- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Liquidity Management is now a core consideration for banks and other financial institutions following the collapse of numerous well-known banks in 2007-8. This timely new edition will provide practical guidance on liquidity risk and its management – now mandatory under new regulation.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Liquidity Risk by E. Banks in PDF and/or ePUB format, as well as other popular books in Business & Corporate Finance. We have over one million books available in our catalogue for you to explore.

Information

Part I

Elements of Corporate Liquidity

1

Liquidity Risk Defined

Liquidity, which we define broadly as the availability of cash or equivalent resources, is the lifeblood of every commercial and sovereign entity. Liquidity allows expected and unexpected obligations to be met when needed so that daily business affairs can proceed uninterrupted. In the absence of sufficient cash resources, activities may be jeopardized; more importantly, the probability of encountering severe financial distress increases. Indeed, as events of the past few years have demonstrated, the loss of liquidity and the onset of financial distress can often happen very quickly – in as little as 24 or 48 hours. Diligent and prudent management of liquidity is therefore a vital part of corporate financial management.

In this introductory chapter we begin our review of liquidity by examining definitions of liquidity risk and considering liquidity risk in relation to general corporate operations and other dimensions of financial exposure. We then provide some background related to the liquidity characteristics of the financial crisis of 2007–2008 along with universal “lessons learned.” We finish by outlining the key themes we intend to explore in the balance of the text.

Definitions of Liquidity Risk

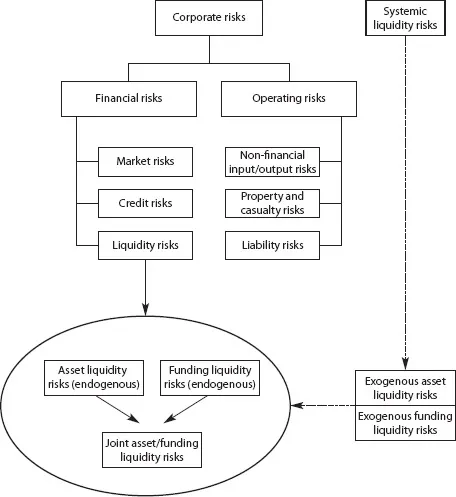

It is well understood that the modern corporation must cope with a broad range of risks in the pursuit of business. The same is true, though sometimes to a lesser degree, of municipal, quasi-governmental and governmental entities. Risk, which we define as any source of uncertainty impacting operations, comes in various forms. Although the taxonomy of risk is necessarily subjective, we begin by segregating risk into financial risk, or the risk of loss arising from financial variables that impact balance sheet and off-balance sheet activities, and operating risk, or the risk of loss arising from variables that impact the physical characteristics and operations of a business. While operating risks (including exposure to non-financial inputs/outputs, property and casualty losses, environmental liability, fiduciary liability, other legal liability, workers’ health, safety, and compensation, and so forth) are crucial to understand and manage, we shall not consider them in further detail, except in the context of how they might lead to cash flow pressures. Instead, we focus on financial risks, decomposing them first into three broad classes: market risk, credit risk and liquidity risk.

Market risk is the risk of loss due to adverse changes in the market prices/variables of a transaction or business. Credit risk is the risk of loss due to failure by a counterparty to perform its contractual obligations. We can provide further granularity by considering financial exposure variables such as volatility risk, curve risk, directional risk, and basis risk (all subsets of market risk); and default risk, credit spread risk, contingent credit risk, sovereign risk, and settlement risk (subsets of credit risk). Both dimensions are essential to proper corporate risk management, but detailed discussion is out of the scope of this book; further descriptions and explanations on these topics can be found in several of the references listed at the end of the book. We shall therefore limit our discussion of market and credit risks to areas where they directly impact aspects of our main focus: liquidity risk, the last of the three broad classes of financial risk. Although liquidity risk is sometimes classified as a subset of market risk, we believe that it is more helpful to consider the category separately. This ultimately allows for more accurate identification, measurement, management and monitoring.

If liquidity is the availability of cash or equivalents, then we can define liquidity risk as the risk of loss arising from a lack of cash or equivalents or, more specifically, the risk of loss arising from an inability to obtain funding at economically reasonable levels, or sell1 or pledge an asset at carrying prices, in order to cover an expected or unexpected obligation. Liquidity risk can therefore be regarded as the risk of economic loss suffered in attempting to secure the cash that is so vital to business operations.

We can also consider further classes of liquidity risk. It is helpful, for instance, to distinguish between funding (or liability) liquidity, asset liquidity, and joint liquidity, as well as liquidity mismatches and liquidity contingencies.

Funding liquidity focuses on the availability of unsecured liabilities that can be drawn on to create cash, including short-term and long-term debt facilities. Funding liquidity risk is, therefore, the risk of loss stemming from an inability to access unsecured funding sources at an economically reasonable cost in order to meet obligations.

Asset liquidity, in contrast, centers on the availability of assets, such as marketable securities, inventories, receivables, and plant and equipment, which can be sold or pledged to generate cash. Asset liquidity risk is thus the risk of loss arising from an inability to convert assets into cash for some expected value in order to meet obligations.

In certain instances asset and funding liquidity join together to produce an incremental degree of risk, which we term joint asset/funding liquidity risk – the risk of loss that occurs when funding cannot be accessed and assets cannot be converted into cash in order to meet obligations.

We can also consider liquidity mismatches. It is common, particularly in financial services, for maturities of cash-sensitive assets and liabilities to be individually and/or collectively mismatched, leading to divergent cash inflows and outflows over time. Liquidity mismatch risk is therefore the risk of loss arising from the non-conformity of assets and liabilities.

Finally, it is important to mention the concept of liquidity contingencies. Future known or unknown events, as well as cash-sensitive contingent transactions that are carried off-balance sheet, can have a meaningful impact on future cash requirements. Liquidity contingency risk can thus be viewed as the risk of loss arising from future events or commitments which unfavorably reshape cash requirements.

We can also consider liquidity risk in the context of internal and external forces. Some aspects of liquidity are specific to an institution, its financial position, and its scope of operations, and are largely or entirely within its direct control. The liquidity features of the firm are not necessarily impacted by, nor do they impact, what happens in an industry or system context; this characteristic is commonly referred to as endogenous liquidity. In some cases, however, liquidity has a broader reach, affecting many institutions in a sector, or contracts in a marketplace; this exogenous liquidity is outside the direct control of any single institution, although in certain instances the actions of individual firms can contribute to the exogenous pressures. Whilst endogenous liquidity events can have a detrimental effect on an institution, exogenous liquidity events can affect multiple institutions simultaneously, injecting an element of systemic risk into the concept of liquidity risk. The financial crisis of 2007–2008, which we shall consider later in the book, serves as in important example of this phenomenon.

For additional perspectives and definitions on liquidity and liquidity risk, we summarize in Box 1.1 sample definitions from a number of regulators and industry bodies. Some of these are specific to financial institutions, and others are applicable more generally to the marketplace at large.

Box 1.1 Sample definitions of liquidity and liquidity risk

American Academy of Actuaries (USA) Liquidity is the ability to meet expected and unexpected demands for cash. Specifically, it is a company’s ability to meet the cash demands of its policy and contract holders without suffering any (or a very minimal) loss. The liquidity profile of a company is a function of both its assets and liabilities. Liquidity risk is inherent in the financial services industry, and one must understand, measure, monitor, and manage this risk.

(AAA, 2000, p. 4)

Bank for International Settlements (Supranational) A liquid market is a market where participants can rapidly execute large volume transactions with a small impact on prices.

(BIS, 2000, p. 5)

Canadian Institute of Actuaries (Canada) Liquidity risk is the inability to meet financial commitments as they fall due through ongoing cash flow or asset sales at fair market value. Liquidation risk is the potential loss when the sale of an asset is urgently required, which may result in the proceeds being below fair market value. The loss is the difference between the fire sale price and the fair market value.

(CIA, 1996, p. 4)

Federal Deposit Insurance Corporation (USA) Liquidity represents the ability to efficiently and economically accommodate a decrease in deposits and other liabilities, as well as fund increases in assets. A bank has liquidity potential when it has the ability to obtain sufficient funds in a timely manner, at a reasonable cost.

(FDIC, 1998, p. 1)

Financial Services Authority (UK) Liquidity risk is the risk that a firm, though solvent, either does not have sufficient financial resources available to it to meet its obligations when they fall due, or can secure them only at excessive cost. It is a basic business risk faced to some degree by most (if not all) firms, though clearly it is more significant for some than others.

(FSA, 2003, p. 3)

HM Treasury (UK) Liquidity is the ease with which one financial claim can be exchanged for another as a result of the willingness of third parties to transact in the assets.

(HM Treasury, 1999)

International Association of Insurance Supervisors (Supranational) The risk emerging when the insurer fails to make investments (assets) liquid in a proper manner as its financial obligations fall due.

(IAIS, 2000)

International Organization of Securities Commissioners (Supranational) The risk to [an institution’s] ability to meet commitments in a timely and cost-effective manner while maintaining assets, and in the inability to pursue profitable business opportunities and continue as a viable business due to a lack of access to sufficient cost-effective resources.

(IOSCO, 2002, p. 3)

Office of the Comptroller of the Currency (USA) Liquidity risk is the risk to a bank’s earnings and capital arising from its inability to timely meet obligations when they come due without incurring unacceptable losses.

(OCC, 2001, p.1)

Office of the Superintendent of Financial Institutions (Canada) Liquidity is the ability of an institution to generate or obtain sufficient cash or its equivalents in a timely manner at a reasonable price to meet its commitments as they fall due.

(OSFI, 1995, p. 2)

Federal Reserve Bank of San Francisco (US) Liquidity is generally defined as the ability of a financial firm to meet its debt obligations without incurring unacceptably large losses.

(FRBSF, 2008, p.1)

Bank for International Settlements (Supranational) Liquidity is the ability of a bank to fund increases in assets and meet obligations as they come due, without incurring unacceptable losses.

(BIS, 2008, p.1.)

Figure 1.1 summarizes the general taxonomy of risks we have outlined before.

Liquidity, Risk, and the Corporation

A company requires liquidity in order to operate successfully. Liquidity can be viewed as the essential resource that permits a company to replace its liabilities, meet contractual obligations, and fund growth, all at a reasonable price, as and when needed. Liquid resources allow planned principal and interest payments; supplier, customer or lease payments; committed capital investments; dividends; and other obligatory cash flows to be met on schedule. Equally important, liquidity allows unanticipated obligations to be met with ease and at a reasonable economic cost. This is important because cash flow surprises are quite common in the corporate world: a company might be called on to make emergency payments to suppliers, provide customer restitution in the event of product problems, acquire a competitor when a sudden opportunity arises, or quickly repay contingent obligations when a lender or investor exercises a repayment option. Since unanticipated obligations cannot, by definition, be predicted with any real precision, a company must maintain access to enough resources to cover such eventualities.

Figure 1.1 A general taxonomy of risks

Failure to meet expected or unexpected payments on a timely basis can have serious ramifications. In particular, when a company cannot cover its obligations, it might jeopardize access to external sources of funding and become a forced seller of assets at unfavorable prices; it might also damage its reputation in the marketplace, create investor and creditor unease, and attract unwanted scrutiny from regulators and rating agencies. Any of these events can lead to instances of financial distress, some of which can culminate in bankruptcy. A company might appear to be perfectly sound from a capitalization perspective (possessing sufficient capital and reasonable leverage), but if it lacks the cash to meet obligations, it might actually be forced into default. Preventing such an event through active management of liquid resources is thus powerful motivation for a firm’s leadership.

Liquidity is also necessary in order to fund asset growth. Although capital is the essential ingredient in long-term investment, expansion, and research and development, liquid resources make possible the initial and periodic payments that are necessary to put plans into motion. Since companies depend on growth to build enterprise value, an ability to properly finance such expansion is imperative.

Endogenous liquidity risk can arise for a number of reasons, as we shall note in subsequent chapters. Broadly speaking, liquidity risks are induced by operating risks, credit and market risks, management/reputational problems, and legal/regulatory/compliance difficulties. Actual exposure and risk of loss can intensify dramatically when several of these forces are combined. Operating risks, including disruptions in daily business flows (such as sourcing, acquisition, extraction, transportation, and so forth) can impact cash flows and generate liquidity losses. Although the prudent company will typically have some type of pre-loss financing in place – through insurance, contingent capital or funding, or other forms of risk mitigation – access might be delayed, or coverage might prove inadequate. Those that lack any pre-loss financing at all can face even more severe problems.

Credit risks can lead to liquidity problems if a counterparty fails to perform on a contracted transaction, such as a derivative or loan. The party (perhaps a bank or another company) expecting its counterparty to supply a cash flow will not receive what it should and might experience a liquidity deficit as a result. Market risks can similarly create losses in a firm’s trading and investment portfolio, leading again to a cash flow shortfall. Although this mainly impacts companies following mark-to-market accounting policies, it can also affect companies that have experienced a permanent impairment in asset value. Management, reputational, regulatory, and compliance problems can also cause, or intensify, liquidity risk. A firm that has damaged its reputation through particular behaviors (such as financial mismanagement, fraud, or product liability/recall) might lose customers and business revenues, causing investors and creditors to re-evaluate their willingness to supply funds. Regulator...

Table of contents

- Cover

- Title

- Part I Elements of Corporate Liquidity

- Part II Liquidity Problems

- Part III Managing Liquidity Risks

- Appendix: A Primer on Gap Management

- Notes

- Selected References

- Index