![]()

CHAPTER 1

Launching a New B2B Technology Product or Service

1. STARTING THE JOURNEY

When determining how to launch a B2B software product and then conquer a marketplace, it is helpful first to gain an understanding of the contours of the market. Conventional wisdom holds that a bell curve, known as the Technology Adoption Life Cycle, is the best representation of a typical B2B technology marketspace. This curve is made up of five distinct segments, and each portion corresponds to a potential group of users of the new product, each of which has very different needs and buying characteristics. Visualized from left to right, as a product gains acceptance in the market, each segment becomes the potential group of customers that should be targeted next by the seller.

In his best-selling book Crossing the Chasm, Geoffrey A. Moore describes each buying segment. Specifically, on the far left of the curve are the Innovators. Innovators are “techies”—users who love new products simply because they are new. While they do not normally have the power within an organization to purchase the new technology, their opinions are respected by the rest of the organization, and they often serve as important gatekeepers to the rest of the organization.

In the next segment are the Early Adopters. Early Adopters are visionaries. Not only do they like new products because they are new, but they have the ability to envision how these products can be used to further their business goals. Moreover, they like to be on the forefront of change and are willing to implement innovative technologies, as they believe these tools give them a leg up over their competitors. To this end, they are comfortable working with new products and accept the problems that typically accompany any new product launch. These customers will likely be the start-up’s first paying customers and early reference sites.

The Early Majority make up the next group of buyers. They are pragmatists who understand the power of technology and are willing to use new products if they clearly further the users’ business goals. That being said, they are reluctant buyers of new, unproven technology, as they do not like taking unreasonable risks. As such, it is their preference to buy from the company that will likely become the market leader. It is critical that they be able to speak with happy references that can attest to the stability of the company and its product. Finally, as they are somewhat conservative, they need to buy a product that is relatively stable and includes most of the features necessary for a successful implementation.

Next on the continuum is the Late Majority. These are conservative buyers who are price sensitive, highly skeptical, and extremely demanding. They expect to receive a full product solution and will only buy the new product once the technology is firmly established in the Early Majority space and a clear market leader has been determined. Combined, these two segments make up the mass market for the product.

Last but not least, on the far right of the continuum are the laggards that do not believe in the power of the new solution. These companies are aware of the solution and the fact that their competitors are using it. In spite of this knowledge, they are willing to forgo its benefits. In sum, they do not like change and will never adopt the new solution, as they believe their “old way” of doing things will always be better. Technology companies will rarely be successful in marketing their solutions to these buyers.

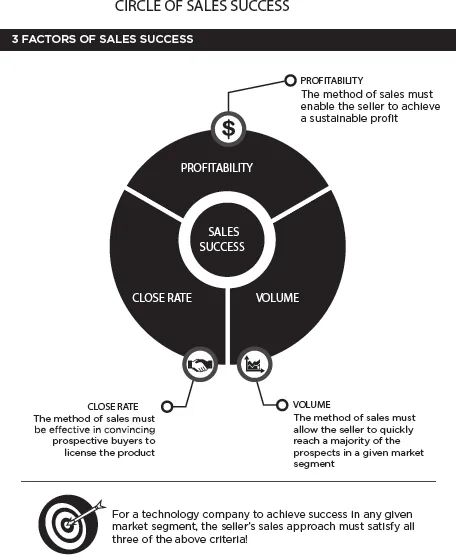

With this understanding of the market, the seller of a B2B technology product must first figure out where the product stands on the bell curve. Knowing this location is an absolutely key factor because the sales approach that works at one stage of the continuum will likely not work in another. The needs and goals of both the buyer and the seller morph over time. The seller will continually need to evaluate and possibly change the sales approach to ensure it is constantly aligned with its goals as well as the goals of the buyers. While the method of interacting with the prospect might change, the chosen sales methodology must satisfy the following three criteria:

1.It must enable the seller to achieve a reasonable and sustainable profit (Profit).

2.It must be scalable, so it can successfully reach enough companies in the chosen market segment (Volume).

3.It must effectively convince prospective buyers to purchase the product or service at an appropriate and sustainable close rate (Close Rate).

For a company to achieve success in any given segment, the seller’s sales approach must satisfy all three of the above criteria! If not, a company’s prospects of success in the given market segment will be significantly diminished, and its growth trajectory will likely stall.

2. ATTACKING THE EARLY ADOPTER SEGMENT WITH A DIRECT SALES FORCE

Businesses have contemplated a number of different sales mechanisms since the industrial revolution. At the beginning of the twentieth century, enterprises relied on loose networks of sales agents distributed throughout the marketplace. However, in the 1950s, with the advent of a more robust transportation infrastructure, companies were in the position to rethink the structure of their sales operations. The result was the modern direct sales force that has been functioning without significant change for the past seventy years.

The defining characteristic of the direct sales force, regardless of the product being sold, is its absolute reliance on the concept that the individual sales professional would visit the prospect at his or her workplace to make the sale. This in-person approach allows the salesperson to develop a tight relationship with the buyer that presumably provides the prospect with the necessary comfort to move forward with the solution being offered. To ensure this occurs, it is not unusual for the salesperson to meet with the prospect multiple times. Due to the time spent on this effort, the average direct sales professional will meet, on average, with approximately eight new prospects per month and engage in five follow-up visits with prospects during the same period. Of course, if the salesperson is also responsible for post-sales support, the above new sales metrics can be substantially lower.

It is extremely expensive in terms of time and money to operate a direct sales force. To increase the efficiency and cost-effectiveness of the approach, almost all companies break up their marketplace into separate and distinct geographic territories. Under this scheme, depending on the size of the marketplace, one or more sales professionals are assigned to work with the prospects in a given territory. This is done to control travel costs and to increase the number of leads the salesperson can deal with cost effectively. In addition, since prospects often know one another within a tightly defined geographic area, territories should also help the seller build reference networks that should improve the prospect’s comfort level with the salesperson and the solution being sold.

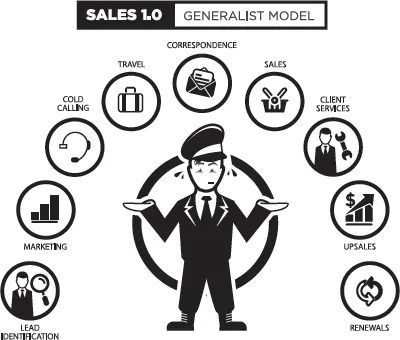

In the sales environment, the salesperson operating within a territory often acts in an independent fashion, “owning” the sales process from start to finish. Known as a Generalist, he or she is responsible for lead identification, direct marketing, cold-calling or appointment generation, and the actual sales process. To accomplish the job effectively, the professional is responsible for completely knowing the product and industry, inside and out. As if all that were not enough, in many cases the salesperson in the territory is also responsible for after-sale customer success, including upsell opportunities and renewals.

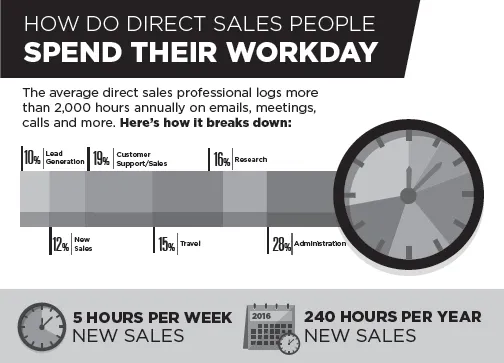

The following chart is a breakdown of the time a salesperson typically spends performing the above tasks. It is startling to note that under the Generalist model, a direct sales professional will spend only 12 percent of his or her time selling.2

Thus, spending only five hours per week, or 240 hours per year, dramatically impacts the sales throughput or new sales volume the sales professional can generate.

This basic sales model is well supported by technology. In today’s environment, almost all sales operations employ some sort of customer relationship management (CRM) software to manage their day-to-day sales operations. Based on the old-fashioned Rolodex, these database packages, such as Salesforce.com, were designed specifically to support and automate the activities of a direct sales force. Almost all of these tools are designed to help a Generalist effectively work prospects from start to finish in a defined territory. In addition, most are now cloud based so traveling sales professionals can have access to information from the road. Moreover, most packages assume the user will be handling relatively few leads, and as a result, the packages have not been optimized to support volume. The basic structure of these systems has certainly perpetuated the employment of the direct sales model.

Since this book is written from the perspective of a new product launch, I would like to introduce you to SocialFlow, a fictional company that is an amalgamation of start-up enterprises I have consulted with to jump-start B2B sales. This example, described in the following fact pattern, will be used throughout the book to evaluate different sales methodologies against the three criteria listed previously—Profit, Volume, and Close Rate—at each stage of the Technology Adoption Life Cycle.

SOCIALFLOW, A START-UP SOFTWARE COMPANY, FINISHED developing its first software product, which helped companies build online loyalty programs. Initially, the two founders served as the company’s sales team. They were able to license the software to a handful of visionaries who were willing to try it. Once the product stabilized, the company hired two experienced sales professionals to work with the founders and attack the Early Adopter market. The goal at this stage of SocialFlow was to license the product to a handful of well-known companies that would be willing to serve as super references for the product.

The company’s fledgling sales operation was relatively unsophisticated. Headquartered in New York City, the company divided the country into four territories, with a founder or salesperson assigned to each region. At first, they relied on personal industry contacts to generate leads. However, to supplement these leads, each professional was also responsible for identifying potential companies within his or her territory by coldcalling prospects. Once “live” leads, defined as prospects that wanted a demonstration of the software, were identified, an in-person visit occurred. To control the sales process, the company used Salesforce.com, the industry-leading, cloud-based CRM system developed in the early 2000s.

SocialFlow discovered that selling to Early Adopters was not an easy task. Plenty went wrong as they attempted to introduce buyers to the new solution. Although improvements were made, theirs was a minimally viable product and as such was still relatively immature and needed substantial work to meet the full-blown needs of the marketplace. Making this process even harder was the fact that the new sales team was figuring out, through a trial-and-error process, the product’s market fit. It was still unclear what would drive potential buyers to license the product. In spite of these difficulties, the company was relatively successful in making inroads with Early Adopters. To this end, it secured a handful of clients that were willing to serve as enthusiastic references for the software solution.

Using the three criteria for a successful sales operation listed earlier, let’s examine why the direct sales approach was the ideal method of sales when selling to the Early Adopter segment of the marketplace.

Profitability

At the early stages of a product launch, the importance of profitability is greatly reduced. It is quite acceptable and even expected that a young company should and will absorb losses while it sells a new product to Early Adopters. In this light, capital is normally set aside to cover the initial shortfall. Providing further leeway to the seller is the fact that, during this stage, the costs of sales are often greatly reduced. The seller is likely dealing with a relatively small number of parties that have either self-identified or have been found through personal connections with the seller. As a result, it is not necessary for the seller to embark on expensive marketing campaigns or to build out a large sales force.

Volume

The Early Adopter segment consists of approximately 10 percent of the buyers in any given market. Given its small size, a direct sales force can be effective in reaching and attacking these defined targets successfully. Moreover, as a practical matter, Early Adopter clients are often identified through personal industry contacts. The segment is also a safe choice, as many early-stage companies have within their grasp the ability, effort, and expense necessary to build an appropriately sized sales operation.

Close Rate

In general, Early Adopters like personal, one-to-one connections that are provided by face-to-face meetings with a company representative. This type of interaction enables the seller to build a powerful connection with the buyer that goes well beyond the traditional seller-customer relationship. This approach should allow these customers to self-identify with the seller and provide them with the emotional comfort necessary to move forward with the solution and to become powerful super references for the new product. Since the Early Adopters are often seeking out the new solution, the close rate with these buyers is often relatively high.

Once success has been achieved with the Early Adopters (with success being defined as obtaining customers willing to serve as references), the seller will be in the position to attack the Early Majority portion of the mass market. At this point, the key to launching a successful product is to make a successful transition from the Early Adopters to this new group of buyers without stumbling.

3. TRANSITIONING INTO THE EARLY MAJORITY SEGMENT OF THE MASS MARKET

If selling to Early Adopters is like scaling Mount Everest, successfully introducing a product to the Early Majority segment is the equivalent of summiting K2. As we have discussed, Early Majority buyers are a difficult bunch of folks. They are pragmatists who are not interested in unfinished solut...