eBook - ePub

Technology Financing and Commercialization

Exploring the Challenges and How Nations Can Build Innovative Capacity

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Technology Financing and Commercialization

Exploring the Challenges and How Nations Can Build Innovative Capacity

About this book

This book offers insights on effective policies that can be applied to other economies in terms of using technology financing to foster technological innovations. It outlines the role of government in accelerating the nation's innovative capacity by promoting technology investments that will achieve successful and sustainable economic development.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Technology Financing and Commercialization by J. Wonglimpiyarat in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

Information

Part I

Concepts of Technology Financing and Commercialization

1

Introduction to Technology Financing, Technology Management, and Commercialization

This chapter provides an overview of technology financing and some important concepts related to technology commercialization. This chapter is organized as follows. Section 1.1 discusses the importance of technology financing with a focus on its relation to the high-tech industry. Section 1.2 reviews the concepts of technology and innovation management, generations of innovation models, and technology strategies. Section 1.3 deals with the process of technology commercialization. It also discusses the groups of customers in the marketing of high-technology products and the difficulties in crossing the chasm (that is, a move from the early adoption stage of technology to a mass market). In Section 1.4, the concept of national innovation system (NIS) is introduced to aid in the understanding of the role of institutional settings in supporting the production, diffusion, and exploitation of knowledge and innovations. This section also addresses the innovation-financing policies required for effective commercialization. Section 1.5 discusses various studies on the life cycles related to innovation management, the degree of technological change, and the concept of disruptive technology in the process of technological change. Section 1.6 discusses the Triple Helix model for competitive innovation systems and the role of clusters in facilitating innovation. Given the importance of science park environment to help entrepreneurial firms get started and grow, Section 1.7 reviews the role of science parks and incubators in supporting the growth of new technology-based firms and promoting technology commercialization (the term ‘technology-based firms’ refers to independent firms that are established with the purpose of exploiting technical knowledge or technological innovation and have substantial technological risks – Little, 1977; Storey and Tether, 1998).

1.1 Introduction to technology financing – why it is important?

According to the United Nations Millennium Development Goals (MDGs), finance can contribute to income growth and poverty reduction. Finance has been regarded as an essential resource for technology entrepreneurs. However, one of the most important issues facing the new business start-ups is their ability to access finances (Pissarides, 1999; Gompers and Lerner, 2001; Denis, 2004; Mani, 2004; Hyytinen and Toivanen, 2005; Wonglimpiyarat, 2007). Financial aspects are incorporated into various activities of start-up businesses. Technology financing is generally concerned with the process of technology and innovation management as well as technology commercialization.

In this study, technology financing is defined as the process of funding innovative businesses to turn technological inventions into commercial innovations. The financing mechanisms can be seen as co-evolving with the high-tech industry because their main activities involve research and development (R&D). Technology financing plays an important role in supporting high-technology start-ups at different stages of the innovation process. The definition is provided in Section 2.1.

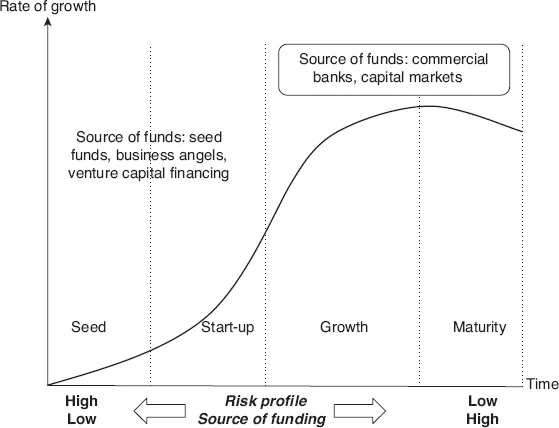

Figure 1.1 shows the funding requirements along the life cycle of technology-based firms from seed to start-up to growth and maturity stages (Wonglimpiyarat, 2009a). It can be seen that in the early stage of the life cycle, start-up firms often face difficulties from lack of collateral to access financial resources from banks and other financial institutions. The formal source of finance from commercial banks and capital markets is available at later stages of the life cycle. Given the risky nature of financing new ventures, the source of finance for early-stage ventures is rather limited. Therefore, seed funds, business angels, and venture capital (VC) financing provide important sources of risk finance for high-risk, early-stage start-ups.1

Finance is an important factor influencing and supporting entrepreneurship. At the seed, start-up, and early stages, a new entrepreneur needs equity financing. Seed funds or capital from private individuals play an important part in the growth of technology-based firms. In later stages (growth stage onwards), commercial banks and capital markets are critical for further growth of successful technology-based firms. From the entrepreneurial financing perspective, firms need capital to turn new ideas into prototypes and prepare for commercial launch. They need funding to cover all the R&D expenses and costs of production. In the later stages of growth, firms may need more capital to grow and expand their production (Allen, 2003). Microsoft, Apple, and Google are companies that first started their businesses with VC funding (VC is a type of equity financing used to fund promising, high-risk, operating companies, often high-technology firms with high growth and exit potential). Microsoft first raised funds from venture capitalists before going public to raise further funding (See Box 1.1).

Figure 1.1 Funding requirements along the life cycle of technology-based firms

Source: Wonglimpiyarat (2009a).

Box 1.1 Microsoft Corporation

Microsoft began its business in personal computing in 1975. The company was founded by Bill Gates and Paul Allen who developed the Altair BASIC program. Microsoft used VC financing to expand its business in the 1970s. Microsoft first issued its stock and had its initial public offering in 1986, which allowed the company to expand. The opening stock price of Microsoft was USD 21 and rose to USD 27.75 at a close. Five years later, Microsoft had a return of 1,336%. As at 2013, Microsoft is the largest software company in the world, dominating the operating systems for all PCs, and hires around 97,000 employees. Realizing how hard it is to start a business, Microsoft has set up a VC division to provide funding and computing and software services, such as cloud computing and an accelerator program, for early-stage ventures as Microsoft knows that start-ups face many problems in business financing. The VC fund helps to expedite the innovations of technology-based firms in the market.

Innovation and entrepreneurship are recognized as engines of economic growth. Growing entrepreneurship may need a proper innovation-financing system to provide various supports to encouraging entrepreneurial activities and foster new ventures. In developing economies, innovation-financing policies play an increasingly important role in entrepreneurial, venture, and economic development (David et al., 2000; Hall and van Reenen, 2000; Hyytinen and Toivanen, 2005). Innovation-financing policies are among the key operational priorities in developing countries to support investment by local firms, especially small and medium enterprises (SMEs), and transnational corporations investing in these countries. (The term SMEs refers to firms employing between 10 and 250 workers, according to the European Union (EU) and the Organisation for Economic Co-operation and Development (OECD) countries (OECD, 2004) definitions.) In knowledge-based economies, economic growth is increasingly dependent upon innovation and access to finance is seen as a critical factor in this process (Bygrave and Timmons, 1992; Freeman and Soete, 1997; Pissarides 1999; Wonglimpiyarat, 2007, 2012).

Government policies are important in financing of technology-based firms, particularly in the early stages of their development. Given the high-risk nature of start-up firms, bank finance seems an inappropriate source of finance for start-up firms due to collateral requirements and banks’ risk aversion (Berger and Udell, 1998; Black and Gilson, 1998; Lockett et al., 2002;. Underlying the process of technology commercialization is the importance of government public policies to overcome the financing gaps (Lerner, 1999, 2002; Jeng and Wells, 2000; Mani, 2004). In developing countries, the government’s financing mechanism plays an important role in driving the innovation system (Mani, 2004). The set of institutions and financial policies is central to technology and innovation development in that the efforts of R&D institutions and industries can lead to effective technology commercialization, bringing about business creation and economic growth.

Innovation and high-technology policy can assist firms at early stage of development by using risk capital to provide potential economic progress. Technology financing is the necessary resources for early-stage ventures, given the risk-averse nature of conventional financial intermediaries. However, technology financing not only concerns the availability of financial resources, but also management of technology and innovation to develop new ventures and support the commercialization of innovative projects. It is argued that the commercialization of technology requires effective relations and interactions among universities, industry, and government (see Triple Helix Model – Section 1.6), along with appropriate public policy frameworks. Governments may consider the use of entrepreneurial financing schemes (loans, VC financing, grants, tax incentives, and capital market funding schemes) as policy instruments to finance technology-based firms.

Silicon Valley in the US is a good example of where the successful development of the high-tech industry is seen as a result of the government’s policy of stimulating the supply of VC to support technology-based firms (see Chapter 4). The dense industrial networks, knowledge intensity, community dynamics among businesses, governments and other sectors, high-quality labor markets, and the supply of VC help encourage entrepreneurship and experimentation in the Silicon Valley (Saxenian, 1994; Miller, 1999). The high-tech development in Silicon Valley is arguably the most developed in the US, and many governments around the world have tried to replicate its success.

1.2 Technology and innovation management

The terms ‘technology’ and ‘innovation’ have different definitions. New science or technology can lead to an invention, though it will not necessarily have commercial viability. The term ‘innovation,’ according the UK Department of Trade and Industry, is the successful exploitation of new ideas. Today, innovation is increasingly seen as a powerful way of securing competitive advantage and offering new ways of opening up new markets (Tidd and Bessant, 2009). More importantly, innovation has the underlying concept of commercialization – the successful entry of a new science or technology-based product into a particular market (Tidd and Bessant, 2009). Many scholars see technology as supply driven or technology pushed (Schumpeter, 1939) where innovations are perceived as a linear progression from scientific discovery or the lab to the marketplace. However, the demand-pull or market-pull model suggests the development of innovation where the market is seen as the source of new ideas to direct R&D (Schmookler, 1962).

The level of technological change is argued to be a fundamental driving force bringing about economic growth. In respect of evolutionary economics, technological change reflects innovative efforts, but with varying degrees of appropriability and uncertainty about the technological and commercial outcomes. Based to Dosi’s models of technological paradigms and trajectories, the term ‘technological paradigm’ is defined as a pattern for the solution of selected techno-economic problems, a pattern that is based on highly selected principles (Dosi, 1982, 1988a, 1988b). Similarly, Freeman and Perez (1986, 1988) used the term ‘techno-economic paradigm’ to refer to an innovation that affects the whole economy, for example, steam power, electric power, and electronic computers.

An innovation can also be seen as a result of interactions between technology push (Schumpeter, 1939) and demand-pull (Schmookler, 1962). The launch of the Xerox Star computer system in 1981 by the Xerox Palo Alto Research Center (PARC) is an example of technology push (Xerox PARC, with its strong R&D capability, provided the scientific base for innovation development) that failed to achieve commercialization. Xerox’s ideas were copied by Apple Computer, which successfully launched Apple L...

Table of contents

- Cover

- Title

- Introduction

- Special Introduction: The Entrepreneurial University Wave

- Part I Concepts of Technology Financing and Commercialization

- Part II Case Studies of Successful Technology Financing and Commercialization Programs

- Part III Forging Ahead – Innovative Case Studies in the Asian Economies

- Part IV Technology Financing to Enhance Innovative Capacity

- Notes

- References

- Index