to total assets (Demirgüç-Kunt and Huizinga, 1999; Mamatzakis and Remoundos, 2003; Athanasoglou et al., 2006), the ratio of liquid assets to deposits (Shen et al., 2009), the ratio of liquid assets to customer and short-term funding (Kosmidou et al., 2005), the ratio of net loans to customer and short-term funding (Pasiouras and Kosmidou, 2007; Kosmidou, 2008; Naceur and Kandil, 2009; Shen et al., 2009), the ratio of financing gap to total assets (Shen et al., 2009), and the ratio of net loans to deposits and short-term funding (Mohd Said and Hanafi, 2011).

The empirical findings of the studies that have analyzed the relationship between bank performance (measured by ROA and/or ROE) and bank liquidity defined using traditional liquidity measures (for example, the ratio of liquid assets to total assets, and the ratio of liquid assets to total deposits) are heterogeneous. In particular, some authors showed a negative relationship between the level of liquidity and bank performance (Molyneux and Thornton, 1992; Guru et al., 2002; Mamatzakis and Remoundos, 2003), whereas other authors, on the contrary, found a strong positive relationship between liquidity and bank performance (Bourke, 1989; Demirgüç-Kunt and Huizinga, 1999; Kosmidou et al., 2005; Kosmidou, 2008; Shen et al., 2009). Finally, yet other authors managed to demonstrate either that liquidity had no effect on either ROA and ROE (Athanasoglou et al., 2006; Mohd Said and Hanafi Tumin, 2011) or that liquidity risk did not significantly determine ROA or ROE (Naceur and Kandil, 2009).

More recent studies have also considered the impact of the financial crisis on bank performance (Beltratti and Stulz, 2009; Xiao, 2009; Millon Cornett et al., 2010; Dietrich and Wanzenried, 2011). However, none of these studies considered liquidity measures in their analysis.

Loosely following the above-mentioned strand of literature, this study aims to contribute to the current debate on the implications of the new structural liquidity ratio (specifically, the NSFR) of Basel III on the European banks’ profitability during the period 2003 to 2010.

1.3 Data sample and variables

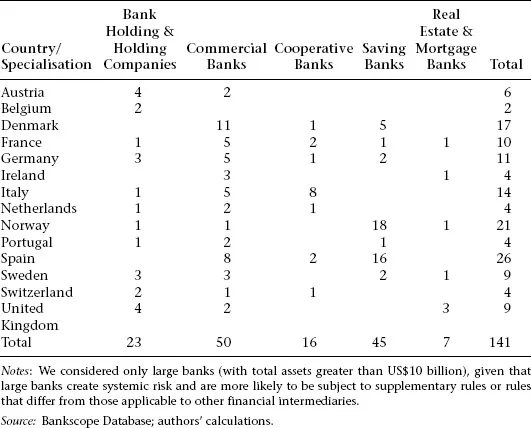

This study considers only the largest European banks (with total assets greater than US$10 billion) operating in five areas of specialization: Bank Holding & Holding Companies, Commercial Banks, Cooperative Banks, Savings Banks, and Real Estate & Mortgage Banks. The final sample is composed of 141 European banks over the period 2003 to 2010; see Table 1.1 for sample distribution by specialization by European country.

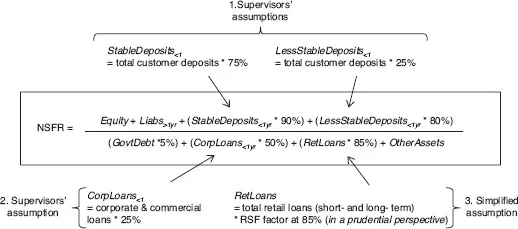

For each bank in the sample, we calculated the NSFR value on the basis of information available in Bankscope, one of the Bureau Van Dijk databases. Since Bankscope does not contain all the detailed information specified in Basel III, we used a simplified version of the NSFR (see Figure 1.1) based on three assumptions. In particular, there is no distinction between: stable and less stable deposits;3 corporate loans with less than one year to maturity and those with more than one year to maturity; and finally retail loans with less than one year to maturity and those with more than one year to maturity. For these reasons, the only way to determine the NSFR is to use two supervisors’ assumptions indicated in a working paper of the Bank International Settlements (BIS) written by King in 2010 and a simplified prudential assumption (see Figure 1.1).

Table 1.1 Sample distribution by specialization in each European country (2003–2010)

Figure 1.1 The NSFR construction

Notes: Liabs: Liabilities; GovtDebt: Government Debt; CorpLoans: Corporate & Commercial Loans; RetLoans: Retail Loans; RSF: Required Stable Funding.

1.The supervisors’ assumptions affirm that the 75 percent of deposits are stable and 25 percent are less stable. See King (2010);

2.The supervisors’ assumptions affirm that the 25 percent of corporate loans are less than one year in maturity. See King (2010);

3.In the Bankscope Database, Retail Loans are calculated as the sum of Residential Mortgage Loans, Other Mortgage Loans and Other Consumer/Retail Loans.

Source: BCBS (2010), King (2010) and Bankscope; authors’ calculations.

Figure 1.2 shows the results of the average NSFR value of the largest European sample banks in each year. This showed an increasing trend until 2007...

Table of contents

- Cover

- Title

- Introduction

- 1 The Impact of the New Structural Liquidity Rules on the Profitability of EU Banks

- 2 Basel III and Banking Efficiency

- 3 Estimating the Probability of Financial Distress in European Markets: Prediction Models and Empirical Applications

- 4 Performance Management Systems in Swedish Savings Banks: A Longitudinal Study through the First Quarter-Century of Deregulation

- 5 Does Asset-Backed Securitization Affect the Credit Risk of the Originator Banks? The Italian Case

- 6 Microcredit Securitization

- 7 Country Risk: Measurement Approaches and ECAIs Rating

- 8 Top Players in Central and Eastern Europe: Does their Widespread Presence Enhance Bank Efficiency?

- 9 Asset Management Issues in Sovereign Wealth Funds: An Empirical Analysis

- 10 A VAR Approach to the Analysis of the Relationship between Oil Prices and Industry Equity Returns

- 11 China’s Controlled Potential Property Bubble and Its Economic Slowdown: Overview of Causes and Policy Options

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Bank Performance, Risk and Securitisation by Joseph Falzon in PDF and/or ePUB format, as well as other popular books in Business & Accounting. We have over one million books available in our catalogue for you to explore.