- 62 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The Asia Small and Medium-Sized Enterprise Monitor (ASM) is a knowledge-sharing product developed as a key resource for micro, small, and medium-sized enterprise (MSME) development policies in Asia and the Pacific. This second volume examines how Asia's MSMEs survived over a year into the coronavirus disease (COVID-19) pandemic and discusses post-pandemic policy actions for MSME development. This study is based on the findings from MSME surveys during 2020 and 2021 in Indonesia, the Lao People's Democratic Republic, the Philippines, and Thailand.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Asia Small and Medium-Sized Enterprise Monitor 2021 Volume IV by in PDF and/or ePUB format, as well as other popular books in Economics & Economic Policy. We have over one million books available in our catalogue for you to explore.

Information

Thematic Impact

This section breaks down the analysis to specific groups: (i) tourism-related MSMEs; (ii) digitally operated MSMEs; (iii) internationalized MSMEs; and (iv) women-led MSMEs. Government mobility restrictions—including travel bans—severely damaged tourism. The pandemic accelerated the ongoing digitalization of businesses. Supply chain disruptions and a drop in foreign demand brought about by national mobility restrictions hit globalized MSMEs hardest. And women-led MSMEs—a critical MSME segment—needed to continue innovating to contribute to economic growth. What was the pandemic’s impact on all these during the first year?

1. Tourism-Related MSMEs

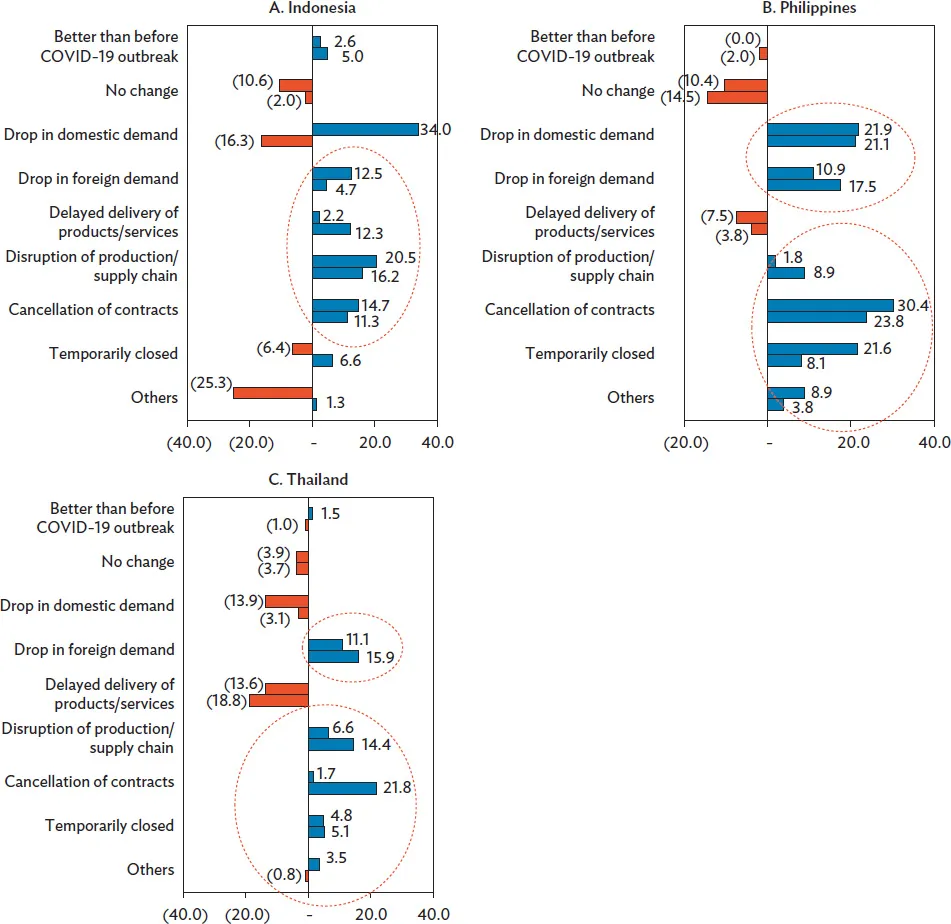

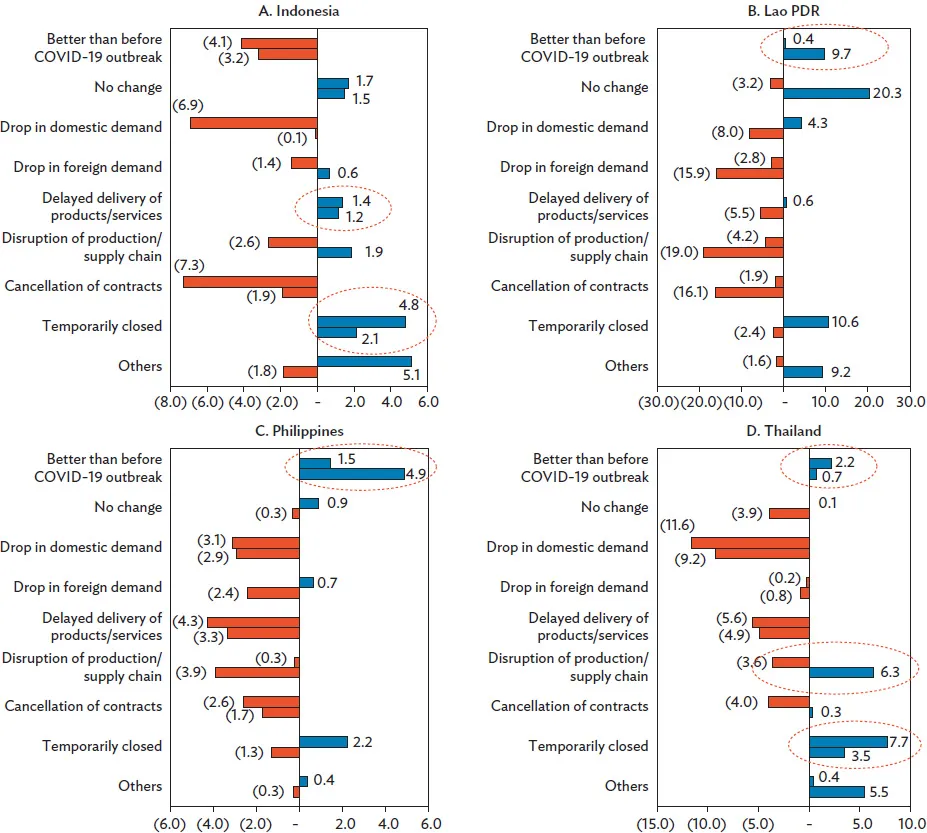

In the August–September 2020 and March–April 2021 surveys, tourism-related firms were defined as those who declared being a member of tourism organizations or associations. They included restaurants, hotels, tour services, transportation services, and souvenir shops. Figure 7 shows a gap in the survey response ratio between tourism-related MSMEs and non-tourism MSMEs. The blue bar indicates a higher impact (a higher percentage share) in tourism-related firms, with the red one showing the opposite. The upper bar is for August–September 2020 and the lower for March–April 2021.9

Tourism-related MSMEs accounted for less than 20% of surveyed MSMEs (Table 3). Overall, the business environment for the tourism sector remained dismal during the first year of the pandemic, affected by the prolonged pandemic and frequently adopted national mobility restrictions. In Indonesia, the drop in foreign demand (from tourists), delayed delivery of products and services, created supply chain disruptions and contract cancellations affected tourism MSMEs more than non-tourism MSMEs (Figure 7A). In the Philippines, a drop in both domestic and foreign demand, supply chain disruptions, and contract cancellations dramatically reduced tourism-related MSMEs during the year, resulting in higher temporary closures than non-tourism MSMEs (Figure 7B). Thailand followed a similar trend; higher foreign demand loss, supply disruptions, contract cancellations, and temporary business closures in tourism-related MSMEs throughout a year (Figure 7C).

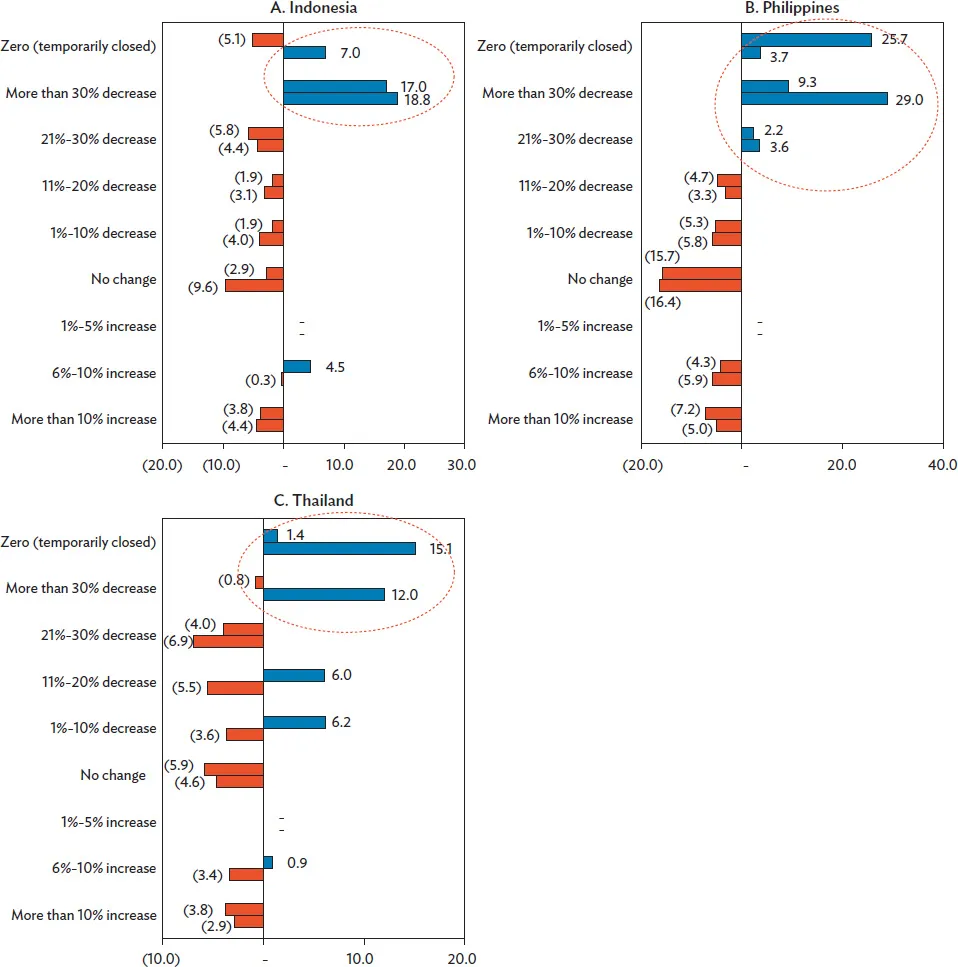

In short, tourism-related MSMEs remained stymied a year after the outbreak. In the tourism sector, zero-revenue or temporarily closed MSMEs and/or MSMEs with over 30% revenue losses were more likely to appear and worsen 1 year into the pandemic (Figure 8). Indonesia promoted tourism as part of its stimulus packages from the start of the pandemic in 2020, especially for major tourist destinations like Bali. The Philippines and Thailand also allocated national budgets to stimulate tourism spending in 2020. Despite these assistance programs, tourism-related MSMEs had not recovered as of March–April 2021.

2. Digitally Operated MSMEs

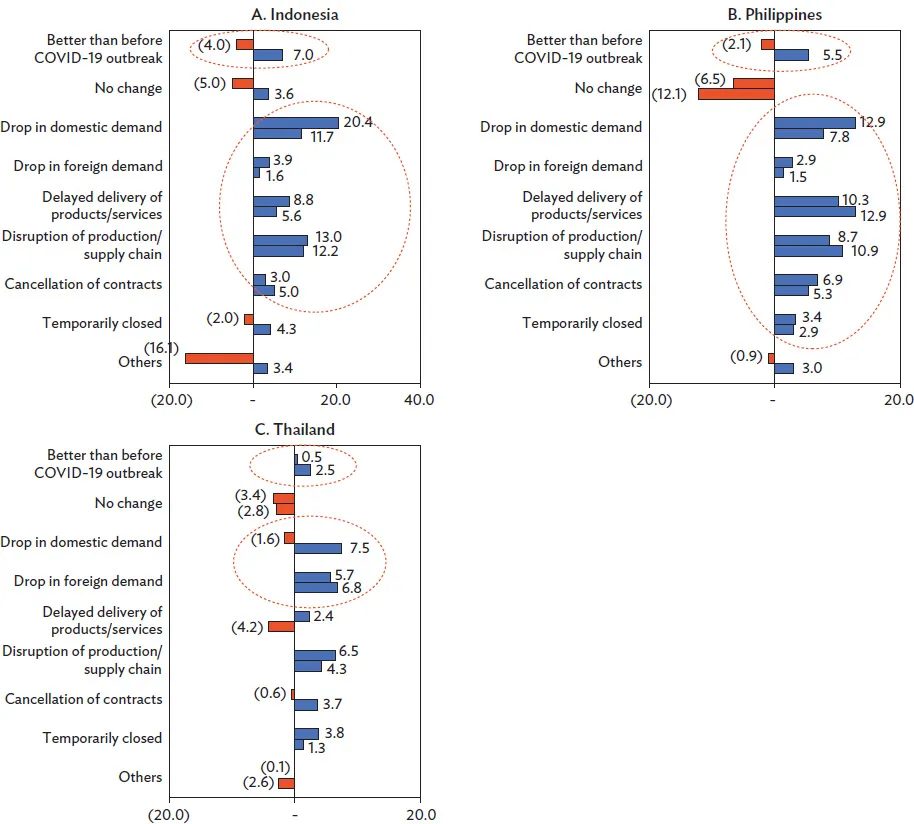

Here we compare the pandemic impact between August–September 2020 and March–April 2021, with digitally operated firms defined as those who are engaged in selling goods and services online or e-commerce.10 The pandemic and mobility restrictions were an incentive for more MSMEs to go digital. But digitally operated MSMEs were not always successful given the pandemic. The impact of the drop in demand, supply disruptions, and contract cancellations were likely higher in digitally operated MSMEs than non-digital firms surveyed, while those who reported better a business environment than prior to COVID-19 increased in digitally operated MSMEs, although they were a small fraction (Figure 9).

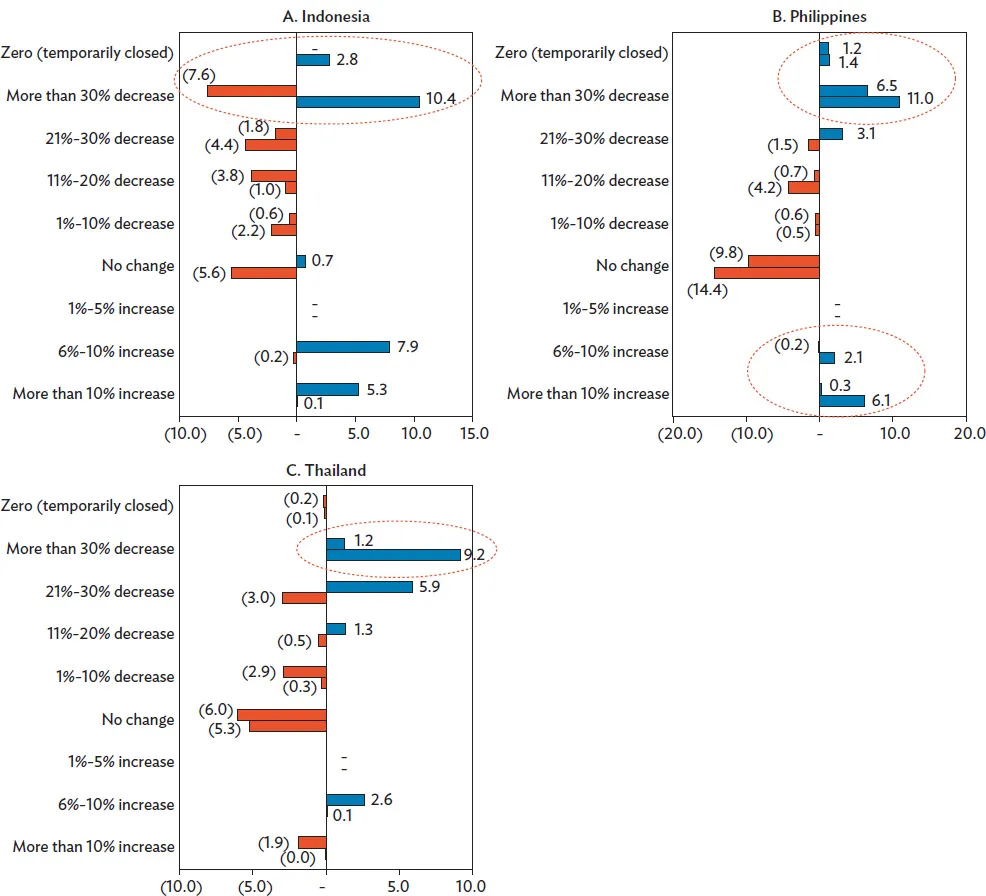

The profitability of digitally operated MSMEs was mixed during the pandemic. In Indonesia, the share of those with a more than 6% income increase was likely higher in digitally operated MSMEs than non-digital MSMEs in August–September 2020 (Figure 10A). They were mainly small firms selling essential daily goods, food, and health-care products and delivering them. However, toward 2021, the share of those with no revenue or more than a 30% decrease in income likely increased in digitally operated MSMEs than non-digital MSMEs. They were mainly firms involved with nonessential goods and services. In the Philippines, those profitable and less profitable co-existed among digitally operated MSMEs, with two streams of businesses—those which were hurt by the pandemic and those which benefited. This became clearer toward 2021 (Figure 10B). Thailand followed a similar trend as Indonesia (Figure 10C).

This suggests MSMEs that retained demand—such as essential goods and services, daily products, and food—could continue to operate successfully. As the pandemic wore on, other MSMEs dealing with nonessential products and services likely faced greater operational difficulties, even if digitalized (e-commerce).

3. Women-Led MSMEs

The pandemic had a mixed impact on women-led MSMEs—or MSMEs run or owned by a woman. Some faced a sharp drop in demand, supply disruptions, and saw their business hurt more by the pandemic harder than men-led MSMEs. Others reported a better business environment than before the pandemic (except in Indonesia) (Figure 11). This subsection compares the impact on women-led MSMEs between March–April 2020 and March–April 2021. Similar to the previous subsections, the blue bar indicates a higher impact (a higher percentage share) in women-led MSMEs compared with men-led MSMEs, and the red band shows the opposite.

In Indonesia, the business environment for women-led MSMEs was harsh throughout the first year of the pandemic (Figure 11A). While the share of those reporting no change was slightly higher than men-led MSMEs, women-led MSMEs were more likely to face supply disruptions, delayed product delivery, and temporary business closures than men-led MSMEs. In the Lao PDR, women-led MSMEs more likel...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Tables, Figures, and Box

- Foreword

- Acknowledgments

- Abbreviations

- Executive Summary

- Introduction

- Country Responses to COVID-19

- Methodology

- Data Structure

- Company Profiles

- The COVID-19 Impact on MSMEs during the First Year of the Pandemic

- Thematic Impact

- Policy Implications

- Conclusion

- Appendixes

- Footnotes

- Back Cover