![]()

1

Introduction to the Trading System at the Tokyo Stock Exchange

Abstract: In Chapter 1 we provide an overview of trading at the First and Second Sections of the Tokyo Stock Exchange. We discuss how investors can send bid–ask orders to the TSE and outline how these orders are executed. We also explained the arrowhead trading system, implemented January 2010; by reading our example of the market clearing process, readers should become familiar with TSE trading systems. Then we summarize relevant financial characteristics of the firms listed on both sections of the TSE.

Kubota, Keiichi and Hitoshi Takehara. Reform and Price Discovery at the Tokyo Stock Exchange: From 1990 to 2012. New York: Palgrave Macmillan, 2015. DOI: 10.1057/9781137540393.0006.

In this chapter we describe an overview of trading at the First and Second Sections of the Tokyo Stock Exchange (TSE hereafter). We also explain how transaction information is transmitted to security firms, institutional investors, and individual investors. This information is for readers who never look at TSE stock data even though they may have knowledge of financial economics, and for readers who have not traded TSE stocks even if they have other stock trading experience.

We explain institutional details and regulatory changes affecting Japanese stock trading in Chapter 2. These are TSE listing requirements, trading details, and disclosure rules; the new Companies Act; the Financial Instruments and Exchange Act (FIFA); and new and revised accounting standards.

Our explanation is based on the official TSE guidebook (TSE, 2012) and its official webpage (TSE, 2014). We try to accurately convey the minimum information necessary for our readers to understand the mechanism of stock trading. The TSE webpage information (viewed from October 2014 to January 2015) was the most recent at the time of writing.

1Listing on the Tokyo Stock Exchange

There are currently six stock markets at the Tokyo Stock Exchange, all part of the Japan Exchange Group. The daily public markets are: First Section, Second Section, Tokyo Mothers, JASDAQ, and TOKYO PRO MARKET. ToSTNeT is an off-time trading hour public market, classified as a PTS (proprietary trading system) (TSE, 2014).

There are also three smaller public stock markets, in Fukuoka, Nagoya, and Sapporo. The stocks listed on these exchanges are, however, smaller firms, and they are not dual-listed on the TSE,1 unlike in the US where 13 public stock markets compete for buy and sell orders of the same stocks (Lewis, 2014).

Overall, 3500 stocks are listed and traded every day in Japan, but most of the large firms are listed in the First Section (1840 firms) and the Second Section (541 firms), according to the October 21, 2014, TSE webpage. In 2007, the TSE was ranked fourth in both total volume and total value, after the NYSE Group, NASDAQ, and the London SE (Berk and DeMarzo, 2011).

The Japan Exchange Group was formed in January 2013 by the merger of the TSE and the Osaka Stock Exchange (OSE). The OSE within the Japan Exchange Group now specializes in derivative instruments, while the TSE handles all trading including the stocks listed previously on the OSE.

The requirements for listing on the First Section are (1) stockholders numbering more than 2200; (2) floating stocks (as defined by the TSE)2over 20,000 units and more than 35% of the stock issued; (3) market equity value (as predicted) over ¥25 billion, and so forth. We omit delisting conditions, but they are detailed on the English version of the TSE webpage.

2Trading mechanisms at the Tokyo Stock Exchange

Trading sessions are mornings (9:00–11:30) and afternoons (12:30–15:00), Monday through Friday. There are opening and closing auctions for both sessions called Itayose, to decide opening and closing prices, and Zaraba, for continuous auction trading during normal hours. For Zaraba trading, there are two types of orders: limit orders and market orders. There are also specific orders such as: (1) orders to be executed only during the opening auction; (2) orders to be executed only during the closing auction; (3) limit orders that become market orders at the closing session if not already executed (Stop Orders); and (4) Immediate or Cancel (IOC) orders (TSE, 2012). The settlement date is the third business day after the trade date.

In Itayose, all sell/buy orders must be executed in the morning opening session or the afternoon closing session. In the morning opening session, orders are handled as if they were received at the same time and are executed in descending order by the number of orders placed by brokerage houses. In the afternoon closing session, allocation by the limit price takes place when there is an order imbalance.

For Itayose, three conditions must be satisfied: (1) all sell/buy market orders must be executed; (2) all limit orders to sell (buy) at prices lower (higher) than the execution price must be executed; and (3) at the execution price, the entire amount of both all buy or all sell orders must be executed (TSE, 2012).

In the afternoon closing session, Itayose is used again, and the closing price is determined. However, when a possible clearing price may exceed (go below) the daily price limit (which we shall explain shortly), due to a large order from either the bid or the ask side, a special method to conduct a closing auction at the limit price is implemented.3

In Zaraba, however, which takes place during continuous trading hours in the morning and the afternoon sessions, the priority of order execution is first by price, and then – if the bid-and-ask limit order prices are equal – by time. In TSE trading, unlike on the NYSE, a daily price limit is imposed; for example, for a price between ¥500 and less than ¥700 the limit is ¥100; for a price between ¥2000 and less than ¥3000 the limit is ¥500; and so forth. Outside these limits, no trading is allowed to take place. The price limit is determined by the “base price,” which is usually the previous closing price. “Base price” exceptions are for large unbalanced orders from the previous day, when a special quote (explained below) is formally flagged, or on an ex-dividend day for dividend adjustments.

In addition, the executed price during the continuous auction has to stay within certain smaller parameters based on the previous executed price of the current day, even within the daily price limit. These parameters form the “special quotation renewal interval,” and if execution cannot take place within this interval, the TSE will announce a special quote (Tokubetsu Kehai) price as a boundary of the next price-change interval. For example, if the last executed stock price (or the special quote price) was between ¥500 and ¥699, the interval is ¥8 on either the upper side or the lower side, and if it is between ¥2000 and ¥2999, it is ¥50, and so forth. This special quote price is renewed every three minutes, if still not executed to meet the order imbalance of buy and sell orders.

TSE’s arrowhead system can process a single large order, either buying up or selling down, which stays within the bounds of the special quote renewal price, by using a “sequential trade quote.” When this order is received, the sequential quote is provided every one minute, which is within the bounds of twice the initial special quote range and in this case the Itayose trading method will be implemented.4

When specifying the bid or ask price for a trade, the price has to be on an integer base of Japanese yen. The pre-determined typical tick sizes for TSE stocks are as follows: 1 yen for stocks less than 3000 yen; 5 yen for stocks above 3000 and less than 5000 yen; 10 yen for stocks above 5000 and less than 30,000 yen; and so forth. After the launch of the arrowhead, the finer pre-determined tick price was provided.

For some stocks whose pre-determined minimum bid–ask spread was reduced, the effective spread of these stocks might have been reduced; this is an empirical question. If so, the resulting decrease in the bid–ask spread for some price ranges is expected to reduce the trading cost as measured by the spread. Note that changes apply to some stock price ranges, but not to others, so the researchers have to be careful to distinguish these stocks when analyzing the impact of the arrowhead on spreads.5

In market microstructure theory, bid–ask spread is considered a liquidity measure. We report some results in Chapter 3 and 5 on the trend of bid–ask spreads in the early years of the 21st century.

3Stock trading execution and trading information transmission

In this section, we first provide a concrete example of how the traded price is determined and how orders are executed during the Zaraba continuous auction sessions.

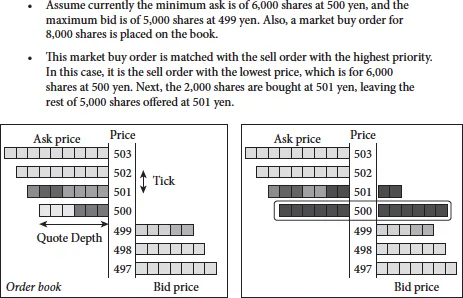

In Figure 1.1, assume the minimum ask (sell) price is currently ¥500 and there are 6000 shares of limit orders, the maximum bid (buy) price is ¥499, and there are 5000 shares of limit orders. We also assume that there are market buy orders of 8000 shares. Then, as the figure shows, this market buy order is first matched with the highest priority sell order. In this case, the sell order with the lowest price – 6000 shares at ¥500 – is matched first. Next, 2000 shares are executed at ¥501 from this market buy order, and leaving the rest of the 5000 shares offered at ¥501 unexecuted. The difference in the shades of the graph at the bid-and-ask shows how orders were executed and remain unexecuted.

FIGURE 1.1 Zaraba example (continuous auction)

The best four bid-and-ask orders in the graph are an illustrative example at the TSE – but what kind of order information is available to investors? The TSE provides two kinds of market information to investors; in Zaraba, (1) all quotes, without any processing, and (2) the processed information of order quantities at the best bid and offer, the second-highest to eighth-highest (-lowest) prices, and the aggregated bid (offer) quantity of the ninth-highest -lowest) prices or lower (higher). In Itayose trading, the information will be only up to the seventh (no aggregate) (TSE, 2012).

Commercial stock information vendors usually purchase Type 1 information, unprocessed, and provide it on a fee basis to customers such as investors, banks, and other information users. Depending on the fees, they may provide five best ...