![]()

CHAPTER 1

Introduction: An Overview of Corporate Financial Management

Corporate financial management can be defined as the efficient acquisition and allocation of funds. The efficient acquisition of funds requires the firm to acquire funds at the lowest possible cost, and the efficient allocation of funds requires investing funds at the highest possible expected rate of return. If the firm acquires funds at the lowest possible cost and invests funds at the highest possible return, net cash flow to the firm will be maximized. The objective of corporate financial management is to maximize the value of the firm. The value of the firm is the market capitalization of the firm, which is the number of common equity shares times the price per share. The value of the firm is determined by the risk and return characteristics of the firm. The relationship between risk and return is positive and linear. Firms that want to earn higher rates of return must be willing to assume greater levels of risk, and firms that want to have lower levels of risk must be willing to accept a lower rate of return. The risk and return characteristics of the firm are determined by the decisions made by the managers.

Corporate financial management decisions fall into three categories. Managers make decisions about

1. investing;

2. financing;

3. paying dividends.

Investing decisions determine the specific assets purchased by the firm, and the assets purchased by the firm determine the asset structure of the firm or the left-hand side of the balance sheet, assets. The financing decisions determine the extent to which the firm uses fixed cost financing. Fixed cost financing is the use of bonds that have a cost to the firm that does not change over the life of the bond, that is, the interest payment is fixed for the life of the bond. The financing decisions determine the right-hand side of the balance, liabilities and owners’ equity. The dividend decision is separate because, on the one hand, the dividend decision is an allocation of funds but is not an investment decision because no assets are purchased. On the other hand, the dividend decision affects the right-hand side of the balance sheet, specifically, retained earnings, but is not a financing decision. In addition, the dividend decision affects firm valuation through a number of mechanisms.

Once the firm’s financial managers have made a set of decisions, we have a firm that can be represented by the financial statements—the balance sheet and the income statement. The financial statement information can be used to estimate the level and the riskiness of expected future cash flows for the firm. The cash flows are represented by a probability distribution of all possible cash flows and the probability of each of the possible cash flows. The degree of operating leverage is determined by the amount of fixed cost assets used by the firm, and the degree of financial leverage is determined by the amount of fixed cost financing used by the firm. The combine leverage effect is represented in the required rate of return for the firm.

The value of the firm is the discounted present value of all of the future cash flows discounted at the required rate of return. Cash flow today is worth more than cash flow in the future because the firm can invest cash flow and earn a rate of return on cash currently in one’s possession, which means that next year’s cash level will be higher than today’s cash level. Alternatively, cash in the future is worth less than cash today. The more risky the cash flow is further into the future, the less the cash flow is worth today. Each cash flow in the future, free cash flow to equity (FCFE)t, which will grow from FCFE0, which is the current dividend, at an estimated rate, g, must be discounted by the required rate of return, (1 + k), to reflect the amount of risk and the time in the future. The sum of the growing and discounted future cash flows from time zero to time infinity is as follows:

(1.1) P0 = ΣFCFE0 (1 + g)t/(1 + k)t

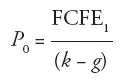

We can simplify this expression after making a number of simplifying assumptions to the following expression:

(1.2) That is, the value of a share of stock is equal to the expected dividend at time t = 1 divided by the required rate of return minus the expected future growth rate.

The information and process to value a company require finding financial data, stock price and dividend data, and bond data. FCFE is derived from the balance sheet, the income statement, and the statement of cash flows. Short-term growth is estimated using sustainable growth, and long-term growth is estimated using gross domestic product (GDP) growth. The required rate of return is calculated using the security market line with market beta, Treasury bond rates, and the long-term rate of return on the stock market.

Table 1.1 shows the relationship among value, expected cash flow, and the discount rate for a firm that does not grow. As the expected net cash flows increase, for a given discount rate, the value of the firm increases. Alternatively, as the required rate of return decreases for a given expected net cash flow, the value of the firm increases.

Table 1.1 The relationship among value, expected net cash flow, required rate of return, and required rate of expected net cash flow return

| (percent) | 100 | 200 | 300 |

| 20 | 500 | 1,000 | 1,500 |

| 10 | 1,000 | 2,000 | 3,000 |

| 5 | 2,000 | 4,000 | 6,000 |

...