![]()

1

Enterprise Risk Management

Introduction

Living and working in today’s environment involves many risks. The processes used to make decisions in this environment should consider the need both to keep people gainfully employed (through increased economic activity) and to protect humanity from threats arising from human activity. Terrorism led to the gas attack on the Japanese subway system in 1995, to 9/11 in 2001, and to the bombings of the Spanish and British transportation systems in 2004 and 2005 respectively. But nature has been far more deadly, with hurricanes in Florida, tsunamis in Japan, earthquakes in China, and volcanoes in Iceland. These locations only represent recent, well-publicized events. Nature can strike at us anywhere. We need to consider the many risks that exist, and to come up with strategies, controls, and regulations that accomplish a complex combination of goals.

Risks can be viewed as threats, but business exists to cope with risks. No one should expect compensation or profit without taking on some risk. The key to successful risk management is to select those risks that one is competent to deal with, and to find some way to avoid, reduce, or insure against those risks not in this category. Consideration of risk has always been part of business, manifesting itself in the growth of coffee houses such as Lloyd’s of London in the 17th century, spreading risk related to cargoes on the high seas. The field of insurance developed to cover a wide variety of risks, related to external and internal risks covering natural catastrophes, accidents, human error, and even fraud. Enterprise risk management (ERM) is a systematic, integrated approach to managing all risks facing an organization. It focuses on board supervision, aiming to identify, evaluate, and manage all major corporate risks in an integrated framework. The board is responsible for providing strategic input, identifying performance objectives, making key personnel appointments, and providing management oversight. Enterprise risks are inherently part of corporate strategy. Thus consideration of risks in strategy selection can be one way to control them. ERM can be viewed as top-down by necessity for this reason.

Definition

Risk management can be defined as the process of identification, analysis and either acceptance or mitigation of uncertainty in investment decision-making. Once risk has been processed in this manner, risk management seeks coordinated and economical application of resources to control the probability and/or impact of adverse events, and to monitor the effectiveness of actions taken.1 Risk management is about managing uncertainty related to a threat. ERM has been recognized as being one of the most important issues in business management in the last decade. There are systematic variations in ERM practices in the financial services industry. There is a need to monitor and address all risks inherent in organizational operations as necessary to avoid economic catastrophe. There is a need to consider all corporate risks within a single ERM framework in order to gain long-run competitive advantage.

In the US, recent crises include the 2007 subprime crisis of the banking industry, the Fannie Mae and Freddie Mac crisis in secondary US mortgage markets, the failure of Lehman Brothers, Merrill Lynch’s takeover by Bank of America and insurance industry giant AIG applying for emergency financial support from the Federal Reserve. More recently, the H1N1 virus has sharpened the awareness of the response system worldwide. Risks can arise in many facets of business. Global economic crisis risks are profound and widespread over the last decade. Businesses in fact exist to cope with risk in their area of specialization. But chief executive officers are responsible for dealing with any risk that fate throws at their organization.

Risk management began in the financial disciplines. Financial risk management has focused on banking, accounting, and finance. There are many good organizations that have done excellent work to aid organizations dealing with those specific forms of risk, applying many types of models. Risk management can also be applied in other areas, to include accounting. Risk management can be defined as the process of identification, analysis and either acceptance or mitigation of uncertainty in investment decision-making. Risk management is about managing uncertainty related to a threat. Traditional risk management focuses on risks stemming from physical or legal causes such as natural disasters or fires, accidents, death and lawsuits. Financial risk management deals with risks that can be managed using traded financial instruments. The most recent concept, enterprise risk management, provides a tool to enhance the value of systems, both commercial and communal, from a systematic point of view. Operations research (OR) is always useful for optimizing risk management.

Accounting perspective

Accounting responsibilities involve auditing organizational operations to provide stakeholders with accurate, transparent information of finances. This includes assuring that a sound process is in place to detect, deal with, and monitor risk. The accounting approach to risk management is centered to a large degree on the standards promulgated by the Committee on Sponsoring Organizations of the Treadway Commission (COSO), generated by the Treadway Commission beginning in 1992. The Sarbanes–Oxley Act of 2002 outlines regulatory requirements for publicly traded firms to establish, evaluate, and assess the effectiveness of internal accounting controls. SOC has had a synergistic impact with COSO. While many companies have not used it, COSO offers a framework for organizations to manage risk.2 COSO objectives are:

1.Effectiveness and efficiency of operations

2.Reliability of financial reporting

3.Compliance with applicable laws and regulations.

To attain these objectives, COSO identifies the components of internal control:

•Control environment

•Risk assessment

•Control activities

•Information and communication

•Monitoring.

COSO was found to be used to a large extent by only 11% of the organizations surveyed, and only 15% of the respondents believed that their internal auditors used the COSO 1992 framework in full. Chief executive officers and chief financial officers are required to certify effective internal controls. These controls can be assessed against COSO. This benefits stakeholders. Risk management is now understood to be a strategic activity, and risk standards can ensure uniform risk assessment across the organization. Resources are more likely to be devoted to the most important risk, and better responsiveness to change is obtained.

The COSO framework

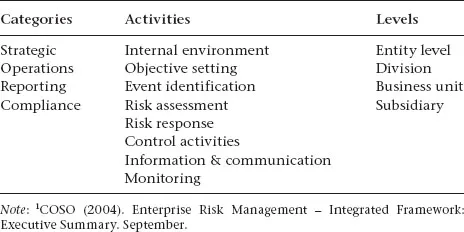

In 2004, COSO published an Enterprise Risk Management – Integrated Framework.3 COSO provides a framework to manage enterprise uncertainty, expressed in their ERM Cube. The cube considers dimension of objective categories, activities, and organizational levels, as shown in Table 1.1.

Table 1.1 COSO ERM cube1

This framework provides key principles and concepts, a common language, and clear direction and guidance.4

Categories

The strategic level involves overarching activities such as organizational governance, strategic objectives, business models, consideration of external forces, and other factors. The operations level is concerned with business processes, value chains, financial flows, and related issues. Reporting includes information systems as well as means to communicate organizational performance on multiple dimensions, to include finance, reputation, and intellectual property. Compliance considers organizational reporting on legal, contractual, and other regulatory requirements (including environmental).

Activities

The COSO internal control process consists of a series of actions.5

1.Internal Environment: The process starts with identification of the organizational units, with entity level representing the overall organization. The tone is set by the top of the organization. This includes actions to develop a risk management philosophy, create a risk management culture, and design a risk management organizational structure.

2.Objective Setting: Each participating division, business unit, and subsidiary would then identify business objectives and strategic alternatives, reflecting vision for enterprise success. These objectives would be categorized as strategic, operations, reporting, and compliance. These objectives need to be integrated with enterprise objectives at the entity level. Objectives should be clear and strategic, and should reflect the entity-wide risk appetite.

3.Event Identification: Management needs to identify events that could influence organizational performance, either positively or negatively. Risk events are identified, along with event interdependencies. (Some events are isolated, while others are correlated.) Measurement issues associated with methodologies or risk assessment techniques need to be considered.

4.Risk Assessment: Each of the risks identified in Step 3 is assessed in terms of probability of occurrence, as well as the impact each risk will have on the organization. Thus both impact and likelihood are considered. Their product provides a metric for ranking risks. Assessment techniques can include point estimates, ranges, or best/worst-case scenarios.

5.Risk Response: Strategies available to manage risks are developed. These can in...