1.1 Introduction

Quantitative finance traces its roots to modern portfolio theory. Despite the deficiencies of modern portfolio theory, mean-variance optimization nevertheless continues to form the basis for contemporary finance. The term postmodern portfolio theory captures many of the advances in financial learning since the original articulation of modern portfolio theory. A comprehensive approach to financial risk management must address all aspects of portfolio theory, from the beautiful symmetries of modern portfolio theory to the disturbing behavioral insights and the vastly expanded mathematical arsenal of the postmodern critique.

This survey of portfolio theory, from its modern origins through more sophisticated, “postmodern” incarnations, evaluates portfolio risk according to the first four moments of any statistical distribution: mean, variance, skewness, and excess kurtosis. Postmodern Portfolio Theory also evaluates the challenge that prospect theory and behavioral finance pose to portfolio theory and, more broadly, to quantitative finance. The efficient capital markets hypothesis and the conventional two-moment capital asset pricing model now compete with the postmodern alternative of an expanded four-moment capital asset pricing model and its behavioral extensions. Mastery of postmodern portfolio theory’s quantitative tools and behavioral insights holds the key to the efficient frontier of risk management.

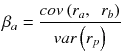

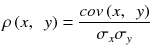

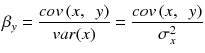

This book proceeds in four parts. Part 1 introduces portfolio theory. Chapter 2 expounds modern portfolio theory as a framework for assessing risk-adjusted financial returns. Conventional mean-variance analysis, the foundation of modern portfolio theory, emphasizes expected return, standard deviation, and beta. These quantitative measures are drawn from the lower moments of statistical distributions.

Chapter 3 outlines new approaches to portfolio theory that account for market abnormalities and investor behavior. The foundational theory of contemporary finance is riddled not only with mistakes in measurement, but also with mistakes in perception. At its most ambitious, the postmodern critique seeks ways to account for the destructive potential of systemic coordination and cascades. At its most modest, postmodern portfolio theory respects fundamental limits on human knowledge.

Parts 2 and 3 pursue the postmodern agenda for risk management by emphasizing asymmetry in finance and the higher statistical moments of financial returns. This book’s approach to postmodern portfolio theory emphasizes single-sided statistical moments, the statistical notions of skewness and kurtosis, and behavioral responses to these decidedly abnormal financial phenomena. Beginning with a bifurcation of beta on either side of mean returns, Part 2 of this book tours financial and behavioral space in search of a mathematically cogent account of risk on either side of mean returns. After a brief exploration of time series models that measure asymmetry in volatility alongside intertemporal changes in volatility, Part 3 specifies a four-moment capital asset pricing model based upon a Taylor series expansion of log returns.

Part 4 devotes additional attention to the problem of fat tails and kurtosis risk in finance. It does so by examining the treatment of value-at-risk and expected shortfall as measures of market risk in the trading book of financial institutions observing the Basel Accords on international banking regulation. Risk management, even when undertaken by some of the world’s largest financial institutions under central bank supervision, cannot fully escape mathematically dictated limitations on economic forecasting.