![]()

CHAPTER 1

Explaining Our Central Theme: How Beliefs Impact Behaviors and Results

“Leadership is about instilling the beliefs and behaviors that produce desired results.”

—John Allison, former Chairman and Chief Executive, BB&T

- Although external competitive forces are constantly working against a company’s growth in shareholder value, it is the internal misconceptions that exist within management that place the greatest limitations on corporate performance.

- Improving shareholder value is about overcoming these misconceptions and establishing the beliefs and behaviors that lead to superior results in both the customer and capital markets.

- Ensuring that employees truly know what leads to superior performance and how to put those principles into practice is one of the most important roles of the chief executive and their management teams.

WHAT IS SUPERIOR PERFORMANCE?

If asked, the senior management teams of virtually every publicly traded company will say that they are focused on delivering superior shareholder returns. Yet very few companies have been able to outperform their peers consistently over extended periods of time.

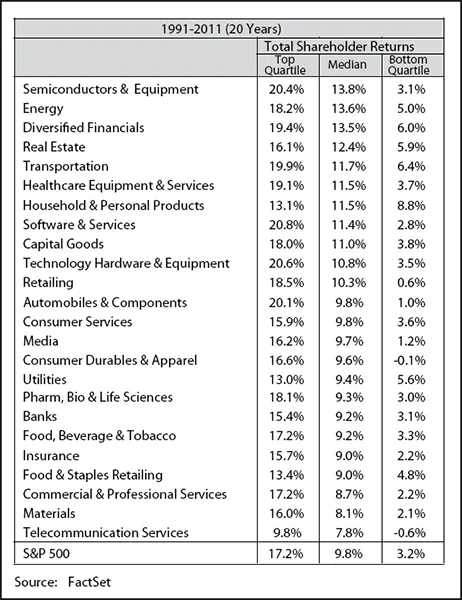

Over the past twenty years, the average company in the S&P 500 delivered total shareholder returns (TSRs, or stock price appreciation plus dividend yield) of about 10 percent annually. In other words, $100 invested in the average S&P 500 company today would be worth $110 a year later. At that rate of return, it would take approximately 7 to 8 years for a company to double its shareholder value.

If we group companies within an industry into quartiles, however, as we do in Figure 1.1, those firms in the top 25 percent did significantly better, with most generating TSRs of 16 percent to 20 percent. In effect, companies in the top quartile have doubled their shareholder value in 4 to 5 years.

Why is this gap so large? What distinguishes chief executives and companies that have been able to consistently deliver shareholder returns in the top quartile of their peer group from those that have not? Is it product innovation? The assets the company controls? The market share position it has built? Or is superior performance just a statistical phenomenon that is difficult, if not impossible, to either predict or replicate?

Based on nearly twenty-five years of working with some of the world’s best-run companies, we have learned that superior performance is not random; it can be managed. More specifically, what we have observed is that superior performance is the result of a disciplined approach to management and the resulting culture that this discipline creates. Underpinning this discipline is a set of beliefs that the CEOs, along with the senior management teams, have instilled in their organizations. Those beliefs drive behaviors, which in turn drive the outstanding results these companies have been able to achieve.

Figure 1.1: Range of Shareholder Returns by Industry, 1991–2011

Superior Performance Is Not a Random Walk

In his now classic book, A Random Walk Down Wall Street, Princeton economics professor Burton Malkiel argues that stock prices typically follow a “random walk” in their day-to-day fluctuations. As a result, investors cannot consistently outperform market averages.

However, over longer periods of time, chief executives of well-run companies are able to deliver superior shareholder returns relative to peers within their industry. Why? These CEOs don’t get caught up in chasing all revenue growth or quarterly EPS goals. Instead, they put in place the standards and capabilities that allow their organizations to differentiate between value-creating and value-consuming investments and they focus their strategies on delivering consistently superior cash flow and shareholder value growth.

CHECK YOUR PREMISE

“I know what increases shareholder value,” many managers say. “I hire good people who make good products and deliver outstanding service, which leads to satisfied customers. That in turn generates healthy earnings growth and solid increases in our stock price.”

As a general rule of thumb, that is correct. But not all customers and investments are profitable. So, yes, you want to hire good people and you want those good people to make good products that satisfy customers. But you also want your people to understand fully how their decisions and actions link to and drive profitability and cash flow. You don’t want your advertising manager spending all their time thinking about boosting shareholder value. But you do want to make sure that the majority of advertising investment is driving profitable growth.

The idea of hiring good people who make good products leads us in the right direction, but it is not specific enough. As we will see in a moment, there is a single path that will lead to maximum shareholder value. But as you move down it, there may be scores of different decisions that a wide range of employees will have to make. The odds are very small that they will make all those decisions correctly without a specific set of principles that they can follow.

It makes much more sense for senior management to explain to employees:

- What drives shareholder value.

- How to determine where and why shareholder value is being created and consumed.

- How to use this information to make better strategic and resource allocation decisions and deliver higher levels of profit growth and cash flow.

WHERE COMPANIES GO WRONG: COMMON MISCONCEPTIONS

Correcting management misconceptions about what drives shareholder value and how to effectively grow it is the first step toward producing superior shareholder returns. What are some of those misconceptions? Let’s highlight a couple of the more chronic ones.

Believing All Growth Is Good

Markets are not homogeneous, yet most managers consider all share points to be valuable and believe that all revenue growth is good. Few management teams appreciate just how much profit margins and cash flow vary by product category, customer segment, channel, geographic region and activity across the value chain.

While most management teams segment their markets by consumer, product, or channel to better understand customers’ needs, few managers go through the effort of measuring the profitability those market segments generate today or can generate in the future.

As a result, most management teams are reduced to managing a business profitability by aggregated financial line item. When viewing the averages, all revenues look good, all costs look bad, and the opportunities to better manage the business mix are not seen, let alone acted upon.

From an aggregate line-item perspective, there is a strong bias to achieve revenue share leadership. After all, doesn’t market share leadership generate significant competitive advantages such as economies of scale, being top of mind with consumers, and gaining leverage with the trade? And don’t these advantages naturally lead to superior financial results?

The answer to both questions is: not necessarily. Blind pursuit of market share makes a critical and often painfully incorrect assumption that all points of market share contribute to shareholder value.

You have to overcome what Sir Brian Pitman, former Chairman and CEO of Lloyds TSB, calls with a great degree of irony, “the Institutional Imperative.”

“There is a propensity to grow, regardless of the consequences to the shareholder. It is present in all companies, even the best managed. It is an extremely tenacious force that works incessantly against achieving superior shareholder returns. Not all growth is good. Your focus must be on the things that increase shareholder value,” said Pitman.

It is not the case that Pitman was antigrowth. He was just much more clear than most about what his company was focused on growing: shareholder value.

You may be surprised to learn that in many Fortune 200 companies, less than 40 percent of the company’s employed capital is generating over 100 percent of its shareholder value, while 25 percent to 35 percent of its employed capital is actually destroying shareholder value!

When you think about that statement, you can begin to appreciate the enormous leverage that exists to improve the shareholder value of most corporations. Companies can often double shareholder value by redirecting resources (both capital and people) to more aggressively grow those parts of the company that are contributing to shareholder value while reducing investment in those areas that are not.

Believing That EPS Growth Alone Drives Shareholder Value

Most management teams are convinced that growth in earnings per share drives their companies’ stock prices. (After all, this seems to be the only thing sell-side analysts talk about.) The reasoning goes something like this: “I have a price-to-earnings multiple of 15; the market values companies like ours with P/E ratios between 14 and 16. So improving shareholder value isn’t that complicated: we’ll grow our earnings, multiply those earnings per share by our P/E multiple, and that will determine our stock price. The analysts rarely ask about the balance sheet if we don’t carry too much debt and don’t make any acquisitions that would dilute earnings.”

Appealing as that logic may seem, it is wrong. Most managers are surprised to learn that not all EPS growth improves shareholder value. Actions that increase earnings can actually consume shareholder value if those actions compromise the company’s future cash flow potential. How often have you seen shortsighted managers chase EPS growth by cutting back on necessary reinvestment or reducing marketing and R&D spending in order to make next quarter’s earnings target? How often have you seen acquisitions that are accretive to earnings but do not generate an adequate return on the capital invested to make the acquisition? And how often have you seen managers “invest for the long term” by pouring capital into declining businesses only to see future cash flows continue to deteriorate?

Earnings Are Made Up, Cash Flow Is Real

Roberto Goizueta, one of the greatest creators of shareholder value of all time, was asked to describe how he had been so successful at growing the value of the Coca-Cola Company. He said he learned it from his grandfather, who used to say: “I am a great believer in cash flow. Earnings are a man-made convention, but cash is cash. The larger the company is, the less it understands cash flow. The smaller the business, the better it understands cash flow.”

Cash flow, not earnings, drives shareholder value. And the capital requirements of a company (or business) have a direct impact on the percentage of earnings that is translated into cash flow.

A more accurate measure of profitability, from the shareholder’s perspective, is called economic profit.3 Economic profit is the earnings generated by a company (or business) minus a charge for the capital employed to generate those earnings. As we will discuss further in Chapter 2, cash flow drives shareholder value, and economic profits drive the shareholder value that is created in excess of the capital invested in a company (or business).

WHAT’S REQUIRED TO EFFECTIVELY MANAGE SHAREHOLDER VALUE?

When you chip away all the stuff that doesn’t work and lay to rest all the misconceptions, you are left with five core principles shared by the CEOs who have been able to sustain superior total shareholder returns over time:

- Establish the right definition of winning and measure of success.

The executives at shareholder-value-managed companies believe that their ultimate objective is to deliver superior returns for their stockholders over time. They define winning as (a) delivering higher returns for their shareholders relative to their industry peers by (b) delivering consistently greater cash flow and economic profit growth than their peers. While these executives acknowledge the importance of revenue growth, market share, earnings per share, and return on capital, they understand that focusing on any of these measures in isolation can lead to sub-optimal shareholder value creation.

- Capitalize on the fact that shareholder value is always highly concentrated.

The executives at shareholder-value-managed companies know that economic profits and shareholder value contribution are always highly concentrated in every market and market segment. These executives capitalize on the tremendous performance leverage that this concentration offers. They make sure their managers are developing strategies and allocating resources in ways that increase their ...