The Changing Dynamics of International Business in Africa (Adeleye et al.

2015a,

b), the inaugural volume of the Academy of International Business Sub-Saharan Africa Chapter Book Series, provides multidisciplinary insights on inward foreign direct investment (FDI) to Africa, outward FDI from Africa, and intra-regional FDI in Africa. Highlighting the emerging trends, key issues, complexities and challenges of doing business in the Sub-Saharan Africa region, the book deliberately covers a wide range of topical issues. As the editors observe, one phenomenon remains understudied in the international business literature: the marked increase in intra-African trade and investment, or Africa-to-Africa internationalization.

While much attention in the international business literature has focused on the rise of FDI from BRIC countries into Africa, the literature on intra-African and outward FDI from the region is scant. This is surprising, given the marked increase in the internationalization activities of African firms in the last decade or so: South African multinationals such as MTN, SABMiller, Standard Bank, Telkom, Dimension Data, Massmart, Nampak and ShopRite now have a presence in at least a dozen African countries, as do Nigerian firms such as Dangote and UBA … Togo-based Ecobank has established a significant footprint across the region, with operations in 33 countries. This phenomenal increase in the internationalization activities of African enterprises provides an interesting opportunity to explore the patterns, strategies, barriers and outcomes of the ‘Africa-to-Africa Internationalization’. Adeleye et al. (2015a, b): 5–6

This volume therefore seeks to address this major gap in the literature. Africa-to-Africa Internationalization: Key Issues and Outcomes examines the key issues, challenges and prospects of intra-African FDI and provides guidance on avenues for future research. The goal is to increase our understanding of Africa-to-Africa internationalization and, ultimately, to stimulate research about this important but under-researched topic. This introductory chapter provides an extensive overview of Africa-to-Africa internationalization and is organized into three main sections. In the first section, we provide contextual information on Africa’s position in the global economy. The second section focuses on the internationalization of African firms, examining current trends, key issues and challenges. In the third section, we highlight the five thematic areas and issues covered in this volume: the rise of pan-African banks, corporate political activity in the context of business regionalization, internationalizing in the digital era, internationalizing in a VUCA region (a region characterized by volatility, uncertainty, complexity and ambiguity), and building proudly African businesses and brands.

Background: Africa in the Global Economy

The global economy is witnessing rapid growth in the economies of developing nations, to the extent that the conventional wisdom that major international business and investment activities are undertaken primarily by multinational enterprises originating from developed economies has come under scrutiny (Sun and Lee 2013). In particular, the global economy has witnessed an increasing number of excellent business models and innovations from the developing world, such that multinationals originating from the developing world are now able to compete with rivals from developed economies (Luo et al. 2011). Meanwhile, as the developing economies of Africa, Asia, Eastern Europe and Latin America continue to outgrow developed economies, as economic prosperity spreads across multiple developing economies, and as these countries continue to be viewed as attractive locations for global investments (UNCTAD 2012), developed economy multinationals, such as Microsoft, General Electric and Cisco, have begun to look to such markets to strengthen their growth trajectories (Khanna and Palepu 2010). While success stories continue to be told about the big emerging markets of Asia (e.g. China and India) and Latin America (e.g. Brazil and Chile) and the transition economies of the former Soviet Union and Eastern Europe, success stories of emerging markets in Africa (e.g. Kenya, Nigeria and South Africa) are seldom the topic of discussion in international business research and policy debates. Indeed, Africa is often in the news for negative reasons: stories of extreme and challenging conditions, including civil wars, revolts, famines, diseases and corruption, often attract headlines in the global press.

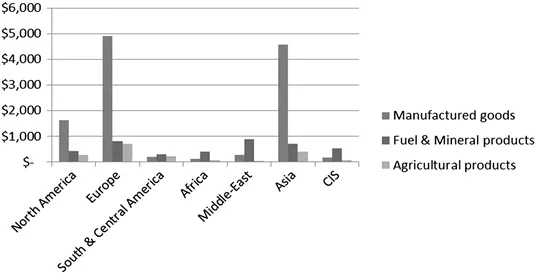

At international business and trade forums, discussions tend to coalesce around the idea that Africa is isolated and disconnected from global business and trade activities. Arguments have been put forward that while other continents, particularly Europe, have removed most barriers to international trade, resulting in free movement of goods, services and people, the African continent is still burdened with heavily militarized national borders that hamper free movement of goods, services and people from within and outside the continent. It is also argued that free trade is impossible in Africa because Africa does not have much to offer the world by way of trade links: shipping routes, air networks and internet connections (for both communication and for commerce) to the global economy are underdeveloped. For example, businesses in Africa are required to deal with multiple and incoherent sets of national contract laws, adding billions a year to transaction costs for businesses. Less than 1 % of African consumers shop online within an African border, and most African country markets are barred from online business transactions by severe internet security problems. Inbound financial transactions to Africa are saddled with multifaceted transfer problems, making it increasingly unsafe for multinational enterprises to do business with Africa cost effectively. Land and property ownership is a massive problem: traditional chiefs and kingships claim informal hereditary rights to landownership, making legal land acquisition in Africa by investors a big risk. While Africa also suffers from the notion of rich-country protectionism by the West, Africa’s own domestic policies on customs, tariffs and foreign investment lack transparency and consistency, and poor port and road infrastructure limits timely flow of merchandize goods. Africa’s high land transportation costs limit cross-border transactions. Barriers to crossing borders within Africa also restrict intra-African business, thus limiting Africa’s participation in the global economy. As can be seen in Fig.

1.1, Africa’s contribution to the global economy seems to be negligible compared to other regions.

The Global Flow of Foreign Direct Investment

As the world continues to struggle to recover from the impact of the 2008 financial crisis, and as many nations and regions continue to experience low economic growth, the flow of FDI globally has struggled to return to the growth rates experienced prior to 2008. From 2001 to 2007, global foreign direct investment inflows grew by a compounded annual growth rate (CAGR) of 18.3 %. However, from a post-2008 high of $1.58 trillion in 2011, global FDI inflows have declined by 21 % to $1.23 trillion in 2014. The fall in global FDI inflows has been influenced by a number of economic and political factors. These include the recent economic contraction in the major emerging markets of Brazil and Russia, lacklustre economic growth in the European Union, slowing economic growth in China, and ongoing geopolitical tension in various parts of the world compounded by a crash in oil prices that blew open a hole in the budgets of many oil-producing nations.

One key trend that has emerged from an examination of global FDI flows from 2008 to 2014 is the fact that developing countries, led by Asia and Africa, are now the major recipients of FDI. From 2011 to 2014, developing countries have seen their share of FDI increase from $639 billion to $681 billion, a 6.6 % increase. Over the same period, global FDI to developed countries fell drastically by 39 %, from $828 billion in 2011 to $498 billion in 2014. Faster economic growth coupled with improved macroeconomic management practices, high domestic demand, a relatively more stable political environment in developing economies, and increased government liberalization policies have improved investing prospects in many parts of the developing world, a trend that many investors seeking higher returns have sought to explore. While Asia continues to attract the largest share of global FDI, accounting for over 40 % of global FDI inflows, Africa’s share of this global FDI flow is increasing, a trend that has contributed to post-crisis average growth that is 2 percentage points above that of the world economy.

Foreign Direct Investment to Africa: Overview and the Growth of Intra-African FDI

Since 2005, Africa has experienced significant growth in FDI, from $14 billion in 2005 to $54 billion in 2014. This represents an 18.4 % increase on a CAGR basis, making Africa one of the world’s fastest-growing regions for foreign investment. Key factors that have contributed to the growth of FDI into Africa are the rise in commodity prices, increased government liberalization in certain sectors of the economy, including finance and telecommunications, and slow global economic growth in other regions of the world. These factors have made the faster-growing economies of Africa more attractive to investors, particularly emerging market investors. In recent times, however, following the dramatic decline in global commodity prices, FDI into Africa has declined slightly, from $56 billion to $54 billion in 2014. Egypt, Ghana, Nigeria, South Africa, and central African countries like Ethiopia have emerged as the major destination for FDI.

FDI inflows into Africa have traditionally been dominated by developed countries, with Western Europe and the United States providing substantial FDI in terms of capital invested and the number of projects engaged in. However, while Europe and North America have been the major sources of FDI funds, their share of the number of FDI-related products has stagnated.Intra-African investors are increasingly becoming a major source of FDI (as measured by the number of projects, see Table

1.1). In 2005, Africa’s share of total FDI projects announced on the continent amounted to approximately 7.9 %. By 2014, FDI projects originating from Africa had increased to about 19 %, led by transnational corporations from Nigeria, Kenya and South Africa. For many countries, particularly land-locked or non-oil-exporting countries, intra-African FDI remains a significant source of foreign capital. The increasing trend in intra-African FDI is in line with many African governments’ effort at improving regional ties by encouraging trade within Africa. Intra-African projects have been concentrated in manufacturing and services, particularly financial and telecommunications services. In contrast to external FDI flows, only 3 % of intra-African FDI projects were in the extractive industries during the period from 2009 to 2013. Intra-African trade, while small, is growing and is seen as a major source of expansion for many African corporations seeking to increase their presence outside of their home countries.

Table 1.1Major Sources of FDI Projects to Africa

Western Europe | 39.0 | 36.8 |

Africa | 7.9 | 19.2 |

Asia-Pacific | 17.5 | 15.7 |

North America | 24.6 | 14.7 |

Middle East | 8.0 | 9.1 |

Rest of Europe | 1.3 | 3.7 |

Intra-African FDI flows have taken an interesting and promising course in recent years. According to World Investment Report (2014), the observed increase in FDI to Africa is being sustained by growth in intra-African flows. Importantly, FDI inflows to Africa have risen by 4 % to $57 billion, an increase driven by international and regional market-seeking and infrastructure investments. In the period leading up to 2014, expectations for sustained growth of an emerging middle class attracted FDI in consumer-oriented industries, including food, information technology, tourism, finance and retail. The overall increase has been driven by the eastern and southern African sub-regions, while others have been experiencing falling investments. In southern Africa, flows have almost doubled to $13 billion, mainly due to record-high flows to South Africa and Mozambique. In both countries, infrastructure has been the main attraction, with investments in the gas sector in Mozambique also playing a role. In East Africa, FDI has increased by 15 % to $6.2 billion as a result of rising flows to Ethiopia and Kenya. Kenya is becoming a favoured business hub, not only for oil and gas exploration but also for manufacturing and transport. Ethiopian industrial strategy may have attracted Asian capital to develop its manufacturing base. FDI flows to North Africa decreased by 7 % in 2014 to $15 billion. Central and West Africa saw inflows decline to $8 billion and $14 billion, respectively, partly due to political and security uncertainties brought about by the Boko Haram insurgency.

Intra-African investments are also increasing, led by South African, Kenyan and Nigerian transnational corporations (TNCs). Between 2009 and 2013, for example, the share of announced cross-border greenfield investment projects originating from within

Africa increased to 18 % from less than 10 % in the preceding period. For many smaller African countries that are often land-locked or non-oil-exporting, intra-regional FDI is a significant source of foreign capital. Increasing intra-African FDI is in line with leaders’ efforts towa...