- 194 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Regression Analysis

About this book

The technique of regression analysis is used so often in business and economics today that an understanding of its use is necessary for almost everyone engaged in the field. This book covers essential elements of building and understanding regression models in a business/economic context in an intuitive manner. The book provides a non-theoretical treatment that is accessible to readers with even a limited statistical background. This book describes exactly how regression models are developed and evaluated. The data used in the book are the kind of data managers are faced with in the real world. The book provides instructions and screen shots for using Microsoft Excel to build business/economic regression models. Upon completion, the reader will be able to interpret the output of the regression models and evaluate the models for accuracy and shortcomings.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

- Realize that this is a practical guide to regression not a theoretical discussion.

- Know what is meant by cross-sectional data.

- Know what is meant by time-series data.

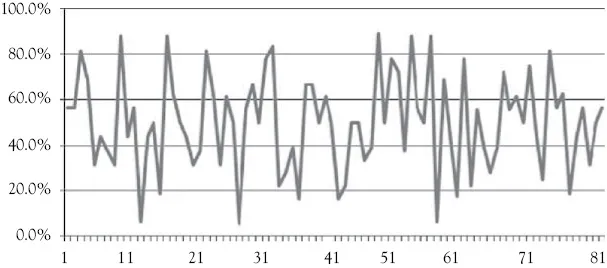

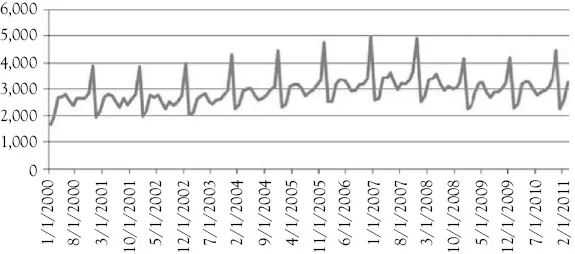

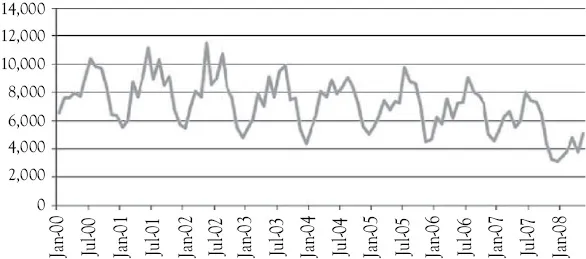

- Know to look for trend and seasonality in time-series data.

- Know about the three data sets that are used the most for examples in the book.

- Know how to differentiate between nominal, ordinal, interval, and ratio data.

- Know that you should use interval or ratio data when doing regression.

- Know how to access the “Data Analysis” functionality in Excel.

Table of contents

- Cover

- Title

- Copyright

- Abstract

- Contents

- Chapter 1: Background Issues for Regression Analysis

- Chapter 2: Introduction to Regression Analysis

- Chapter 3: The Ordinary Least Squares (OLS) Regression Model

- Chapter 4: Evaluation of Ordinary Least Squares (OLS) Regression Models

- Chapter 5: Point and Interval Estimates From a Regression Model

- Chapter 6: Multiple Linear Regression

- Chapter 7: A Market Share Multiple Regression Model

- Chapter 8: Qualitative Events and Seasonality in Multiple Regression Models

- Chapter 9: Nonlinear Regression Models

- Chapter 10: Abercrombie & Fitch and Jewelry Sales Regression Case Studies

- Chapter 11: The Formal Ordinary Least Squares (OLS) Regression Model

- Appendix: Some Statistical Background

- Index

- Adpage

- Backcover

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app