![]()

CHAPTER 1

Introduction: The Global Auto Industry Through the Lens of Technology

In the first two decades of the 20th century, the automotive industry was a dynamic, high-tech industry frequently gracing the pages of Scientific American. Outside investors provided seed money to hundreds of ventures, almost all of which soon failed. The occasional success generated great wealth, filling the Detroit Institute of Art with the works of European and American masters, and outside the United States enriching the founding families of Fiat, Citroën, Honda, and Volkswagen. Other fortunes were made by parts suppliers and distributors. Today the industry is again technologically dynamic, replete with brash new entrants, venture finance and a host of players—particularly suppliers—with R&D levels typical of other high-tech industries.

Yet the industry remains dominated by large, incumbent firms, the youngest of which have been producing cars for 50 years. While the industry has been international almost from its inception, for a century multinational operations were either extensions of domestic operations, or as with GM’s Opel subsidiary in Germany, decentralized, stand-alone enterprises. Today the industry is increasingly global, with major players expecting to undertake production and sales of vehicles in multiple markets. Designing and engineering now seek to reflect the tastes of middle-class consumers inside and outside the home market as well as the ability to source identical materials and components around the globe.

The car companies themselves now occupy only a small share of the value chain. Most production costs and manufacturing jobs are accounted for by suppliers. Even more jobs are downstream, with the distribution, local marketing and the financing of inventory and sales handled through independent dealerships. Assemblers provide only 20 percent of the industry’s total value added. Given this web of firms and function, will new technologies result in incremental change to existing vehicle architectures and product market segmentation? Or will we see a reorganization of the value chain, with for example new suppliers for electrical components displacing piston and transmission suppliers, while new business models for vehicle ownership and transportation services undermine the role of dealerships?

Our answer is definite: change will be incremental, as we elaborate in Chapter 11. To develop that case, we analyze the historical development of the industry from its inception in the late 19th century through today using technology as a running theme. Inventions and breakthroughs—including new business models, such as the electric car sharing of Autolib—are the stuff of headlines. From the perspective of real businesses, however, the process of innovation—developing ideas into commercial products, that is, putting better cars on the road—is a slow process, moving from an initial implementation to commercially meaningful products through a gradual process of learning by doing.

A set of simple models provides a framework for our analysis. First is industrial organization, using the concepts of monopoly, oligopoly, and monopolistic competition to illustrate long-run change in the competitive structure of the industry. A second is an emphasis on typologies of technology that emphasize its embodiment in the knowledge and working practices of teams of people. Invention may capture headlines, but bringing a product to market entails complementary innovation of many interrelated systems to enable such inventions, and then their refinement via “good engineering.” Technology, however, is not only limited to physical products and their production, but also to how products are conceived and configured—market niches and commercial strategy—and how they are distributed and used. To use basic economics jargon, how organizations are internally organized, the employment of novel business strategies and improved marketing, and alternate ways of coordinating across the value chain change the production possibilities frontier. Third and finally, transportation systems are embedded in a complex array of institutions that include roads and regulations, and how we organize around “mobility.” Of particular concern are regulations regarding safety, fuel efficiency, and emissions, which we analyze from a technology perspective in Chapters 6-8.

These abstract ideas can be linked to concrete issues. First, over the past 50 years entry into the industry—including the creation of new brands and product segments such as minivans and more recently crossover vehicles—expanded the number of new vehicle models available to consumers three-fold. In the process, both margins and per-vehicle sales volumes shrank. Can new vehicle producers obtain acceptable returns, sufficient to fund operations on a continuing basis? Even worse for incumbents, will the reliance of car companies on suppliers for key technologies—batteries, power controls, radar, transmissions—facilitate the entry of new players? Think here of Great Wall, the leading producer of SUVs and crossovers in China, which is now the world’s largest motor vehicle market. Similarly, will improved simulation-based engineering tools and more flexible manufacturing technologies allow firms to develop new models more quickly and cheaply? The start-up Local Motors takes this to its logical extreme, proposing to sell crowd-sourced designs with the body “printed” to customer specifications using additive manufacturing technologies. These changes make earning profits even more challenging.

New technologies often prove disruptive. Will the development of electric vehicles undermine existing players, and facilitate the entry or growth of relatively new firms, such as Tesla in the United States or BYD and Chery in China? Innovations are not limited to “hard” technology: ride sharing and autonomous vehicles, lumped under the catch-phrase of “Mobility 2.0,” could reduce the need for individual vehicle ownership.

Yet one more set of issues lie in the nitty-gritty details of how the value chain is structured. What drives innovation? Here there are both enablers, the material science revolution and digital engineering, and new regulatory pressures, in competing demands for energy efficiency, low emissions, and enhanced safety. How do firms reorganize internal operations and interfirm coordination to meet these new demands with new business models including “global” design and production? This also has the potential to shift the locus of core functions, from where manufacturing locates, particularly assembly plants, to where engineers reside. For example, will this lead to a recentralization of functions with Detroit at the center of engineering for a global manufacturing footprint, or will engineering be dispersed across multiple regions including the North American “auto alley”, the European “auto corridor” and some as yet unnamed counterpart in China?

We believe the presentation of these issues is enhanced by taking a stand. In Chapter 11 we sketch why we believe the industry is not undergoing a transformative revolution. Key is our understanding of technology as the knowledge of how to do things, embedded in complex structures from how production is organized across firms to perceptions of cars as symbols of status and enablers of personal independence. Blueprints may capture the “hard” components of a finished vehicle, but the know-how required to develop the next model resides in teams of engineers backed by specific digital tools and their ability to work with leading suppliers. Manufacturing likewise consists not only of a particular layout of specialized machinery, but also in the tacit knowledge including trade secrets for how to utilize and improve that layout to produce high-quality parts in volume and on time. How dealerships are organized—who controls the customer interface, who sells the finance package and warranties—and how the sales operation responds to the ebb and flow of demand for specific models is also a form of technology. The idea that this is simple and that assemblers can sell the vehicles they produce directly to consumers has been disproved time and again and in multiple countries since the franchised dealership system developed a century ago.

Critical to our view is that new technologies are generally expensive in their first implementation. Moving toward the “autonomous” vehicle, for example, entails increasing costs. At the same time, the normal economist’s argument points to diminishing returns from expanding the set of product attributes. Keeping in your lane in good weather, and automatically braking as necessary to maintain a safe following distance on an expressway—those technologies are already on the road, and bring clear safety benefits. How valuable is extending that capability to all sorts of inclement weather, or for downtown driving where construction, double-parking and pedestrians require much more expensive technologies? Although there are niche applications, at present the business case for greater vehicle autonomy is unclear. While vehicle-to-vehicle (V2V) communication and “smart” infrastructure can help overcome such obstacles, implementing that would require a wider social commitment to finance such improvements. Likewise Mobility 2.0 points to the low utilization—perhaps 4 percent of the day—of a very expensive asset, encompassing a range of proposals to monetize this parked capital good. However, to be viable, vehicle sharing and other ideas require shifts in long-standing habits of not needing to wait, social attitudes where vehicle ownership is a powerful communicator of status, and institutional changes in licensing, insurance, and so on. In sum, increasing costs for new technologies run into diminished marginal benefits. The incentive to make any single change in isolation is thus weak, while benefits require multiple simultaneous innovations. Existing systems are well-adapted to the status quo. The coordination issue is thus a very real barrier to revolutionary change.

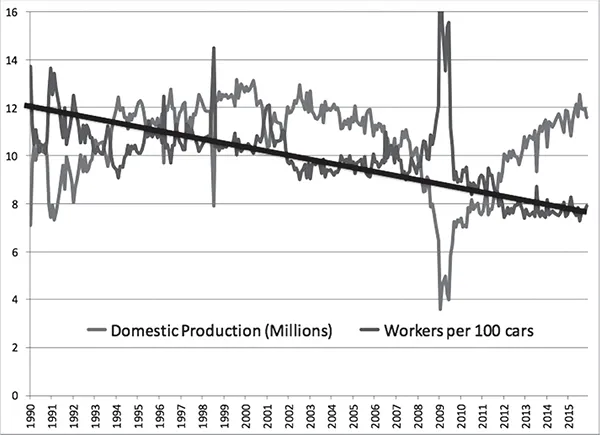

In summary, our historical approach will suggest why we do not believe that we are seeing a revolution in the automotive industry. It will also provide a framework that offers insights into topics from the process of globalization and related shifts in the geography of the industry, to the organization of R&D, and the shift in the structure of the value chain that is enhancing the role of suppliers while continuing to improve productivity. Even if there is no revolution, cumulative change does matter. As illustrated in Figure 1.1, gradual improvements in labor productivity mean that despite a return of output to its peak of the late 1990s, manufacturing employment remains one-third below pre-2008 levels. Furthermore this is in a market where vehicles are larger and far more complicated than a quarter century ago. Worse, and not specific to the automotive sector, manufacturing compensation no longer moves in line with productivity. But the industry remains important: the sector employs 900,000 workers in the United States alone, and the numbers are similarly large in other producing countries.

Figure 1.1 U.S. Automotive Productivity: Workers per 100 Vehicles

We trust you will find the story as fascinating as we do.

![]()

CHAPTER 2

History 1: The Rise of Oligopoly

The Early Years: Entrepreneurs and New Venture

The concept of automobility dates back centuries, figuring in the drawings of Roger Bacon in the 13th century and Leonardo da Vinci in the 16th. By the mid-19th century, various ventures produced vehicles that freed steam engines from their rails, albeit with little initial success outside of steam tractors and threshers. Meanwhile by the late 1800s streetcars transitioned from horse-drawn to electric, improving speed and lowering costs; the start of suburbanization predated motor vehicles. Finally came the carriage trade and the new-fangled development of bicycles. It was the German, Karl Benz, who in 1886 produced the first widely recognized car, which used a two-stroke internal combustion engine (ICE) that he had worked to perfect. Over the next 25 years perhaps 3,000 entrepreneurs tried their hand at making vehicles, particularly in France and then in the United States, but also in Germany, England, and Italy. Early vehicles took a wide variety of forms, with motorcycles and tricycles building upon the bicycle industry, and “horseless carriages” modifying four-wheeled horsedrawn buggies. Motive force came from steam, electric motors and lastly ICEs. Steam offered power but was slow to start and heavy. Gasoline engines were primitive, noisy, weak in power and prone to breaking down. Electric vehicles started immediately and were quiet, but had limited range.

Business concepts likewise varied. One market was for the wealthy to promenade their contraptions. Electric vehicles were suited to this and to other uses that revolved around a fixed base. In the United States, electric vehicles were the largest segment through 1903. Taxis and buses were another market. Into the 1910s most taxis in New York City were electric. The more technically inclined might engage in touring, or hire driver-mechanics for support. Racing was another early market, attracting large crowds and making the front page of newspapers. Again, electric and steam vehicles held speed records through 1902, when the wealthy American William Vanderbilt set a record in France. This was then bettered by Henry Ford in 1904 in a gasoline racer of his own construction. But overall reliability was poor, and production volumes miniscule, under 20,000 globally in 1901, with France the largest producer. Scientific American concluded in an 1897 article:

It is quite possible that the wonderful rapidity with which, in these days, a useful invention has developed from a crude idea into a practical shape with a positive commercial value has made us a little too exacting. . . . The recent competitions have proved that the perfected car, considered as a commercial product and something more than a mere toy, has probably yet to be built. . . . among the certainties of the future are a motor car which will shall be light, swift, strong, durable and cheap, which, as a means of banishing the noise and unsanitary filth of horse-propelled vehicles from our streets, and as a means of transportation for freight and passengers in country districts, will be as indispensable to the everyday life of the races as are the steam locomotive and the electric car [trolley] of our day.

“The Future of the Motor Car.” (July 17, 1897) Scientific American 77:3, 35.

Nevertheless there was widespread interest in this new set of technologies, an interest that rivaled that of electricity and railroads. Scanning the contents of Scientific American shows that in the early 1890s, motor vehicles were not yet far enough along to be more than curiosities. By the late 1890s, however, there was a regular column reporting novel vehicle configurations, speed and distance records and improved propulsion systems. At the turn of the century, cars were second to matters electrical, overtaking railroads, steel, and ships (Table 2.1).

Table 2.1. Number of Articles by Topic in Scientific American

All of this is reminiscent of other startup industries, as traced by Hannan and Carroll (1995) and subsequent studies in the “population ecology” tradition. From an early start in Germany, the core of the industry moved to France and then after 1905 to the United States. Rampant entry resulted in an industry peaking at about 300 firms in 1910 in the United States. Records are available to allow at least 770 firms to be tracked that actually produced a vehicle. The numbers in France, Germany, Italy, and the U.K. were smaller, and peaked closer to 1925. Over time there were over 300 entrants in Italy, France, and the UK, and 200 in Germany. Overall history documents 2,500 entrepreneurs who lasted long enough to sell a vehicle, but many more disappeared without a trace or never made it to market.

The venture capital phenomenon that we see today is nothing new. Henry Ford’s first two firms failed, leaving outside investors to foot the bills while he kept the engineering drawings. Then there is General Motors, which at the start was a stock market play engineered by Billy Durant, who had built a fortune through what we would now call financial engineering. The entity’s name reflected exactly what it was: an amalgam of firms that assembled cars or supplied parts to assemblers. Durant was, however, no manager, and the firm went through two early restructurings – one in 1909, when the bankers on the board exercised power to fire Durant after he was unable to come up with the financing to buy the Ford Motor Company, and the other in 1920 when Durant, back as president, again ran the company into the ground. There were likewise groups of serial entrepreneurs and managers, who moved from venture to venture. Durant himself was involved in a successful startup, Chevrolet, which he used to reacquire General Motors, and in Durant Motors, which failed. The remnants of Henry Ford’s second venture became Cadillac. Walter Chrysler first managed Buick, a GM subsidiary, then moved to Willys Overland (the forerunner of Jeep) and Maxwell before establishing Chrysler. Similar cases are found in E...