eBook - ePub

Geography, Location, and Strategy

- 480 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Geography, Location, and Strategy

About this book

Changes in both technology and global political economy have vastly accelerated the pace of globalization in the last 40 years, eroding barriers that limited firms' geographic scope, and unleashing a seemingly unlimited set of new threats, challenges, and opportunities to create value globally. Globalization presents managers with an environment to create value that is more complex, risky, and also more promising than ever before. Despite recent advances in our understanding of how locations impact the creation and appropriation of value by firms, the speed of these changes has often surpassed the speed of research on the connections between geography and firms. This volume draws together researchers working at the forefront of this area in a variety of disciplines—economics, geography, marketing, organizational behavior, psychology, sociology, and strategy—in order to explore the many ways that locations matter for firms. In 11 varied papers, the authors draw on newly available data, recently developed theory, and diverse methodology to understand the relationships between firm boundaries, firm activities, and geographic borders.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

HOW FIRMS ARE ORGANIZED ACROSS BORDERS

THE INTERNATIONAL CONFIGURATIONS OF US MULTINATIONAL CORPORATIONS

ABSTRACT

This paper explores how key insights from highly cited and well-used frameworks that describe the strategies and structures of MNCs are reflected in the international configurations of US MNCs. After reviewing existing frameworks that highlight different MNC choices regarding the integration, responsiveness, and dispersion of firm value chain activities, I perform a cluster analysis on a comprehensive and confidential database of US MNCs. The results reveal five configurations which both support the importance of key insights from existing frameworks while at the same time highlighting underexplored configuration characteristics, like the low levels of integration in US MNCs, the global sourcing arrangements for accessing foreign inputs and distribution, different approaches to regional expansion, and the limited geographic expansion of US MNCs pursuing product diversification. I argue that these underexplored characteristics suggest directions for future research to better reflect the international configuration choices of MNCs.

Keywords: Multinational corporations; configurations; strategies and structures

INTRODUCTION

Over the past five decades, researchers have shown keen interest in understanding the spatial organization and international configurations of multinational corporations (MNCs). Several frameworks have been offered that reflect different integration, responsiveness, and dispersion choices by firms. For example, the integration responsiveness framework (Bartlett & Ghoshal, 1989; Prahalad & Doz, 1987), the configuration-coordination framework (Porter, 1986) and Ghemawat’s AAA framework (2007) all explore the strategic choices that MNCs make in terms of the dispersion and integration of firm value chain activities across foreign markets, while Stopford and Wells (1972) model of organizational structures and more recent studies on network integration (Birkinshaw & Hood, 1998; Gupta & Govindarajan, 2000) focus on the coordination and control of the foreign operations of MNCs. However, existing empirical evidence in support of these frameworks has tended to be based on either a handful of case studies or a limited sample of MNCs. For example Stopford and Wells (1972) examined one of the largest samples, and included 187 US firms in their analysis, Bartlett and Ghoshal’s (1989) influential study was based on case studies of nine MNCs (three each from the US, Europe, and Japan), while Prahalad and Doz (1987) interviewed just over 20 MNCs. Studies that take more of an integrated network approach have considered much richer data from subsidiaries (Birkinshaw & Morrison (1995) examined 126 subsidiary responses, while Gupta & Govindaragan (2000) examined 117 US subsidiaries, 112 Japanese subsidiaries, and 145 European subsidiaries), but even these are limited in how representative they are. Considering the state of both the theoretical and empirical examinations of the international configurations of MNCs, there is a need for not only analyses of more representative samples, but also an exploration of how well the insights from extent frameworks and models capture key decisions that MNCs make as they disperse and integrate their value chain activities across countries.

In this paper, I have both modest and ambitious goals for extending our understanding of the international configurations of multinational firms. On the more modest side, I start by reviewing key insights from prior frameworks that consider the strategies and structures of MNCs. My review highlights firm decisions regarding the integration, responsiveness, and dispersion of value chain activities, with different firm decisions for manufacturing, R&D and marketing across countries resulting in different international configurations by MNCs. I then explore how these decisions are reflected in the choices of a comprehensive and confidential dataset of US MNCs collected by the Bureau of Economic Analysis (BEA) at the US Department of Commerce. While cluster analysis has been criticized because of the potential for researcher bias and imposition of group structures on data where no groups actually exist (Barney & Hoskisson, 1990; Ketchen & Shook, 1996), I base this analysis on existing theories and frameworks and use advances in cluster analysis techniques that consider the prediction strength of the resulting groups across separate samples to determine the most robust configurations. It should be noted right from the start that this paper is not intended to be a causal examination of the influences on firm choices across different configurations, but rather, it is exploratory in its examination of the configurations of a comprehensive sample of US MNCs. The results reveal five configurations that show differences across the integration and dispersion choices of US MNCs, but low levels of local responsiveness across all configurations.

On a more ambitious vein, I discuss the results from the cluster analysis to try to identify underexplored trends that impact the international configurations of MNCs. While the cluster analysis results support several main themes from extant frameworks on the strategies and organizational structures of MNCs, these results also reveal differences across the approaches of US MNCs that are not well captured in extant frameworks. Key underexplored configuration characteristics include the low levels of integration in US MNCs, global sourcing choices for accessing foreign inputs, different approaches to regional expansion, and the limited geographic expansion of US MNCs that pursue product diversification. I argue that these underexplored characteristics suggest directions for future research to better capture the international configuration choices of MNCs. For example, these underexplored factors suggest that future research on firm configurations across countries could more thoroughly analyze the product, people, and knowledge integration choices of MNCs, better incorporate alternate arrangements for access to low-cost and supplier inputs from foreign countries through offshore outsourcing, better incorporate the various types of regional expansion that MNCs pursue, and take into account the trade-offs across administrative complexity associated with product and geographic expansion.

EXTANT FRAMEWORKS ON THE STRATEGIES AND STRUCTURES OF MNCS

There are several frameworks that describe the strategic and structural choices that MNCs make when expanding and organizing their foreign operations. Some common themes that emerge from these frameworks are the choices that firms make regarding the integration, responsiveness, and dispersion of value chain activities, with different firm decisions across firm value chain activities resulting in different international configurations. My review highlights both the integration and responsiveness choices that have long been highlighted in the integration responsiveness (IR) framework, in addition to different choices MNCs face in configuring their value chain activities in terms of the dispersion and intrafirm integration of value chain activities across countries. I start by considering frameworks that focus on the strategic choices of MNCs. The integration responsiveness framework has been called the dominant framework for analyzing firm international strategies in the international business literature (Devinney, Midgley, & Venaik, 2000; Malnight, 2001);1 this framework highlights competing choices of MNCs in terms of their global integration versus local responsiveness choices. I also review Porter’s (1986) configuration and coordination framework, which highlights the impact of firm decisions across different value chain activities. And finally (and more recently) Ghemawat’s (2007) AAA (an acronym for adaptation, aggregation and arbitrage) framework considers two distinct types of benefits firms can achieve from global integration, including both aggregation and arbitrage advantages, in addition to incorporating benefits from adaptation.

Strategic Choices of MNCs

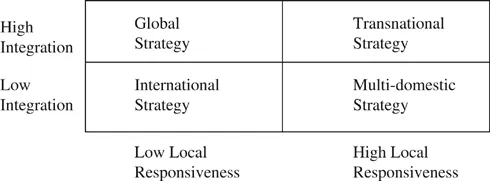

The IR framework offers a typology of four strategies by MNCs, including an international, global, multidomestic and transnational strategy, as shown in Fig. 1. The vertical axis focuses on global integration pressures, which are formed by the presence of global customers, global competitors, the need for cheaper costs and access to raw materials (Bartlett & Ghoshal, 1989; Prahalad & Doz, 1987). At the extreme, firms that organize themselves to sell standardized goods that are produced in the most cost effective locations and that respond to homogenous consumer demands across country settings are responding to global integration pressures. In contrast, the horizontal axis represents local responsiveness pressures, which are formed by differences in customer needs distribution channels, government policies, or market structure differences across countries (Prahalad & Doz, 1987). At the other extreme, firms that have no linkages across their operations and sell customized products that are produced within the host country (which could be influenced by tariffs and/or government policies) are responding to local responsiveness pressures. Bartlett and Ghoshal (1989) emphasized the need for firms to be simultaneously responsive to different environments while also integrating operations to gain efficiency advantages. By stressing the transnational approach, Bartlett and Ghoshal (1989) highlight an ideal approach in which firms configure their operations to benefit from cost efficiencies, shared knowledge, and local adaptation and responsiveness whenever possible. The tension between integration or responsiveness that lies at the core of the IR framework identifies important elements that have been shown to influence the international strategies of MNCs across empirical studies (Bartlett & Ghoshal, 1989; Harzing, 2000; Leong & Tan, 1992; Prahalad & Doz, 1987; Roth & Morrison, 1990).

Fig. 1. The Integration Responsiveness Framework. Source: Adapted from Prahalad and Doz (1987).

In a similar ...

Table of contents

- Cover

- Title Page

- Geography, Location, and Strategy

- Part I How Firms are Organized Across Borders

- Part II How Global Firms Overcome Cross-Border Challenges

- Part III Value Created by Cross-Border MNC Activity

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Geography, Location, and Strategy by Juan Alcacer, Bruce Kogut, Catherine Thomas, Bernard Yin Yeung, Juan Alcacer,Bruce Kogut,Catherine Thomas,Bernard Yin Yeung, Brian S. Silverman in PDF and/or ePUB format, as well as other popular books in Betriebswirtschaft & Business allgemein. We have over one million books available in our catalogue for you to explore.