![]()

Chapter 1

Opportunities for Leadership Driven Management

Unknown to most people, strong financial control does exist in government. At the federal level,1 Congressional Oversight Committees, Agency Auditors General, the Office of Management and Budget, and the Government Accountability Office all work hard in their role as watchdogs, protecting the public from acts of “waste, fraud, and abuse.” The federal management control complex makes significant efforts and spends enormous funds to implement these controls.

Current controls are rule based, and the rules work like commandments of the “thou shall not” category, prescribing things that should not be done and listing penalties for violation. It is not the purpose here to critique the costs and benefits of these practices. We will assume that they are necessary and useful in preventing “sins of commission” and “mismanagement.

Unmanagement Offers Much Greater Opportunity Than Mismanagement

However, rule based federal management practice is mostly silent on what good management practice should do. The objective here is to explore cost management practices that are not currently being extensively used in government management. The potential savings and efficiency improvements from these largely unexploited management techniques may be significantly more important than currently used controls.

This is to say that “unmanagement” rather than “mismanagement” may be the greater problem and a tremendous opportunity. In a sense, then, we must also address “sins of omission” and consider what we should do proactively and aggressively to better manage government’s fiscal resources and their role in accomplishing the work of government. This is not an accounting issue; instead, it requires strong leadership driven management.

The Current State of Rule Based Federal Financial Management

The generally accepted definition of good management in government is spending 99.9% of the budget appropriation. This is not necessarily bad as far as it goes. Prohibition (“thou shall not”) of spending more than appropriated is a good thing. This strong prohibition against overspending the budget provides the foundation for the effective existing budgetary control process.

The strong prohibition of overspending comes from the Anti-Deficiency Act. The Act makes it a criminal offense for federal agencies to spend more than appropriated. The Supreme Court has also made it clear that the Executive Branch cannot defy the will of Congress by spending less than budgeted.

Spending less than 99.9% of budget is diligently avoided at all levels of federal agencies. Significant effort is made to spend funds because unspent funds are “lost” to the budget holder, and reduced spending levels make it harder to justify desired budget increases in the future.

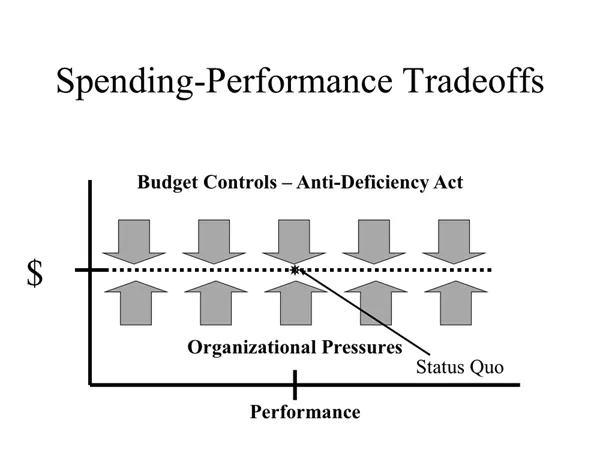

Figure 1.1 shows that the pressures to avoid overspending and underspending budget work to keep spending at budget levels. Budget controls and the powerful Anti-Deficiency Act mitigate against increased spending while organizational pressures strongly discourage underspending. These pressures are independent of performance. In other words, statutory spending requirements can be met and 99.9% of the budget can be spent at all levels of performance.

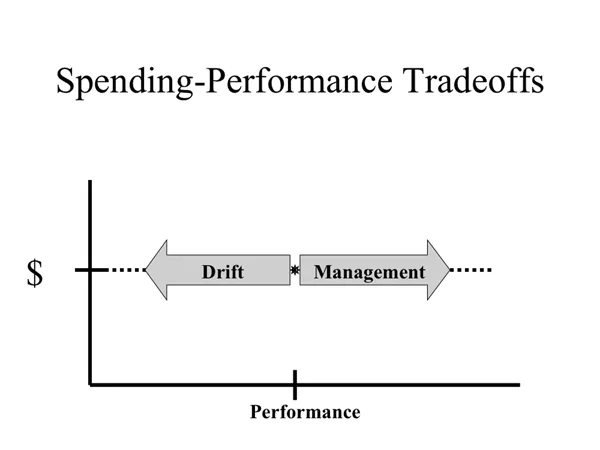

This current definition of good financial management is unsatisfactory, as it ignores how wisely the budget appropriation was spent. Good financial management should mean continuously improving the cost effectiveness of operations in ways that ultimately improve the overall effectiveness of government programs and missions. Figure 1.2 captures this management impact as an arrow driving increased performance within the spending constraint.

One very good Army garrison commander described the cost management and control process as being like sailing into the wind. Ships can sail into the wind only by adjusting the angle of the sails properly, steering at the correct angle into the wind, and tacking back and forth skillfully into the wind. However, he related that “as soon as you stop working the sails and let go of the rudder, the prevailing winds take over and you go in the opposite direction.” (Colonel Mike Boardman, Garrison Commander, Fort Huachuca. See chapter 8, for more on the Fort Huachuca implementation of organization based control.)

Figure 1.2 labels this phenomenon as “drift”: the natural tendency of people and organizations toward inefficiency and less challenging performance.

Conflicted Roles in Rule Based Management Practice

Rule based management processes do well in relatively simple matters but suffer when complex judgment is required. For example, traffic laws can prescribe the rules of the road. They can mandate speed limits, required stops, and even specified levels of equipment maintenance. Penalties exist for noncompliance (if caught violating) by traffic police (at a cost). The rules, however, cannot prevent lapses in judgment or ensure safe driving.

The nature of rule based processes creates a conflicting role for the rule making power in government. Consider the role of Congress in financial management and control. It holds the purse strings and it sets the rules.

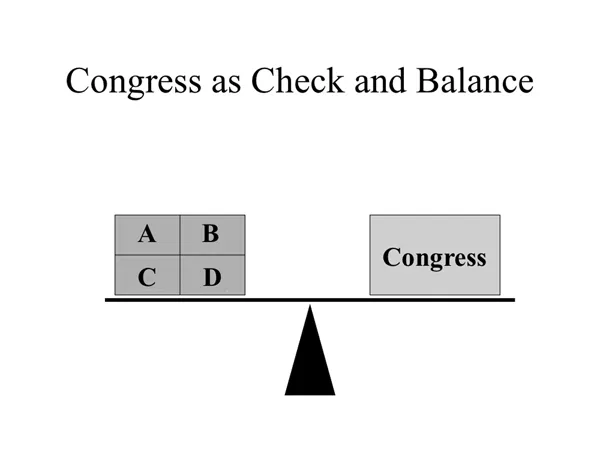

The historical, constitutional role of a rule maker such as Congress is as a check and balance to the power of the Executive Branch. Congress uses its hearings, its budget and appropriation authority, and its Government Accountability Office and Congressional Budget Office to influence spending by Executive Branch agencies. Fulfilling this role generally results in an arm’s length, sometimes adversarial, approach in which Congress exercises its oversight powers. Figure 1.3 shows Congress balancing the power of Executive Branch departments A, B, C, and D.

However, financial behavior of the Executive Branch is not independent of Congress. Congress is an integral and essential part of the financial management process in three ways.

First, Congress is solely responsible for appropriating the budget. The Executive Branch proposes and Congress disposes. Second, Congress has passed strict laws to ensure that the budget levels it appropriates are not overspent. Its Anti-Deficiency Act makes overspending the budget a criminal action punishable by fines and imprisonment. Third, it has been established that the Executive Branch is not permitted de facto budget setting power by neglecting to spend funds appropriated by Congress.

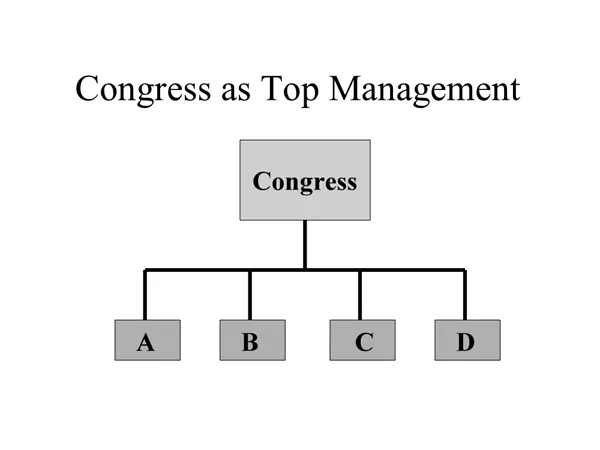

In this role, Congress assumes the top level of the financial management hierarchy. It is ultimately responsible for setting policies and funding outcomes. Hierarchies are common organizational structures, and the top of a hierarchy is usually recognized as the top management of that hierarchy.

Figure 1.4 depicts Congress at the top of the financial management hierarchy, providing all funding and direction to Executive Branch departments A, B, C, and D.

These contrasting roles of checks and balances and financial executive are not unique to Congress. They are common to many government organizations. The Office of Management and Budget seeks both oversight and financial leadership over federal departments. Departments seek both oversight and financial leadership over their agencies, and so forth.

These contrasting, and somewhat schizophrenic, roles raise interesting questions of practical effectiveness. Yet Congress purports to be interested in resource consumption within the Federal Government. It seems to be the underlying theme indicated in the Chief Financial Officers Act and the Government Performance and Results Act.

Consider that the Chief Financial Officers Act states that “billions of dollars are lost each year through fraud, waste, abuse, and mismanagement among the hundreds of programs in the Federal Government. These losses could be significantly decreased by improved management.” Similarly, a major objective of the Government Performance and Results Act is to “improve Federal program effectiveness and public accountability.” Furthermore, the Federal Financial Management Improvement Act states that one of its goals is to “improve performance, productivity and efficiency of Federal Government financial management.”2

These and other laws clearly indicate that Congress believes it has a role in improving the financial management of the Federal Government. Achieving this goal begs the question of whether the traditional checks-and-balances role is compatible with the leadership role.

Rule Driven Differences to Leadership Driven Management

Rule based management centers on laws, regulations, restrictions, and compliance audits. It appears similar to that of the legal process in which attorneys work in a rule driven, but adversarial, manner. The oversight process exhibits the dynamics of a legalistic approach. Evidence is sought and the jury of legislators, top managers, or the public is influenced. The goal of the process is to expose wrongdoing, and the process becomes inherently adversarial. Wrongdoing is most easily proved when actions are shown to violate established laws, rules, or principles: The success of this process requires rules and tests for compliance to the rules. These behaviors are common to the role of checks and balances.

On the other hand, effective management from the apex of the financial management chain of command would seem to require a more leadership driven approach. The leader, whether coach or captain, is part of the team. The leader, of course, must comply with the rules of the game. However, his role is much broader. Simply playing by the rules does not win the game. The leader must grow people, design processes, and deploy strategies to develop a winning team. There is not one way to do this. While every team plays by the same set of rules in any sport, there are many ways to play the game. The leader seeks to find the best combination of capabilities and opportunities to improve team performance.

Whereas the rule maker makes a rule, the leader makes a plan. The rule maker publishes the rule, while the leader trains personnel and teaches the plan. The rule maker seeks to prove or disprove compliance through an audit, and the leader tests the plan through interaction and review. The rule maker exposes wrongdoing in order to punish. The leader seeks to understand mistakes in order to learn from them. The rule maker penalizes wrongdoing, whereas the leader corrects mistakes and builds from what’s right. The rule maker follows up by closing loopholes in the rules, whereas the leader evolves to a new and better plan.

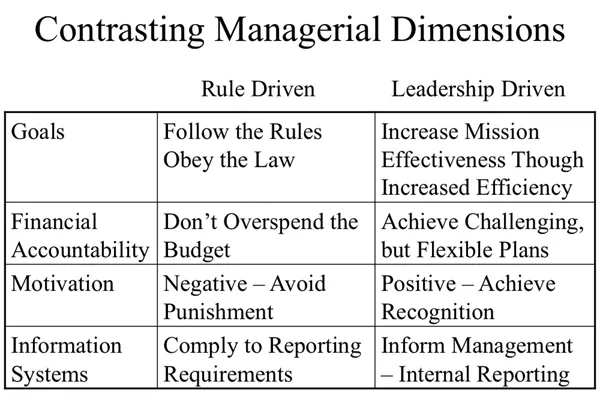

Consider four crucial dimensions of management: (a) goal setting, (b) accountability, (c) motivating, and (d) information systems (Figure 1.5).

The goal of an oversight process is to write comprehensive rules that, when obeyed, provide the desired outcome. Continuous process improvement, however, requires billions of efforts by millions of people because achievable improvements are embedded throughout the organization. Success requires a culture in which the goal is to increase mission effectiveness by improving efficiency. Such a goal appeals to dedicated personnel who have committed their lives and careers to the missions they manage.

Financial accountability is currently based on not overspending the budget. The current definition of good financial management in the Federal Government is to spend 99.9% of the bud...