eBook - ePub

The British Growth Crisis

The Search for a New Model

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The British Growth Crisis

The Search for a New Model

About this book

Britain remains mired in the most severe and prolonged economic crisis that it has faced since the 1930s. What would it take to find a new, more stable and more sustainable growth model for Britain in the years ahead? This important volume written by a number of influential commentators seeks to provide some answers.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The British Growth Crisis by J. Green, C. Hay, P. Taylor-Gooby, J. Green,C. Hay,P. Taylor-Gooby in PDF and/or ePUB format, as well as other popular books in Politics & International Relations & Macroeconomics. We have over one million books available in our catalogue for you to explore.

Information

Part I

Diagnosing the Crisis

1

Should the UK Continue to Follow Liberal Economic Policies?

Graham Gudgin and Ken Coutts

Introduction

The current economic crisis in the UK, which began in 2008, has been the deepest and most prolonged for over a century. The level of output, or gross domestic product (GDP), is now 20 per cent below the pre-2008 trend,1 and the cumulative loss of income since 2007 is equivalent to a whole year’s GDP. Even with the recent upturn in growth, no economic forecaster currently expects full convergence back towards the pre-2008 trend.2 That trend had been well established, at least since 1948 when modern records began. Since there was also continuous growth from the early 1930s to 1948, this means that the UK economy is in new territory not previously experienced in most people’s lifetime.

This is the time to question whether the UK is following the most appropriate form of capitalism. Conventional wisdom, notwithstanding the recent recession, is that the liberal market policies followed since Mrs Thatcher’s election victory in 1979 (and, to some extent, a few years earlier) remain the best model for the UK economy, albeit with additional safeguards to prevent future banking collapses. This belief is based on a view that liberal market policies reinvigorated a failing economy and underpinned a resurgence of UK prosperity from 1980 onwards. For several decades this view appeared to be supported by the facts on the ground and by a rejection of Keynesian economic theory in many university economics departments.

Most people, including most economists, still view the period 1979–2007 as one of faster economic growth and greater prosperity, as well as one of lower inflation, greater industrial peace and higher efficiency in the privatised, formerly state-owned, companies.3 In this chapter we ask whether this benign view of the post-1979 world is a true reflection of the economic facts. The aim is not to conduct an exercise in economic history for its own sake, but to investigate the extent to which the switch to a liberal market model is an essential underpinning for our prosperity. Those who believe in the free market economic model must be able to show that economic performance after 1979 was better than it would have been under the ‘corporatist’ economic policies of earlier decades. The easiest way to do this is to show that performance was better than during the decades prior to 1979. We show that the most important economic indicators, including GDP per head, were not better in the post-1979 decades. This makes it incumbent upon supporters of liberal market policies to explain why what they believe to be a superior economic system did not produce the goods.

This chapter thus compares the three decades of ‘corporatist’ economic policy prior to 1979 with the three ‘liberal’ market decades from 1979–2012 to assess which, on balance, were the more favourable. The end of the latter period saw the largest recession for a century, and this in itself is an indictment of a liberal market regime. While it is not the purpose of this chapter to describe the causes of the recent economic crisis in detail, we can say that the crisis was clearly caused by the build-up of household debt over three decades of financial liberalisation, leading eventually to a vastly over-extended banking system dependent on loans backed by over-valued housing assets. The value of housing had been unrealistically increased by easily available credit in a liberalised banking system, and individuals were willing to gear themselves to realise huge capital gains. As Minsky (1995)4 clearly predicted, years before the crash, credit-based bubbles always end in economic crashes as the demand for credit disappears once asset prices begin to fall, and the supply of credit from troubled banks dries up.

The economic crash of 2008/2009 caused many to question the validity of the liberal market model. The main international policy response to these questions has been to strengthen rules on bank reserves to avoid future financial stresses causing the collapse of major banks. Otherwise the liberal market model remains intact. This chapter asks the much more general question, extending well beyond banking, of whether liberalising the economy led to faster economic growth and greater stability as modern economic theory suggests it should.

Definitions

While we do not propose to conduct a lengthy review of the nature of liberal market policies the broad characteristics are easily summarised. Several of them could be included within a definition of ‘globalisation’.

They are:

•Free markets, including:

•Free trade, low tariffs and absence of non-tariff barriers

•Free movement of capital and labour

•Light regulation of business and labour markets

•Light-touch regulation of banking and removal of restrictions on the Building Society movement

•Private ownership of most production and services

•Low income taxes

•Weak trades unions

•Strong competition law.

The contrasting policy regime that dominated the three decades prior to 1979 is often described as ‘corporatist’.5 During the 1950s, 1960s and 1970s the economy was highly regulated with relatively high tariffs on trade,6 controls on capital movements, large-scale industrial subsidies and regional investment controls, cartels and weak competition rules, substantial public ownership of production,7 and close involvement of powerful trade unions in determining economic policy.8 Wage and price controls were also intermittently in force during periods of high inflation, and average and marginal income tax rates were high by post-1980 standards.

After 1979 all of this was to change. Fixed exchange rates had already been abandoned internationally in 1971 and a start was made on UK financial deregulation in the same year. Capital controls were quickly removed in 1979 followed by wage, price and investment controls. Over the 1980s a whole series of deregulatory measures were introduced in the financial and commercial sectors. Although the level of taxation was not permanently reduced there was a major switch away from high marginal income taxes and towards indirect taxes. Competition law was strengthened9 and trades union laws introduced. Finally, a major programme of privatisation transferred the ownership of many public corporations to the private sector. In some cases this was a reversal of earlier nationalisations, but in the utilities this was a sell-off of organisations that were originally developed by local or central government.

The key question is whether these liberal market reforms led to faster economic growth and higher productivity across the UK economy as a whole. There is a widespread consensus that market liberalisation reforms since the 1970s have strengthened the competitiveness of the UK economy, ended a long period of relative economic decline and introduced a sustained period of rapid and stable growth. For instance, Professor John Van Reenan, Director of the Centre For Economic Performance at the LSE, wrote in April 2012, ‘Mrs Thatcher’s reforms helped to end a century of relative UK economic decline’.10 The widely quoted economic historian Professor Nick Crafts takes a similar view.11 Crafts (2011) concludes that ‘applied economists in the UK are now generally agreed that strengthening competition in product markets is good for productivity performance’. Crafts reviews a range of studies showing that price-fixing and cartels, market concentration, separation of ownership and control, and strong trades unions all tend to reduce growth in productivity, as do barriers to trade and to new entrants in a sector. By 1979 it was relative decline which dominated interpretations of the post-war period. At the same time economic turbulence, and especially the high inflation of the 1970s, led to a reaction to the ‘corporatist’ model that had prevailed under both Labour and Conservative governments until 1979. High inflation, frequent and damaging strikes, and dissatisfaction with the performance of a range of nationalised industries all contributed to the Thatcher victory in 1979 and the subsequent free market revolution.12

Evaluating the impact of free market reforms since 1979

The economic changes undertaken since the 1970s are so numerous and interwoven that an evaluation is necessarily complex. In this chapter we focus primarily on growth and productivity in the macroeconomy and on inflation, although we will have something to say about the impact of individual changes, such as the privatisation programme and deregulation. The starting point in making a judgement on the impact of the liberal reforms is to conduct comparisons. Our main comparison is of UK economic performance in the three decades since 1979 with the three preceding decades. In doing so, we also compare UK performance with other advanced economies over the two periods to address the issue of relative growth and decline. A number of studies have investigated the impact of deregulation and increased competition by comparing individual sectors and firms.13 These studies are valuable and informative, but also partial. A necessary starting point in our view is to look at the performance of the UK economy as a whole, and to use sectoral and other studies as an aid to interpretation. The 30 years since the election victory that brought the Thatcher government to power is a long enough period to attempt an assessment of the impact of this revolution on the UK economy.14

The salient facts

Per capita GDP

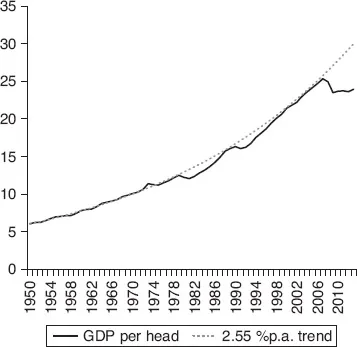

Looking back over the past sixty years, the evidence now clearly shows that there was no sustained improvement in the trend growth of per capita GDP in the UK after 1979.15 Indeed, per capita GDP has only once returned to the pre-1979 trend, at the pinnacle of the 1980s boom in 1989 (Figure 1.1). The current level of per capita GDP in 2014 was 20 per cent below what it would have been if the 1950–1979 trend had continued. This suggests two things. Firstly, any claim that market liberalisation in the UK raised the growth rate in per capita GDP depends entirely on the view that in the absence of liberal reforms the trend would have deteriorated after 1979. Any assessment of the impact of market liberalisation in the UK thus needs to examine the plausibility of the proposition that, in the absence of the liberal reforms, deterioration in the growth trend would have set in after 1979.

Figure 1.1 Real GDP per capita in the UK (£000, 2003 price reference year)

Source: GDP in constant prices (chain-linked 2010 reference year) from ONS UK National Accounts December 2013. Population is from the same source. The trend is fitted by least squares regression to real GDP per head over the period 1950–1979. The trend in 1950 was one per cent below the actual GDP per head. This accords with Dow’s estimate of the position of the economic cycle in that year (J.C.R Dow The Management of the British Economy 1945–1960 NIESR CUP 1965).

Secondly, the superior trend over the three decades before 1979 was achieved despite the presence of all of the corporatist apparatus listed above, which is now generally, but in our view unnecessarily, regarded as damaging to economic growth and productivity. As well as high marginal income tax rates and higher inflation (the latter being mainly confined to the period from the late sixties to the early eighties), much of the period was characterised by wage, price and investment controls,16 fixed exchange rates, greater public ownership, subsidisation and regulation of industry, alleged poor management and restrictive labour practices,17 together with a less favourable record of strikes and industrial relations.

Any claim that the economic record has been better under a more liberal economic regime must explain why faster growth was possible under the more corporatist and interventionist regime that characterised the period up to 1979. Such a claim also needs to establish why a continuation of the corporatist regime after 1979 would have led to a poorer economic record than it did prior to 1979. In the latter case two possible reasons for a worsening economic growth performance in the UK are available. First, world trade grew more slowly in the second period. Second, the progressive adoption of free trade under GATT rules could have reduced the growth ...

Table of contents

- Cover

- Title

- Introduction: The British Growth Crisis

- Part I Diagnosing the Crisis

- Part II Evaluating Responses

- Part III Global, Local and Sectoral Dimensions

- Part IV Alternatives Beyond Growth?