- 144 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Mergers and Acquisitions

About this book

This book provides executives with an in-depth look at the consequences of M&As for acquired top management teams. It examines M&As as a corporate growth strategy, the importance of top management teams to a firm's long-term performance, the reasons why executives depart after an acquisition, and the effects of these departures on target company performance.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Mergers and Acquisitions by Jeffrey Krug in PDF and/or ePUB format, as well as other popular books in Business & Leadership. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

Turmoil in Top Management Teams Following Mergers and Acquisitions

Out of a corporate office of 126, only six were offered positions—the rest became history. The company for the most part has since been broken apart and sold.

—Chairman of the board shortly after his company was acquired in a hostile takeover by a corporate raider

The Role of Top Management Teams

A firm’s top management team is composed of its top executives—those responsible for formulating and executing strategies for achieving the firm’s long-term goals and creating sustainable competitive advantage. Strategy making has become an increasingly difficult—and important—task given globalization trends and rapid technological change over the last 30 years. Globalization trends have subjected firms to more intense competition from multinational firms with global scale advantages, global suppliers with greater negotiating power, and a wider range of customers located worldwide who have differing product and brand loyalties. Technology trends have increased the costs of developing new technologies and shortened product life cycles. To cover escalating costs, many firms have turned to global markets as a means of expanding sales volume. In sum, globalization trends and technological change have made it increasingly difficult for executives to sustain high levels of performance over the long term. Among their many responsibilities, executives are responsible for the following:

- Determining the firm’s mission. A mission is the firm’s reason for being. In what businesses should the firm compete? What customer needs should be served? What competencies are necessary for meeting customer needs? The mission may also outline the organization’s values—those things that define the character of the organization and its employees. Establishing the firm’s mission is an important task because it establishes boundaries for executives’ actions. A narrowly defined mission can protect shareholder interests by discouraging executives from undertaking risky ventures or diversifying into businesses unrelated to the firm’s core competencies. However, it can also unnecessarily hamper executives as they respond to maturing markets, technology changes, and industry turbulence.

- Establishing a corporate vision. The vision describes what the firm wants to become. Similar to the “BHAG” concept (big, hairy, audacious goals) described by Jim Collins in his book Good to Great, executives are responsible for visionary thinking that motivates employees and leads to superior long-term performance.1

- Establishing short- and long-term goals of the firm. Goals translate the firm’s mission and vision into quantifiable, measurable targets. They include both strategic goals such as achieving higher market share, revenue, and asset growth and financial goals such as improving profitability, operating margins, return on assets, and return on invested capital.

- Formulating long-term strategy. Strategy represents the course of action taken by executives to achieve the firm’s short- and long-term goals.2 There should be a strong link between the firm’s mission, vision, goals, and strategy. Mission defines the firm’s business, customers, and competencies. Vision defines the firm’s strategic direction. Goals translate the firm’s mission and vision into measurable targets. Strategy focuses on achieving the firm’s goals. In sum, strategy articulates how the firm will deliver the goals and objectives implied by the firm’s mission and vision.3

- Overseeing strategy execution. The best-formulated strategies are irrelevant in the absence of good execution. Strategy formulation is often viewed as a top-down exercise because it is the firm’s executives who make decisions about the firm’s long-term strategic direction. In contrast, strategy implementation is often viewed as a bottom-up exercise because it is the firm’s employees who implement strategy. It is, however, the firm’s top management team that delegates decision-making rights to managers and employees below it. Likewise, the top management team plays a major role in motivating the firm’s employee base and driving improvements in productivity.

- Monitoring and evaluating corporate performance. Assessing performance is more than a simple exercise of comparing actual with forecasted performance on a standardized set of accounting and stock market measures. Jim Cramer, host of the daily stock market show Mad Money, is fond of reminding viewers that every industry has a unique performance metric that competitors use to assess their performance relative to competitors. In the fast-food industry, for example, this metric is “same store sales.” Industry competitors such as McDonald’s could easily grow sales by simply building new restaurants. However, new restaurants potentially cannibalize sales from existing restaurants. Growing corporate sales at the expense of individual franchise sales would quickly alienate a company’s franchise base. Therefore, great effort is made to formulate and execute strategies that build sales at the individual restaurant level. In addition to industry metrics, the most successful companies build their strategies around achieving excellence in strategic metrics. Walgreens, for example, is known for focusing on maximizing profits per store visit. A focus on this metric has the effect of focusing Walgreens on achieving the proper merchandise mix by selling a combination of goods (e.g., soft drinks and snack foods) that deliver high profit margins. Customers are willing to pay premiums for these products in return for the convenience of having a Walgreens strategically located near their home or workplace.

Composition of the Top Management Team

Each year, Standard & Poor’s Register of Corporations, Directors and Executives4 publishes data on more than 75,000 corporations and biographical sketches on close to 400,000 executives. A casual review of companies included in this reference source reveals a wide variation in both the number of executives and composition of job titles making up the top management teams of different companies. Each set of executives includes those with strategy-making responsibilities in the firm. Top management teams typically include most of the following job titles:

- Chairman of the board

- Chief executive officer (CEO)

- Chief operating officer (COO)

- President

- Executive vice president

- Senior vice president

- Vice president

- Chief financial officer

- Controller

- Secretary

Top Management Team Turnover Following a Merger or Acquisition

How many of your top executives do you expect will still be in your firm next year? In 2 years? In 5 years? Studies indicate that firms lose an average of 8% to 10% of their top executives each year through normal attrition. This attrition includes retirement and departures to take advantage of an offer from another firm.

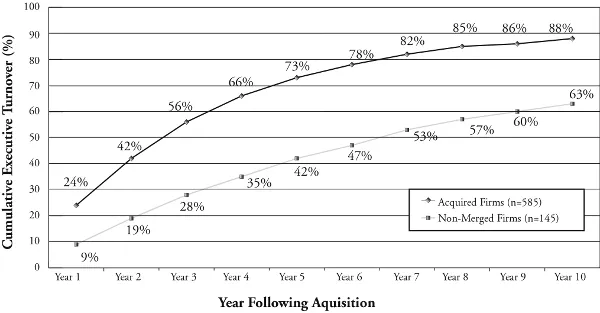

Following acquisition, however, you can expect the situation to be dramatically different. In the first year following acquisition, a target firm can expect to lose about 24% of its top executives—a turnover rate about three times higher than normal. In the second year, it can expect to lose an additional 15%. That’s a loss of approximately 40% of the company’s original top management team in the first 2 years after the acquisition!

Figure 1.1. Target company top management turnover rates following an acquisition

Note: Cumulative turnover = Number of executives in original top management team who have departed by end of year divided by number of executives in original top management team.

Source: Jeffrey A. Krug.

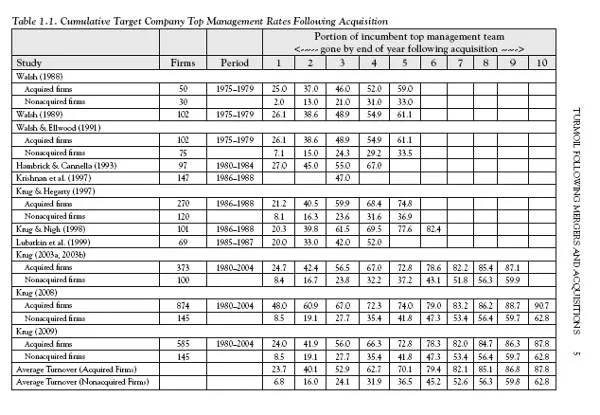

Table 1.1 summarizes the results of existing studies that have documented top management turnover rates in target companies following an acquisition. A graphical view of these data is shown in Figure 1.1. Jim Walsh5 was the first to empirically analyze executive turnover rates following a merger or acquisition. Although his study sample is small, studies that followed his initial effort have found similar results. He randomly sampled 50 target companies from the Federal Trade Commission’s (FTC) Statistical Report on Mergers and Acquisitions, which reports acquisitions of U.S. manufacturing and mining firms acquired by publicly traded U.S. firms between 1975 and 1979. He collected turnover data using surveys sent to each parent company. Each company was asked to report the departure date of each target company executive who was employed at the time of the acquisition.

Based on survey responses, Walsh calculated cumulative top management turnover rates for each company in each of the 5 years following the target company’s acquisition. He did not consider executives hired after the acquisition because his objective was to understand whether acquisitions lead to higher than normal turnover in the target firm’s incumbent top management team—those executives in place at the time of the acquisition. He found that an average of 25% of the target company’s incumbent top management team departed in the first year after the acquisition. By the fifth year, 59% of the original top management team had departed.

To determine whether these turnover rates were “higher than normal,” Walsh randomly sampled 30 companies that had not been acquired during a 5-year period from Standard & Poor’s Stock Guide.6 Based on information reported in each company’s 10-K report, he calculated top management turnover rates for each of these firms in each of 5 consecutive years of the study. Only 2% of the executives in the control group of nonmerged firms had departed by the end of the first year of the firm’s initial observation. By the end of the fifth year, 33% had departed.

Structure of the Book

This book is structured around two themes. First, it examines the role that mergers and acquisitions (M&As) play in formulating and executing corporate strategy. Chapter 2 discusses global M&A trends and the different strategies that firms use to grow revenues and assets over the long term. It then discusses why M&As are a popular strategy for growing the firm over the long term and why technology and globalization trends should spur increased worldwide M&A activity over the next several decades. Chapter 3 examines the role of top management teams in formulating and executing corporate strategy. It discusses why executives matter, how top management teams are created, and the importance of managerial discretion in creating effective executive teams. Chapter 4 discusses the economic rationale for M&As and whether they create value for shareholders. Chapter 5 discusses why M&As fail. In particular, it discusses the tendency of acquiring firms to overpay, synergy creation in M&As, and the importance of industry structure in determining firm profitability and merger success.

Chapter 5 also examines the effects of M&As on target company executive teams, how acquiring firms can minimize the negative effects of an acquisition on target company leadership, and how firms can build more effective top management teams during the postmerger integration process. Chapter 6 discusses the relationship between postmerger executive turnover and postmerger performance. Current evidence suggests that turnover is a major cause of poor performance. I take a contrary view and explain why turnover can sometimes be a beneficial outcome of an acquisition. Chapter 7 discusses merger motivations, executive perceptions of different merger motives, and the strategic drivers of M&As. Chapter 8 discusses why executives stay or leave after an acquisition. Lastly, chapter 9 provides executives and acquiring firms with strategies for managing executive turnover and building more effective top management teams following a merger or acquisition.

Understanding Leadership Issues in Mergers and Acquisitions

Walsh’s analysis demonstrated that executive turnover rates in acquired firms are significantly higher than comparable turnover rates in nonmerged firms—in each of 5 years following an acquisition. His results offered the first empirical evidence that M&As create conditions within target companies that cause an abnormally high number of executives to depart. He also found that more senior executives (those holding the job title of chairman, CEO, or president) leave more quickly—on average within 17 months after the acquisition—than less senior executives (those holding the job title of vice president, controller, secretary, and treasurer, among others), who leave on average within 23 months.

Walsh7 and Walsh and Ellwood8 supplemented Walsh’s9 original study. They found that most acquiring firms take action to restructure the target company’s top management team within the first 2 years after the acquisition. Target company top management turnover rates are greatest within this short period after the merger. However, the effects of this early turnover often linger for several years, as turnover rates continue to be higher than normal for a minimum of 5 years after the acquisition. They also found that turnover in the first year after the acquisition is negatively correlated with turnover in the second year. In contrast, turnover in the second year is negatively correlated with turnover in the third year. This finding suggests that parent companies have the tendency to initiate major change in a single year and do not make major subsequent changes in the target’s executive team. As I argue later, the tendency of acquirers to make structural changes in the target company’s top management team shortly after the acquisition and then ignore the lingering negative effects of these changes may contribute to the merger’s failure.

A number of subsequent studies using similar methodologies have found similar results. For example, Hambrick and Cannella10 analyzed 97 of the largest publicly traded U.S. companies acquired between 1980 and 1985. They calculated turnover rates for executives who held the job title of vice president or above or who were in...

Table of contents

- Mergers and Acquisitions

- Preface

- Chapter 1: Turmoil in Top Management Teams Following Mergers and Acquisitions

- Chapter 2: Mergers and Acquisitions

- Chapter 3: Top Management Teams

- Chapter 4: Do Mergers and Acquisitions Create Value?

- Chapter 5: Why Mergers Fail

- Chapter 6: Executive Turnover and Postmerger Performance

- Chapter 7: Before the Merger: Merger Motivations and Objectives

- Chapter 8: After the Merger: Why Executives Stay or Leave

- Chapter 9: Conclusion

- Notes

- References