Abstract

The UK financial services industry is undergoing a period of deep transformation, which affects all industry participants. This chapter reviews the impact of the global financial crisis on UK banking and discusses the events that lead to unprecedented government intervention and subsequent regulatory reforms. It also provides an overview of the changing structure of the UK banking and financial sectors. While UK banking is still dominated by few very large banking groups, the recent entrance of new banks has increased its competitive nature, particularly in the retail banking sector.

1.1 Introduction

The UK banking and financial sector has been severely impacted by the events of 2007–2008, which resulted in UK banks suffering big losses forcing significant government intervention in the sector. State aid was then followed by wide-ranging regulatory reforms, aimed at making the sector more resilient to shocks, by limiting risk-taking and improving bank conduct. The main outcome of the reform process has been the Financial Services (Banking Reform) Act of December 2013, which targets bank business models, with a view to “ring-fence” retail and wholesale banking activities.

The UK banking market is dominated by the presence of large banking groups: Lloyds, HSBC, the Royal Bank of Scotland (RBS), and Barclays control nearly 50 % of the mortgage market, 77 % of the personal current account market, and 85 % of small business banking (Molyneux 2016).

In the post-crisis banking landscape, political efforts to increase competition in the sector have led to new entry: in 2010, Metro Bank was the first to obtain a full banking licence in over a century and since then several new banks have been authorised by regulators (British Bankers’ Association 2014). These new entrants are referred to as challenger banks because they compete in a market dominated by long-established operators. Challenger banks have been remarkably successful in expanding their loan books and making some inroads in the retail market. This increased competition in the system, in addition to the effect of regulatory reforms, as well as far-reaching technological innovations, presents new challenges for the building societies sector.

Against this background, this chapter outlines the key events that impacted the UK banking market since the outbreak of the global financial crisis in 2007. Section 1.2 provides a brief outlook of the UK; Section 1.3 discusses the impact of the global financial crisis on UK banking and financial markets. Section 1.4 examines the recent regulatory developments and structural reforms. Section 1.5 presents a brief analysis of the industry structure and performance and Section 1.6 concludes the chapter.

1.2 A Brief Overview of the UK Economy

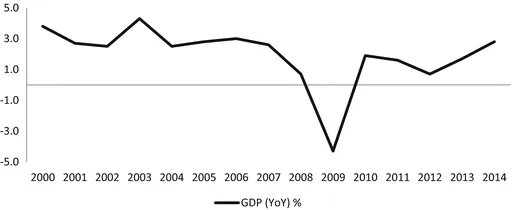

After more than a decade and a half of steady growth, the UK economy was officially declared to be in a recession in January 2009. The recession was a consequence of the credit crunch that began in the USA in August 2007 and which resulted in a global financial crisis starting in the autumn of 2008. It is now more than seven years since Lehman Brothers collapsed, ushering in the worst phase of the financial crisis, and the UK economy has been recovering at a relatively strong rate since early 2013 (Fig.

1.1).

In 2014, the UK economy grew by 3.0 %, the fastest rate since 2007 and the strongest growth rate in the G7 group of countries (Office for National Statistics). UK growth has been driven primarily by services and is projected to continue at a solid pace in 2015 and 2016, boosted by domestic demand (Institute for Fiscal Studies (IFS)). There are still, however, causes for concern. For example, while the household debt-to-income (DTI) ratio has fallen over the last three years, it remains around 150 %, significantly higher than those of other European countries and the USA.

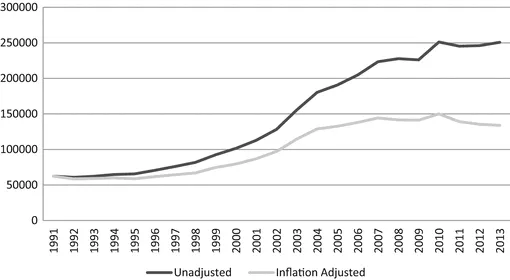

After several false starts following the financial crisis, the UK economy seems to be enjoying a period of sustained strong growth, helped by low oil prices, low inflation boosting purchasing power, and low interest rates fostering investment. It is expected that the low cost of finance will help maintain domestic demand growth. Rising house prices have also supported consumer confidence and spending (Fig.

1.2 and Table

1.1).

Table 1.1Economic Indicators

2000 | 3.8 | 0.8 | 2.1 | 3 | 6.5 | 9.8 | 112 |

2001 | 2.7 | 1.2 | 2.1 | 1.8 | 4.9 | 10.7 | 119 |

2002 | 2.5 | 1.3 | 2.2 | 1.7 | 2.7 | 9.9 | 130 |

2003 | 4.3 | 1.4 | 2.8 | 2.9 | 2.7 | 9.2 | 141 |

2004 | 2.5 | 1.3 | 2.2 | 3 | 1.2 | 7.7 | 152 |

2005 | 2.8 | 2.1 | 2.3 | 2.8 | 2.1 | 7 | 154 |

2006 | 3 | 2.3 | 2.9 | 3.2 | 1.8 | 6.5 | 164 |

2007 | 2.6 | 2.3 | 3.2 | 4.3 | 2.4 | 7.1 | 168 |

2008 | 0.7 | 3.6 | 4.3 | 4 | −0.6 | 5.6 | 167 |

2009 | −4.3 | 2.2 | 2 | −0.5 | 2.3 | 9.3 | 159 |

2010 | 1.9 | 3.3 | 4.8 | 4.6 | 0.9 | 11 | 151 |

2011 | 1.6 | 4.5 | 5.3 | 5.2 | −1.9 | 8.6 | 150 |

2012 | 0.7 | 2.8 | 3.2 | 3.2 | 1.6 | 8 | 147 |

2013 | 1.7 | 2.6 | 3.1 | 3 | −0.2 | 6.4 | 147 |

2014 | 3.0 | 1.5 | 2.4 | 2.4 | 1.5 | 6.0 | 144 |

Although the UK economy is continuing to recover, the recession triggered by the global financial crisis had serious repercussion in many areas. UK banking was hit dramatically by the global financial crisis. A once profitable, innovative, and dynamic industry virtually collapsed, exposing a series of weaknesses that increased the severity of the crisis and its impact on the UK...