eBook - ePub

Understanding Alternative Investments

Creating Diversified Portfolios that Ride the Wave of Investment Success

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Understanding Alternative Investments

Creating Diversified Portfolios that Ride the Wave of Investment Success

About this book

Walker outlines the tools necessary to evaluate alternative investments and further diversify your portfolio using hedge funds, real estate, venture capital, gold and more. Using ground-breaking data on alternative investments, the author explores how to apply new risk measurements for building a portfolio with these investment vehicles.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Understanding Alternative Investments by S. Walker in PDF and/or ePUB format, as well as other popular books in Business & Servizi finanziari. We have over one million books available in our catalogue for you to explore.

Information

1

DOES THE UNIVERSE MOVE IN WAVES?

Besides the exploration of alternative investments and how they move in waves, Understanding Alternative Investments reviews how occurrences in nature, such as waves, can be used in finance. That is, the study of waves can be used for additional knowledge about investing in alternative investments. Ocean waves are generated by wind energy: “Wind energy is imparted to the sea surface through friction and pressure, causing waves. As the wind gains strength, the surface develops gradually from flat and smooth through growing levels of roughness. First, ripples form, then larger waves, called shop. The waves continue to build, their maximum size depending on three factors: wind speed, wind duration, and the area over which the wind is blowing, called the fetch.”1 Years ago, I was vacationing in Avalon, New Jersey, for the summer. Sitting on the beach, staring out at the ocean, I pondered how waves never stopped rolling in; they are incessant. Moreover, they could change direction, speed, and height in an instant. They were also influenced by the weather and other events. No wave is ever the same, but they share similarities. For example, I noticed the curve of a wave was not too different from any of the shells at my feet. Surfers love this curve, called the “barrel.” While it seemed far-fetched at the time, I wondered if these patterns or cycles could be broken down into mathematical equations. I thought of how these waves were calm but could suddenly turn into rogue waves, not too different from the storms on Wall Street, otherwise known as recessions or depressions. I was convinced that nature might teach us something about investing.

Financial waves exist on Wall Street and not every day is a sunny one. Financial storms happen and can be quite devastating, not too different from hurricanes or other natural storms by sea. Hurricanes can and will happen. Likewise, financial storms are beyond our control. Whether they are financial or not, storms can cloud our vision and lead us to make bad decisions while in a panic mode. Paradoxically, often the worst of times are the best of times to invest. Alternative investments all move in waves. Patterns, cycles, and trends occur with alternative investments. There are waves that exist with hedge funds, venture capital, commodities, real estate, LBOs, and managed futures.

After Wave Theory for Alternative Investments was released in 2010, I noticed a torrent of articles from newspapers and magazines covering different types of waves, figuratively and literally. One important non-finance wave that developed was one I call a “Protest Wave” or wave of protest exemplified by the movement, Occupy Wall Street. “In many cities (notably London, which has followed the example set by Occupy Wall Street in New York) the protesters have set up encampments that are meant to last indefinitely; in others they came and went. Defining where the wave of protests started is hard.”2 A current wave of animosity and distrust of large banks is transparent and will likely continue until all the shenanigans stop. When protestors gather in 900 cities around the globe, it signifies a real problem.

There also appears to be a mergers and acquisitions (M&A) wave forming amongst registered investment advisors (RIAs). According to industry-wide data compiled by Schwab Advisor Services, in the first quarter of 2013, RIA M&A activity recorded its highest number of deals since the first quarter of 2012, with 13 completed deals totaling $5.8 billion.3 The following RIAs were involved: United Capital, Exencial, Silver Lane Advisors LLC, Luminous Capital Holdings LLC, Mt. Eden Investment Advisors LLC, Hanlon Financial Group, and LPL Financial, to name a few. Waves are prevalent.

Another powerful wave that seems to be forming is that of investors and financial advisors being more attracted to the model of an investment firm versus a “bulge bracket” firm, which was the basis behind Glass-Steagall years ago. I call this wave the Bank Wave. Former heads of the big banks that advocated large universal banks have changed their minds. “Critics of the bank expansions include Philip Purcell, former chairman and chief executive of Morgan Stanley, and Sheila Bair, former head of the Federal Deposit Insurance Corporation. John Reed, who ran Citicorp before it was merged with Travelers Group Inc. in the 1998 megadeal creating Citigroup, and recently retired Citigroup Chairman Richard Parsons have said it was a mistake to allow the creation of the big financial conglomerates.”4 Megabanks might be too unwieldy and cause additional problems. Citigroup grew too large and the US Government essentially broke up the bank and sold parts off after the Great Recession. The result was beneficial and Citigroup prospered. Many investment firms did quite well during the Great Recession and continue to attract top tier talent and investors looking for an alternative to the big banks or “bulge bracket” firms.

WAVES IN SCIENCE

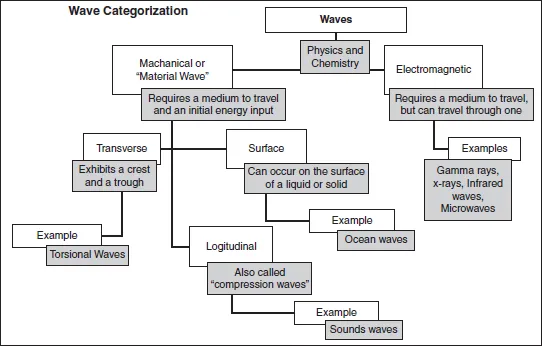

Waves vary in each scenario. The patterns, cycles, or trends that I have identified with waves and alternative investments might actually be found on a much larger scale with the universe. Waves are found in numerous places and differ from one another, such as transverse (a disturbance sends waves perpendicular to the original wave) and longitudinal waves (a disturbance that sends waves in the same direction as the original wave). In mathematics and science, a wave is a disturbance that travels through space and time, usually accompanied by the transfer of energy.5 Waves are repetitive. They move in cycles.

The question of how the universe commenced has been debated for millennia. Albert Einstein suggested that the universe was formed from a large explosion (the “Big Bang”). As we know, evidence of the Big Bang was discovered in 1965, ten years after Einstein’s death. Scientists concluded that the Big Bang was the beginning of all space and time. The universe was thought to have begun with the Big Bang approximately 14 billion years ago and has expanded ever since. Another more recent belief is cyclical, where the Big Bang happened not just once but a myriad of times. Paul Steinhardt and Neil Turok describe a cyclical model of the universe:

Which proposes that the big bang repeats itself every trillion years or so leading to the formation of new galaxies, stars, and planets each time. Instead of relying on inflation to smooth out the original fluctuations, the model has an ultra-slow phase of contraction leading up to each bang that smoothes and flattens the universe naturally. Hence, the cycles are interwoven. The events at the end of one cycle determine the large-scale structure in the cycle to come.6

Dr. Paul Frampton, Louis J. Rubin Jr., and Lauris Baum, all from the University of North Carolina, believe there are four parts to a cyclical universe: expansion, turnaround, contraction, and bounce.7 It is possible that the universe moves in waves; there could be a pre-big bang alternative or cyclical model. Years ago I pondered whether or not alternative investments move in waves. As Carl Sagan states in Broca’s Brain, “The universe forces those who live in it to understand it.”8 We learn new things about science just as we do with finance. For example, gravitational waves were found, shedding light on another type of wave: “One of the most exciting new developments in physics is the imminent advent of gravitational wave astronomy—viewing the cosmos not with light and its electromagnetic complements like radio, x-rays, infrared, microwaves and gamma-rays, but rather with ripples of gravity, or gravitational waves.”9 Studying various waves helped me with the premise that alternative investments move in waves. Antiquated theories or old beliefs should be replaced with new ones. New scientific studies replace old ones that are no longer applicable.

There are many different types of waves that we are oblivious to but they still exist. Sitting on a beach, once can observe “ocean” waves. “Light” waves from the sun help with a summer tan. When you head home from the beach and put something in the microwave oven, one is exposed to “microwaves.” Microwaves are even used with executing trades on Wall Street. On your way to work in the morning, you turn on the radio to hear how your sports team did or to listen to some music. The sounds you hear involve “radio waves.” Scientists are even working on T-waves or Terahertz waves that are in between microwaves and infrared light waves. For example, the California Institute of Technology is working on a chip that enables T-waves to penetrate a wide variety of non-conducting materials. One day, like Superman, it will be possible for us to use a cell phone to see through paper, plastic, wood, masonry, clothing, and ceramics. The bottom line is that there are different types of waves that surround us day to day. Figure 1.1 is a Wave Categorization chart that provides some of the examples and types of waves that exist in chemistry, physics, and mathematics.

Figure 1.1 Types of Waves in Nature with Examples.

Source: Author.

OCEANIC WAVES

The best-known waves are ocean waves. The base substance, water itself, has many unusual properties, such as high surface tension and heat capacity, which are of tremendous significance to everything from the oceans’ ability to support life to their stabilizing effect on the world’s climate, and their ability to transmit waves.10 Today there are even devices that monitor ocean waves. “Pennington-based Ocean Power Technologies Inc. last week announced the trial deployment of an autonomous wave energy device, part of the company’s PowerBuoy product line.”11 By studying ocean waves, one might derive a better understanding of waves found with alternative investments.

In “Ocean Waves,” there are numerous studies regarding wave height in the sea including during hurricanes: “It is of interest, however, to estimate the largest wave height in the long term when sea severity is changing. A typical example of this situation is the estimation of extreme wave height during a hurricane including the growing and decaying stages of the sea condition.”12 In 1973, Borgman developed an approach for estimating extreme wave height during a hurricane. However, in order to estimate extreme waves and sea states, it is necessary to gather enough data over a fixed time period. It does not appear that there is a perfect way to predict extreme values of waves and sea states. There is no theoretical basis for selecting any particular probability distribution to characterize significant wave height data.13 Rogue waves were discussed in Wave Theory for Alternative Investments. “An unusually high single wave event observed offshore is commonly called a freak wave. This definition is somewhat obscure since neither the cause of the occurrence nor criteria to define freak waves have been clarified. Freak waves have been observed only rarely and these observations occurred under unexpected conditions: hence, only few measured data are available.”14 Freak waves or rogue waves can be seen in the financial markets, as recently witnessed in the Great Recession.

Naysayers believe that one cannot predict or forecast a wave, whether it is found in the ocean or on Wall Street. Yet one individual formed a company that actually predicted waves in the ocean. His name is Sean Collins, the surfing swami who developed a wave-prediction program called Surfline. “Sean Collins transformed the search for a perfect wave from a spiritual quest to something like a science.”15 Surfers swear by his program. Surfers want to find the best waves. Using undersea maps with satellite and buoy data, Collins became adept at predicting good surfing waves based on the weather.16 It is not inconceivable that one day software will exist that guides investors to making better choices with alternative investments.

FINANCIAL WAVES

Just as there are different types of waves found in the ocean, there are financial waves such as IPO waves, M&A waves, equity waves, fixed income waves, cash waves, value waves, growth waves, foreign bond waves, and others. Securities called Credit-Default Swaps, which are traded amongst banks and various institutional investors, can move in...

Table of contents

- Cover

- Title

- INTRODUCTION That Was Then, This Is Now

- CHAPTER 1 Does the Universe Move in Waves?

- CHAPTER 2 Not All Financial Advisors Are Created Equal

- CHAPTER 3 Access to Alternative Investments and Competitive Advantages

- CHAPTER 4 The Changing Financial Landscape

- CHAPTER 5 I Hate To Say It, But I Told You So

- CHAPTER 6 The “Smart Money” Is Globa

- CHAPTER 7 Hedge Funds: Evil or Angels in Disguise?

- CHAPTER 8 The Fools’ Gold or the Real Deal?

- CHAPTER 9 Venture Capital

- CHAPTER 10 Asset Allocation and Alternative Investments

- CHAPTER 11 Modern Portfolio Allocation

- CHAPTER 12 Devising Portfolios with Alternative Investments (Active vs. Passive)

- CHAPTER 13 The Asset Allocation Process and Sample Portfolios

- Notes

- Index