![]()

CHAPTER 1

Creating Dropdown Lists

In this chapter, we will show how to develop dropdown lists or menus to control data entry and user choices available in the model. Dropdown lists can greatly facilitate data entry by limiting user entries and forcing users to choose a value from a controlled list. The data validation dialog box in the Excel’s Data tab is used to construct dropdown lists of various types and complexities.

Creating Simple Dropdown List

It is very helpful in financial models to be able to pick option from a dropdown menu of various options available in the model. For example, I have a worksheet that has products’ pricing scenarios under (a) Low Case, (b) Base Case, and (c) High Case. If I have a dropdown menu of these three pricing options in the model, I will be able to assess the impact of these three pricing scenarios on the economics of the project easily. Creating a dropdown menu requires the following steps.

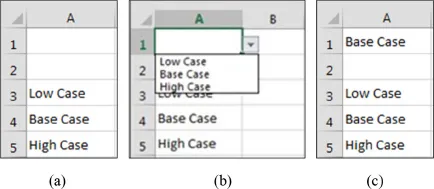

1. Enter the names of the three scenarios in Cells A3, A4, and A5 as shown in Figure 1.1a.

Figure 1.1 Stages of creating a dropdown menu in Excel

2. We would like to select the option in Cell A1. Upon selection of the desired option in Cell A1, VLOOKUP, INDEX, and MATCH functions are then used to read the respective pricing scenario from the products’ pricing worksheet.

3. Place the cursor in Cell A1.

4. Click on the Data tab of Excel’s Ribbon.

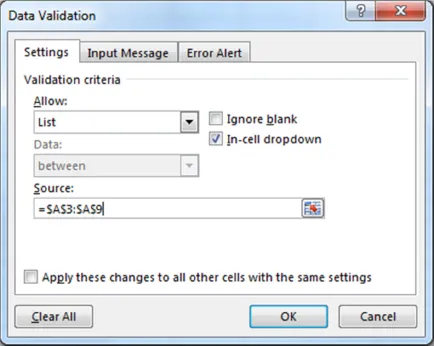

5. Click on Data Validation icon. The Data Validation dialog box appears as shown in Figure 1.2.

Figure 1.2 Data Validation dialog box

6. Select List in the Validation criteria Allow dropdown.

7. Select the Source, which is the list of options in Cells A3 to A5.

8. Tick the Ignore blank and In-cell dropdown in the dialog box.

9. Click OK—a dropdown arrow will appear in Cell A1. The arrow will show only when the cell is active (cursor is in the cell).

10. Click on the dropdown arrow to select the option. The dropdown list as shown in Figure 1.1b appears. The final option selection “Base Case” in Cell A1 is shown in Figure 1.1c.

11. The dropdown can be easily cleared by placing the cursor in Cell A1 → Data Validation → Clear All → OK.

Note: Normally the list of options in Cells A3 to A5 will be somewhere way below the main body of the model or even better somewhere to the right of the entire model. Therefore, the list will not be visible.

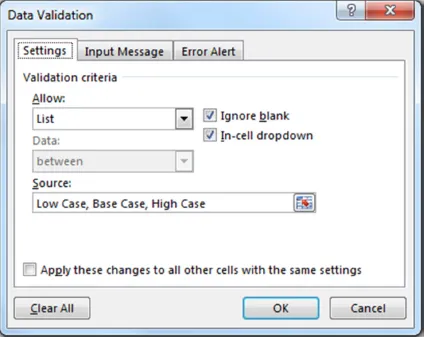

Another way to achieve the same objective is to actually enter the list in the Source of the Data Validation dialog box as shown in Figure 1.3. Place the cursor in the cell where you want to enter a dropdown menu. Click on Data Validation → List → Enter the list in the Source → OK. This will produce the same dropdown down menu as shown in Figure 1.1.

Figure 1.3 Data Validation dialog box with a list in the Source

Creating Dependent Dropdown List

In financial modeling, many times we will have variables that will be dependent upon other variables. One typical example is crude oil and products’ export. We have a worksheet (called “Pricing”) in the financial model. This worksheet has multiple scenarios of products’ pricing. We can run economics by selecting a pricing scenario from dropdown menus and then using the VLOOKUP or HLOOKUP to read the corresponding price for each year in the main body of the model. This will be shown later in the book. The “Pricing” worksheet contains the following scenarios.

1. Low Case Scenario

a. Crude Oil

i. Arab Extra Light

ii. Arab Light

iii. Arab Medium

iv. Arab Heavy

b. Condensate

i. Khuff Condensate

ii. Other Condensate

c. Export Products

i. Propane

ii. Butane

iii. Pentanes Plus

The same will apply to the Base Case Scenario and the High Case Scenario. The crude oil is exported to Far East (FE), Europe (EU), Asia, or the United State of America (USA). The price for each destination will be different because of the transportation and supply and demand for a particular product in the region.

Here we will show how to set up dropdown menus to enable us to select a particular pricing scenario from the pricing worksheet.

Figure 1.4 shows various pricing options or scenarios available in the “Pricing” worksheet. These will be located somewhere away from the main body of the model, either to the right or at the bottom. In this list, the product types in Columns B, C, and D are dependent on the Products in Column A. This means that if I pick Crude_Oil, I should be able to select what quality of crude oil. Column E has the pricing scenarios. The Low Case has (a) four pricing for the cr...