- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The XVA of Financial Derivatives: CVA, DVA and FVA Explained

About this book

This latest addition to the Financial Engineering Explained series focuses on the new standards for derivatives valuation, namely, pricing and risk management taking into account counterparty risk, and the XVA's Credit, Funding and Debt value adjustments.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The XVA of Financial Derivatives: CVA, DVA and FVA Explained by Dongsheng Lu in PDF and/or ePUB format, as well as other popular books in Commerce & Ingénierie financière. We have over one million books available in our catalogue for you to explore.

Information

II EXPOSITION OF VARIOUS VALUATION ADJUSTMENTS

Introduction

Traditional derivatives valuations are developed based on the concept of risk neutral and no arbitrage. A risk neutral portfolio should return a risk-free rate, meaning the future cash flows should be discounted using a risk-free rate. Before the 2008 Lehman-induced credit crisis, the prevailing risk-free rate used in the market was the LIBOR rate. If all market participants are discounting cash flows using the same rate, it becomes the market pricing. In the good old days before the crisis this worked well.

Much like the 1987 Black Monday crash taught people the importance of tail risk and volatility skew, the financial turmoil around 2008 has shown people that credit default can be real for very large size financial institutions and entities with superior ratings, and it can come very quickly. The super-senior AAA-rated CDOs, CDO-squares and the like are prone not only to the rating agency flaws, but also the disastrous model problems. The demise of Lehman Brothers and the impact on the financial world could have been much worse if not for the tremendous amount of rescue effort by the US government, the Fed, European Central Bank and government entities throughout the world.

The Lehman default sent the market into a rapid downward spiral, which put all banks and financial institutions into defensive mode. With many firms fighting for their own survival, the liquidity in the market dried up very quickly: firms were extremely cautious when lending to others while many assets became illiquid. Some markets disappeared completely, such as the commercial paper market and the synthetic funding structure market such as structured investment vehicles (SIV). This liquidity squeeze led the skyrocketing of short-term borrowing cost, and showed the market the importance of funding and liquidity. In a stressed market, funding can be very difficult and costly over an extended period of time. Without being prepared, it is easy to have a “run” on the bank and quickly one falls into default.

The funding of uncollateralized derivative trades can lead to significant liquidity issues for the lender. In a bad market, dealers refuse to trade with counterparties who could be viewed as having a liquidity problem, or ask for more collateral from the badly viewed names. Without being prepared with sufficient capital for such a stressed scenario, a financial firm simply cannot survive without external help, such as from government. Regulators quickly came to realize the importance of liquidity and capital – or the lack of liquidity and capital – during the financial crisis. This has formed the basis for the new regulations that came about as a result of trading, risk management, finance, capital and liquidity, among many other things.

The Lehman-triggered credit crisis resulted in some permanent impacts on the market. The split of the degenerate LIBOR curve into multiple LIBOR basis curves is one of them. The split of LIBOR basis curves reflects the market perception of different credit risk for different frequency of LIBOR payments. Incorporating credit default risk accurately in derivatives valuations becomes prevalent practice in trading, financial accounting and risk management. With the funding cost being real, more and more banks with centralized funding desks started to include the funding cost as an essential part of the daily profit and loss of each line of business, as well as financial reporting. Moreover, more and more stringent rules and regulations from various authorities and agencies have been implemented and enforced.

Illustration of XVA calculation logistics for typical client quoting

While the management of credit risk in banks has quite a long history, the years since 2008 have seen the shift from a passive credit limit-based management to a more active management with more accurate quantitative measures and applications in a much broader scope. Similarly, funding cost management for a derivative desk is not a new concept, either. The practice of calculating funding cost has been in the large investment banks for years; however, it was never really done it on a consistent portfolio basis, but more from an accounting perspective. The 2008 credit crisis changed all that permanently. More and more banks are accounting for funding cost in marking derivatives portfolios; funding and liquidity costs are measured with businesses as well as capital rules in mind. While this process is still evolving, we attempt here to explain all these from a practical perspective.

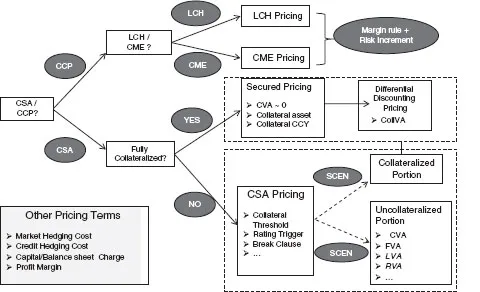

In the diagram above, we show a simplified logistics used by dealers in typical client quoting activity. When a customer requests a quote, the dealer may ask the following questions sequentially:

1.Is it a bilateral trade with CSA or a central cleared trade? For a central cleared trade going to central counterparties (CCPs), it would go into differential pricing on CCPs given the margin rules and incremental risk from the incoming position.

2.For a bilateral trade, is it fully collateralized? If it is fully collateralized, the derivatives pricing would enter into the secured pricing world, which bears little credit risk and small CVA. However, one would need to differentiate different collateral assets and collateral currencies embedded in CSA. We call this part of the calculation differential discounting pricing. The value of the collateral can be coded as collateral value adjustment, or CollVA.

3.When a bilateral trade is not fully collateralized one normally has to figure out, by way of scenarios, the collateralized portion and uncollateralized portion of counterparty exposures. For the collateralized portion, one can resort to differential discounting; while for the uncollateralized portion, one would have to consider CVA, FVA, LVA, RVA and possibly other XVAs.

In this part of the book, we will cover the basics of valuation adjustments, as being the result of credit defaults, and funding cost, namely Credit Value Adjustment (CVA), Debit or Debt Value Adjustment (DVA), and Funding Value Adjustment (FVA). We will also briefly cover Replacement Value Adjustment (RVA), Liquidity Value Adjustment (LVA) and Capital Value Adjustment (KVA). While some of these have become discussed extensively among financial professionals, others have emerged and not been given the attention they merit.

3 CVA Primer and Credit Default

3.1 Risk-free rate, overnight index swap (OIS) rate and LIBOR curves

The “risk-free” rate is at the heart of derivative valuations in the form of discounting of future cash flows or evaluating investment returns. In the following we discuss the so-called “risk-free” rate, OIS and LIBOR curves.

3.1.1 Risk-free rate and OIS discounting

Before the 2008 financial crisis, LIBOR benchmark rates were treated as “risk-free” rates in discounting future cash flows by the broader market. This worked well until the Lehman default, which triggered the subsequent credit and liquidity meltdown. In Figure 3.1, we show the benchmark 10-year swap rate with the 3-month Fed Fund–LIBOR spreads from 2005 to 2014. In October 2008, the 10-year swap rate dropped from around 4% to below 3% (right scale), the 3-month Fed Fund–LIBOR spread widened to over 350bps (left scale), reflecting the sharply increasing credit and liquidity risk; meanwhile, another credit indicator, the TED spread, peaked at over 450bps. This clearly calls into question the use of LIBOR as the “risk-free” rate in derivative valuations.

The LIBOR as “risk-free” rate was based on the fact that it was close to AA-rated interbank loans. This was expected to be low risk, but as witnessed in times of stress, this risk could be substantial. Instead, the overnight index swap (OIS) rate has become the new benchmark “risk-free” rate; for example, Fed funds (FF) rate in USD, EONIA for Euros and SONIA for Sterling. The Fed funds rate is the interest rate at which depository institutions lend balances at the Fed Reserve to other depository institutions overnight. The Fed fund rate is achieved by the Federal Reserve through open market operations, such as repo and reverse repo of government and agency securities. The weighted average of overnight borrowing and lending among the banks is expected to be the Fed funds rate.

Compared to other interest rate benchmarks, the OIS rate is the closest to a “risk-free” benchmark rate. It is considered safer than unsecured deposits because it occurs in the Federal Reserve System under the oversight of the Federal Reserve. The OIS has also ...

Table of contents

- Cover

- Title Page

- Copyright

- Contents

- List of Figures

- List of Tables

- Acknowledgements

- Introduction

- I INTRODUCTION TO DERIVATIVES TRADING

- II EXPOSITION OF VARIOUS VALUATION ADJUSTMENTS

- III XVA MODELING AND IMPLEMENTATION

- IV XVA RISK MANAGEMENT AND HEDGING

- Notes

- Bibliography

- Index