Digitalisation in Europe 2021-2022

Evidence from the EIB Investment Survey

- 75 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

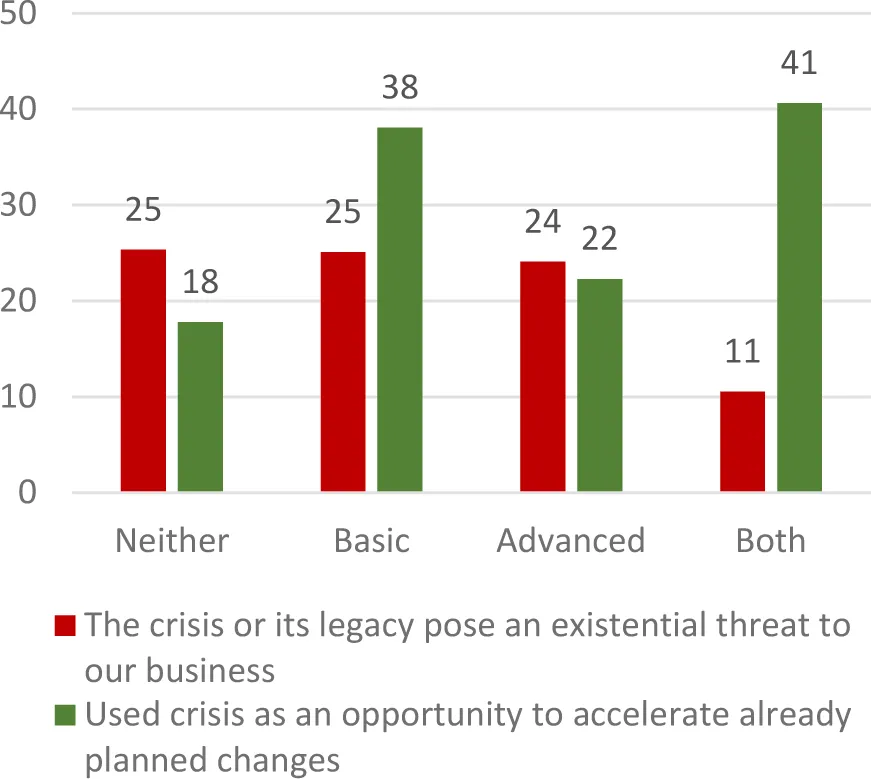

The coronavirus crisis accelerated the digital transformation of Europe's economy. Before the pandemic, cutting-edge digital technologies were primarily used by the most innovative and modern firms. The COVID-19 crisis, however, brought the digital transformation to the larger society — and made digitalisation integral to firms' survival.Digital firms were better able to cope with the disruption unleashed by the pandemic, and they were less likely than non-digital firms to see sales decline significantly from 2020 onwards. Many of them used the crisis an opportunity to accelerate their digitalisation.The Digitalisation in Europe 2021-2022 report uses results from theEIB Investment Survey (EIBIS), conducted from April to July 2021, to shed light on the level of digitalisation among Europe's small and medium firms.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

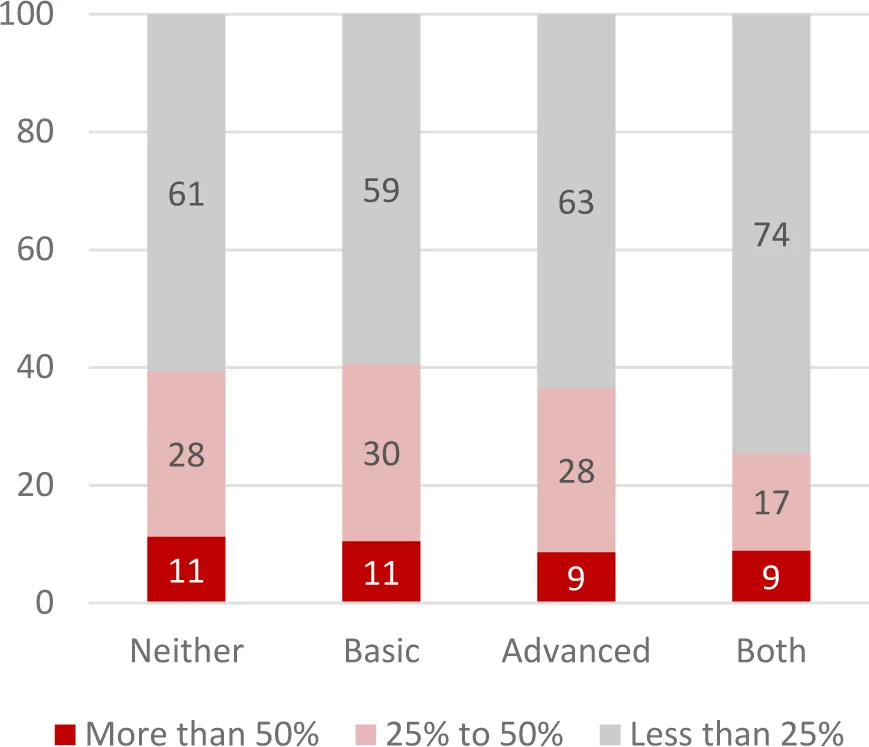

The role of digitalisation during COVID-19

Impact of the COVID-19 crisis on the business

| Basic vs. neither | Both vs. advanced | |

| Omitted category: micro | ||

| Small | 0.069*** | 0.020 |

| (0.025) | (0.032) | |

| Medium | 0.173*** | 0.128*** |

| (0.031) | (0.032) | |

| Large | 0.179*** | 0.219*** |

| (0.044) | (0.034) | |

| Omitted category: COVID-19 had no impact on sales | ||

| Increased sales or turnover | 0.108** | 0.003 |

| (0.044) | (0.041) | |

| Decreased sales or turnover | 0.080** | 0.044 |

| (0.034) | (0.034) | |

| Observations | 5 560 | 6 135 |

Investment priority over the next three years (in %)

Table of contents

- Cover

- Title

- Table of Contents

- Overview

- Digitalisation in the European Union

- The EIB Corporate Digitalisation Index

- Role of the environment: digital infrastructure and digital skills

- Where does the European Union stand relative to the United States in digital adoption?

- The role of digitalisation during COVID-19

- Digitalisation, intangible investment, innovation and firm productivity

- Digitalisation, employment and management

- Digitalisation and climate change

- Policy recommendations

- References

- Austria (AT)

- Belgium (BE)

- Bulgaria (BG)

- Croatia (HR)

- Cyprus (CY)

- Czech Republic (CZ)

- Denmark (DK)

- Estonia (EE)

- Finland (FI)

- France (FR)

- Germany (DE)

- Greece (EL)

- Hungary (HU)

- Ireland (IE)

- Italy (IT)

- Latvia (LV)

- Lithuania (LT)

- Luxembourg (LU)

- Malta (MT)

- Netherlands (NL)

- Poland (PL)

- Portugal (PT)

- Romania (RO)

- Slovakia (SK)

- Slovenia (SI)

- Spain (ES)

- Sweden (SE)

- Appendix: The EIB Corporate Digitalisation Index

- Appendix: Comparing EIBIS to other data sources

- Copyright